Restrictive OTC regulations for institutions following Hong Kong ETF launch

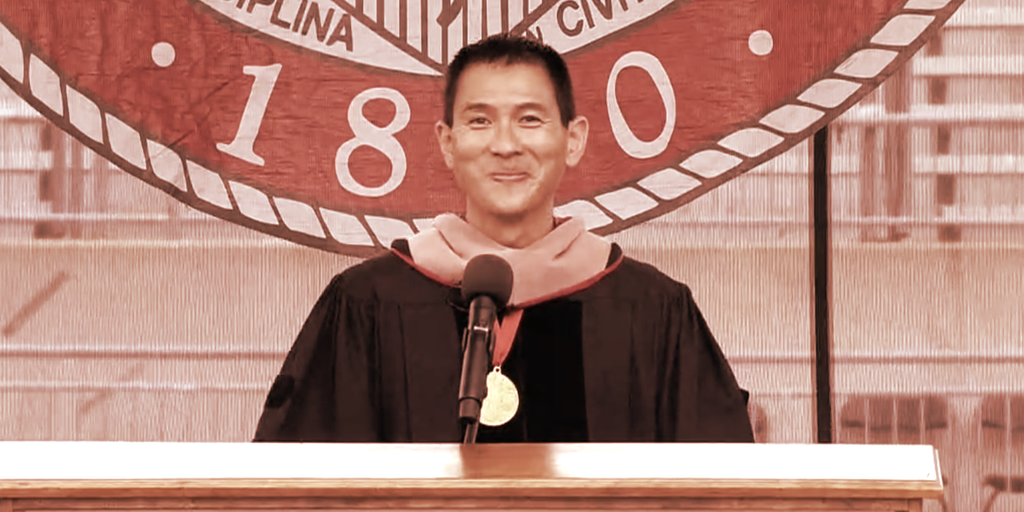

Hong Kong launched the region’s first spot cryptocurrency ETF on April 30, attracting over $130 million in first-day inflows across Bitcoin and Ethereum, emerging as a key player in the race to become Asia’s leading cryptocurrency hub. I did. To gain deeper insight into what this milestone means and Hong Kong’s evolving virtual asset landscape, CryptoSlate We spoke to HB Lim, BitGo’s Managing Director APAC.

Lim brings a wealth of regulatory and cryptocurrency industry experience to the conversation. Prior to joining BitGo, a leading institutional cryptocurrency custody provider, he served as Director of the Abu Dhabi Global Market, where he helped create a progressive cryptocurrency regulatory framework. Mr Lim previously held a role at the Monetary Authority of Singapore, which regulates financial institutions.

In this exclusive interview, Lim shares his perspectives on how spot ETF products in Hong Kong could impact market forces and investor engagement in the region. He also evaluates Hong Kong’s overall virtual asset regulatory framework and how it compares to other competitors vying to become Asia’s cryptocurrency hub, such as Singapore and the UAE.

Lim provides candid insights into areas where cryptocurrency regulation in Hong Kong could be strengthened, including creating licensing options for independent custodians and adjusting rules for institutional OTC trading desks. He also discusses his outlook for digital assets in Hong Kong and APAC and BitGo’s plans to support the region’s growing ecosystem in the future.

With the Hong Kong spot ETF set to launch on April 30, how do you expect this to impact cryptocurrency market dynamics and investor participation in the region?

Currently, the main markets for spot cryptocurrency ETFs are North America and Europe. This means that the ETF is untradeable during most of Asia’s trading hours, which is out of sync with the 24/7 market for cryptocurrencies. Therefore, holding a spot cryptocurrency ETF in Hong Kong provides investors with more seamless trading hours to access cryptocurrencies.

Additionally, some investors may prefer not to trade spot cryptocurrency ETFs listed in North America or Europe for reasons such as less favorable taxes or restrictions from regulators in their home countries. Hong Kong spot cryptocurrency ETFs offer another option for investors who believe Hong Kong offers more advantages in terms of tax and regulatory access.

The Hong Kong spot cryptocurrency ETF offering will deepen the liquidity of the Hong Kong cryptocurrency market and grow the supporting ecosystem of cryptocurrency exchanges, cryptocurrency custodians, banks, brokers and professional services.

Given your regulatory background, how do you evaluate Hong Kong’s overall virtual asset regulatory framework? Are you striking the right balance between innovation and investor protection?

Hong Kong has developed a very comprehensive and strong virtual asset regulatory framework and should be commended for that. Nonetheless, there are areas that could be improved, such as creating a regulatory framework for independent virtual asset custodians to provide additional options for custody, and adjusting Hong Kong’s proposed regulatory framework for OTC trading of virtual assets. .

Currently, virtual asset exchanges in Hong Kong can only use virtual asset storage services provided by subsidiaries. Banks that wish to provide virtual asset custody but outsource this service may only use virtual asset custody services provided by Hong Kong licensed virtual asset exchanges or other Hong Kong licensed banks. Cryptocurrency exchanges and banks in Hong Kong are currently not permitted to use professional third-party independent virtual asset custodians, limiting options in the market. There is currently also no licensing regime from the HK SFC or HKMA for independent virtual asset custodians in Hong Kong.

A thriving Web3 industry requires the support of professional, independent virtual asset custodians. Virtual asset wallets are the gateway to the web3, and proper storage and protection of virtual assets is essential to building trust in the industry. Hong Kong could therefore benefit from developing a regulatory framework to enable independent virtual asset managers to be licensed, thereby providing complementary options for virtual asset management in Hong Kong.

In terms of OTC trading, Hong Kong recently issued a consultation paper to regulate OTC trading of virtual assets. The proposal appears to be somewhat restrictive in that it would only allow OTC trading desks to offer cryptocurrency-fiat trading pairs, and limit trading to only those cryptocurrencies approved for trading on licensed exchanges in Hong Kong. The offer appears to be aimed at brick-and-mortar stores in Hong Kong that offer retail customers the ability to buy and sell cryptocurrency assets, and appears less suited to institutional OTC trading desks that do not deal with retail customers and adhere to strict regulations. Programs that include Know-Your-Customer verification. OTC trading offerings would benefit from having a separate regime that recognizes the lower risks posed by institutional OTC trading desks.

With Singapore and the UAE also competing to become Asia’s leading cryptocurrency hub, how do you think Hong Kong’s spot ETF product will strengthen its competitiveness?

If Hong Kong offers a spot cryptocurrency ETF, it will attract more web3 companies, investors and talent to take root in Hong Kong, which will lead to a virtuous cycle of growth for the web3 ecosystem there.

What excites you most about the future of digital assets in Hong Kong and the APAC region, and how does BitGo plan to contribute to these developments in the future?

Virtual asset wallets are the gateway and foundation of web3, and virtual asset wallet and storage service providers such as BitGo play an important role in all web3 ecosystems. BitGo has been active in the APAC region for several years and remains optimistic about web3 adoption and growth in Hong Kong and the rest of APAC. As a company that puts security and compliance first, we will continue to contribute to the web3 ecosystem in Hong Kong and the rest of APAC through thought leadership and support companies through secure and trusted virtual asset wallets and prime brokerage services. I hope you can.