RTX Corporation Stock: Value to Rise in 2024 (NYSE:RTX)

Michael Fitzsimmons

Buying above-average stocks at below-average prices is a great way to achieve long-term success in the stock market. With the S&P 500 (SPY) recently hitting new all-time highs, this may seem difficult to achieve.

However, the following is important: The Santa Claus Rally that continues ahead of the New Year is hosted by Meta Platforms (meta) is responsible for the lion’s share of SPY’s market capitalization-weighted gains.

Thankfully, value investors can rejoice as there are a number of stocks that remain in value territory that still make sense to pick from. This led to RTX Corporation (New York Stock Exchange:RTX) was last covered here in August, highlighting valuable opportunities despite recent powder metal issues. The price of RTX later dropped to $69 in October. Since my last visit it has recovered to below 0.45%.

As shown below, RTX remains down 15% in real terms since the start of 2023. In this article, we provide an update and discuss why RTX is a top value stock with potentially strong returns from here. So let’s get started!

RTX Stock (Alpha Exploration)

Why RTX?

RTX Corporation is a leading aerospace and defense company serving government and commercial customers around the world. It employs 180,000 people across its businesses, including Collins Aerospace, Pratt & Whitney, and Raytheon. It generated a total of $67.1 billion in revenue over the past 12 months.

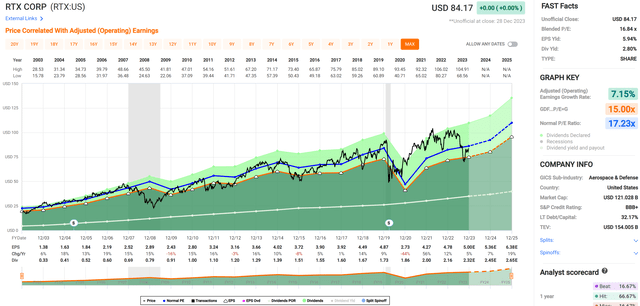

As you can imagine, the aerospace/defense industry is a difficult industry to tackle because incumbents have a significant scale advantage. High capital requirements and accumulated industry know-how increase pricing power and barriers to entry. RTX in particular has performed well on this front, delivering historically high shareholder returns. As you can see below, RTX has delivered a total return of 3,124% over the past 30 years, outperforming the S&P 500 and industry peers Boeing (BA) and Lockheed Martin (LMT), and lagging behind Northrop Grumman (NOC)’s 6,127%. Total revenue.

Those who follow RTX know that there have been some issues over the past year. The impact of Pratt powder metal substances, among others, will require hundreds of aircraft engines to be removed for inspection by 2027. This defect may cause: Engine cracks occurred, costing RTX $2.89 billion to fix the problem.

A product defect is never good news for any investor, but the good news is that no additional financial impact is expected and much of the damage has already been quantified, as management recently stated in its last investor conference call.

Let me give you some thoughts on the metal powder issue. With the initial removal and inspection of the PW1100 engine powering the A320 Neo aircraft, our financial and operational outlook is consistent with our expectations. We have also made significant progress in safety assessments for other Pratt & Whitney powered vehicles. These include the PW1500 powered by the A220, the PW1900 powered by the Embraer E2, and the V2500 powered by the legacy A320.

Since the analysis has been substantially completed, we do not anticipate a significant increased financial impact as a result of this fleet management plan. The focus of Pratt & Whitney and the entire RTX organization is maintaining the trust of our customers and partners. We are constantly working to improve the plans we currently have.

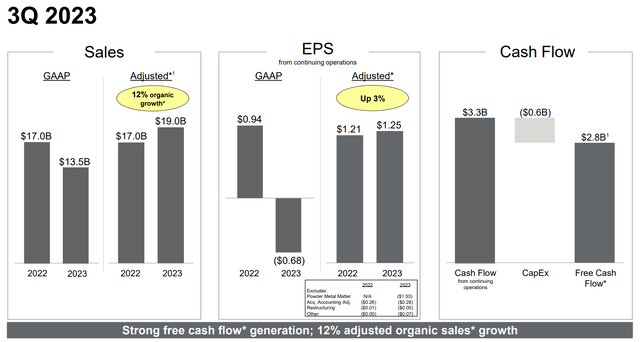

Despite some short-term noise related to the recall, RTX continues to see strong business growth, with adjusted sales reaching $19 billion during the third quarter, up 12% year-over-year organically. This was driven by mid-teens revenue growth in the Collins Aerospace segment and 3% revenue growth in the Raytheon segment, driven by strong demand across commercial aerospace end markets. As you can see below, RTX also grew its adjusted EPS by 3% YoY and generated significant free cash flow of $2.8 billion during the third quarter.

investor presentation

Looking ahead, RTX has numerous new opportunities backed by a significant backlog of $190 billion. The backlog comes as RTX has signed several contracts with the U.S. DoD, including a $156 million award from the U.S. Navy and a $408 million contract with the U.S. to produce 53 air-to-ground missiles. He has now increased in the fourth quarter. The Air Force tests hypersonic missiles. RTX offers an efficient YTD bookings-to-billing ratio of 1.26x (1.17x for its Raytheon segment), so its solid backlog and recent success will add to RTX’s revenue stream in the short to medium term.

Risks to RTX include the difficult-to-predict nature of the defense spending bill each year; That’s because cuts in defense spending by the U.S. Congress could have a negative impact on defense contractors. However, this does not appear to be a factor in the short term, as most of RTX’s future revenue is locked in through long-term contracts.

Moreover, while defense spending has traditionally enjoyed bipartisan support in Congress, it is nonetheless worth considering for investors. Other risks arise from unforeseen product defects and unforeseen issues related to modern powder metal issues, which may result in increased financial obligations.

In particular, RTX plans to return a lot of cash to shareholders through share buybacks, as many risks due to the powder metal problem appear to be reflected in its discounted stock price. This is reflected in our $10 billion accelerated share repurchase program.

This could be immediately supported by RTX’s $5.5 billion in cash on its balance sheet and $3 billion in expected 2024 revenue from the combined sale of Raytheon’s Cyber Services business and Collins Actuation business. Based on the stock’s current market capitalization of $120.8 billion, this $10 billion share buyback, if fully implemented, would reduce outstanding float by 8.3%.

Meanwhile, RTX has a BBB+ investment grade rating from S&P and a net debt-to-EBITDA ratio of 3.46x, making it suitable for a capital-intensive business. As EBITDA has recently been negatively impacted by powder metal defects, leverage ratios are expected to trend closer to 3.0x.

What’s important for dividend investors is that RTX is a Dividend Aristocrat with 30 consecutive years of increases. The current yield is 2.8% and the dividend is well protected with a payout ratio of 45%. RTX has also increased its dividend by a range of 7.3 to 7.8% annually from 2021.

Going back to valuation, I think RTX remains attractive at its current price of $84.17 and its forward PE of 16.8, which is lower than its normal PE of 17.2. Analysts expect EPS growth to be just 7.6% next year, but annual revenue growth is expected to accelerate to a range of 12-17% in 2025-2026.

FAST graph

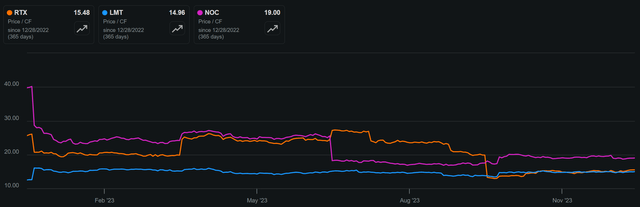

RTX also has more diversified revenue streams and appears to be reasonably valued compared to its peers, with cash flow of 15.5x, slightly higher than LMT’s 15.0x, despite being well below NOC’s 19x.

RTX vs Peer Price to Cash Flow (Alpha Exploration)

Investor Implications

Overall, RTX appears to be well-positioned for future growth despite the challenges posed by the powder metal issue. With a strong backlog, solid financials, and a focus on returning shareholder value through share buybacks and dividends, RTX is a solid option for investors looking to invest in the aerospace and defense industry. Given that the stock has had ample time to stabilize from both company-specific and macroeconomic news on interest rates, we believe RTX stock may remain rangebound in the near term, so we are downgrading it from ‘Strong Buy’ to ‘Strong Buy’. . It is rated ‘Buy’.