Salesforce Has Lost Popularity: Trade Bear Put Spread Options Strategy | Option play

key

gist

- Salesforce stock is likely to trade within the $210-$220 range.

- The bear put spread is a strategy to consider if you want to take advantage of stocks trading between $210 and $220.

- With CRM’s earnings about three weeks away, a bearish put spread can lower the cost of bearish exposure.

Once a darling of the tech world, Salesforce (CRM) fell out of favor until recently, reaching an all-time high earlier this year. But since then, investors have continued to shy away from this cloud computing stock, focusing on more pure-play AI-related companies, and Salesforce is at risk of falling again. As CRM matures and its growth rate moderates, it will no longer be able to maintain the industry-leading valuation it once had and must face the realities of its fundamentals.

Once a darling of the tech world, Salesforce (CRM) fell out of favor until recently, reaching an all-time high earlier this year. But since then, investors have continued to shy away from this cloud computing stock, focusing on more pure-play AI-related companies, and Salesforce is at risk of falling again. As CRM matures and its growth rate moderates, it will no longer be able to maintain the industry-leading valuation it once had and must face the realities of its fundamentals.

Salesforce Analytics

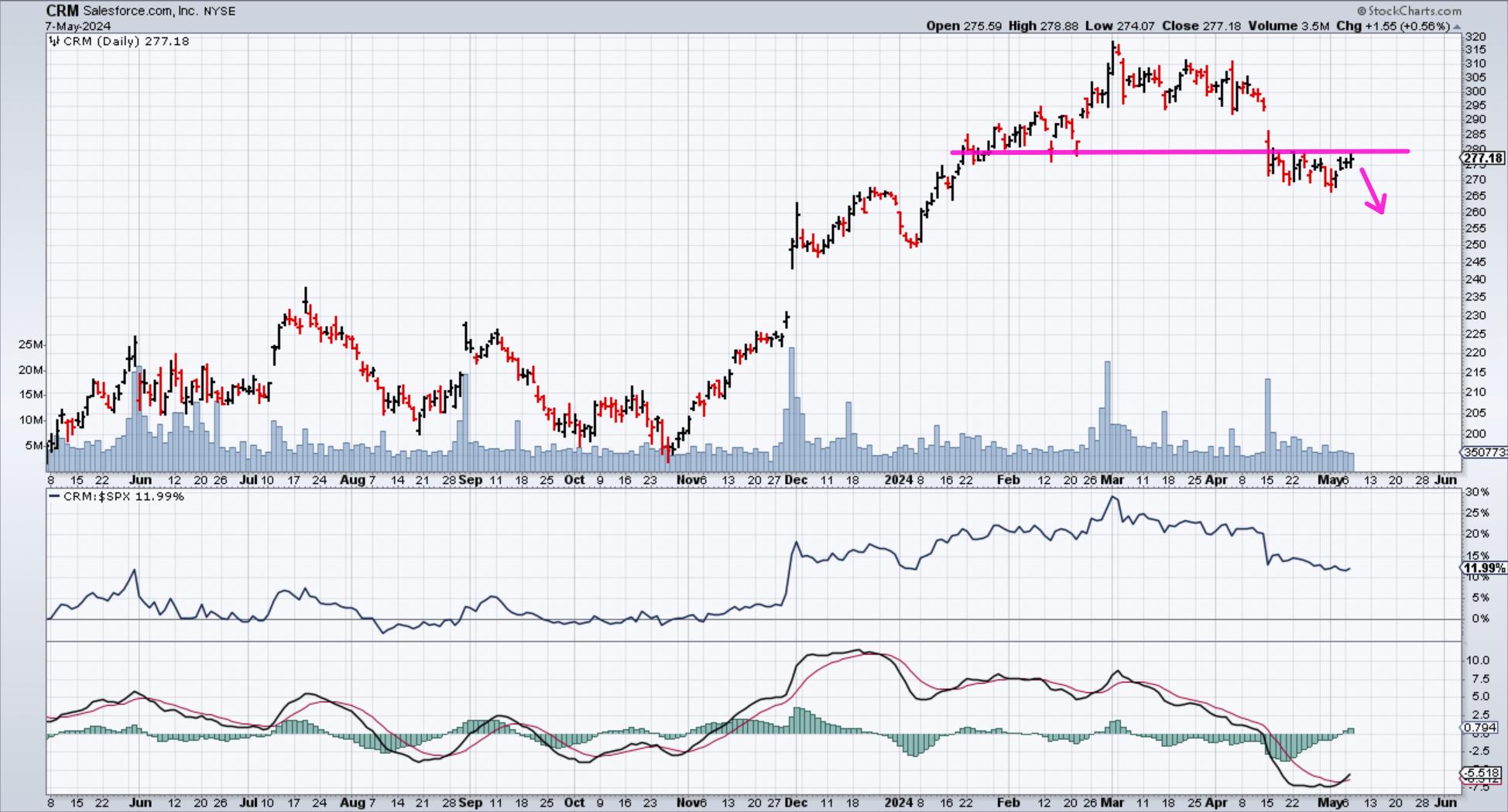

Looking at CRM’s five-year chart, we can see that the stock has traded within a fairly wide range between $130 and $310. Earlier this year, the upper limit of the range was revisited and an attempt was made to break out to a new all-time high (see chart below). This quickly failed, and the stock recently reversed back into the range as momentum turned negative. This suggests that CRM is likely to continue heading back towards the midpoint of the range, i.e. the $210-220 area.

Chart 1. Salesforce (CRM) stock daily chart. CRM’s stock price tested the resistance level and fell. Since momentum is also negative, the stock price is likely to fall.Chart source: StockCharts.com. For educational purposes.

CRM currently trades at over 28x forward earnings, which is high despite fairly moderate growth over the past 12 months. The average EPS growth rate over the past three years has exceeded 45%, but future EPS growth is expected to slow to 16%, a third of that. The sales growth rate is expected to fall below 10%. This makes it difficult to justify a valuation 40% higher than the S&P 500 when growth is slowing significantly.

Bear Vertical Spread for Salesforce

If you have a bearish outlook for a stock, a bearish put spread can be a viable options strategy. This strategy involves buying a put option at the current stock’s strike price and then selling a put option with a lower strike price on the same expiration date. Your maximum risk is the net premium paid between the two legs. The risk graph below shows the profit/loss scenario for a bearish put vertical spread.

Risk graph of bear put spreadIf the stock falls below the lower strike price, this strategy will realize its maximum profit potential as the distance between the two strikes minus the premium paid. You will also realize your maximum loss potential if the stock holds above the higher strike price.

Risk graph of bear put spreadIf the stock falls below the lower strike price, this strategy will realize its maximum profit potential as the distance between the two strikes minus the premium paid. You will also realize your maximum loss potential if the stock holds above the higher strike price.

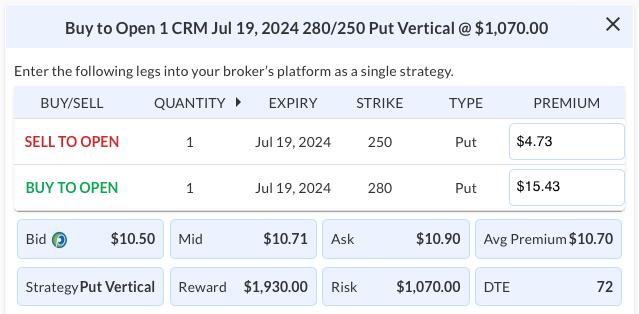

After three weeks of earnings, it’s a good idea to see a slight increase in CRM option prices and use spreads to lower the cost of finding bearish exposure. I plan to buy the $280/$250 put vertical @ $10.70 debit on the July expiration date. This entails:

- Buy July $280 put @ $15.43

- Sell July $250 put @ $4.73

If CRM is above $280 at expiration, you risk $1070 per contract, and if CRM is below $250 at expiration, you stand to make $1930 per contract.

takeout

If you want to profit from a potential decline in stock price, you can trade a bearish put spread. It limits risk, has a reasonable profit potential, and is cost-effective.

Tony Zhang is Chief Strategist at OptionsPlay.com, where he assembled an agile team of developers, designers, and quants to create the OptionsPlay suite of products for trading and analysis. He also developed and managed many of the firm’s expanded partnerships at the Options Industry Council, Nasdaq, Montreal Exchange, Merrill, Fidelity, Schwab and Raymond James. As a proven thought leader and contributor to CNBC’s Options Action show, Tony shares ideas on how to leverage profits while reducing risk using options. Learn more