SCTR Report: Why TSLA Stock Is So Strong | Don’t Ignore This Chart!

key

Takeaway

- Tesla stock is gaining technical strength on its daily and weekly price charts.

- Tesla stock analysis suggests there are medium-term trading opportunities.

- Before taking a buy position, know your entry and exit positions.

When stock markets are tumbling and you’re trying to figure out whether recent jobs and manufacturing data are good or bad for the economy, it’s easy to miss out on stocks that could deliver profitable returns in the medium term.

When stock markets are tumbling and you’re trying to figure out whether recent jobs and manufacturing data are good or bad for the economy, it’s easy to miss out on stocks that could deliver profitable returns in the medium term.

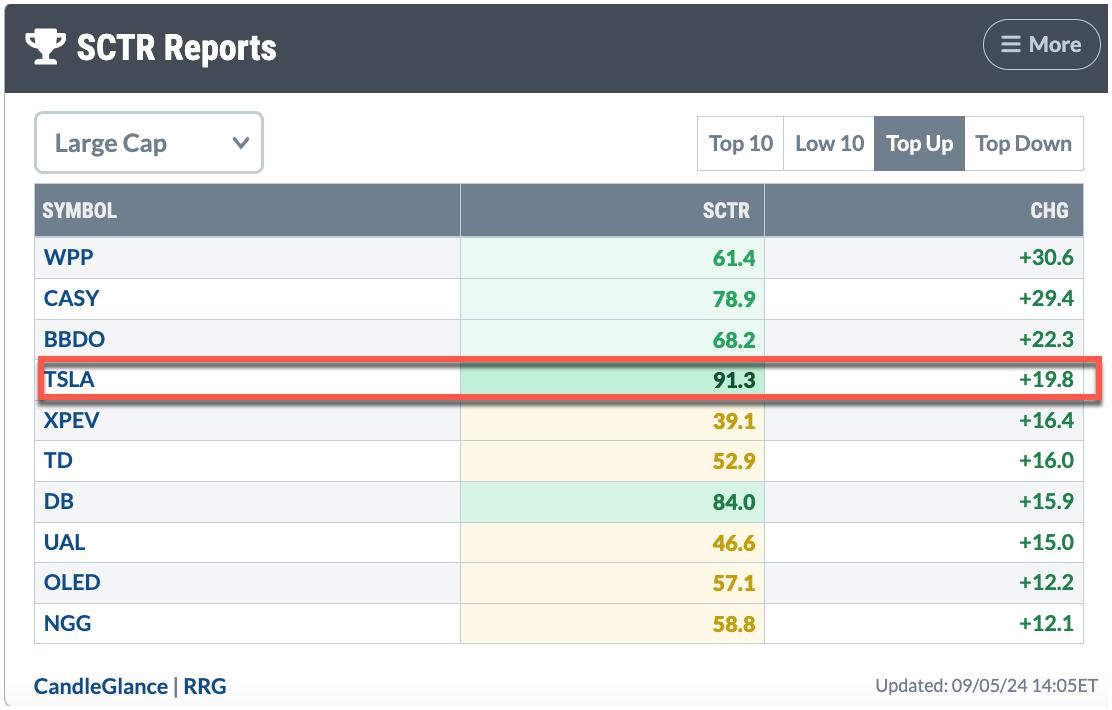

One stock that has shown strong technical strength over the past few days is Tesla, Inc. (TSLA). I noticed that TSLA stock has entered the StockCharts Technical Rank (SCTR). We provide top 5 reports in the large cap, top up category. When an actively traded stock like TSLA falls close to 30% and shows signs of recovery, it is time to pay attention.

Figure 1. The daily SCTR report shows TSLA among the top five large-cap stocks.Image source: StockCharts.com. For educational purposes only.

Tesla Stock Analysis

Tesla’s stock rally may be due to news of its autonomous driving software, but it’s worth analyzing TSLA stock from a technical perspective. If there’s enough momentum to drive the stock higher, it could be a profitable mid-term trade.

Let’s start by analyzing the TSLA weekly chart (see below).

Figure 2. TSLA stock analysis on the weekly chart. TSLA is trading between its 50-week and 200-week moving averages. The RSI is rising steadily and the relative performance against the S&P 500 is also rising.Chart source: StockChartsACP. For educational purposes only.

TSLA is trading between its 50-week and 200-week simple moving averages. (SMA). Both SMAs indicate a relatively flat weekly trend for TSLA stock. However, the SCTR score is rising and the Relative Strength Index (RSI) is showing a gentle upward slope. TSLA’s relative strength against the S&P 500 ($SPX) is weakening. If the line breaks above the downward sloping red dotted trendline (see panel below), the stock could be up more on the weekly perspective. TSLA’s stock price was in the $400 range before the decline.

Is it worth buying Tesla stocks now? Let’s analyze Tesla’s daily price movements (see below).

Figure 3. Daily chart analysis of Tesla stock. Tesla stock is still above its August 20 high, but momentum should be stronger. Expect the MACD to start rising.Chart source: StockChartsACP. For educational purposes only.

Here are some things to keep in mind:

- TSLA is trading above its 21-day exponential moving average and its 50-day SMA.

- The short-term uptrend since the August lows is still valid.

- Chaikin Money Flow (CMF) The indicator is in positive territory, which means buying pressure is greater than selling pressure.

- Moving average convergence/divergence (MACD) oscillator shows relatively weak momentum.

When should you buy TSLA?

Since TSLA’s stock price is news-related, it’s best to thoroughly analyze the charts before deciding when to enter a long position. Here are some things to consider:

- Can TSLA break its August 20 high? If so, there are signs of an uptrend (higher highs and higher lows). If not, look at where the stock sets its next low. A break below the uptrend line violates the uptrend condition.

- CMF is showing more buying pressure, but it would need to move higher to levels similar to the spike between July 1 and July 10.

- The MACD should move into positive territory and rise like it did in July.

- Finally, your SCTR score must remain above 70.

When should TSLA be terminated?

Let’s say the uptrend continues with strong volume and momentum. If you opened a long position above $228 (the August high), use the annotation tool on the chart to add Fibonacci correction levels from the recent low and high. Use these levels to help determine entry and exit points.

The conclusion is as follows: Add TSLA’s daily and weekly charts to one of your StockCharts ChartLists. Watch the price action and decide if it is worth entering the trade. Know how much you are willing to lose on the trade before entering the trade and set a stop loss level and profit target. Set StockCharts Notifications It will notify you when it reaches a certain price level. You don’t want to get married to stocks. It’s a numbers game.

disclaimer: This blog is intended for educational purposes only and should not be construed as financial advice. The ideas and strategies should not be used without first evaluating your personal and financial situation or consulting a financial professional.

Jayanthi Gopalakrishnan is the Site Content Director at StockCharts.com. She spends her time devising content strategy, delivering content that educates traders and investors, and finding ways to make technical analysis fun. Jayanthi was the Editor-in-Chief of T3 Custom, a content marketing agency for financial brands. Prior to that, she was the Technical Analysis Editor at Stocks & Commodities magazine for over 15 years. Learn More