Review of the Uses of Fibonacci Levels – Trading Strategy – March 20, 2024

Unraveling the Mystery:

Using Fibonacci tubes in strategic forex trading

The Fibonacci sequence, a mathematical pattern found throughout nature, has fascinated mathematicians and traders for centuries. In the world of forex trading, Fibonacci pipes provide a unique tool for identifying potential support and resistance areas, price retracements, and even profit targets.

Extension of the popular Fibonacci tube The Fibonacci retracement tool provides a unique lens to identify potential price movements in the forex markets. They leverage the mathematical beauty of the Fibonacci sequence, which is believed to maintain natural order within financial markets.

Although it is not a perfect system, strategic use of Fibonacci levels can improve your understanding of potential support and resistance zones. Your toolbox of the trade.

Fibonacci tube decoding:

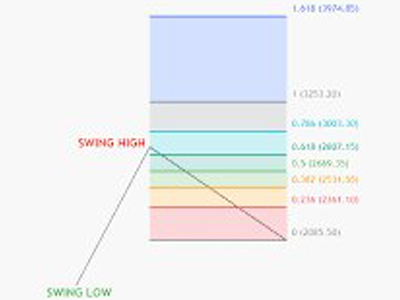

Imagine a series of horizontal lines drawn on a price chart due to significant high and low fluctuations. These lines, adjusted based on Fibonacci ratios (e.g. 38.2%, 50%, 61.8%, 78.6%), create channels that act as potential price magnets.

The power of each level comes from its unique relationship between the Fibonacci sequence and market psychology. Traders often, consciously or unconsciously, recognize these ratios as areas of potential price reversals or continuations.

Power at each level:

- 38.2% & 50%: These shallow retracement areas are common pause points during an established trend. Price support at these levels is often a sign of a continuation of the trend.

- 61.8%: This level has enormous implications. A 61.8% price reversal suggests a stronger countertrend movement. It often coincides with existing support or resistance levels, strengthening the possibility of a reversal.

- 78.6%: A deeper retracement or price reversal signals a potentially significant trend change. It is important to confirm this twist with others. technical indicators To avoid false signals.

remember: This is a potential price range and not guaranteed. Markets are dynamic and different factors can affect price movements.

Tips for effectively using the Fibonacci tube

All about confirmation:

- Price Candlesticks: Look for bullish reversal patterns, such as pin bars or wraparound bars, at support levels, or bearish reversal patterns, such as shooting stars or double tops, at resistance areas within the tube.

- Moving average: A price bounce from a key Fibonacci level that coincides with a moving average could strengthen the support/resistance signal.

- Confirmation is key: Price action at Fibonacci tube levels is not guaranteed. Always use more Technical indicators or fundamental analysis To identify potential transactions.

- Market dynamics rules: Forex is a dynamic market. The Fibonacci tube provides insight, not guarantees. Price action may be influenced by: unexpected event.

- Manage your risks wisely: Always practice appropriate risk management techniques, such as stop-loss orders, to limit potential losses. (To control costs and stop losses, use tubes combined with previous resistances.)

- Practice makes perfect: As with any other trading tool, familiarize yourself with the use of Fibonacci tubes by practicing on a demo account before risking any real capital.

Beyond Price Levels: Harmonic Patterns

Fibonacci levels extend their influence beyond basic support and resistance. When combined with harmonious price patterns (e.g. Gartley, Bat or Butterfly patterns), powerful trading opportunities are created. These patterns involve Fibonacci ratios in their formation, and their confluence with Fibonacci tube levels adds significant weight to potential price movements.

remember: Fibonacci levels are a stochastic tool that increases the likelihood of identifying potential turning points. While it does not guarantee a reversal, it does indicate areas where price action may hesitate, retrace or reverse, allowing you to make informed trading decisions.

conclusion

Fibonacci levels are a useful tool for forex traders. By understanding the importance of each level and its potential impact on price movements, you can make informed trading decisions. Remember that Fibonacci levels are just one piece of a puzzle. combined with something else technical analysis and powerful Risk management strategies for navigating the ever-evolving foreign exchange markets.

disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult a qualified financial advisor before making any investment decisions.

happy trading

May Pip be in your favor!