Rocks than stocks | Gonogo Show 041824 | GoNoGo Chart

key

gist

- A new risk-off environment for stocks

- The main products

The S&P500 trend condition has reversed to “NoGo”, reinforced by a purple bar. Alex Cole and Tyler Wood, CMT identify cross-market factors including rising interest rates ($TNX) and a strong U.S. dollar (UUP) that could create headwinds for risk assets. The strong “Go” trend in the Volatility Index ($VIX), still hovering around 20, is also related to the new risk-off nature of this environment.

The S&P500 trend condition has reversed to “NoGo”, reinforced by a purple bar. Alex Cole and Tyler Wood, CMT identify cross-market factors including rising interest rates ($TNX) and a strong U.S. dollar (UUP) that could create headwinds for risk assets. The strong “Go” trend in the Volatility Index ($VIX), still hovering around 20, is also related to the new risk-off nature of this environment.

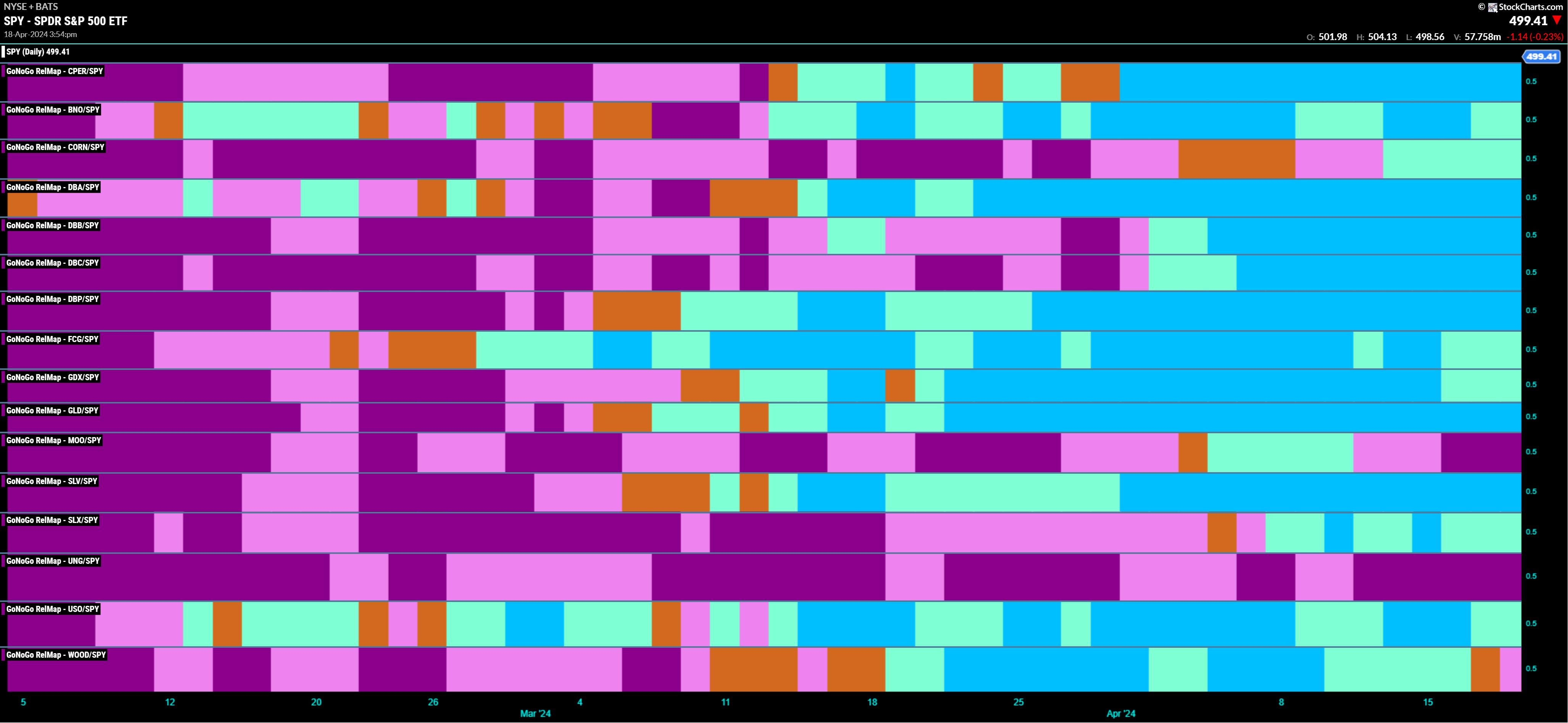

This week we again take a closer look at GoNoGo Trend® conditions across a variety of commodity markets, including precious and industrial metals ($GOLD, $COPPER), softs ($COCOA, $COFFEE) and energies ($OIL). Relatively outperforms US stocks ($SPY) in “Go” conditions. To express this thesis, Alex and Tyler look at several stocks that could benefit from this trend, including Freeport McMoran (FCX), Harmony Mining Inc (HMY), and Marathon Oil (MRO).

As seen in the GoNoGo Sector RelMap®, market leadership has been replaced by cyclical sectors this week. Energy ($XLE), Industrials ($XLI), and Materials ($XLB) continue to outperform the S&P 500 Index. Interestingly, Communications ($XLC) and Utilities ($XLU) also joined the leadership group. Alex and Tyler take a deeper dive at the industry group level within the Materials Sector (XLB) to see that relative performance is driven by the Aluminum, Non-Ferrous Metals, and Mining groups. In absolute terms, the material was corrected to a neutral yellow bar when the GoNoGo Oscillator® was at zero. Finally, Alex and Tyler review similar risk-off conditions in the cryptocurrency space as Bitcoin ($BTCUSD) reverses into “NoGo” trend conditions and what to watch out for next in terms of trend continuation and downside entry opportunities.

Follow: https://twitter.com/ChartsGonogo

Link: https://www.linkedin.com/company/gonogo-charts-llc

Learn more: https://www.gonogocharts.com/

Rocks than stocks | GoNoGo Show April 18, 2024

Tyler Wood, CMT, co-founder of GoNoGo Charts, is committed to expanding the use of data visualization tools that simplify market analysis to remove emotional bias from investment decisions. Tyler served as Executive Director of the CMT Association for over 10 years to advance the proficiency and skill of investors in mitigating market risk and maximizing capital markets returns. He is a seasoned business executive focused on educational technology for the financial services industry. Since 2011, Tyler has presented technical analysis tools to investment firms, regulators, exchanges and broker-dealers around the world. Learn more