Sector Power for Blockchain Investors

(Courtesy of Reddit user Wargizmo)

Understanding the industry is a superpower in cryptocurrency investing.

Many people buy cryptocurrency without knowing what the company actually does. This is like buying a stock because the bookie recommended it. Smart stock investors research the underlying companies, and smart cryptocurrency investors do the same.

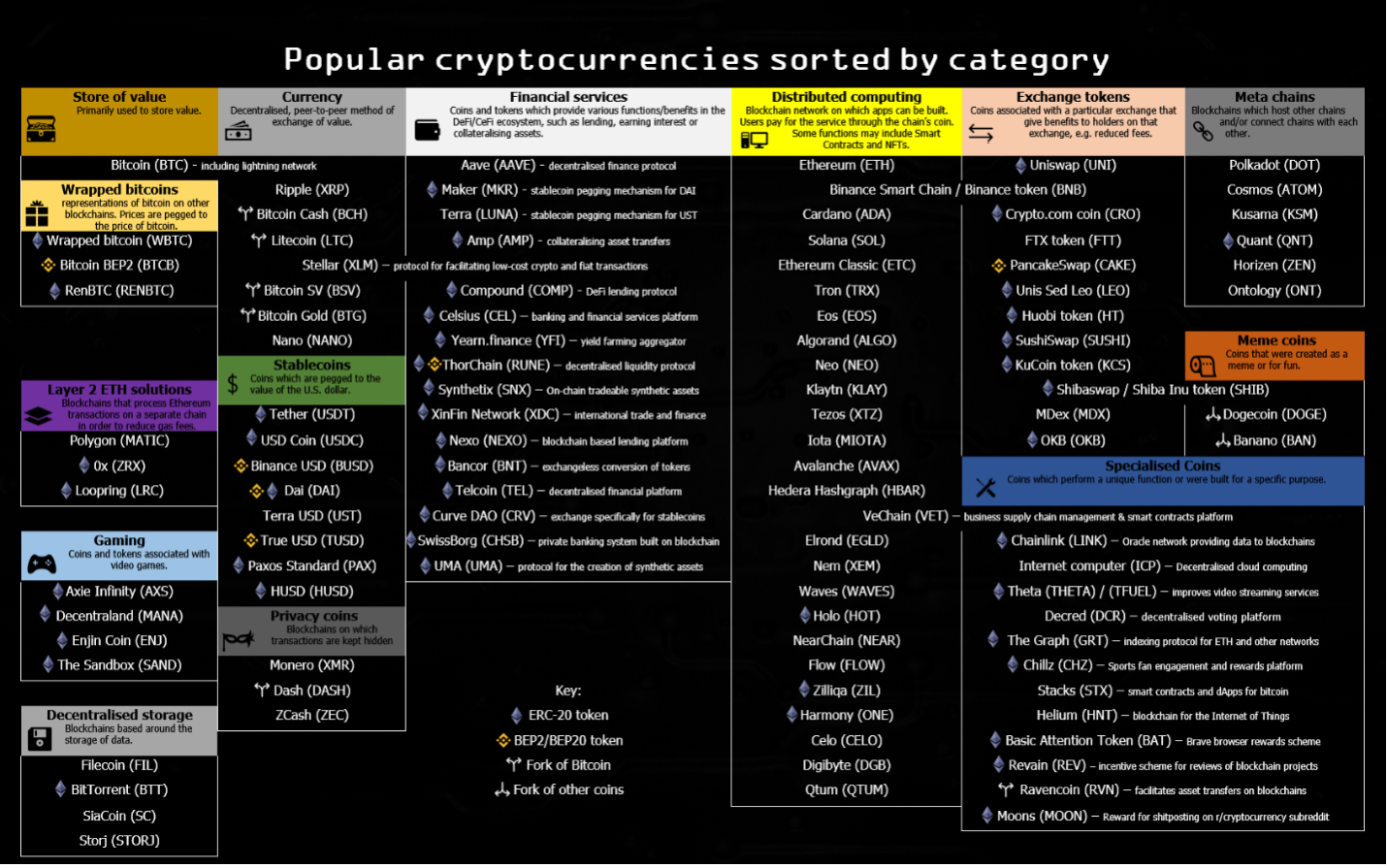

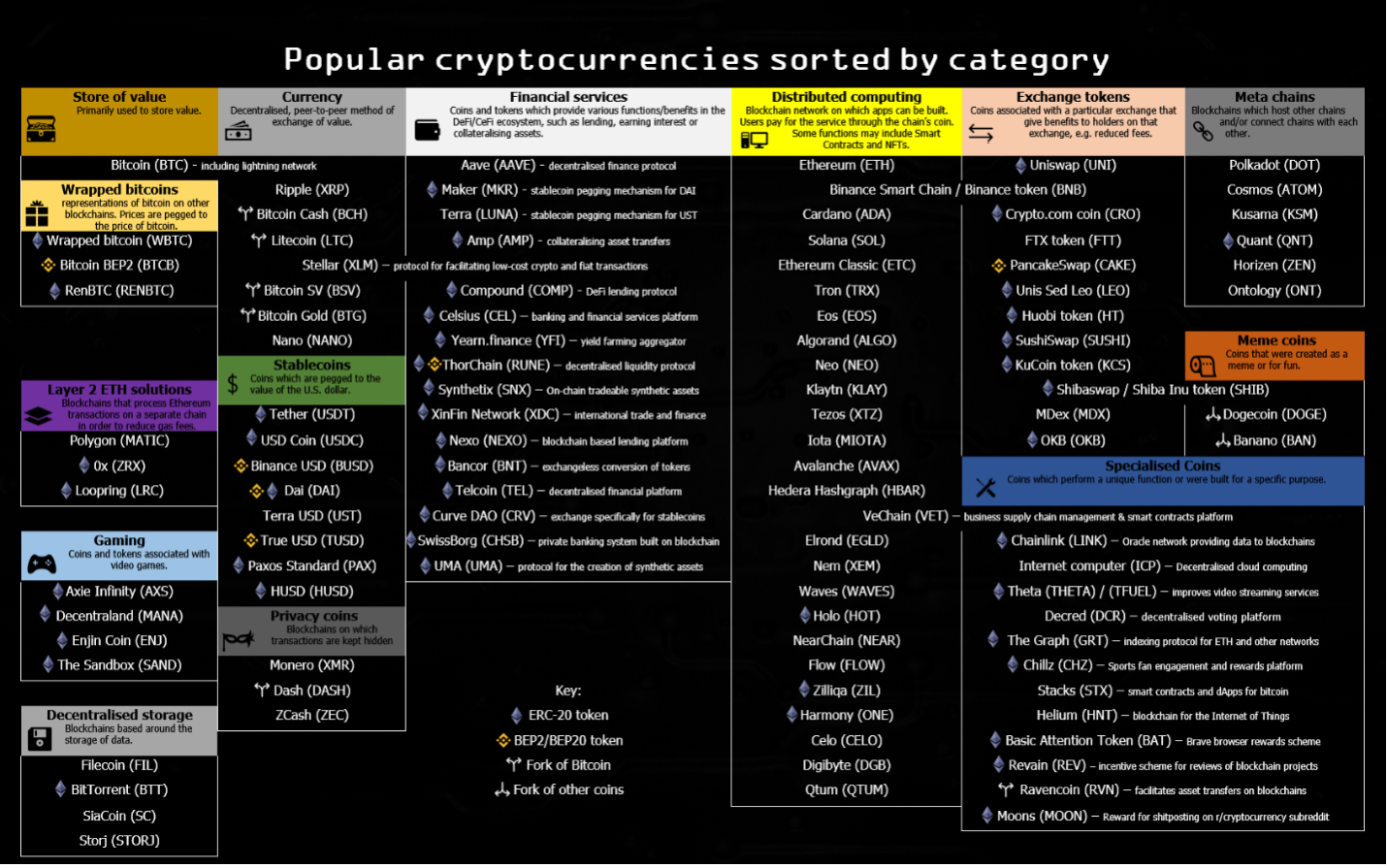

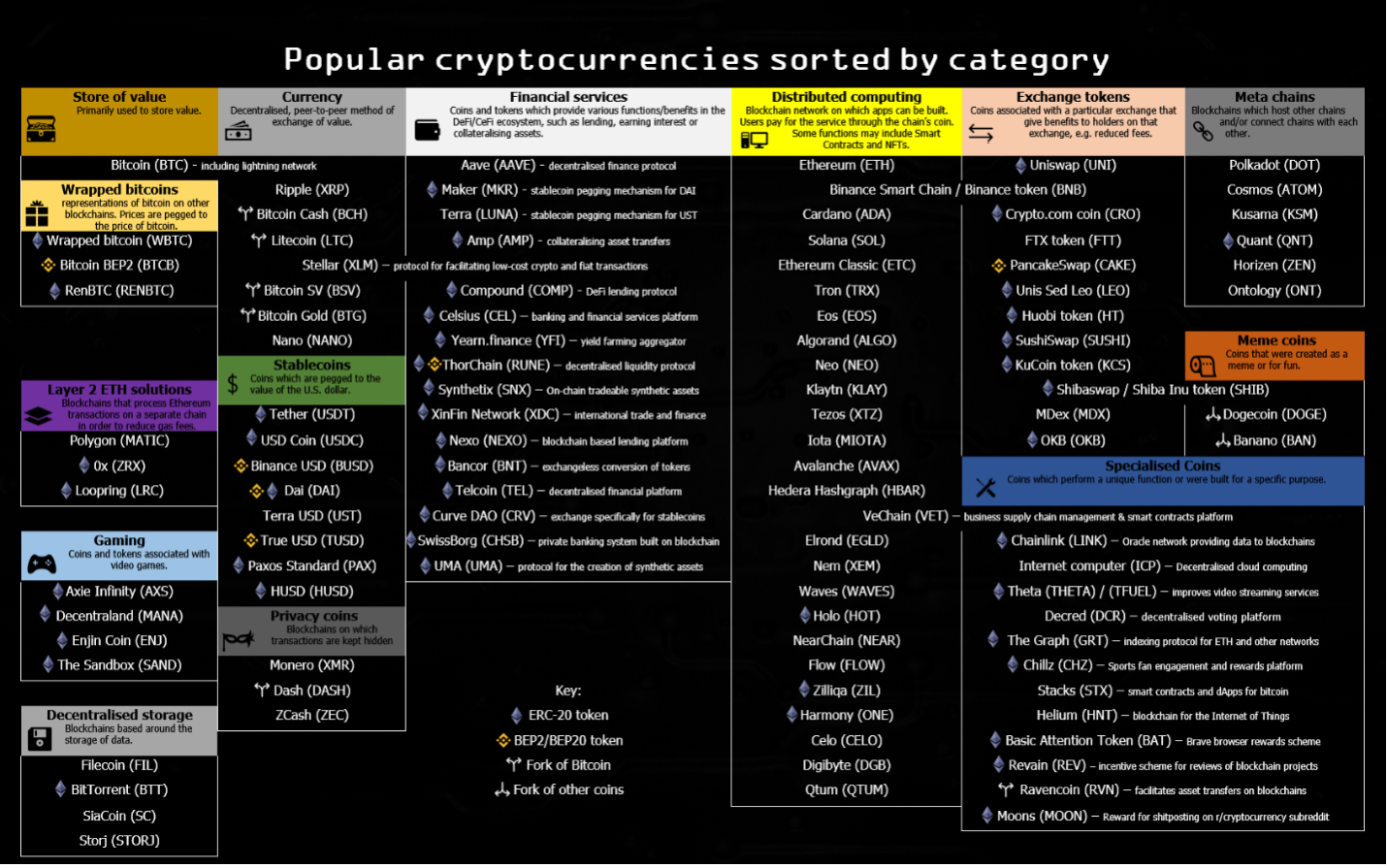

The chart above is similar to the traditional stock market “sector” concept. To learn how to harness this superpower, let’s look at the concept of sectors.

The power of sector investment

Traditional stock market companies are assigned to Global Industry Classification Standard (GICS) categories. (Not the sexiest name. “Superpowers” is much better.) GICS has 11 divisions.

- energy

- ingredient

- industrial goods

- consumer discretionary

- consumer goods

- health care

- finance

- information technology

- telecommunication services

- utility

- real estate

Sectors allow you to group companies by industry.. While GICS lists stock market sectors, this chart is an attempt to list cryptocurrency sectors.

Sectors are like superpowers, because it helps identify categories within the blockchain industry, a kind of x-ray vision. This will give you insight into which companies will be the winners in each cryptocurrency sector.

In other words, you can predict which tokens will dominate that category.

If we compare this to the general view of cryptocurrencies by market cap, we can see that this chart brings structure and order to the industry. You can pick winners in the categories that matter to you..

As cryptocurrency investors, we need to know our sector. (It rhymes.) Let’s review each sector on this chart in order of potential investment opportunity.

Store of value (superior potential)

There is actually only one player here: Bitcoin (BTC). Although Bitcoin has not become widely popular as a currency, it has gained popularity as a store of value, like “digital gold.” This is why, for example, more companies are storing part of their cash reserves in Bitcoin.

This store of value argument is why many investors believe, “If you’re only going to invest in one digital asset, invest in Bitcoin.” They believe that despite its short-term volatility, Bitcoin is an excellent long-term store of value. (Bitcoin is the foundation of the blockchain believer portfolio.)

Distributed Computing (Great Potential)

Distributed Computing (Great Potential)

I will call this category “Blockchain Platforms.” This is probably the easiest cryptocurrency investment decision after Bitcoin. If you believe that blockchain is here to stay, people will need a platform to develop blockchain, just like they need a Windows, Mac, or Android operating system to develop apps.

Of course, the 800 pound gorilla in this category is Ethereum (ETH). In some ways, Ethereum seems like the most undervalued “company” in the world, with a global community of users, developers, and platforms building on top of it at breakneck speed. This can be seen as the infrastructure of the ‘Internet of Value’.

In other words, Ethereum is not a lock. Many technology platforms gained an early lead but then lost that lead (Betamax, MySpace, IBM). Other worthy contenders include Binance Smart Chain (BNB), Cardano (ADA), and Solana (SOL).

We can:

1) Ethereum is the clear leader and a handful of smaller blockchains that specialize in niche applications. (Think of virtual monopolies like Google and all the other search engines.)

2) 2-3 large competing blockchains (oligopoly like Windows vs. Mac OS).

Financial services (excellent potential)

Financial services (excellent potential)

There is a lot of hype in the blockchain industry, but when it comes to decentralized finance (DeFi), the hype may be warranted. In our view, DeFi platforms are so important to the future of finance that we have written several guides on how to invest in DeFi, how to evaluate DeFi, and how to find DeFi unicorns.

Using DeFi products is still a bit technical and unstable. But once you learn how it works, there is no comparison as it is so much better than traditional financial products like online banking and online brokerages. It’s like upgrading from a travel agent to Google Flights. And DeFi apps will only get better.

DeFi investments are generally riskier. This is cutting-edge, state-of-the-art. But the potential returns are also much greater. If you want to invest in DeFi, consider the projects with the largest market capitalization. This usually means that the project has the most users and is in a good position to become a category leader.

Exchange tokens (some possibilities)

Exchange tokens (some possibilities)

Exchanges are an important part of the blockchain ecosystem. An exchange is where you buy, sell, and exchange one digital asset for another. Since this is the single biggest use case for blockchain today (token trading), you would think a digital exchange would be a perfect investment opportunity.

The challenge is that traditional exchanges are difficult to operate in a context where legal and regulatory issues continue to be intertwined. Although each country’s laws are constantly changing as they figure it out, blockchain is a global, borderless system that occurs 24 hours a day.

The history of blockchain is filled with numerous exchanges that have come and gone. Who will be left in the end? As Yoda said, “It is impossible to see the future.”

Stablecoins (some possibilities)

Stablecoins (some possibilities)

Stablecoins (digital assets that typically hold their value 1:1 to the U.S. dollar) are one of the fastest-growing segments of blockchain. The two giants are Tether (USDT) and USD Coin (USDC), the latter of which is issued by Circle and will eventually launch as a publicly traded stock (see our guide on how to invest in Circle).

The problem is that it is difficult to make money with stablecoins because their prices do not move. Of course, you can earn “interest” (commonly called “yield”) using new DeFi protocols (see our best DeFi interest rates page). This can be an important part of your investment strategy, such as storing some of your existing funds in CDs or money market funds.

Stablecoins are “safe,” but with low risk comes low reward. (And it’s not entirely risk-free; you may still be taxed by the government.) If you want bigger returns, look elsewhere.

Decentralized storage (some possibilities)

Decentralized storage (some possibilities)

Let’s say you have a large hard drive with several petabytes of capacity, and you’re only using a portion of that storage space. You can “rent” your unused storage for others to use and then get paid in blockchain tokens. On the other hand, users with large files can ‘rent’ storage at a low price.

It’s still early days, but the promise of decentralized storage is exciting to watch. Filecoin (FIL) is the frontrunner and probably the best investment opportunity.

The key “tipping point” will be when these distributed storage systems begin to be widely adopted by businesses and enterprises. Until then, most investors will probably “wait and see.”

Games (some possibilities)

Games (some possibilities)

The blockchain economy is similar to the video game economy. That is, the kind where you buy real money to buy virtual goods like custom skins or weapons. So there is some overlap here, but there is certainly no category leader yet. It will be an interesting and fun space to look at.

We also see that in the traditional video game industry, there are thousands of games and hundreds of game publishers, but very few game publishers that we would consider an “investment.” Instead, smart investors will want to look for gaming platforms like Xbox or Playstation (i.e. invest in MSFT or SONY).

Metachain (some possibilities)

Metachain (some possibilities)

These technologies provide blockchain interoperability, for example data transfer between Ethereum and Cardano. Imagine investing in a company that provides interoperability between Windows and Mac. These companies do exist, but they are usually only a very small part of the overall Windows/Mac market. It’s probably best for most retail investors to hold off.

Currency (limited potential)

Currency (limited potential)

The biggest irony is that “cryptocurrencies” are not real currencies. So the “currency” investment in the chart above is probably not a good long-term investment. Ripple (XRP) may be an exception because it is designed for special payment types, such as international money transfers. However, Ripple is currently the subject of an SEC investigation (see our article about the SEC and XRP).

The bigger problem is that dozens of governments are already developing their own central bank digital currencies that offer the convenience of digital currencies, but with government backing. Once CBDCs are launched on a large scale, why would people use other digital currencies?

Privacy Coin (Limited Potential)

One reason you might want to use a different currency is if you want to remain completely anonymous. Bitcoin and other cryptocurrencies are only partially anonymized. Although you can still see the entire transaction history on the blockchain, privacy coins are a black box.

Privacy coins are used for legitimate reasons, such as protecting an individual’s privacy or escaping from an authoritarian government, but they are also used for shady transactions, making them unlikely to be widely used. The government hates them. Additionally, all challenges listed in the “Currency” section above still apply.

Wrapped Bitcoin (Limited Potential)

This is known as: derivativeOr a digital asset built on top of another digital asset. The problem with derivatives is that they are becoming increasingly complex and risky for most investors. big short).

This leads to asset based asset asset based asset based asset and the entire Jenga tower can quickly collapse. (I always link to the Ryan Gosling/Steve Carrell scene. big short).

Layer 2 ETH solution (limited potential)

This is a new technology built on top of Ethereum. Most investors ask themselves these simple questions: If you believe in Ethereum so much, why not invest in it??

(For more information, see our Investor Guide to Layer-2.)

Meme Coin (limited potential)

Feel free to invest in Dogecoin because it’s fun. Especially if you think losing all your money is fun.

(See our Investor Guide to Memecoins for the same message.)

Special coins (mixed bag)

Special coins (mixed bag)

Finally, there is the “Everything Else” category. That means all the wonderful and strange experiments being tried on blockchain. It’s worth watching to see which areas are gaining traction and potentially seeding new sectors.

Summary of Sector Superpowers

Investing in blockchain projects using sector views is like having “laser eyes” in real life.

While everyone else is chasing “price trends,” “social media sentiment,” or other cryptocurrency craze, you can cut through the chaos.

Sectors provides a calm, logical look at blockchain investment opportunities by category. The process is as follows:

- Understand each sector.

- Decide which sectors will be most important to you in the long term.

- Then identify one or two leaders in each sector.

- Depending on your blockchain believer portfolio, invest accordingly.

- profit.