Scams in Modern Finance – Part 1: Introduction | dance with the trend

Note to readers: Over the coming weeks and months, I will be republishing content from my book “Investing in Trends” in article form here on my blog. For reasons you will learn below, I call this series “The Scams of Modern Finance.” I hope you found this helpful. As always, let us know your thoughts in the comments area below the article. – Greg Morris, November 2023

Chapter 1 Introduction

I’ve learned a few things over the years and probably retained fewer than that. For example, we know that when dealing with unknowns, such as stock market analysis, you can never speak in absolutes. I also know that randomly guessing what to do in the market is a recipe for failure. Investing requires a process. Any process is better than no process. Even worse, it is a random or constantly changing process. I hope this book will help you find your way. successful process.

The noblest joy is the joy of understanding. — Leonardo da Vinci

How can you start analyzing the market if you don’t use the right tools to determine the current state of the market? If you do not fully understand the current state of the market, your analysis, actual or expected, will be at least as off as the current analysis. And the errors become more complex depending on the period of analysis in question. This highlights why most predictions are a waste of time.

credible misinformation

We must remember that things are often not what they seem. It’s amazing how often people believe things that aren’t true (speaking from experience here). Here are some things many of us learned from our teachers and parents during our formative years. Most of it we accepted as fact because we heard it from people we trusted.

mythology: The water in the bathtub drains faster towards the end.

actually: Assuming the sides of the bath are cylindrical, the pressure is constant. It just seems to drain faster because you can observe it starting to swirl towards the end, something you couldn’t observe when the tub was full. The swirling action tricks you into thinking it is draining faster.

mythology: George Washington cut down a cherry tree.

actually: George Washington didn’t cut down the cherry trees. It was a story meant to help adults teach children that lying is wrong. Even our Founding Fathers didn’t lie. Writing about Washington shortly after his death, author Parson Mason Locke Weems sought to humanize Washington.

mythology: Washington threw silver coins across the Potomac River.

actually: The Potomac River is nearly a mile wide at Mount Vernon, and silver coins did not exist at the time.

mythology: The Battle of Bunker Hill was fought at Bunker Hill.

actually: The battle took place at Breed’s Hill in Charleston, Massachusetts.

mythology: Dogs sweat through their tongues.

actually: Guess what? Dogs don’t sweat. Their tongues have large, wet salivary glands.

great. The following two examples of credible misinformation are only for the powerful who find this section interesting. You should skip the rest. It’s only for weirdos like me.

mythology: In the Northern Hemisphere, December 21st is the shortest day of the year.

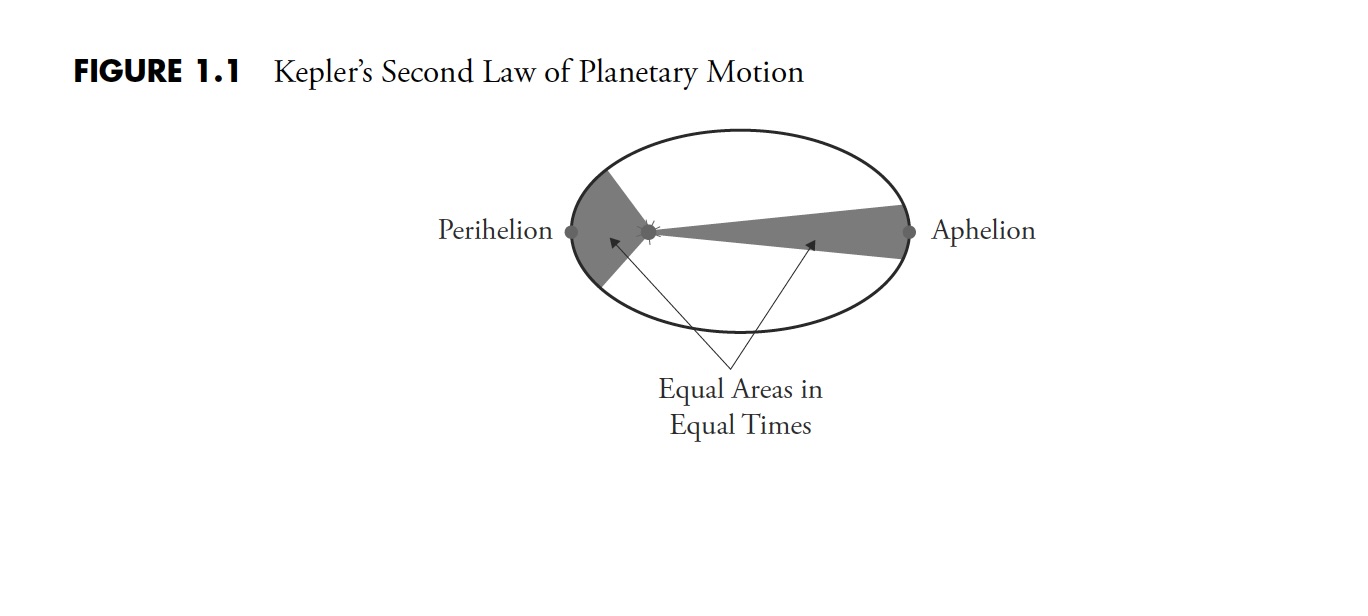

actually: Most people probably believe this. But in reality longest It is an astronomical day based on Kepler’s second law of planetary motion (a planet in an elliptical orbit covers the same area in the same amount of time). When the Earth is closest to the Sun, the Northern Hemisphere is tilted, and a much larger arc is swept during the day’s journey than when the Earth is furthest from the Sun. If the question was asked, “What day has the shortest daylight hours?” then that would be correct.

See Figure 1.1 for Kepler’s second law of planetary motion.

Another observation about the Earth’s tilt is that summers in the Southern Hemisphere are generally warmer than summers in the Northern Hemisphere. This may be influenced by the fact that there is much more ocean in the Southern Hemisphere, but it is also tilted more towards the Sun when the Sun is closest to the Earth.

Figure 1.1 Kepler’s second law of planetary motion

Figure 1.1 Kepler’s second law of planetary motion

mythology: In the Northern Hemisphere, bath water drains counterclockwise.

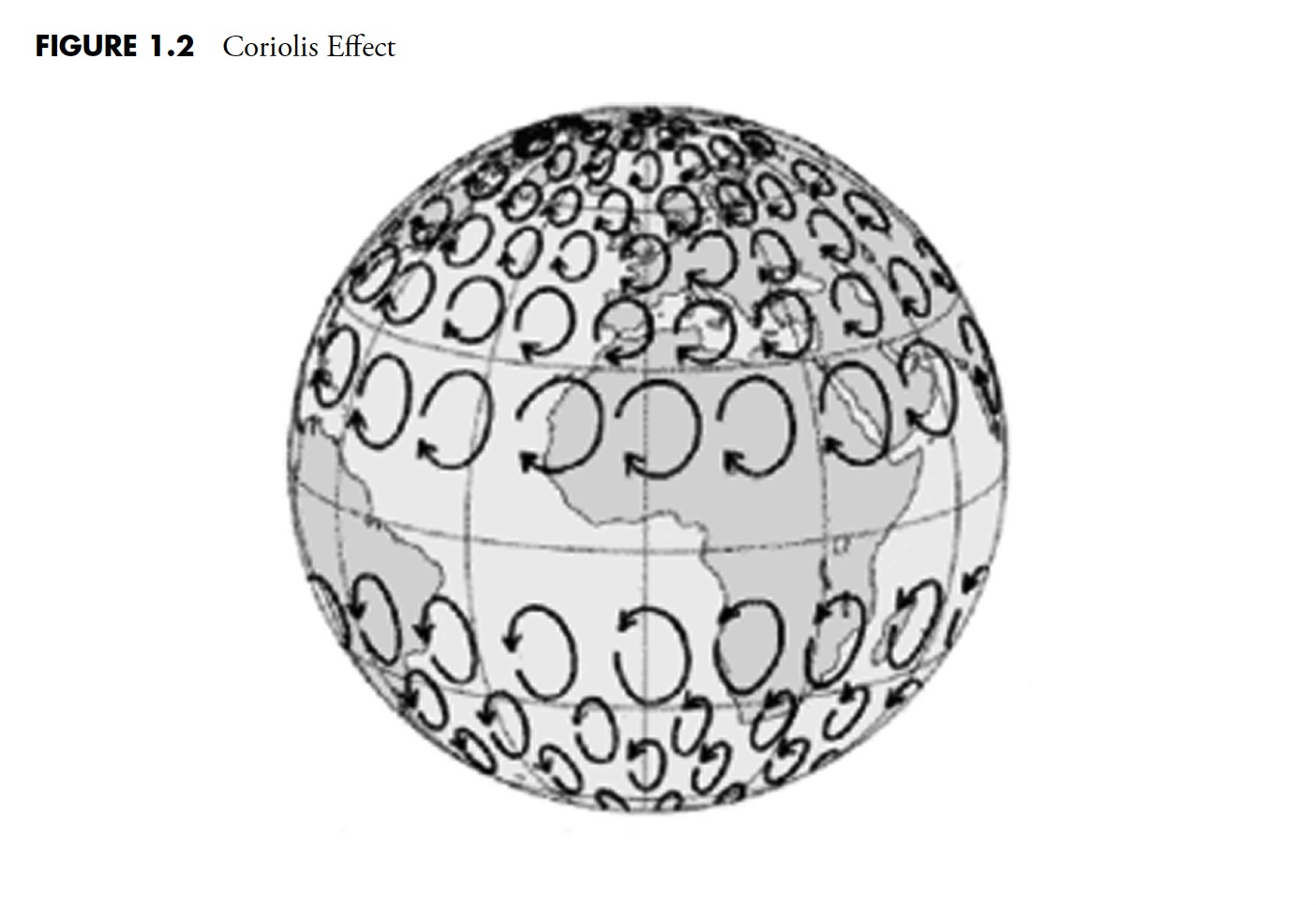

actually: Another example of how people have believed things that are simply not true is that many people in the Northern Hemisphere will say that when you drain the water from a bathtub, the water will swirl counterclockwise. Although they could, that’s not why I think they would. This is an example of a little scientific knowledge being applied completely wrong. The Coriolis effect (see Figure 1.2) is caused by the rotation of the Earth and typically applies to large, nearly frictionless objects, such as weather systems. This is why hurricanes rotate counterclockwise in the Northern Hemisphere, and clockwise in the Southern Hemisphere. The rotational effect is measured in arcseconds, a very small unit of angular rotation (a unit of angle measurement equal to 1/60th of an arc, or 1/3600th of a degree). It would be completely wrong to apply this principle to the rotation of water draining from a bathtub. Weather patterns of high and low pressure are also reversed. I’d like to see a weather reporter from Dallas move to Santiago and adapt.

Hopefully you understand my point. Over the past few years, the Internet has been the source and go-to source for a lot of exaggeration and disinformation. How many times have you received an email from a friend (probably not the sender) and believed it to be true, but forwarded it anyway without bothering to check? Many of them are fake so you should start verifying them. There is a lot of credible misinformation out there.

Figure 1.2 Coriolis effect

Figure 1.2 Coriolis effect

If you like this type of information, I would recommend Samuel Arbesman’s book. The Half-Life of Facts: Why Everything We Know Has an Expiration Date. Arbesman is an expert in scientometrics, which looks at how facts are created and reconstructed in modern society. People often cling to selected “facts” to justify their beliefs about how things work. “We are obsessed with adding facts to our personal store of knowledge that match what we already know, rather than assimilating new facts, regardless of how they fit with our views,” Arbesman says. (B4). This is called confirmation bias, and we cover it in Chapter 6.

A general theme throughout the book is separating fact from fiction. In this case, the fiction is often a well-accepted theory about finance, economics, or markets in general. If you believe some of the things I said in the previous paragraph, how much do you believe in the world of investing? Maybe you have accepted some things as fact that simply aren’t true. I know for sure that I did.

This chapter provides a lot of basic information to help you understand the rest of the book. Definitions, mathematical formulas, descriptions of anomalies, historical events affecting the data, various calculation methods, and other important information are usually included in the appendices. Understanding this material is so important that it is explained prior to the discussion rather than included in an appendix, as is usually the custom.

Thank you for reading this far. I plan to publish one article in this series each week. Can’t wait? The book is on sale here. What’s next: a list of useful indicators and terms to know, followed by a frank discussion about financial data sources and their accuracy.