Rondure New World + overseas fund EM Stock Holdings (mid-2024)

Rondure Global Advisor is a woman-owned investment advisor based in Salt Lake City, Utah. Rondure New World Fund (MUTF: RNWOX / RNWIX) And now it’s been liquidated Rondure Overseas Fund (MUTF: rosax / Losix) Who are the holdings we covered last year? Rondure New World + overseas fund EM Stock Holdings (mid 2023).

At the end of September, the fund manager made the following announcement:

📯 Final Shareholder Letter (Londure Global Advisors)

It is with a heavy heart and thoughtful consideration that we inform you of this. Rondure New World Fund (MUTF: RNWOX / RNWIX) It is scheduled to be liquidated on October 18, 2024, and the closure will also result in the closure of Rondure Global Advisors.

The economic environment for our emerging markets-focused strategy has been challenging for some time. Our entire team has been committed to meeting these challenges with the relentless goal of achieving long-term positive returns for our customers and investors. Unfortunately, recent unexpected developments within our business have caused us to reevaluate our ability to continue. This is a painful outcome, and not one we expected, especially given that emerging markets remain an interesting and compelling long-term investment. We did not make this decision lightly, but ultimately, after considering the economic and operational realities of continuing to operate, we realized that closure was the best outcome for our customers.

If, like us, you remain interested in the long-term opportunities in the emerging markets sector, we’ve got you covered: Grandeur Peak Global Advisors How to Allow Rondure Clients to Invest in Soft Closes Grandeur Peak Emerging Markets Fund (MUTF: GPEIX).

With the recent interest rate cuts from the Federal Reserve and a slight loosening of the dollar’s value, it’s not clear what the company’s true situation is from its short press release. Now seems like a strange time to throw in the towel on investing in international or emerging markets.

This profile or interview article explains how the company operates.

📰 Tour the world in pursuit of returns that exceed the index (Barron’s) October 2017 🗃️

Traveling the world and meeting companies is Laura Gerritz And her Rondure Global Advisors team provides insights that lead to superior stock analysis.

When you think of a foreign stock analyst, you think of a glamorous world traveler, preferably talking to CEOs in countries far from five-star hotels. In the pursuit of global value, Laura Geritz and the Rondure Global Advisors team have achieved many accomplishments. But since it is the customer’s money, they travel by coach and stay in cheap hotels.

📰 Global investors must (WSJ) April 2018 🗃️

Star Mutual Fund manager Laura Geritz left the company last year. Wasatch Advisors She invested everything she had in a new fund company in Salt Lake City.

She also left a world where managers receive performance bonuses. to Rondure Global Advisor She capped her own salary and cut much of her bonus structure. “If I do my job and choose the right stocks,” she says, “At the end of the day, we will be very well rewarded with our customers. If not, I don’t deserve it…. I am confident.”

Mr. Geritz, who made a name for himself running international, emerging markets and frontier funds in Wasatch, started the company five years ago with Wasatch friends who founded the company. Grandeur Peak Global Advisors. The company performs back-office, compliance and accounting support for Rondure.

This podcast is long, but worth a listen.

🎥 RWH040: Going Global with LAURA GERITZ (We Study Billionaires) 2:05:15 hours (January 2024)

In this episode, William Green talks about: Laura GerritzFounder of Rondure Global Advisors, which scours the world to find high-quality companies trading at attractive prices in: India, China, Japan, Thailand, Taiwan, Türkiye, Brazil, Mexico. Here, Laura argues that more funds should be allocated to undervalued stocks outside the US. She also talks about her unusual lifestyle, built around constant travel, voracious reading, and abundant time to think.

What you will learn in this episode:

How Laura Geritz earned the nickname “Money Bag.”

How she got into the investment industry while living in Japan.

She was shaped by the frugal, unglamorous culture of rural Kansas.

What she learned from her mentor and partner, Robert Gardiner.

Why so many talented women quit the investment business.

Why does she think many investors are taking too much risk?

Reasons for the delayed strong rebound in overseas stocks.

How she evaluates the risks and rewards of Chinese stocks.

How she sifted through 70,000 stocks to identify great companies.

What foreign investors don’t understand about Japanese companies.

How to become a continuous learning machine.

How Laura handles adversity when she doesn’t like her investing style.

Why she keeps her calendar noticeably neat.

After listening to Geritz, I wonder if she’s shutting down the company for personal reasons to pursue other interests, although the press release seems to hint at other issues (cash flow?).

Otherwise as mentioned Posted last Sundayfor the first 10 minutes Check out the 2024 Platinum Investor Roadshow (55:55 minutes) The webinar discussed Australian-based structural/organizational/portfolio issues. Platinum Asset Management Let’s take a look at these challenges and how they reorganized themselves to address them.

We also did this in 2022 when star fund manager Terry Smith liquidated his emerging markets fund.

When investing in emerging markets growth stocks fails: Fundsmith Emerging Equities Trust plc liquidates

Terry Smith’s (“Britain’s Warren Buffett”) mature growth equity investment style ran into some problems when he applied it to emerging markets as he prepared to liquidate Fundsmith Emerging Equities Trust plc.

way back Rondure Global Advisor‘ Last year, both funds performed abnormally. High number of SE Asia stocks It is expressed as a percentage of holdings or total holdings, which can affect performance (given that the region is not popular with fund managers).

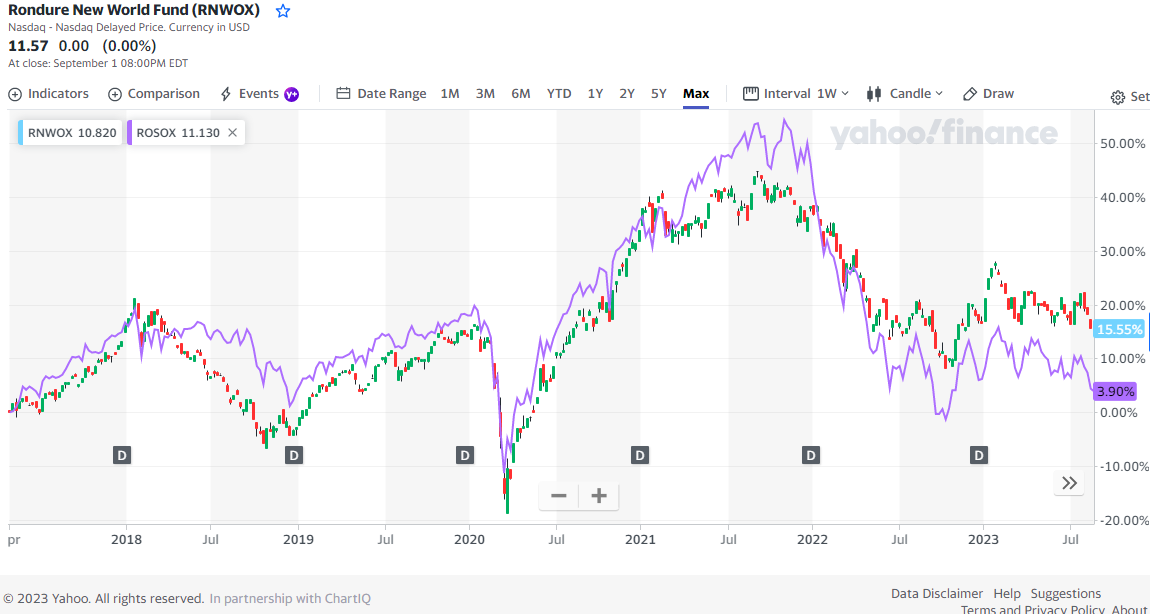

Next is performance. Rondure New World Fund (MUTF: RNWOX / RNWIX) And now it’s been liquidated Rondure Overseas Fund (MUTF: rosax / Losix) As of last year:

And for now:

This isn’t a particularly notable performance, but the fund isn’t overly concentrated in a few particularly popular stocks (such as Nvidia or TSMC), which puts the performance of many funds or ETFs in doubt. for example: As noted in our recent report: Taiwan ETF Holdings (early 2024) Post, the ETF holds nearly a quarter of its holdings in TSMC alone. As long as TSMC outperforms, that ETF will also outperform (and probably outperform Taiwanese closed-end funds).

Nevertheless, various holdings Rondure New World Fund And it’s already been liquidated Rondure Overseas Fund It’s worth taking a closer look to fill in the gaps in your portfolio.

To make your life easier, this post includes:

-

Which fund or fund holds the stock?

-

IR page link and Yahoo! This is a brief explanation of stock prices. Finance or Finviz (for US listings).

-

Link to Wikipedia page (for what it’s worth…)

-

It is the price/book (most recent quarter) ratio plus the forward or trailing P/E plus the dividend yield tied back to Yahoo! This is a financial statistics page.

-

The latest long-term technical charts financial resources linked back to Yahoo!

Funds held date:

All stocks that have not yet been tagged and added to the index page have also been added to the index page.

And as always, this post Provided for informational purposes only (And to make your life easier by providing relevant information, links and charts). This does not constitute investment advice and/or recommendations…

(Londuré New World Fund)

ANTA sports products (Hong Kong: 2020 / turn off: AS7 /OTCMKTS: Andy /OTCMKTS: ANPDF) We are involved in design, R&D, manufacturing, marketing and sales. professional sports productsIt sells shoes, clothing, and accessories to Chinese consumers. By embracing all-round brand portfolio include door, row, descent and Colon SportsForming a consortium of investors for a successful acquisition amer sports 2019 (Global sportswear group with internationally recognized brands) Arc’teryx, Salomon, Wilson, Peak Performance, Atomic, etc.), ANTA Sports aims to unleash the potential of both the mass and luxury sportswear markets.

-

Wikipedia

-

Price/Book (most recent quarter): 4.50

-

Forward P/E: 19.08 / Annual Dividend Yield: 2.29% (yahoo! financial resources)

(Londuré New World Fund)

alibaba (NYSE: baba) It is a Chinese multinational technology company specializing in e-commerce, retail, internet and technology.

-

Wikipedia

-

Price/Book (most recent quarter): 2.06

-

Forward P/E: 13.42 / Annual Dividend Yield: 1.74% (yahoo! financial resources)

(Londuré New World Fund)

auto home (NYSE: ATHM) is the leading online destination for Chinese car consumers with three websites: autohome.com.cn, che168.comand ttpai.cn.

Autohome, a transaction-oriented company, operates ‘Autohome Mall’, a full-service online transaction platform, to facilitate transactions between automobile manufacturers and dealers. It also offers other value-added services such as car finance, car insurance, used car trading and aftermarket services through its website and mobile applications.

-

Price/Book (most recent quarter): 1.20

-

Forward P/E: 15.77 / Annual Dividend Yield: 4.99% (yahoo! financial resources)

(Londure New World Fund)

China Resources Beer Holdings or CR beer (Hong Kong: 0291 / turn off: CHK /OTCMKTS: CRHKY / CRHKF) It is a listed beer subsidiary. China Resources (Holdings) Co., Ltd. (one of China’s largest state-owned conglomerates). The group focuses on manufacturing, selling and distributing beer products. China Resources Snow Breweries Limited (“CRSB”) is a wholly-owned subsidiary of the Company. In 2019, the Group launched a strategic partnership. Heineken Group.

-

Wikipedia

-

Price/Book (most recent quarter): 3.19

-

Forward P/E: 16.86 / Annual Dividend Yield: 2.27% (yahoo! financial resources)