Schindler Holding: On the sidelines since last game (OTCMKTS:SHLRF)

HJBC

introduction

Schindler Holding (OTCPK:SHLAF) (OTC:SHLRF) is one of the few key players in the elevator and escalator oligopoly. The market is well divided between Schindler, Kone and Otis. I followed Schindler for a while. Because now I like the way this Swiss company is run. Because there is a lot of interest in balance sheet safety. Of course, as the world enters an era of inflation, demand for construction-related items is decreasing. Schindler is still feeling the effects of the economic downturn, but fortunately its maintenance and modernization department is picking up the slack.

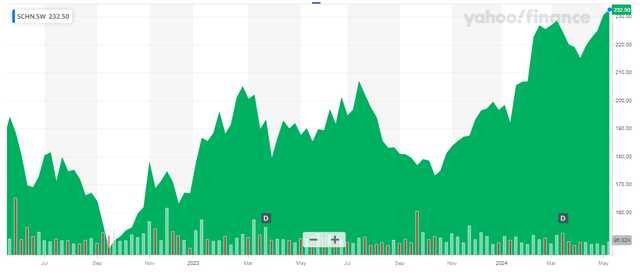

yahoo finance

As explained in a previous article, Schindler holds two types of shares outstanding: registered shares and participation certificates. This article focuses on the certificate of participation represented by SHLAF. The economic rights of the certificate of participation are similar. However, only holders of registered shares can exercise their voting rights at the general shareholders’ meeting. Registered shares are trading in Switzerland Use SCHN as ticker symbol On Wednesday it closed at 232.5 CHF. Participation certificates are traded as follows: SCHP as ticker code It closed at 238.6CHF. Depending on their respective share prices, it is currently better to buy registered shares, but the average daily volume of registered shares is only around 21,000, while the liquidity of participating certificates is closer to 100,000. However, if volume is not an issue, investors can choose the cheapest one. As of now, registered shares will be trading. SCHN as ticker symbol. That is the list I will mention in this article.

2023 was a very good year, with margins expanding again.

Before discussing Schindler’s 2024 start, I wanted to take a step back and look at the 2023 results to paint a picture and provide more context.

The company’s EBIT margin in 2022 was just 8%, so Schindler wanted to focus on improving margins to drive bottom-line results.

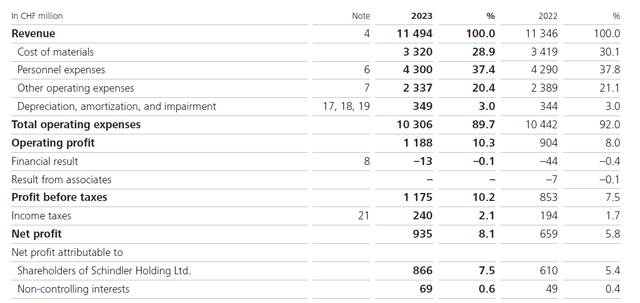

In 2023, the company reported total revenues of CHF 11.5 billion, an increase of approximately 1.5% compared to 2022. While this is a decent result, the more interesting factor is the company’s ability to control its operating costs under COGS. It actually decreased by about 3%. Labor costs remained relatively unchanged, and ‘other town operating costs’ also decreased by about 2%.

Schindler Investor Relations

As you can see in the image above, total operating expenses decreased by approximately 10% to CHF 10.3 billion, resulting in an operating profit of CHF 11.9 billion. This is a notable increase from the CHF 904 million reported in 2022. As the company’s financial performance improved, pre-tax income also surged to 1.18 billion Swiss francs, and reported net profit was 935 million Swiss francs, of which 866 million Swiss francs were held by Schindler’s common shareholders. belonged to them. This represents EPS of 8.05 CHF per share.

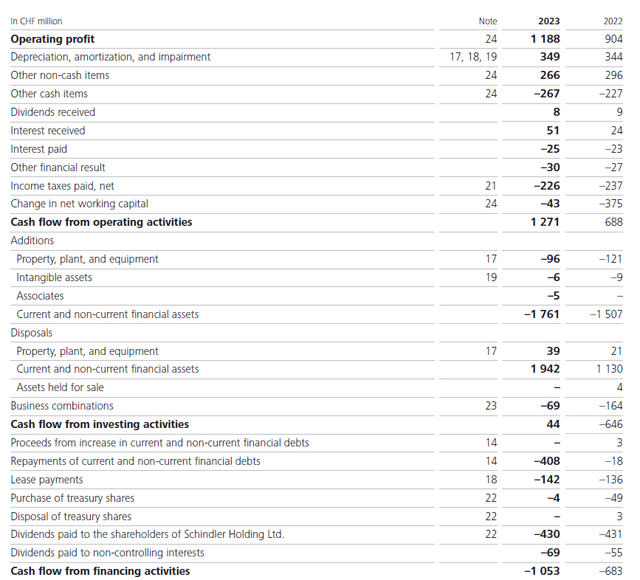

Because Schindler operates a business with relatively low capital expenditures, its cash flow has traditionally been very good. In 2023, the company reported operating cash flow of 1.27 billion Swiss francs, but to reach adjusted operating cash flow it would still need to add back an investment of 43 million Swiss francs in working capital, 142 million Swiss francs in rental costs and 690 million Swiss francs in lease costs. You must deduct 10,000 Swiss francs. Dividends paid to non-controlling interests Additionally, because the company paid ‘only’ 226 million Swiss francs in cash taxes, despite owing 240 million Swiss francs as of its fiscal 2023 income statement. An additional 14 million Swiss francs must be deducted from taxes.

Schindler Investor Relations

This resulted in adjusted operating cash flow of 1.09 billion Swiss francs.

Total capital expenditure was approximately CHF 102 million. This resulted in net free cash flow of 989 million Swiss francs. Divided by the current share count of 107.8 million shares, net free cash flow per share would be CHF 9.15.

In addition to paying dividends of just over 400 million Swiss francs (relating to dividends for fiscal 2022), the company drained all of its cash onto its balance sheet. It ended 2023 with 2.34 billion Swiss francs in cash on its balance sheet, and also had approximately 1.24 billion Swiss francs in financial assets. Meanwhile, the liabilities section of the balance sheet had financial liabilities (excluding lease liabilities) of only CHF 251 million. This means that Schindler maintains a net cash position of 3.32 billion Swiss francs, or almost 31 Swiss francs per share.

Margins will continue to expand in 2024

Schindler does not provide detailed financial statements for the first and third quarters, but the quarterly trading statements generally provide good insight. In a trading update, the company called its first quarter performance a ‘solid start to the year’, with its servicing and modernization segment performing very strongly while the new installations market ‘remains challenging’.

Total revenue in the first quarter of this year was approximately 2.67 billion Swiss francs, a decrease of just over 4% compared to the first quarter of last year. Although Schindler reports its financial results in Swiss francs, FX plays an important role as most of its revenue is generated in other currencies, and when expressed in local currencies, revenue actually increased by 1.1% as FX represents a headwind exceeding 5%. . . As noted above, the strong revenue in local currency terms was driven by strong performance in the Maintenance and Modernization segment, which more than offset weak performance in the new installations market.

Even though revenue was down on a reported basis, EBIT actually increased by just over 3%, resulting in an EBIT margin of 10.9%. This compares very favorably to the EBIT margin of 10.1% reported in Q1 2023. This also had a direct impact on sales. As a result, Schindler’s first quarter net profit rose almost 9% to 232 million Swiss francs.

Despite the decline in revenue on a reported basis, the company actually reported a solid start to the year and reiterated its full-year goals. Revenues will grow at a low single-digit rate in local currency, with EBIT margins reaching approximately 11% (taking into account the 10.9% margin in Q1, meaning we can expect modest EBIT margin growth for the remainder of the year). . .

investment thesis

The company generated EBITDA of CHF 1.54 billion, approximately CHF 1.4 billion adjusted for lease amortization. The current market capitalization is approximately CHF 25.1 billion, and the enterprise value, based on year-end net cash position, is CHF 21.7 billion. Assuming a 4% increase in EBITDA to CHF 1.6 billion, Schindler is currently trading at an EV/EBITDA multiple of around 15. This is not entirely unreasonable for companies in a strong oligopoly.

Schindler is not ‘cheap’ by any standards. Although its current free cash flow yield is only 4%, the company’s balance sheet is safe thanks to its significant cash reserves, and the oligopolistic elevator and escalator market makes the situation very clear.

There was a missed opportunity in September last year when the previous article was published, when the stock was trading below 185 CHF. At this moment I am looking for a new entry point into the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.