RELX: Business remains strong, but now appears overvalued (downgrade) (NYSE:RELX)

JHVEPhotography

UK-based professional services group RELX (New York Stock Exchange: RELX) has an attractive business that continues to perform strongly, and even its exhibitions sector is now closer to overcoming the difficult times caused by the pandemic. I continue to Although I think the investment case is compelling, I think the stock is currently overpriced and I would lower my rating to ‘Sell’ accordingly.

I last covered this name in a bullish January 2022 article, RELX: Improving Performance Highlights the Investment Case. London shares have risen 52% since the report was published.

My basic thesis at the time of my last (and previous) work was that RELX benefits from ongoing revenue potential in wide-moat areas such as legal publishing. The pandemic has taken a huge toll on the exhibition business, but it is on the path to a long-term recovery. The direct exhibition model will continue in the future.

2023 was a year of development

Business models have been covered extensively elsewhere (a good primer is The Wolf Report’s RELX: Consulting Appeal, But Only At a Good Price), so I won’t repeat them here.

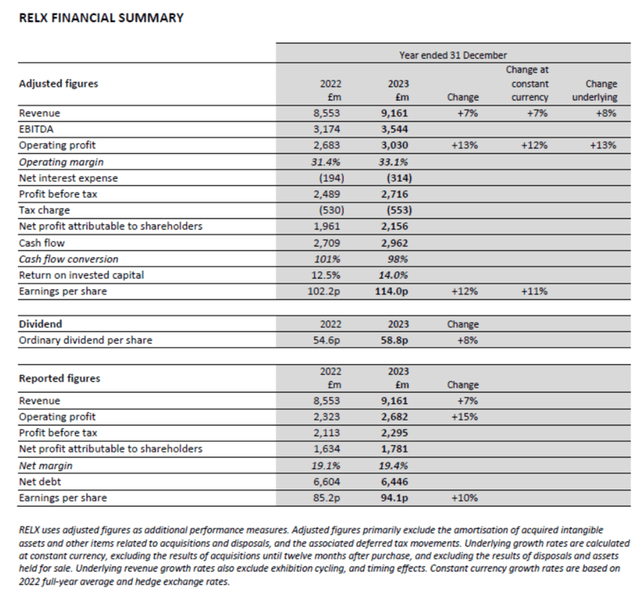

Last year was a solid year for the company. Revenues, profits and cash flow all rose. Net debt has decreased slightly, at £6.5 billion, which is still significant, but quite small considering the company’s market capitalization is almost 10 times that amount.

company notice

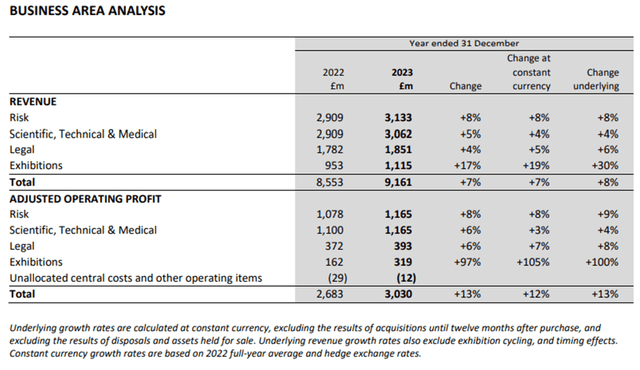

The growth was extensive. Sales and adjusted operating profit increased in all four business sectors, and the exhibition sector in particular rebounded in terms of adjusted operating profit.

company notice

Looking at this in a longer-term context, we can see that RELX is now firmly out of the pandemic. One segment of the business that is still below 2019 levels is the exhibitions segment, and even there the shortfall compared to 2019 is not large enough to impact RELX’s overall valuation.

|

2019 |

2023 |

change |

|

|

Revenue (£m) |

|||

|

Science, technology and medicine |

2,637 |

3,133 |

19% |

|

Risk and Business Analysis |

2,316 |

3,062 |

32% |

|

legal |

1,652 |

1,851 |

12% |

|

Exhibition |

1,269 |

1,115 |

-12% |

|

Adjusted operating profit (£m) |

|||

|

Science, technology and medicine |

982 |

1,165 |

19% |

|

Risk and Business Analysis |

853 |

1,165 |

37% |

|

legal |

330 |

393 |

19% |

|

Exhibition |

331 |

319 |

-4% |

|

Unallocated central costs and other operating items |

– 5 |

– 12 |

140% |

Table calculated and edited by the author using company announcement data

Will things continue in a positive direction? The pandemic has demonstrated a clear risk to the exhibition business if business travel suddenly declines, and I continue to see this risk as key for the sector despite the increased move to online conferences. I think some online conferences and exhibitions are valuable, but others are just a physical strain.

I also think a recession is a risk to the business. Our client base includes many professional services firms such as legal partnerships and insurance businesses. Some of your expenses are critical to your business, but when economic conditions are poor, many tend to be cut or postponed. That would be detrimental to RELX.

Potential for further dividend growth

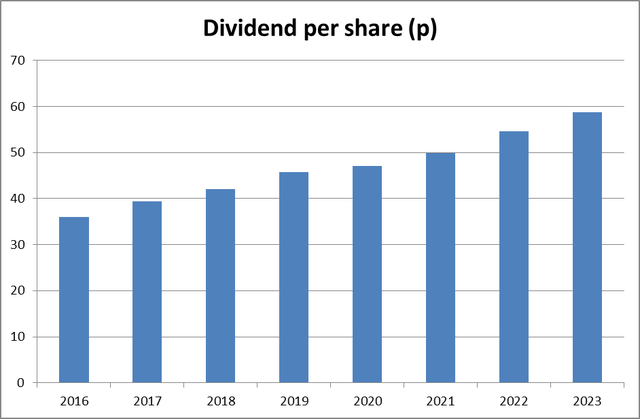

Rising stock prices mean falling dividend yields. Currently, this is 1.7%, less than half the FTSE 100 average.

Chart edited by the author using company announcement data

RELX has been raising its dividend at a decent rate (over 7% last year) and we expect it to continue to do so going forward. Last year, free cash flow excluding finance costs was £1.8 billion. Outflows were £2.1 billion, of which £1.1 billion were shareholder dividends and £800 million were share buybacks. If cash flows remain broadly constant excluding buybacks, dividend costs have been well covered with significant room for future growth.

I think the valuation is too high.

In recent years, RELX appears to have won friends among the investor community through its strong investment case and continued strong business performance.

In fact, the stock price has risen 34% over the past year. This is an 84% increase over the past five years.

However, this caused the price-to-earnings ratio to rise to 37. That seems absurdly high to me. Price the company as if it is expected to achieve significant growth. RELX is a mature business, mostly in mature business areas such as legal information and exhibition organization, although it has seen significant growth over the past few years. Sustained growth through acquisitions is also possible, but organic growth opportunities here are clearly limited in the long term. While the strong moats of some companies (e.g. LexisNexis) provide good pricing power, I nonetheless view RELX as a company with fair and sustained growth opportunities rather than a strong growth story in its own right.

Based on this, I would be more comfortable with the P/E ratio not exceeding 20 and therefore changing the rating to “Sell” due to valuation issues and not business quality.