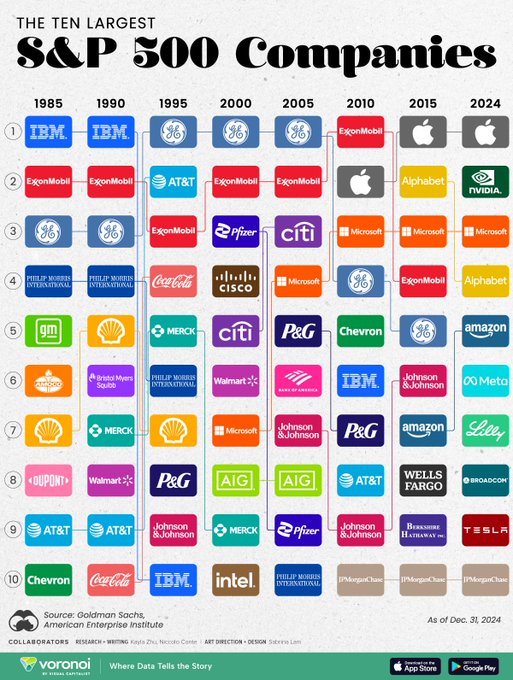

RingCentral: Expect continued margin expansion and steady debt reduction (NYSE:RNG)

dcbog/iStock via Getty Images

Investment theory

RingCentralNew York Stock Exchange:RNG) maintains a leading position in the unified communications as a service (UCaaS) market, which is expected to grow at a CAGR of 19.4% through 2032. $311 billion. Demand is growing, but fierce competition in the market has put pressure on pricing. RingCentral has differentiated itself from its competitors primarily through its reliability and strategic partnerships. The company has also launched several AI-based products and plans to upsell them to its large existing customer base.

In terms of profitability, the business has shown strong operating leverage, with margins rising from 10.4% in Q1 2022 to 21.9% in the last quarter. As a result, the company’s risk associated with its upcoming debt maturities has been reduced by robust FCF generation. The current valuation is less demanding than peers, but it is not attractive given the high valuation. Stock-based compensation (“SBC”) is involved. Therefore, I maintain a Neutral rating on the stock.

Financial Highlights and Future Expectations

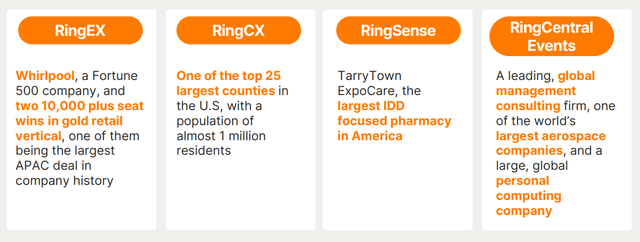

Q2 Investor Presentation

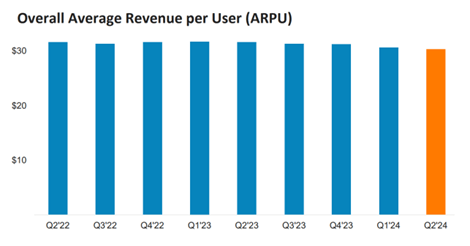

Revenue grew 10% to $593 million in the second quarter, significantly exceeding management’s guidance. A key driver of this performance was increased momentum for the company’s new AI-based products, as shown above. RingCX, its Contact Center as a Service (CCaaS) product, grew exceptionally by 70% quarter-over-quarter. RingSense, which provides customer insights, and RingCentral Events, which manages large-scale events, also experienced strong growth. While these new products are growing from a relatively small base, management expects their overall contribution to annual recurring revenue (ARR) to reach $100 million by the end of 2025. Given that the company can offer these products to customers at a significantly higher price point than its current price point of less than $30 per seat, this is expected to drive ARPU in the coming quarters. Discussing the pricing of these new products, the company’s CFO stated:

And just to remind you of the ARPU for the new product, RingCX is living at $65 per seat per month, which is way above the company average, and RingSense for Sales is around $60 per month.

Q2 Investor Presentation

As seen above, ARPU has declined in recent quarters as the company has focused more on enterprise customers, which typically involves large price concessions. This has been a headwind to revenue growth so far, but I expect this metric to improve going forward, driven primarily by large upsells. I expect this to support high single-digit revenue growth in line with analyst estimates in the medium term.

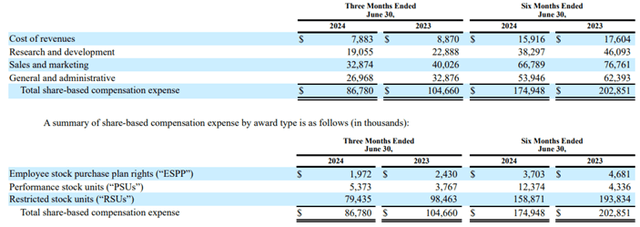

I also expect the company to continue to demonstrate operating leverage. In Q2, sales and marketing expenses decreased by 150 basis points as a percentage of revenue. Going forward, I expect R&D expenses to decrease as a percentage of revenue as new products are already in the market. This should expand margins by at least 200 basis points annually over the medium term. Therefore, investors can expect earnings to outpace revenue growth by this margin going forward.

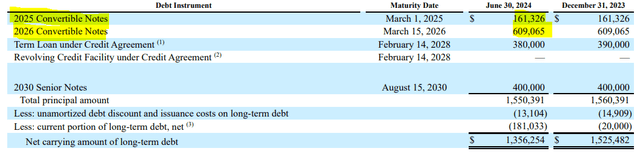

2nd Quarter Financial Report

Given the business’s robust FCF generation, which management expects to be close to $400 million this year, and its $200 million cash position, I don’t expect the company to face significant problems paying down its debt maturing in 2025 and 2026 as shown above. Excess capital will likely be used for share repurchases to offset SBC’s dilution.

evaluation

At its current share price of $33, the company has a market cap of just over $3 billion. With a net debt position of $1.3 billion, the company is worth $4.3 billion. Based on management’s guidance for FCF of around $400 million this year, the stock is trading at a Price/FCF and EV/FCF multiple of 7.5 and 10.7, respectively.

Meanwhile, RingCentral’s competitors Zoom (ZM) and 8×8 (EGHT) are growing at mid-single digit rates and have EV/FCF multiples of 9 and 10.4, respectively. I find this valuation relatively attractive, as I expect RingCentral’s FCF to grow at around 10% over the medium term. However, my biggest concern is the company’s high SBC level. At around $350 million per year, its annual run rate is roughly in line with what the company’s annual FCF is generating. Management has started to address this by significantly reducing the amount of equity grants, as explained by the CFO when he said:

As of the first half of 2024, net new share grants have decreased by approximately 60% compared to last year, which is ahead of our previous target of reducing share grants by 58% from 2023 levels.

2nd Quarter Financial Report

The high SBC level makes the company much less attractively valued on a GAAP basis. In addition to being valued on par with peers, I would argue that this provides investors with reasonable downside protection as the company is an attractive acquisition candidate from much larger companies like Cisco (CSCO) and Salesforce (CRM) that are looking to strengthen their UCaaS offerings.

Risks to Consider

competition

In addition to competing with major players like Microsoft (MSFT), Zoom, and 8×8 in the UCaaS market, RingCentral now has to compete with the likes of Five9 (FIVN) in the AI-based CCaaS space. Given its significant existing customer base, RingCentral believes it is better positioned to achieve greater success by upselling new products to existing customers rather than focusing solely on acquiring new customers.

AI-based automation

AI-based chatbots and virtual assistants can significantly reduce the number of people needed to handle a task, which will in turn reduce the number of seats needed per customer. RingCentral is working to counteract this impact by offering its own AI-based product line for its customers.

debt

The company has nearly $1.5 billion in total debt compared to $200 million in cash. Successful debt restructuring depends on the business continuing to generate strong FCF.

Macroeconomic weaknesses

A difficult economic environment could particularly impact RingCentral’s small business customers. If widespread layoffs occur, these companies may reduce their workforce, reducing the number of RingCentral seats they need.

conclusion

While AI could pose a significant threat to long-term business growth, management is currently leveraging AI-based products to drive revenue growth and profitability in the medium term. The current valuation appears reasonable, but it is not particularly attractive considering the costs associated with SBC. Therefore, I maintain a neutral rating on the stock.