Second-highest weekly close ever — 5 things to know about Bitcoin this week

Bitcoin (BTC) begins the new week fighting against old resistance after June began with surprising volatility.

BTC price action depicts a tug-of-war between bulls and bears centered around the 2021 all-time high of $69,000. Who will win?

The increasingly unpredictable near-term market environment has made for some interesting viewing and trading in June so far. External factors in the form of US macroeconomic data have shown that they can immediately reverse the trajectory of a cryptocurrency.

This, combined with the whales’ liquidity structuring moves, has so far prevented Bitcoin from beating final resistance en route to finding prices above $74,000.

While this has left many market participants frustrated, we expect to see more catalysts of the same style in the future.

The US is expected to release important inflation data throughout the week, and the Federal Reserve is scheduled to hold its latest meeting to discuss interest rate changes.

Meanwhile, a glimmer of hope comes from Bitcoin gradually solidifying various support/resistance reversals over higher periods, something that has not gone unnoticed.

With so much at stake in the current trading range, Cointelegraph takes a closer look at the key talking points regarding BTC price action going forward.

BTC price: range-bound but ripe for change

Bitcoin had a contrastingly quiet weekend after a sudden bout of macro volatility in the final Wall Street trading session last week.

According to data from Cointelegraph Markets Pro and TradingView, Bitcoin’s all-time record $69,000 point formed the market’s focus in 2021 and will continue into the new Asian session.

Without a rise or fall, liquidity has started to thicken around the spot price in classic style, which is being tracked by monitoring resource CoinGlass, potentially setting up hunting and thus more volatility.

“There is no significant change in the spot order book. Request liquidity enhancement of around $70.5K – $71K. Bidding liquidity is firm at a low of $68.5K – $68K.” Popular trader Skew concludes in his latest analysis of X (formerly Twitter):

“Market reaction to a sweep on either side of the ledger will be important early in the week in case of a return or continuation of the trade.”

Fellow trader Daan Crypto Trades said the CME Group’s Bitcoin futures market close guided the new week’s price and that price action was revolving around it “as usual.”

“I assume this will lose its edge once we get outside of this range, but until then, it’s a good tool to use to not get cut out for the weekend,” he told X subscribers.

Meanwhile, Michaël van de Poppe, founder and CEO of trading firm MNTrading, described BTC/USD as “a consolidation between two important levels.”

“A breakout to $71.7K would be huge, but being conservative is the norm during CPI weeks,” he concluded.

CPI meets Fed meeting in key macro week for cryptocurrencies.

The macro environment will be driven by two key events this week: the Federal Reserve’s interest rate decision and subsequent press conference, and the May Consumer Price Index (CPI) release.

Due to the double whammy of risk asset volatility, CPI is scheduled to be released on the day the Federal Open Market Committee (FOMC) convenes.

“The long-awaited June Fed meeting is officially eyeing the Fed’s guidance,” trading resource Kobeissi Letter wrote about the upcoming week.

This data may prove to be particularly relevant for cryptocurrency traders. Last week’s US employment data significantly beat expectations, causing an immediate stir with BTC/USD briefly falling nearly 2%.

Popular trader CrypNuevo commented on how Bitcoin may react to inbound data, flagging two possible scenarios.

“Scenario 1: Recover NFP move early in the week, consolidate until FOMC comes out, make aggressive FOMC move, then revert FOMC move. Scenario 2: FOMC restores NFP movement. Until then, we are simply consolidating and sweeping away the lows,” X’s post said in part.

CrypNuevo cited the non-farm payrolls, or NFP, print that sparked the cryptocurrency rout last week.

Market expectations about the Federal Reserve’s policy changes have actually remained unchanged for a long time. They believe the FOMC will not cut interest rates this month and it may take several more meetings before the Fed follows central banks elsewhere and cuts rates, according to data from CME Group’s FedWatch Tool.

Meanwhile, June 13th is another key macro data day when the US releases the Producer Price Index (PPI) along with weekly unemployment claims.

“But don’t forget that when economic data shakes up markets, those moves tend to bounce back later. And here is the same case as the NFP movement two days ago,” CrypNuevo wrote in an additional post.

“Will we be tracking NFP movements before the FOMC?”

BTC weekly close nears all-time high.

BTC/USD’s weekly close was significant within the broad consolidation framework that has been in place since March’s all-time high of $73,800.

As various commentators, including celebrity trader and analyst Matthew Hyland, have pointed out, the recent closing price was $69,630, the second-highest price in Bitcoin’s history.

This comes despite a late weekend drop, which has since reversed some of the buyers.

Bitcoin ultimately rose 2.7% last week, with the monthly open remaining at support, according to data from CoinGlass.

In a weekend analysis, Daan Crypto Trades said a weekly close above the 2021 high of $69,000 “would be a good start to breaking out of this price range.”

“We’ve done that before, but it was on large runs that required cooling,” he said.

“You could argue that $BTC will have a lot more fuel this time.”

Meanwhile, a well-known pseudonym commentator known as Nunya Bizniz of X considered whether the 23% retracement BTC/USD experienced since the March high was enough compared to previous cycles.

Bitcoin resistance reversal is a “historic technological feat.”

For popular trader and analyst Rekt Capital, there are reasons to be optimistic about BTC price action despite the current range setting.

Analyzing monthly periods, he revealed that a clear resistance/support reversal is underway in the ongoing bull market’s major wins.

He summarized over the weekend: “Bitcoin has performed a historic technical feat of turning a major area of existing resistance into a major new area of support.”

“Bitcoin has since developed a re-accumulation range at the high that resembles a Bull Flag trend continuation pattern.”

According to the attached chart, the resistance area in question appears to be between $58,600 and $61,300, the bull market for 2021. Now, if you look at the monthly period, you will see that the situation has changed in your favor.

“Bitcoin continues to consolidate in its post-halving re-accumulation range,” he said, accompanied by a chart comparing the past and present of the Bitcoin bull market.

“Range high resistance is ~$71500. Range Low Support is at $60600.”

Rekt Capital previously suggested that the currently sideways BTC price action may take longer to resolve itself, but the overall upward trend remains intact.

“At present, Bitcoin is not yet ready to enter the parabolic phase of the cycle,” he reiterated.

Whales pursue ‘mid-term profits’

“Re-accumulation” describes not only the BTC price action this month, but also the habits of Bitcoin whales.

Related: Bitcoin Price Rise to $69,000 Could Send BNB, TON, FIL, and INJ Much Higher

In a June 5 study on on-chain analytics platform CryptoQuant, contributor Cauê Oliveira argued that large BTC investors are currently piling up the coin for “mid-term gains.”

“Unlike high-conviction Bitcoin investors who seek to build long-term reserves, whales typically seek medium-term profits,” he wrote.

“We can easily identify this behavior through the monthly changes in Bitcoin holdings for companies holding more than 1,000 BTC.”

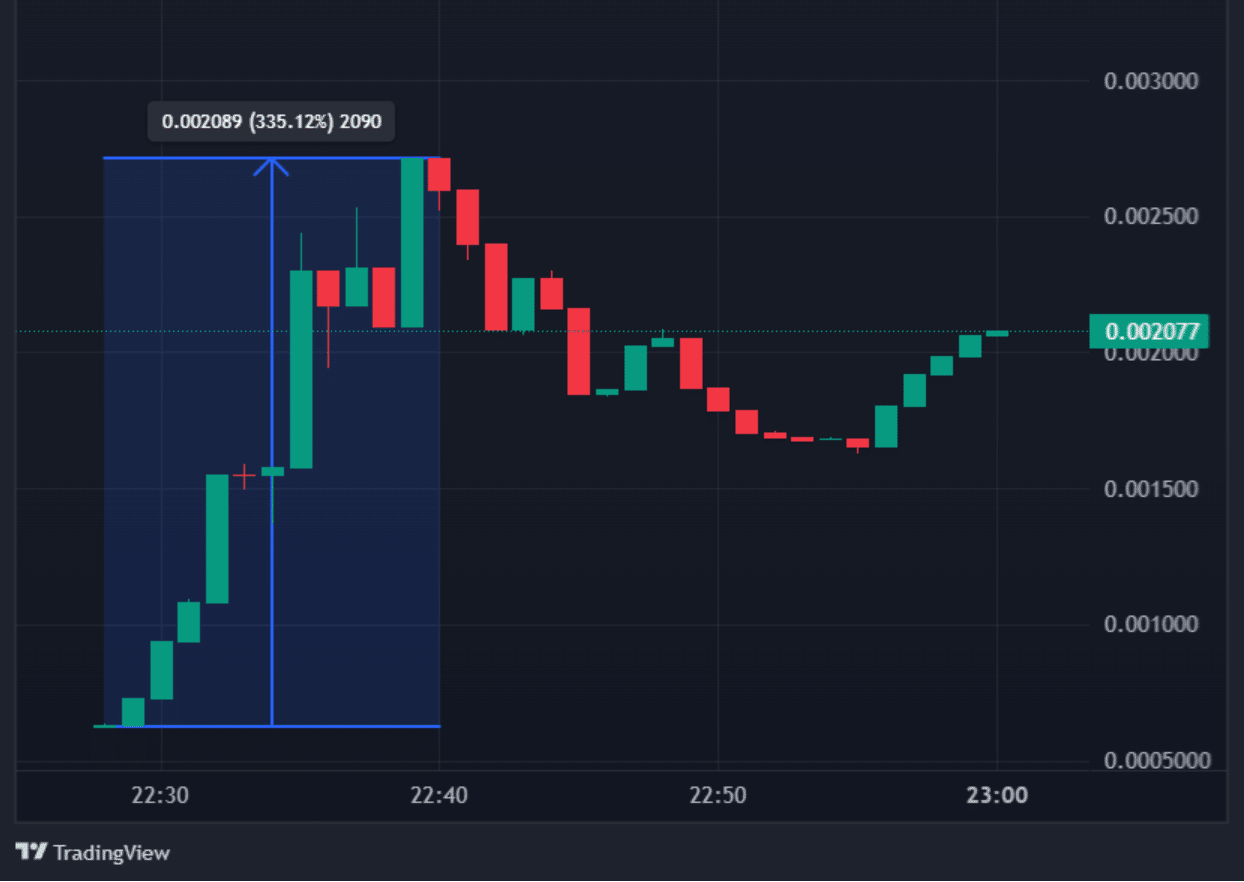

The attached chart shows the monthly percentage change in whale stocks on a 30-day basis. This follows a rapid distribution phase following Bitcoin’s all-time high in mid-March, and is currently rising modestly.

“Be aware that there are accumulation and distribution patterns that directly affect prices,” Oliveira said.

“After an intensive distribution period in March, institutional investors have begun the redeployment process over the past two weeks.”

Oliveira added that whale behavior is already starting to make its presence felt in the market, but is likely to intensify in the coming weeks.

Meanwhile, last week Cointelegraph reported on the phenomenon of long-dormant BTC coming back into circulation, which fellow CryptoQuant analyst JA Maartunn at the time called a circulation.

This article does not contain investment advice or recommendations. All investment and trading activities involve risk and readers should conduct their own research when making any decisions.