Scotts Miracle-Gro: Recommended to hold until Q2 2024 results (NYSE:SMG)

Tony Anderson

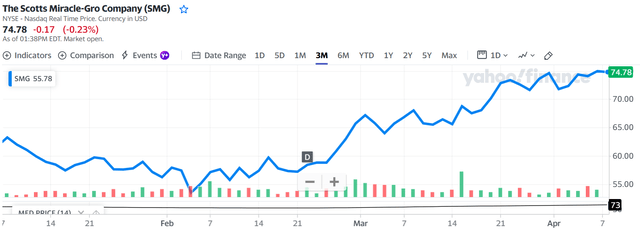

Scotts Miracle-Gro company (New York Stock Exchange: SMG) (“Scotts”) are at a turning point as they navigate turbulent times. Scotts’s trends are heading in the right direction, but the stock appears to be well ahead of the actual economic recovery. From February 7, 2024 Scotts’ stock price soared after first quarter 2024 financial results were released. More than 31% As of April 5, 2024. If the stock price remains the same thereafter based solely on the financial performance and outlook for the first quarter of 2024, my previous analysis, it may have moved closer to a ‘buy’ position from a ‘hold’ position. However, at this point, a ‘Hold’ recommendation is more appropriate as there is a discrepancy between the speed of economic recovery and the current valuation. Given the importance of the second quarter, investors would be wise to assess Scotts’ valuation in early May after analyzing its second quarter 2024 financial results.

ca.finance.yahoo.com/chart

Summary of previous analysis

Scotts, a firm presence in the lawn, garden care and indoor hydroponic gardening markets since 1868, is struggling to recover its business from an ill-fated bet on the emerging cannabis sector.

Scotts generated more than $438 million in free cash flow in 2023, a significant increase over the previous year, and while its stock was trading at record lows, Scotts’ future is fraught with challenges.

The company’s ventures into the cannabis sector through its Hawthorne division initially fueled Scotts’ hyper-rapid growth. Through the acquisitions, Scotts accumulated significant amounts of debt while interest rates were rising rapidly. That success was short-lived, as Hawthorne’s revenue plummeted after peaking in late 2021, significantly impacting the company’s overall profitability and overshadowing its relatively consistent U.S. consumer segment.

Hawthorne’s decline has been exacerbated by factors including a sluggish cannabis sector, the continuation of the 280E tax in the U.S., and reduced spending by consumers and businesses amid persistently high interest rates. Hawthorne’s excess inventory resulting from aggressive acquisitions further complicated Scotts’ situation. The company did see a significant increase in free cash flow in 2023, but this was mainly due to liquidating inventory below cost, an unsustainable tactic.

This can cause your company’s situation to worsen before it can improve, and recovery can take a long time. Therefore, at the time of our previous analysis, we recommended a ‘Hold’, reflecting the significant uncertainty and risk facing Scotts despite its low share price, positive 2023 financial results and attractive dividend yield.

First Quarter 2024 Financial Results

Q1 typically represents a very small portion of annual activity, approximately 15%, including the natural seasonality with which consumers must purchase lawn and garden care products.

For the three months ended December 31, 2024, both our U.S. Consumer and Hawthorne segments continued to experience lower revenue in the first quarter of 2024 compared to the first quarter of 2023.

Total revenue fell to $410 million from $527 million in the same quarter last year.

The U.S. Consumer segment saw sales decline 17%, while the Hawthorne segment saw sales decline 39%.

While these numbers look dire, they are better than expected and show just how pessimistic the market is about Scotts.

Executives explained that the company is restructuring its business to focus on a few but highly profitable brands and expects some of the decline in sales to be due to continued pressure on the rest of the industry.

Not only did sales drop significantly, but gross profit also fell further. Gross profit margin for the first quarter of 2024 was 15.2% compared to 18.2%. If the company restructures to focus on more profitable brands, gross margins will increase significantly. But it went the other way. This is likely due to continued liquidation of old inventory at cost or loss, resulting in lower gross margins.

Total revenue and gross profit were down 22% and 47%, respectively, from the first quarter of 2023, but unfortunately, despite the cost savings from Project Springboard, SG&A’s restructuring resulted in only $114.8 million, down 11% from $128.5 million. It is difficult to completely scale back city business operations. Unprofitable brand.

Scotts’ total debt under its credit agreements and various senior notes was $3.02 billion as of December 31, 2023. Despite a slightly lower debt load due to higher weighted average interest rates, interest expense in the first quarter of 2024 remained very high at $42.8 million, similar to the first quarter of 2023. The weighted average interest rate on Scotts’ debt was 6.0% and 5.2% for the three months ended December 30, 2023 and December 31, 2022, respectively.

Scotts’ net debt to adjusted EBITDA ratio was 7.2 in the first quarter of 2024, within the required 8.25, but still in the risk zone. The 1.05 difference before exceeding the required ratio amounts to only approximately $53 million in annualized adjusted EBITDA on a four-quarter rolling basis. The required ratio drops to 7.75 in the second quarter of 2024, and assuming net debt levels remain the same at $3.02 billion, this means that continuing to meet this covenant will require adjusted EBITDA of approximately $394 million in the second quarter of 2024. This means that you must contribute .

Of course, failure to honor this covenant means that the net debt will default immediately. Because Scotts doesn’t have enough cash to repay all of its debt, Scotts must go into creditor protection, meaning its common stock would be worth effectively $0. Clearly, Scotts’ management does not expect this to happen and believes it will need to be able to generate more than $394 million in adjusted EBITDA in the second quarter of 2024 to continue meeting these contracts. However, fellow investors would be wise to wait until Q2 2024 results before adding to their positions if there is significant downside risk.

To make the second quarter of 2024 a successful quarter, Scotts added approximately $289.3 million in new inventory from October to December 2023. Additionally, Scotts plans to allocate a significant portion of its annual advertising and promotional budget (approximately 33%) to the second quarter of 2024. With creative events and celebrities.

Additionally, in March 2024, Scotts signed an agreement under which BFG would distribute the entire Hawthorne division, allowing the Hawthorne division to focus on product development and the rest of the Scotts team to focus on core U.S. consumer segments.

What to Expect from the Q2 2024 Financials

The second quarter is typically the most important quarter for Scotts. Second quarter 2023 revenue represented 43% of full-year revenue, but adjusted EBITDA for second quarter 2023 was $404.8 million, representing approximately 90% of the full fiscal year.

Whether Scotts can survive the recovery from its turbulent past will depend on its performance in the second quarter of 2024 in terms of meeting its annual EBITDA targets and covenants.

As a result, the second quarter 2024 adjusted EBITDA figure is very important and $394 million is a key target.

Additionally, as Scotts strives to generate record adjusted EBITDA numbers, it may attempt to sell products with better payment terms, which could result in higher accounts receivable balances. Therefore, it will be important to look carefully at your accounts receivable balance at the end of the second quarter of 2024.

Additionally, impairment and restructuring costs are not included in the Adjusted EBITDA figure, so inventory may be written off and some SG&A expenses may also be classified as impairment and restructuring costs, respectively. Therefore, it is important to look at whether there are still high levels of impairment and restructuring costs in the second quarter of 2024.

evaluation

Scotts’ market capitalization increased by approximately $750 million to $4.25 billion as of April 5, 2024, compared to Scotts’ market capitalization of $3.5 billion as of January 5, 2024 from the previous analysis.

Scotts reported a net loss of $380 million for the fiscal year ended September 30, 2023, so the current PE ratio is not very relevant as a valuation metric.

Scotts currently has shareholders’ equity in the red at $385 million, making it a poor valuation metric.

Scotts’ 2023 EBITDA didn’t help its valuation either, as it posted a loss of $19 million.

Adjusted EBITDA excludes impairment and restructuring charges, with Scotts reporting positive adjusted EBITDA of $447 million in 2023.

Using adjusted EBITDA, Scotts’ market capitalization is currently approximately 9.5 times its 2023 adjusted EBITDA, or 7.4 times its projected 2024 adjusted EBITDA.

For a company recovering from an economy that will see prolonged high interest rates, 7 to 9 times adjusted EBITDA is incredibly rich.

One of Scotts’ peers, The mosaic Company (MOS), has a market capitalization of $10.6 billion, which is just 4.1x its 2023 adjusted EBITDA.

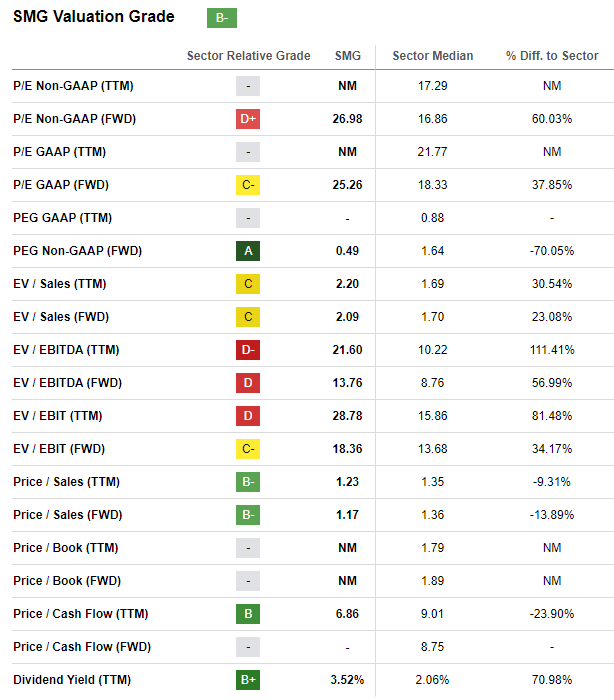

Scotts currently has a B- rating on Seeking Alpha in terms of valuation. Looking more closely, the B- rating is primarily determined by price/trailing cash flow and price/sales, not to mention that Scotts should have cut its dividend some time ago amid a need for cash to help the business recover. Prior year cash flow and sales were primarily driven by the liquidation of older inventory. If not for these two indicators, Scotts’ rating might be C or C-.

lookingalpha.com/symbol/SMG/valuation/metrics

As U.S. inflation figures, jobs reports and other economic data continue to indicate the resilience of the U.S. economy, the Federal Reserve expects to delay and scale back interest rate cuts in 2024. This is certainly not good news for Scotts, given its significant debt load. The interest rate swap contract, with a notional amount of $200 million, expires in June 2024, which will increase Scotts’ annual interest expense by approximately $10 million (the swap contract’s fixed interest rate is 0.49 compared to Scotts’ weighted average interest rate of 6). %no see). Current %) if interest rates remain high at current levels.

Up and Down Risk

The downside risks are very clear. The second quarter of 2024 could be the most important quarter of the year and could determine the pace and health of Scotts’ business recovery. Scotts is at risk of defaulting on its debt if it underperforms in the second quarter of 2024. Additionally, there is widespread caution in the market right now, with the S&P 500 rising significantly between January and March 2024, which could dampen the momentum in Scotts’ stock price.

However, there is some upside potential for Scotts. The U.S. cannabis sector is recovering, with cannabis schedule changes and the 280E tax expected to be eliminated in the coming months. Diverse U.S. cannabis operators like Trulieve Cannabis Corporation (OTCQX:TCNNF) have seen their stock prices rise significantly over the past three months. As a result, demand for Hawthorne products will rise again, potentially helping the Hawthorne division become profitable sooner than expected.

ca.finance.yahoo.com/chart

conclusion

Scotts is at a critical crossroads, with its recent share price surge ahead of the most important quarter of the year, outpacing the reality of a business recovery. This optimistic market reaction does not fully reflect the ongoing challenges that Scotts still faces and must address. Therefore, it appears prudent to maintain a “Hold” recommendation, especially with important Q2 2024 financial results imminent. These results will be pivotal in assessing Scotts’ debt covenants and its ability to meet its annual targets.