Sapphire Strat Maker – Indicator Buffer Document – Trading Strategy – March 15, 2024

1. Introduction

this documentation for sapphire strat maker and Sapphire Strat Maker Alt (Free) Expert Advisor – This is an EA that allows you to create your own strategy without coding. That’s the beauty of this expert advice. Create your own strategy, be creative and no longer be tied to a single strategy. Optimize the parameters to find the best set and you are ready to go!

freely contact me If you have questions about the article or need help creating your strategy.

2. Blog post

3. Metric Buffer Document/Value

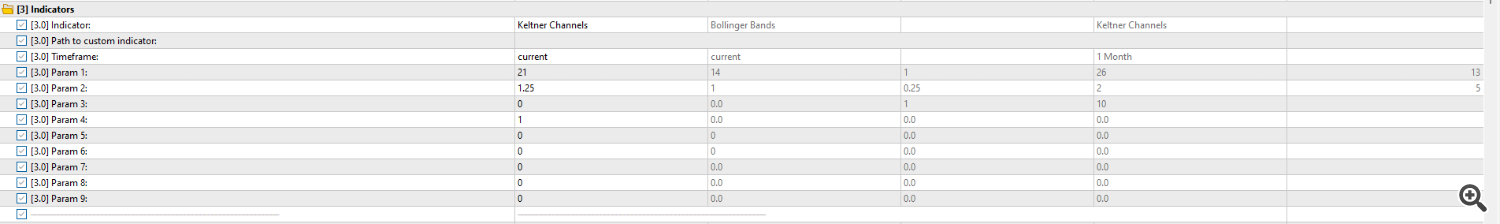

This document is available in the following format: buffer = integer representation. Let’s take the parameters of the Keltner channel as an example. Document – Indicators (to insert the correct parameters):

Here we load a 21-period Keltner channel with a 1.25 deviation, no movement, and simple moving average method applied to the closing price (check out the listing article).

As per the document below top band It uses the buffer with index 1 of the Keltner channel. if we want to get low band, Use the buffer at index 2. if we want to get midline, We use the buffer at index 0.

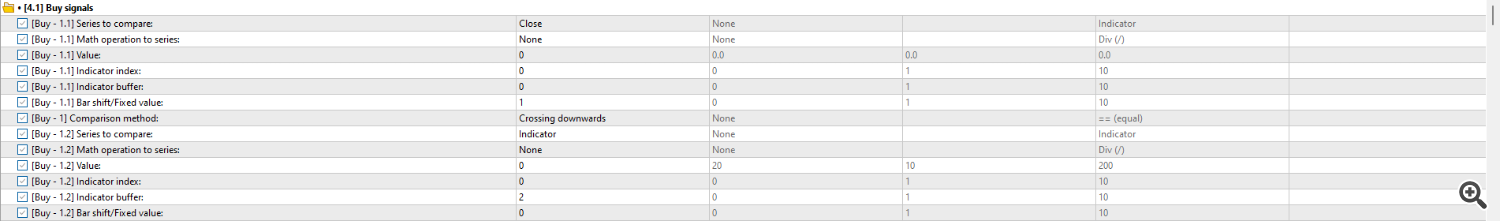

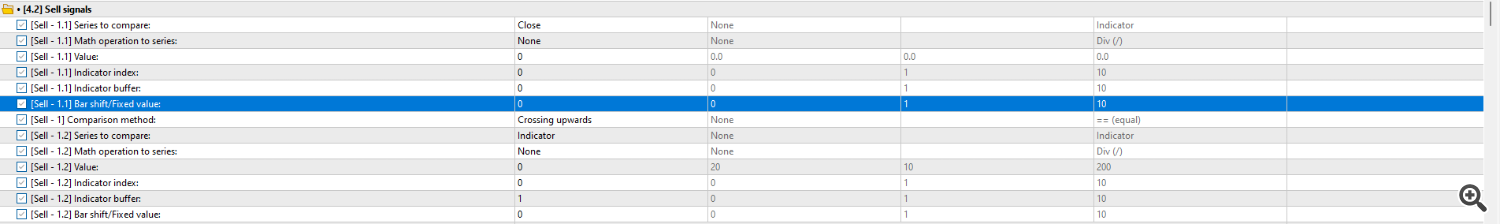

Take a look at how to create a buy signal when the price crosses the close. down the lower band A sell signal occurs when the closing price breaks above the upper band.

According to the document, we bar shift In this case the value is crossing The signal always uses bar 1 and bar 2. Notice that we assign the indicator to index 0 (Keltner Channel) and buffers 2 (for buying) and 1 (for selling) indicator buffer parameter.

Take a look below to see the buffers available for each indicator.

3.1. Bollinger Band

- midline = 0

- upper band = 1

- low band = 2

- midline = 0

- upper band = 1

- low band = 2

- midline = 0

- upper band = 1

- low band = 2

- midline = 0

- upper band = 1

- low band = 2

- upper band = 0

- low band = 1

3.7. Double Exponential Moving Average (DEMA)

3.8. Triple Exponential Moving Average (TEMA)

3.9. Adaptive Moving Average (AMA)

- Kijun Senline=1

- Senko span A line = 2

3.12. ATR (Average True Range)

3.13. Standard Deviation (StdDev)

3.15. Relative Strength Index (RSI)

3.16. William’s Percentage Range (WPR)

3.17. Bollinger Bands %

3.19. Volume Weighted Moving Average (VWMA)

3.20. double moving average

- First moving average = 0

- second moving average = 1

3.21. Product Channel Index (CCI)

3.23. Money Flow Index (MFI)

3.25. Moving Average Convergence Divergence (MACD)

3.26. Sum of two series (+)

3.27. Subtraction of two series (+)

3.28. Multiplication of two series (+)

3.29. Splitting of two series (+)

- Custom indicator buffer size depends on specification. Read the metrics documentation for more details.

If you have any questions please feel free to contact me.