Regal Rexnord: Improved Growth Outlook and Discounted Valuation (NYSE:RRX)

jetcityimages

investment thesis

Regal Rexnord Corporation (New York Stock Exchange: RRX) Above-average backlog levels in the Industrial Powertrain Solutions (IPS) and Automation and Motion Control (AMC) segments, ending channel inventory clearance, improving end market conditions and a With the interest rate cycle likely to reverse this year, demand recovery is expected to be good. Additionally, the company has been strategically shifting its portfolio toward long-term growth markets, and in line with that strategy, it acquired Altra Industrial Motion early last year and recently announced the sale of its industrial motors and generators business. Through these portfolio improvements, the company is targeting long-term growth trends such as electrification, global regulatory push for improved energy efficiency, and increasing levels of global factory automation, which bodes well for mid- to long-term revenue growth.

In ~ On the margin front, the company should benefit from productivity improvement and cost-savings programs such as 80/20, as well as lean initiatives and synergies through the Rexnord PMC and Altra integrations. Additionally, as end-market demand improves and volumes recover as FY24 progresses, the company’s margins are also expected to improve due to operating leverage. Additionally, it is trading at a discount compared to historical averages. Given the company’s improving growth prospects and discounted valuation, we recommend a Buy rating on RRX stock.

Revenue Analysis and Forecast

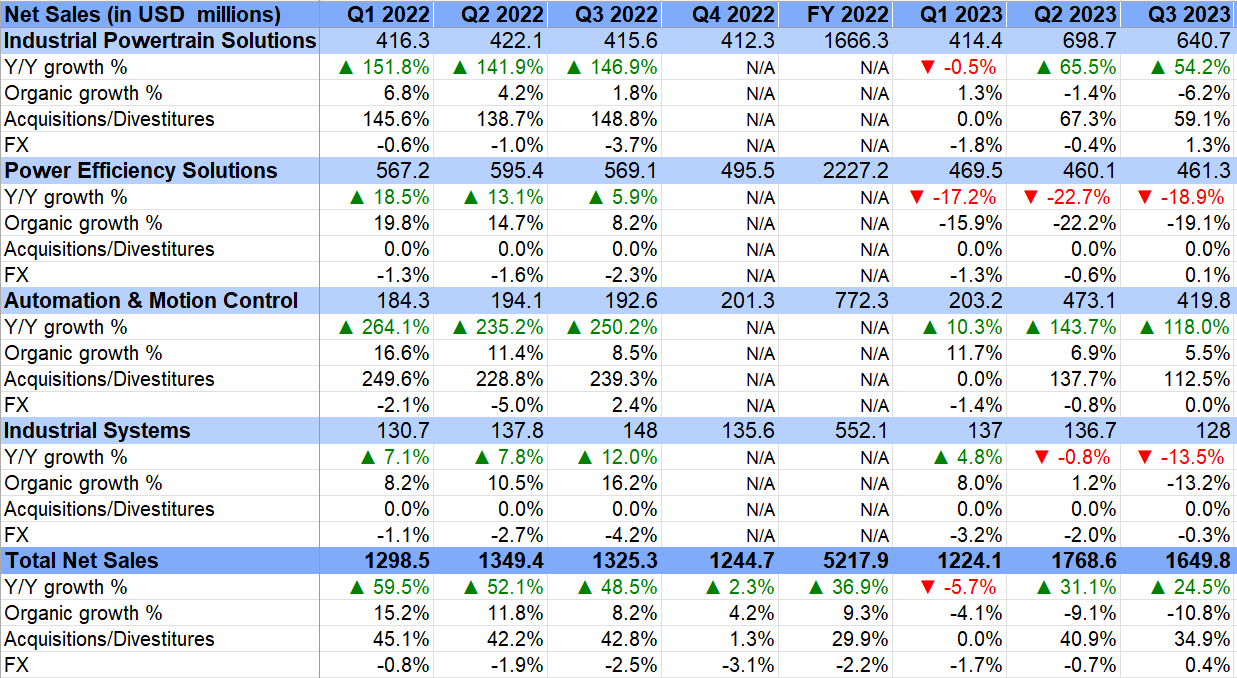

Over the past few years, RRX has seen strong growth thanks to excellent end-market demand and active acquisitions. However, lower inventory levels resulting from a more normalized demand environment and improved supply chain conditions (reduced lead times) and an increase in channel partners and customers negatively impacted the company’s organic revenue growth during recent quarters. In the third quarter of 2023, the Company’s net sales increased 24.5% Y/Y to $1.649 billion, driven by a 34.9% contribution from the Altra acquisition and a 0.4% favorable impact from foreign exchange translations, compared to a 10.8% Y/Y decline. Partially offset. Organic for sale.

RRX’s historical revenue growth (company data, GS Analytics Research)

Looking ahead, we believe we are near the bottom in terms of organic revenue and the company should return to Y/Y organic growth in the coming quarters.

Looking at the company’s results, organic growth was negatively impacted last year due to inventory liquidation, particularly in the short-term business segment. This is a result of the Company’s channel partners and customers reducing inventory in response to normalizing lead times and easing supply chain constraints, as well as some vulnerabilities in end markets given the current high interest rate environment. However, after several quarters of clearing inventory, we believe we are nearing completion because our inventory conditions across channels are much better. Management also noted that inventory clearance in some end markets, such as residential AC, is now complete. Additionally, with the potential reversal in the interest rate cycle this year, some of the company’s near-term businesses will also begin to see a good demand recovery, which will help it finish clearing inventory.

On the last earnings call, management also noted sequential improvement in October orders. With market sentiment further improving in November and December due to commentary on interest rate cuts in 2024, we expect continued improvement in order intake trends when the fourth quarter results are announced.

In addition to improving order trends, companies can also benefit from higher than normalized backlogs in the IPS and AMC segments. According to management, backlogs in the IPS and AMC segments at the end of the third quarter of 2023 were ~45% and 50% above normal levels, respectively.

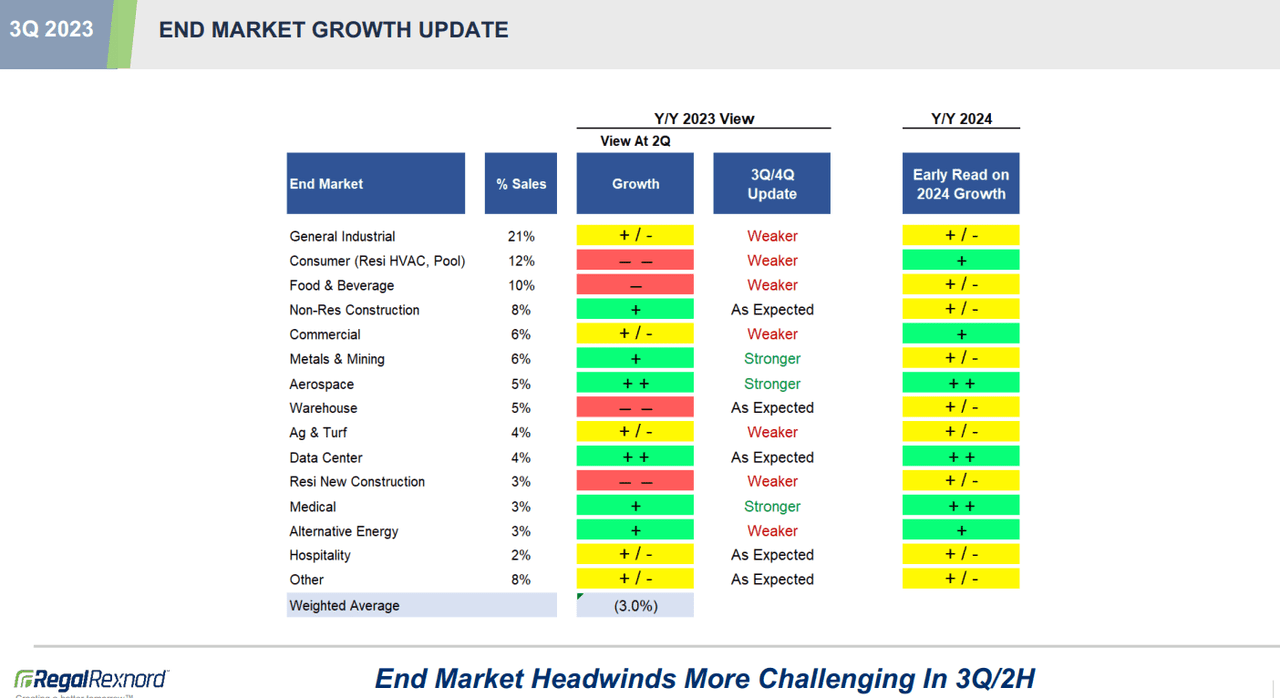

Outlook for the company’s end markets is also improving. At the time of the last earnings call, management shared an early read on 2024 trends that were neutral for general industrial (~21% of sales), non-marine construction (~8% of sales), and residential construction (~3%). % of sales). As expectations for multiple interest rate cuts in 2024 increase, we believe the outlook for these end markets has improved significantly since the last earnings announcement. Lower interest rates not only improve the attractiveness of construction projects, but also stimulate demand in general industry. sector. Therefore, I expect to see a gradual increase in positive commentary on these markets in the next earnings call.

An early read of RRX’s 2024 end market growth (following the company’s Q3 2023 earnings release)

The improved outlook for these end markets, combined with the expected strength in the consumer market, will benefit from a recovery in residential HVAC as inventory closes. Improvements to food and beverage end markets that could benefit from alleviating project timing issues and delays the Company has experienced over the past several quarters; You can benefit from government stimulus programs like CHIPS and the Science Act and the Inflation Reduction Act that encourage reshoring. This bodes well for the company’s growth in 2024.

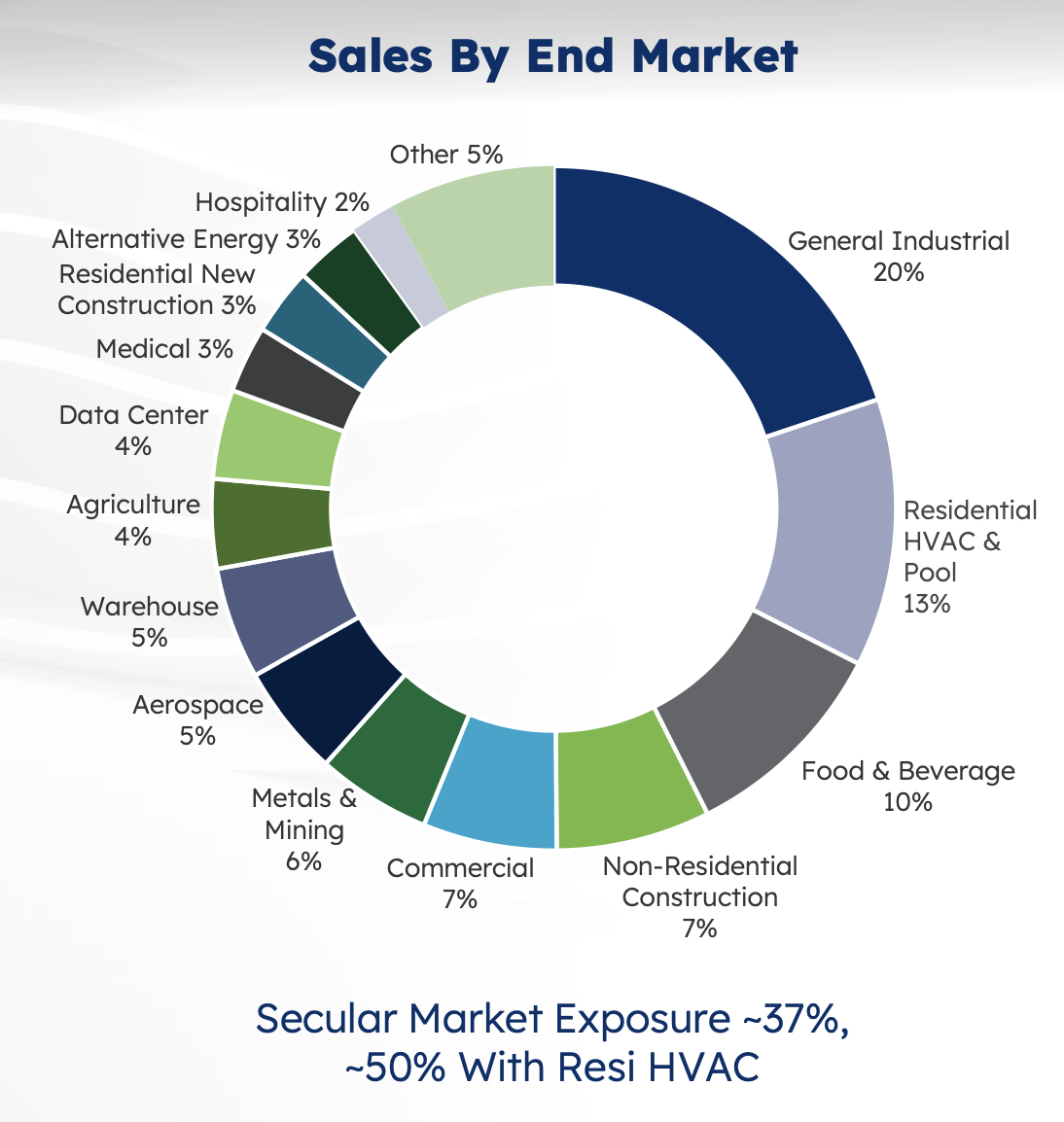

The company has also done well in terms of portfolio transformation and has steadily increased its exposure to secular markets, including aerospace, warehouse, food and beverage, healthcare, alternative energy, and data centers. The recent acquisition of Altra Industrial Motion Corporation (acquired in March 2023) increased the Company’s exposure to long-term growth markets to 37% of the Company’s revenues. With ongoing regulatory efforts to improve energy efficiency, exposure increases by approximately 50% when considering residential HVAC. This portfolio change will allow the company to take advantage of several secular tailwinds, including the push for global regulations to improve energy efficiency, reshoring of manufacturing, electrification, an aging population, and increasing levels of global factory automation, which will help drive sales growth. This will be In the mid to long term.

RRX End Market Exposure (Company Presentation)

In summary, I see the end of inventory clearance, improving order rates, healthy backlog levels, improving end market conditions, the upcoming FY24 interest rate cycle reversal, long-term growth tailwinds, and a federal stimulus program that encourages portfolio transformation and reshoring trends.

Margin Analysis and Forecast

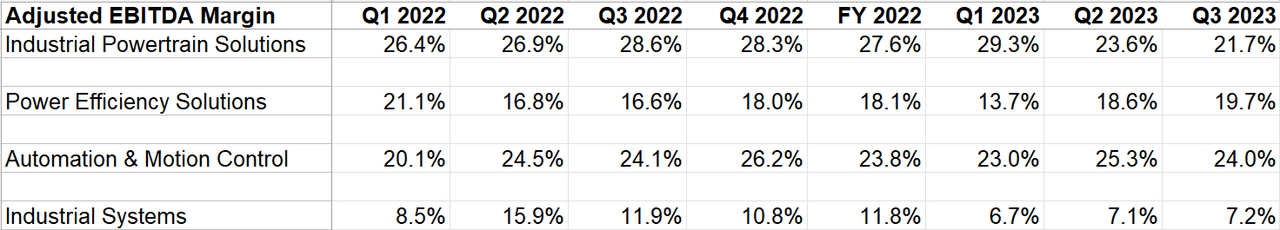

Adjusted EBITDA margin for the IPS segment in the third quarter of 2023 decreased 690 bps year-over-year, primarily due to an unfavorable mix related to near-term weakness in the high-margin aftermarket channel and the impact of $10 million of temporary costs for high customer retention. Service levels during spatial changes associated with PMC cost synergies. In the PES segment, Adjusted EBITDA margin increased 310 bps year-over-year, driven by positive price/cost, improved operating efficiencies, and favorable mix offsetting the impact of lower freight traffic and lower volumes. Adjusted EBITDA margin for the AMC segment decreased 10 basis points year-over-year on a reported basis. However, on a pro forma basis, Adjusted EBITDA margin increased 130 bps Y/Y due to favorable price/cost, improved operating efficiencies, benefits of the 80/20 initiative and cost controls. Industrial Systems’ Adjusted EBITDA margin decreased 470 bps Y/Y, primarily due to lower transaction volume.

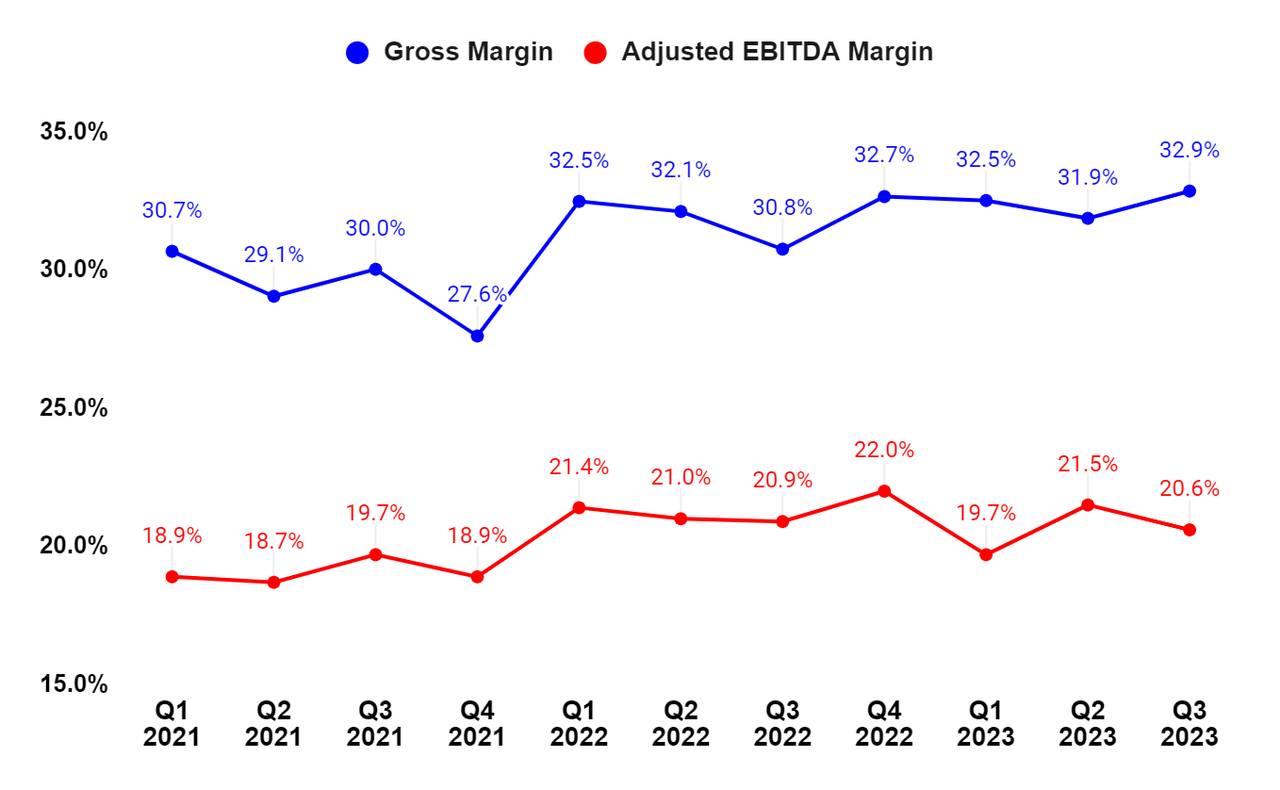

On a consolidated basis, gross margin improved 210 bps Y/Y to 32.9%, and Adjusted EBITDA margin decreased 30 bps Y/Y (10 bps Y/Y on a pro forma basis) to 20.6%.

RRX’s Adjusted EBITDA Margin by Segment (Company Data, GS Analytics Research) RRX’s gross margin and adjusted EBITDA margin (company data, GS Analytics Research)

Going forward, I am optimistic about the company’s margin growth prospects.

The company is performing well in terms of productivity improvement and cost reduction initiatives, including implementing the 80/20 strategy, lean initiatives, and achieving synergies through the integration of the Rexnord PMC and Altra acquisitions. Management expects to realize cost synergies of $13 million at PMC and $10 million at Altra in the fourth quarter and $45 million at PMC and $45 million at Altra in 2024. Additionally, the Altra acquisition provides an enhanced mix and new products to the Company’s products. IPS and AMC portfolios that will also help margin mix in the coming quarters.

Additionally, the company recently announced the sale of its Industrial Motors and Generators business for $400 million in cash proceeds, which is expected to close in the first half of 2024 and will help improve the portfolio’s margin mix. Management expects the company’s gross margin and adjusted EBITDA margin to increase by more than 100 basis points as a result of this transaction.

Management shared a goal of achieving 40% gross margin and 25% adjusted EBITDA margin by 2025, primarily through M&A synergies, 80/20 and lean initiatives, and aggressive new product development. The sale of the Industrial Motors and Generators division will help the company achieve this goal. Additionally, as end market conditions improve and volume recovers, the resulting operating leverage will help expand margins in the short and long term.

Evaluation and Conclusion

RRX is currently trading at 13.22x FY24 consensus EPS estimate of $10.56, which is a discount to its five-year average forward P/E of 15.55x.

While the company has historically traded at a discount to the broader EE/MI sector, recent portfolio transformation initiatives and progress toward achieving a higher growth/higher margin portfolio mix have resulted in a re-rating of the P/E multiple relative to historical levels and industry averages. It will be helpful. .

Goldman Sachs recently cited the company as a top industry pick, citing improving fundamentals and top-quartile EPS growth potential, indicating Wall Street analysts are interested in this story.

We think the company’s return to organic growth next year will help improve investor sentiment surrounding the stock. The margin outlook is also solid, and the stock trading at a discount to historical averages provides a good entry point. So, I have a Buy rating on the company.

danger

- We expect general industrial and construction end markets to improve this year as the interest rate cycle reverses. If interest rate cuts are delayed, at a slower pace than expected, or fail to have the intended impact in terms of improving growth prospects for the industrial and construction sectors, the valuation multiple reassessment I expect may not occur. wake up.

- Inorganic growth is relatively riskier compared to organic growth because there are risks associated with post-acquisition integration, companies overpaying for acquisitions, and the leverage companies use in acquisitions. If the company fails to realize intended synergies or overpays for an acquisition, its stock price may see a slight decline.