“RISK MANAGEMENT” ASSISTANT -@tambangEA – Trading Strategies – 8 April 2024

Please leave a 5 stars rating if you like this free tool! Thank you so much 🙂

The “Risk Management Assistant” Expert Advisor Collection is a comprehensive suite of tools designed to enhance trading strategies by effectively managing risk across various market conditions. This collection comprises three key components: averaging, switching, and hedging expert advisors, each offering distinct advantages tailored to different trading scenarios.

This EA is a development of standard risk management strategies on the market

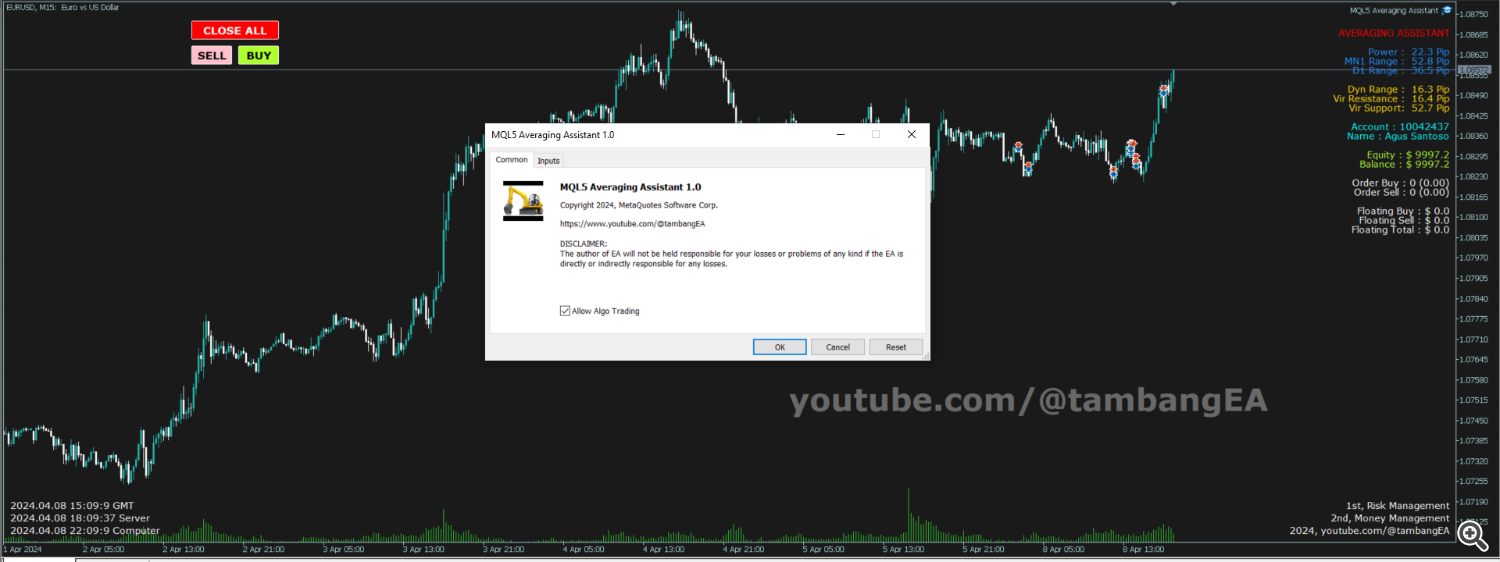

1. Averaging Assistant EA:

Advantage: Averaging expert advisors utilize a strategy where additional positions are opened at different price levels to achieve an average entry price. This approach can help mitigate losses and improve overall profitability in trending markets.

Advantages:

Risk Mitigation: By averaging the entry price of a position, the impact of sudden price fluctuations is minimized, reducing the potential for significant losses.

Enhanced Profit Potential: Averaging allows traders to capitalize on price movements by accumulating positions at favorable levels, potentially increasing profits when the market reverses.

Adaptive to Trends: Ideal for trending markets where price tends to move consistently in one direction, as it allows traders to capitalize on momentum while managing risk effectively.

The “Averaging Assistant” Expert Advisor (EA) utilizing the averaging method is a sophisticated tool designed to help traders manage their risks effectively in the forex or financial markets. This EA employs an averaging strategy, which involves opening multiple positions at different price levels to mitigate the impact of market volatility and potential adverse movements.

Here’s a detailed description of the key features and functionalities of this EA:

Risk Management Parameters: The EA allows traders to define their risk management parameters, including the maximum risk per trade, total exposure limit, and stop-loss levels. Traders can set these parameters based on their risk tolerance and trading strategies.

Averaging Strategy: The core of this EA is its averaging strategy. When a trade is initiated, and the market moves against the position, the EA will open additional positions (averaging down) at predetermined intervals or price levels. These additional positions are aimed at reducing the average entry price of the overall position, thus potentially improving the chances of the trade eventually turning profitable.

Dynamic Position Sizing: The EA dynamically adjusts the position sizes of the averaging trades based on market conditions and the trader’s risk management parameters. It may increase or decrease the size of subsequent positions to ensure that the total risk exposure remains within predefined limits.

Stop-loss Management: The EA incorporates intelligent stop-loss management to limit potential losses. Traders can set trailing stop-loss levels that automatically adjust as the trade moves in their favor. Additionally, the EA may close out all positions if the cumulative loss reaches a certain threshold to prevent excessive drawdowns.

Profit-taking Strategies: In addition to managing losses, the EA also includes profit-taking strategies. Traders can set take-profit levels for individual positions or for the entire basket of trades opened by the EA. This helps lock in profits and prevent giving back gains during volatile market conditions.

Risk Monitoring and Reporting: The EA continuously monitors the overall risk exposure, individual trade performance, and account balance. It provides real-time reporting and alerts to keep traders informed about their portfolio’s risk profile and performance.

Customization Options: The EA offers a high degree of customization, allowing traders to fine-tune parameters such as averaging intervals, maximum number of averaging trades, and risk-reward ratios to suit their trading preferences and market conditions.

Backtesting and Optimization: Before deploying the EA in live trading, traders can conduct extensive backtesting and optimization to evaluate its performance under various market scenarios and parameter settings. This helps validate the effectiveness of the averaging strategy and fine-tune the EA for optimal results.

Overall, the Risk Management Assistant Expert Advisor using the averaging method is a powerful tool for traders seeking to manage risks effectively while implementing a disciplined and systematic approach to trading in the financial markets. By combining sophisticated risk management techniques with the averaging strategy, this EA aims to enhance the overall profitability and resilience of traders’ portfolios.

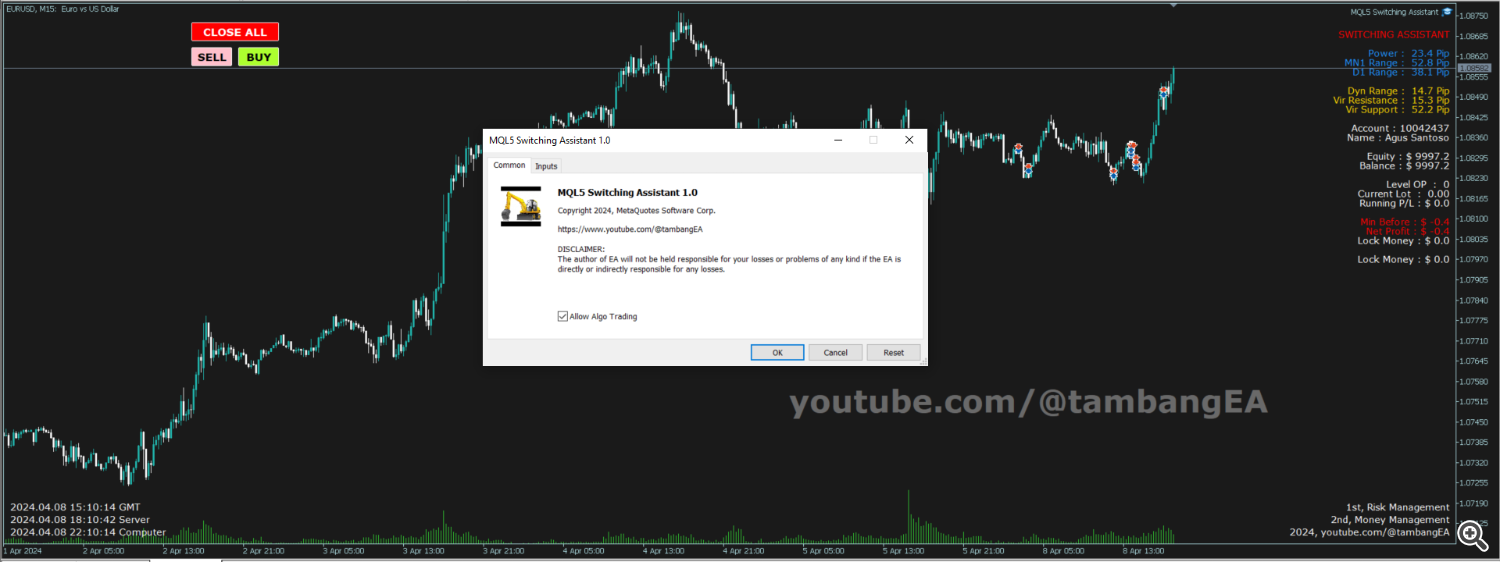

2. Switching Assistant EA :

Advantage: Switching expert advisors employ a dynamic strategy that switches between different trading systems or parameters based on market conditions. This adaptive approach helps optimize performance and reduce risk exposure.

Advantages:

Adaptability: Switching between different trading systems or parameters enables the expert advisor to adapt to changing market conditions, maximizing profitability in various environments.

Risk Diversification: By utilizing multiple strategies, the switching expert advisor spreads risk across different approaches, reducing reliance on any single method and enhancing overall portfolio resilience.

Improved Consistency: The ability to adjust strategies based on market dynamics helps maintain consistent performance over time, even as market conditions evolve.

The “Switching Assistant’ Expert Advisor (EA) utilizing the switching method is a sophisticated tool designed to enhance risk management within trading strategies, particularly in the realm of algorithmic trading in financial markets. This EA operates within the MetaTrader platform, leveraging its capabilities to automate risk management decisions based on predefined parameters and market conditions.

Here’s a breakdown of its key features and functionality:

Dynamic Risk Adjustment: The EA employs a dynamic risk adjustment mechanism that continuously evaluates market conditions, account size, and other relevant factors to determine the appropriate level of risk for each trade.

Switching Methodology: At the core of this EA is the switching method, which involves dynamically switching between different risk management strategies based on predefined criteria. These strategies may include fixed lot size, percentage risk per trade, or other custom risk management approaches.

Trade Analysis: The EA conducts real-time analysis of each potential trade, considering factors such as volatility, correlation, and market sentiment to assess the risk-reward profile before executing a trade.

Customizable Parameters: Users have the flexibility to customize various parameters, including risk thresholds, trade size limits, and switching criteria, to align with their specific trading objectives and risk tolerance.

Risk Monitoring and Reporting: The EA continuously monitors account equity, drawdown levels, and other risk metrics, providing real-time alerts and comprehensive reporting to help traders stay informed about their exposure and performance.

Position Sizing Optimization: By dynamically adjusting position sizes based on market conditions and risk parameters, the EA aims to optimize risk-adjusted returns and mitigate the potential for significant drawdowns.

Backtesting and Optimization: Prior to deployment, the EA allows users to conduct extensive backtesting and optimization to assess its performance under various market scenarios and fine-tune its parameters for optimal results.

Compatibility and Integration: The EA seamlessly integrates with MetaTrader platforms, ensuring compatibility with a wide range of brokers and trading instruments, including forex, stocks, commodities, and indices.

Risk Control Mechanisms: In addition to dynamic position sizing, the EA may incorporate additional risk control mechanisms such as stop-loss orders, trailing stops, and hedging strategies to further mitigate downside risk.

Overall, the Risk Management Assistant Expert Advisor utilizing the switching method empowers traders to implement a disciplined and adaptive approach to risk management, helping to safeguard their capital while maximizing the potential for long-term profitability in the dynamic and often unpredictable world of financial markets.

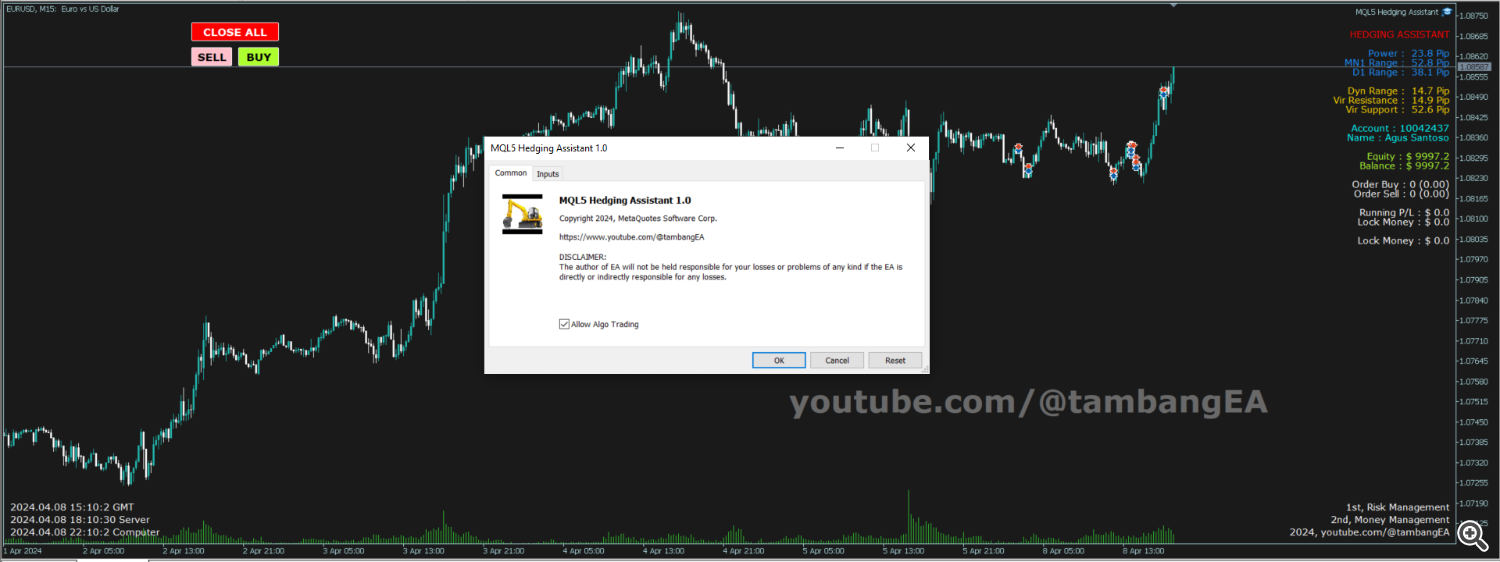

3. Hedging Assistant EA :

Advantage: Hedging expert advisors employ hedging techniques to offset potential losses by opening opposite positions in correlated assets or markets. This strategy provides a safeguard against adverse price movements while allowing traders to remain active in the market.

Advantages:

Risk Protection: Hedging expert advisors act as a form of insurance against unfavorable market movements by offsetting losses in one position with gains in another, thereby reducing overall risk exposure.

Continued Market Participation: By hedging positions, traders can avoid the need to exit the market entirely during periods of uncertainty or volatility, maintaining exposure to potential opportunities.

Flexibility: Hedging strategies can be tailored to specific market conditions and individual risk preferences, offering flexibility in risk management approaches.

In summary, the Risk Management Assistant Expert Advisor Collection offers a comprehensive set of tools designed to effectively manage risk in trading operations. Whether through averaging, switching, or hedging strategies, traders can mitigate losses, optimize profitability, and adapt to changing market conditions with confidence.

The “Hedging Assistant” Expert Advisor with Hedging Method is a sophisticated tool designed to assist traders in managing their risk exposure effectively within the volatile world of financial markets. Utilizing advanced algorithms and hedging techniques, this expert advisor aims to minimize potential losses while maximizing profit potential.

Key Features:

Risk Assessment: The advisor evaluates the trader’s risk tolerance, account balance, and market conditions to determine appropriate risk levels for each trade. It considers factors such as volatility, liquidity, and correlation to make informed decisions.

Dynamic Position Sizing: Based on the risk assessment, the advisor dynamically adjusts position sizes to align with the trader’s risk parameters. It ensures that each trade’s exposure is proportional to the trader’s account size and risk tolerance.

Hedging Strategy Implementation: The advisor employs hedging strategies to mitigate potential losses in adverse market conditions. By opening offsetting positions, it aims to neutralize downside risk while allowing for continued participation in market movements.

Real-Time Monitoring: The advisor continuously monitors market conditions and the trader’s positions to identify potential risks and opportunities. It provides real-time alerts and notifications to prompt action when necessary, ensuring proactive risk management.

Customizable Parameters: Traders can customize various parameters such as stop-loss levels, take-profit targets, and hedging thresholds to suit their individual trading preferences and risk appetite. This flexibility allows for personalized risk management strategies.

Backtesting and Optimization: The advisor offers robust backtesting capabilities, allowing traders to evaluate the effectiveness of different risk management strategies over historical data. Through optimization, traders can fine-tune parameters to enhance performance and adapt to changing market conditions.

User-Friendly Interface: The advisor features an intuitive interface that makes it easy for traders to monitor their positions, adjust settings, and analyze performance. It provides clear visualizations and reports to facilitate informed decision-making.

Benefits:

Enhanced Risk Management: By utilizing advanced algorithms and hedging techniques, the advisor helps traders minimize potential losses and preserve capital during adverse market conditions.

Improved Profitability: The dynamic position sizing and proactive risk management strategies employed by the advisor aim to optimize profit potential while mitigating downside risk.

Time Efficiency: The advisor automates many aspects of risk management, allowing traders to focus on strategy development and analysis rather than manual monitoring and intervention.

Versatility: Whether trading forex, stocks, commodities, or other financial instruments, the advisor can be adapted to various markets and trading styles, providing flexibility for traders with diverse preferences.

In conclusion, the Risk Management Assistant Expert Advisor with Hedging Method offers traders a powerful tool to navigate the complexities of financial markets with confidence. By combining advanced risk management techniques with automated execution, it aims to empower traders to achieve their financial goals while minimizing exposure to market volatility.

// ========