Rocket Lab: Fiscal 2024 looks set to be a big year (NASDAQ:RKLB)

pixel image

investment action

We recommend a Buy rating on Rocket Lab.NASDAQ:RKLB) Last time I wrote about it I believed the implementation was still in progress. There was strong evidence of this, for example, the planned launch sold out. FY24, HASTE contract progresses and several milestones achieved. Based on our current outlook and analysis of RKLB, we continue to recommend a Buy investment opinion.

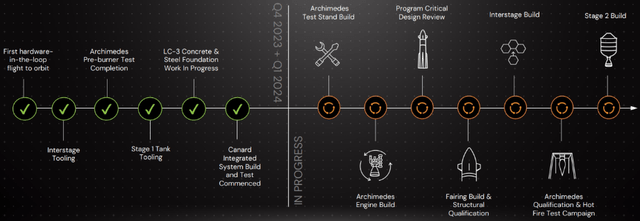

FY24 will be a significant year for RKLB, and we expect good results given our continued execution performance supported by customer adoption. All eyes will be on how RKLB’s Neutron performs this year, and if it performs as expected, the stock is expected to surge as consensus builds confidence in its potential earnings upside.

examine

RKLB

Despite the continued decline in stock prices According to previous updates, the moment of positive inflection is closer to FY24 and the focus will be on RKLB’s new rocket, Neutron. The outcome will likely have a huge impact on the stock’s sentiment, as Neutron is critical to RKLB not only serving lucrative government missions but eventually launching its own constellation.

The initial set of Neutron customers hasn’t been revealed, but executives have hinted at: considerable interest In both the public and private sectors. So, in my view, if Neutron can operate without problems, the market will have more confidence in pricing the future earnings power of the business.

What’s important is that RKLB continues to show that it is viable. On February 21, RKLB announced the successful return of Varda’s space capsule to Earth. In case readers were wondering, the capsule contained pharmaceutical crystals used in antiviral drugs, and the purpose of the roughly eight-month mission was to investigate how drug development could be improved in microgravity. In this case, RKLB’s role will be to build a unique spacecraft for Varda and then perform in-space operations, retrograde maneuvers, and re-entry positioning maneuvers to allow Varda’s capsule to return to Earth via hypersonic re-entry.

I don’t know what you may think, but this shows RKLB’s ability to execute and customers have faith in RKLB to invest in the space. Further evidence that RKLB’s value proposition and product are effective is the fact that three additional Varda missions have been contracted. More importantly, in my opinion, RKLB’s efforts to create a re-entry capsule for Neutron may be affected by Varda’s capsule re-entry. This could theoretically be utilized to support future crewed missions.

It’s also great that RKLB can continue to win contracts and fund its business without having to raise a lot of money. For example, RKLB has signed a contract with the Space Development Agency (SDA) to supply 18 satellites for a sprawling constellation in low-Earth orbit, which will aid in missile tracking capabilities.

The award is based on a fixed-price contract structure and is valued at $525 million. Crucially, RKLB was selected as the main contractor for this SDA contract. If RKLB performs well, more deals may close and add another success to the portfolio.

I’m not a huge fan of capital raising, but I believe that for RKLB, the $355 million capital raising on convertible notes made in February 2024 ($300 million net after expenses) was strategic. The bond matures in 2029 and carries an interest rate of 4.25%. This brings RKLB’s total cash position to nearly $550 million (ending fiscal 2023 at $244.8 million). Given that this and the next few years will be pivotal years for RKLB, having more cash on hand will make it easier for RKLB to step up its investments if needed, especially M&A, which has performed quite well so far. Within six months of going public, RKLB acquired three targets (SolAero, Advanced Solutions, and Planetary Systems Corporations), which RKLB believes helped deliver on the company’s plans to provide end-to-end space services. From a cash burn perspective, this additional capital virtually eliminates the bear case that RKLB will run out of cash before turning EBITDA positive (expected in FY25, according to consensus).

evaluation

author’s work

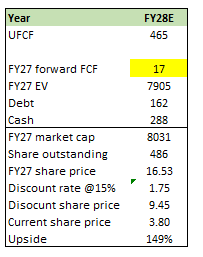

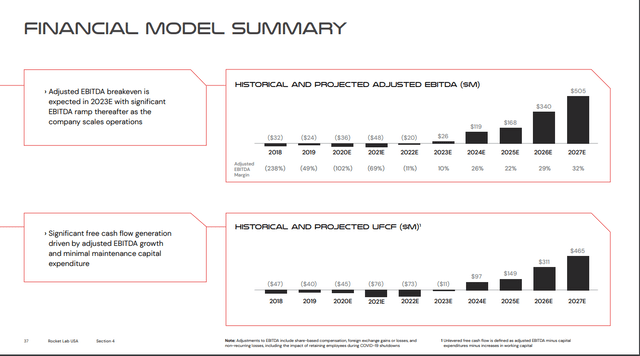

My previous model was to focus on the FY27 UFCF that management had provided in its long-term guidance. However, looking at RKLB’s performance as of FY23, we believe it makes more sense to take a conservative approach when it comes to realizing UFCF $465 million. The reason I say this is because RKLB was expected to achieve $119 million in adjusted EBITDA in FY24, but year-to-date adjusted EBITDA is still at -$146.2 million and the consensus expectation is -$96.5 million in FY24.

To ensure my estimates are not too aggressive, I assume RKLB will meet its FY27 target by FY29, delayed by two years. This is consistent with market expectations that RKLB will achieve its FY25 adjusted EBITDA target of $168 million in FY26 (negative estimate: $189 million). In terms of valuation, looking at the same peers I used previously (e.g. Textron, Barnes, and Howmet Aerospace), valuations have trended up ~10% since December. This is definitely a positive for RKLB, which operates in a similar space. However, since RKLB is a fairly new player that is not yet profitable, we are being conservative here.

Therefore, I continue to value this business at a discount to its peers at 17x FCF. Additionally, I think a more accurate way to show upside potential is to use a discounted stock price basis. Regardless of my beliefs about the execution and fundamentals of the business, this is undoubtedly a high-risk investment that warrants a high discount rate. My model expects a 15% annual return to justify an investment in RKLB, and that assumption achieves my discounted stock price target of $9.45. This still suggests attractive upside for RKLB, even if it achieves it a year later than its UFCF target. predicted.

RKLB

danger

The main risk lies in Neutron’s performance. If it works well, it will be nice if the market starts to trend upward. However, even if it fails for any reason or shows signs that it may not work within the expected time frame, the market is likely to take a more conservative approach to its near-term outlook, putting more pressure on the stock price. And emotions.

final thoughts

What I recommend is a buy investment opinion on RKLB despite the falling stock price. The company continues to demonstrate its execution capabilities through successful missions and contract awards. Fiscal year 2024 is expected to be a key year with the launch of Neutron, a new rocket that will be critical to future growth. Even taking into account the delay in achieving UFCF’s management goal and the 15% discount rate, we believe the upside is still attractive.