Scalper Deriv Expert Advisor User Guide for Optimization – Analysis and Forecasting – May 17, 2024

introduction

scalper derivative This is an expert advisory (EA) designed to take advantage of price movements by simultaneously analyzing multiple time frames based on M1 (1 minute). It can be used to All symbols, leverage and initial capital included. The strategy is based on: Price action and mathematical models It breaks the market down into waves. The behavior of these waves determines market entry.

Learn more Scalper derived EA Strengthen your trading strategy today!

input parameters

- Profit per cycle (1 = 1%): Defines the percentage of profit sought when reaching Take Profit (TP). For example, if your balance is 1000 and your “Profit per cycle” is 1, when you reach TP your profit will be 10 (1% of 1000).

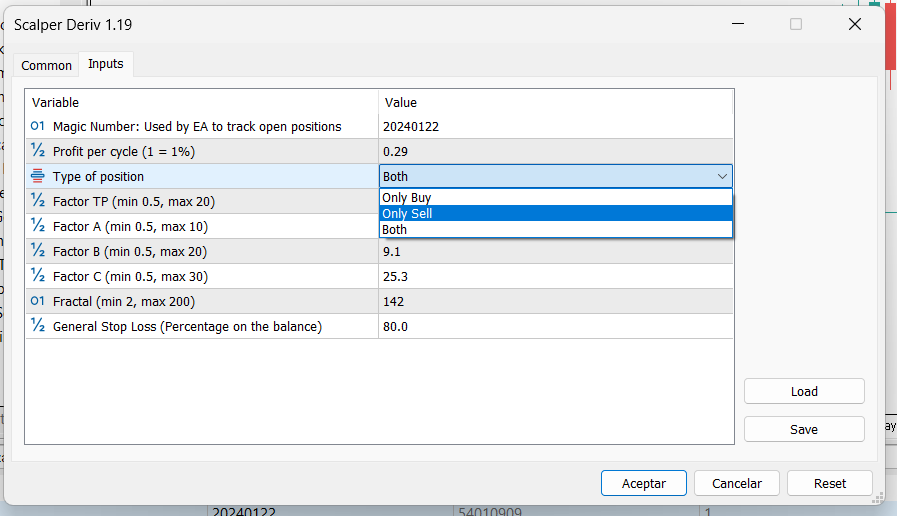

- Position Type: Defines whether the transaction is buy, sell, or both.

- Factor TP (minimum 0.5, maximum 20): This abstract parameter of the mathematical model defines the distance of the TP. The smaller the number, the closer it is to TP.

- Factors A, B, C (minimum 0.5, maximum 30): Defines transaction frequency. The smaller the value, the higher the transaction frequency.

- Fractal (minimum 2, maximum 200): The number of candles in the M1 period considered to identify the last relevant highs and lows.

- Typical Stop Loss: This is the maximum loss ratio for liquidating all losing positions. For example, if you set it to 50 and your balance is 1000, when your total profit reaches -500, all losing positions will be liquidated.

optimization process

Introduction to fast genetic-based optimization algorithms

Optimization is an essential process to improve the performance of Expert Advisors (EAs). that much Fast genetic-based algorithm It is an advanced technique that leverages the principles of genetics and evolution to find the best combination of parameters. This algorithm significantly speeds up the optimization process, allowing a wide range of configurations to be explored efficiently and effectively.

This method mimics natural selection by combining and varying input parameters to find optimal settings that maximize the performance of the EA. This is especially useful when dealing with large numbers of variables and potential combinations, as is the case with Scalper Deriv EA.

Modeling Selection

For versions 1.02 and higher, we recommend using: “1 minute OHLC” For a faster optimization process.

Optimization period

apply 10 to 1 principle:

- To get a settings file for one day, optimize with data from the last 10 days.

- For weekly setfiles, optimize with the last 10 weeks of data.

- For monthly setfiles, optimize with the last 10 months of data.

Optimization: Select criteria

Funding Account or Prop Company

For users operating funded accounts or prop companies, it is important to maintain strict control over risk and loss. Therefore, we recommend that you choose one of the following optimization criteria:

- Minimum reduction: Minimize losses to maintain account stability.

- Composite criteria maximum: Maintains a balance between seeking profits and controlling losses.

additionally “General Stop Loss” Set the parameter to 5 or less. This way, if the drawdown approaches 5%, your EA will automatically close all positions, protecting your account from excessive losses.

regular account

For regular account users who want to maximize their profits, even if they take on higher risks, they may want to consider the following optimization criteria:

- Maximum balance: This criterion seeks high returns in a short period of time with associated risks by maximizing account balances.

- Maximum profit margin: This criterion maximizes the profit factor, which is the ratio of total profit to total loss. A higher return factor indicates a more profitable and stable strategy over time.

In this case, users can choose a more flexible method. “General Stop Loss” Determine value based on your risk tolerance and performance goals.

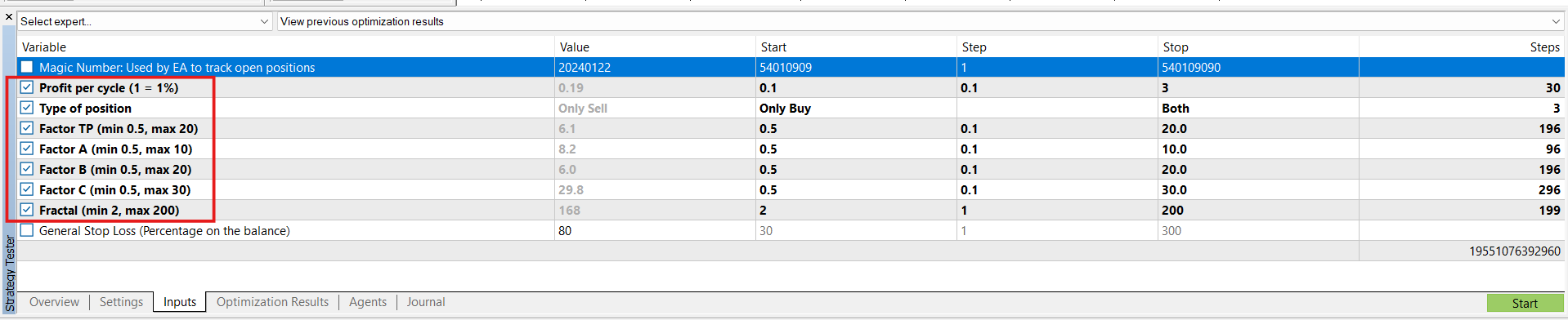

Input tab description

that much input tab Strategy Tester in MetaTrader 5 allows you to configure and optimize the parameters of your Expert Advisor (EA). In this example, only the parameters within the red box should be selected and optimized. The following is a description of each of these parameters, explaining their purpose and the range of values used for optimization.

input parameters

1. Profit per cycle (1 = 1%)

– explanation: Defines the percentage of profit sought when reaching Take Profit (TP). For example, if your balance is 1000 and your “Profit per cycle” is 1, when you reach TP your profit will be 10 (1% of 1000).

– Current value: 0.19

– Optimization range:

– start: 0.1

– step: 0.1

– Stop: three

2. Type of position

– explanation: Define the type of transaction (buy, sell, or both) that the EA will execute.

– Current value: Sales only

– Optimization range:

– option: Buy only, sell only, both

3. TP factor (minimum 0.5, maximum 20)

– explanation: This abstract parameter of the mathematical model defines the distance of the TP. The lower the number, the closer you are to TP.

– Current value: 6.1

– Optimization range:

– start: 0.5

– step: 0.1

– Stop: 20

4. Factor A (minimum 0.5, maximum 10)

– explanation: Defines transaction frequency. The lower the value, the higher the frequency of transactions.

– Current value: 8.2

– Optimization range:

– start: 0.5

– step: 0.1

– Stop: 10

5. Factor B (minimum 0.5, maximum 20)

– explanation: Defines transaction frequency. The lower the value, the higher the frequency of transactions.

– Current value: 6.0

– Optimization range:

– start: 0.5

– step: 0.1

– Stop: 20

6. Factor C (minimum 0.5, maximum 30)

– explanation: Defines transaction frequency. The lower the value, the higher the frequency of transactions.

– Current value: 29.8

– Optimization range:

– start: 0.5

– step: 0.1

– Stop: 30

7. Fractal (minimum 2, maximum 200)

– explanation: The number of candles in the M1 period considered to identify the last relevant highs and lows.

– Current value: 168

– Optimization range:

– start: 2

– step: One

– Stop: 200

Optimization step

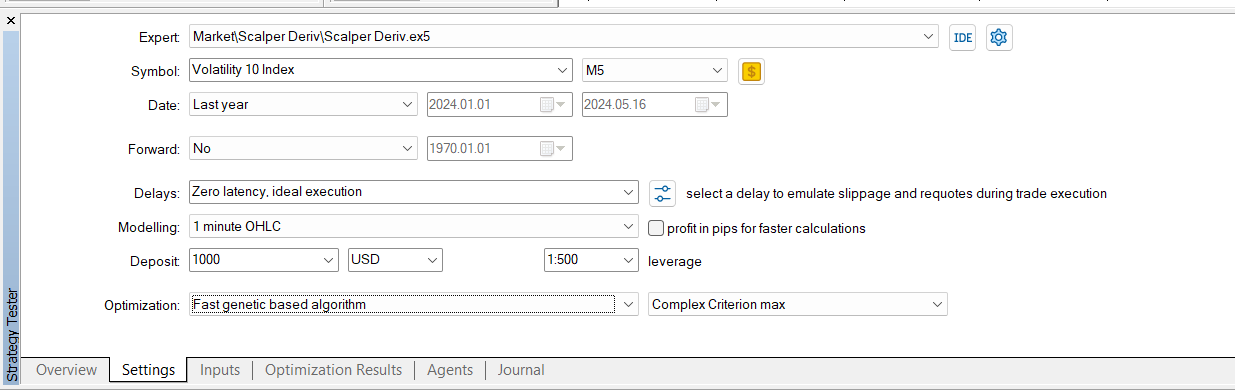

1. Initial setup:

– Select the Expert Advisor (Scalper Deriv\Scalper Deriv.ex5) and the symbol (Volatility 10 Index). This is just an example. You can choose any symbol.

– Configure the period (M5) and period (last year, 2024.01.01 – 2024.05.16). You can choose any time period you want. The M5 is just one example. Date ranges should take into account the 10:1 principle.

– Select modeling type (“1 minute OHLC”) for faster optimization.

– Set the initial deposit amount (1000 USD) and leverage (1:500). You can choose your initial deposit and leverage value.

2. Optimization algorithm settings:

– Select an optimization algorithm (“fast genetic-based algorithm”).

– Select appropriate optimization criteria.

– For funded accounts: We recommend not selecting Balance Max. Use criteria like Drawdown min or Complex Criterion max.

– For standard accounts: You can select any optimization criteria, but we recommend complex criteria maximum.

3. Set input parameters:

– Adjust the input parameters using the start, step, and stop values shown above.

4. Start optimization:

– Click the “Start” button to start optimization.

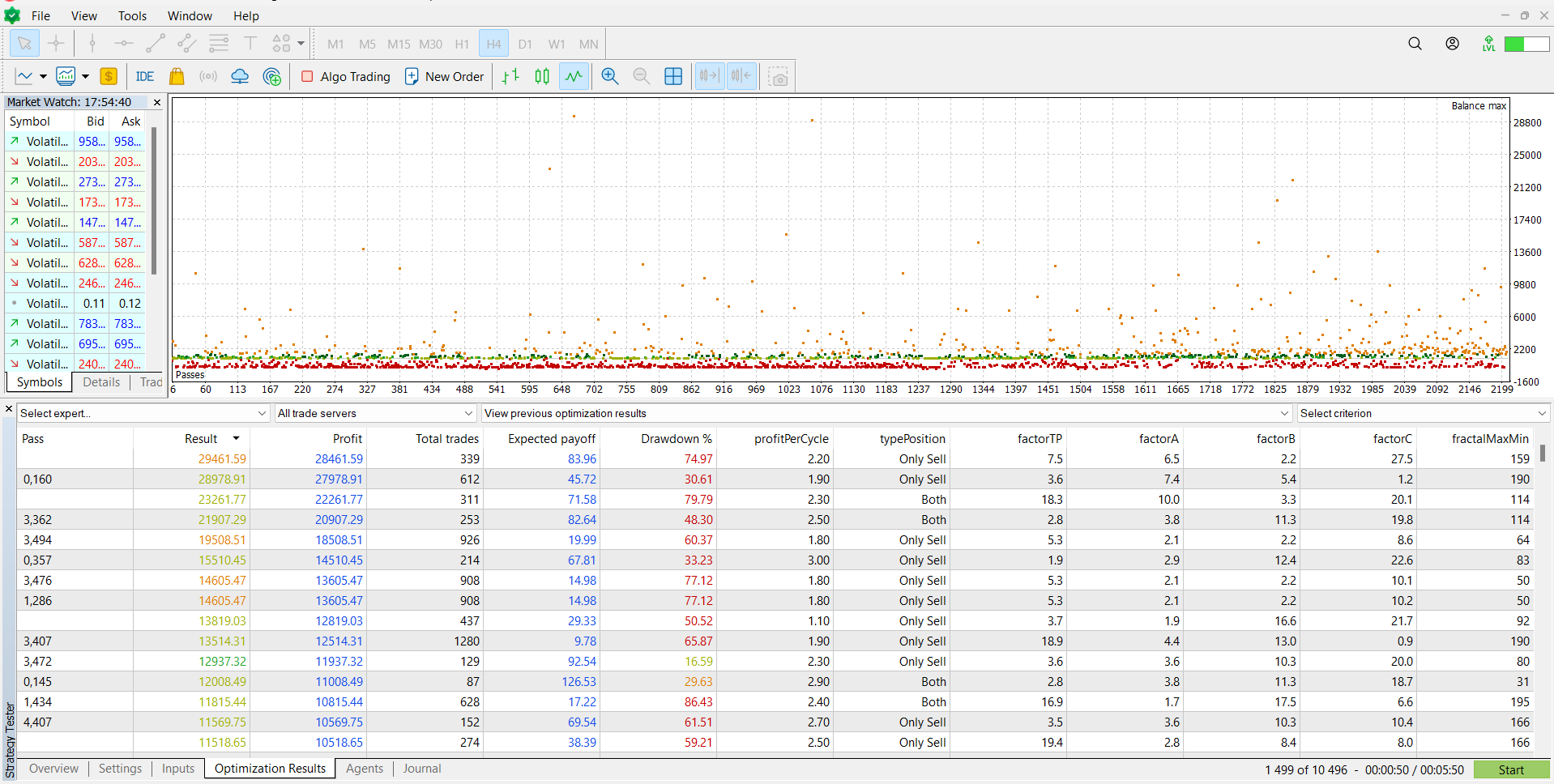

Interpretation of optimization results

At the end of the optimization process, you will see a results window similar to the one below. Understanding these results is important in choosing the best set file for your trading strategy.

key indicators

1. Pass: Number of optimization iterations completed. Each pass represents a unique combination of input parameters tested during the optimization process.

2. Result: The overall performance score for each pass. This is often based on selected optimization criteria such as balance or reduction.

3. Benefits: Total revenue generated by the EA during the optimization period.

4. Total trading volume: Total number of transactions executed by EA in each pass.

5. Expected rate of return: Average profit per trade is calculated by dividing total profit by the number of trades.

6. Decline rate (%): Maximum decline rate that occurred during the optimization period. This represents the largest decrease in your account balance from highest to lowest.

7. ProfitPerCycle: The gain per cycle setting used for the pass.

8. Type Location: Type of transaction executed (buy only, sell only, or both).

9. Factor TP, Factor A, Factor B, Factor C: The values of these parameters used for each pass.

10. FractalMaxMin: Fractal parameter settings used for the pass.

Steps to choose the best set file

1. Evaluate the criteria. Focus on the passes that provide the best balance between high profits and low loss rates. The selected criteria (e.g. balance, decline) should guide this assessment.

2. Check stability: Make sure the path you choose has consistent performance across a variety of metrics. High profits with extremely high loss rates may be undesirable.

3. Review transaction frequency: Make sure the total number of transactions is reasonable. Too few transactions can indicate insufficient data, while too many transactions can be a sign of excessive optimization.

4. Expected payoff analysis: A higher expected return means more efficient trading. Choose a pass that provides a good balance between expected payoffs and losses.

5. Consistency of parameters: Make sure the set file you choose has consistent, logical parameter values. Extreme values may suggest overfitting.

6. Export settings file: After identifying the best passes, export the set file for use in live trading or further testing. In MetaTrader 5, right-click on the desired pass and select “Save As”. File Settings”.

yes

In the image provided, the highest resulting pass is “0,160 passes” with a profit of 29,879.91 and a drawdown of 30.61%. Despite high profits, the downside is relatively high, suggesting a high-risk strategy. Find a balance that suits your risk tolerance compared to other passes.

By carefully analyzing the optimization results, you can identify the most powerful and profitable set files for Scalper Deriv EA. This process helps ensure that your trading strategy is effective and sustainable.

conclusion

To maximize the performance of Scalper Deriv EA, it is important to understand and analyze the optimization results. By following this guide and choosing the best setfile, you can improve your trading strategy and achieve more consistent results. Remember, the key is balancing profitability and risk management.

Additional Resources

For a comprehensive tutorial on how to optimize Scalper Deriv EA, watch our YouTube tutorial.

Visit our MQL5 profile to see all our expert advice and enhance your trading experience.

We recommend using this broker for trading.