Semiconductor supply chain outlook | pursue alpha

deeply

Semiconductors are at the core of the supply chain from computers, mobile phones, automobiles, and manufacturing equipment. The sector’s activities can provide guidance for wider supply chain activities. In fact, the chip shortage during the pandemic It symbolizes how supply chains can fail under stress.

An analysis of the semiconductor industry using supply chain, macroeconomic and financial data, and a review of input from 38 companies, augmented by NLP analysis of revenue records, shows that an upward inflection point in supply chain activity is close, but far from being fully reached. 2024.

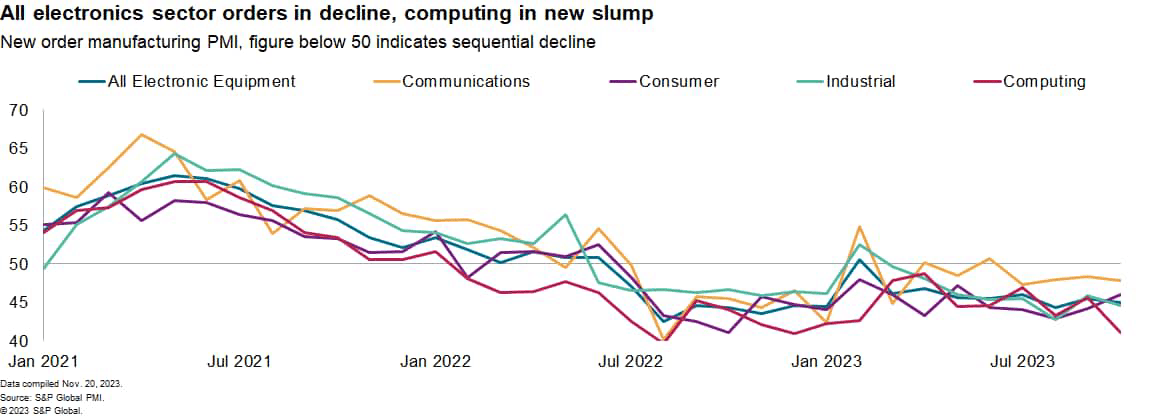

Macroeconomic data shows that the decline in demand is still ongoing. The S&P Global PMI for electronic equipment orders has continued to decline in 15 of the past 16 months, while exports of computer chips from the four largest export regions have declined. It decreased by 9% in October.

On a more positive note, consensus revenue forecasts show revenue recovering for most companies starting in the fourth quarter and then accelerating by 10% in the second quarter of 2024.

Large computer and mobile phone manufacturers expect demand to stabilize in the fourth quarter of 2023 and recover in early 2024. The Connected Devices and Peripherals segment is still in the recovery phase, including stabilization in the fourth quarter of 2023. The downgrade period is coming to an end. Growth in 2024 will depend in part on new products and the renewal cycle of equipment purchased during the pandemic.

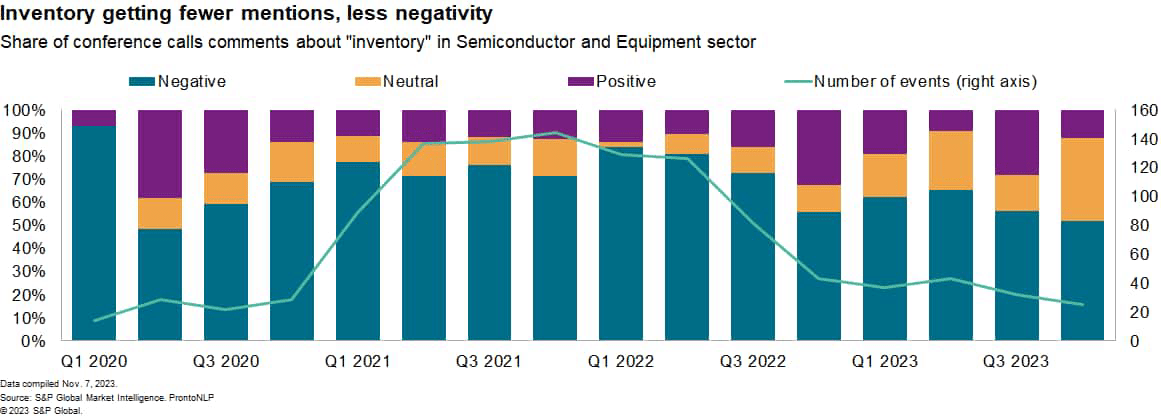

Declining demand for chips has been accompanied by rising inventories. Some companies hope a recovery in demand will help offset high inventories. An NLP-based analysis of earnings reporting records shows that the percentage of companies making negative statements about inventory decreased from 84% in the first quarter of 2022 to 52% in the fourth quarter of 2023.

After closely reviewing input from more than 20 semiconductor manufacturing companies, many predict that demand will catch up with supply and inventory by 2024, across both production and fabless models.

The decline in demand in the electronics sector can also be seen in semiconductor exports from the four major export regions: mainland China, Taiwan, Korea, and Japan. Exports of the four companies fell 9% year-on-year in October 2023, similar to a 7% decline in September and a 10% decline in August, according to Market Intelligence data. This supports evidence from PMI data on electronic equipment purchases and may indicate that the slowdown recovery has stalled.

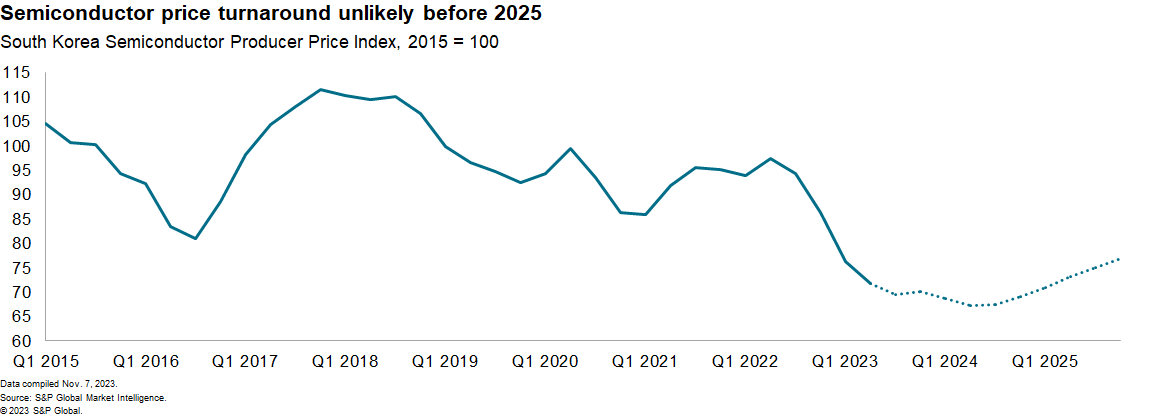

Makers of memory chips and storage devices have experienced the biggest downturn in the past two years due to lower demand for consumer applications, including computers and mobile phones. This is most evident in South Korea, where memory chips accounted for 55% of semiconductor exports in 2022, according to Market Intelligence data. Korea’s average semiconductor price in the third quarter of 2023 fell 29% compared to the second quarter of 2022. According to Market Intelligence, it is expected to decline further in 2024 and then recover in 2025.

Suppliers of chemicals and bonding materials to the semiconductor sector have been challenged by inventory clearance periods, but have now stabilized, with growth showing signs of returning. According to Market Intelligence data, global exports were down 12% in September compared to the same period last year, but the export restrictions mentioned above may not have a noticeable impact overall given the restrictions on high-end graphics processors.

Chip manufacturing equipment companies expect orders and sales to resume cautiously during 2024 as geopolitical challenges are addressed. Time, Tariffs and Tracking: Supply Chain Outlook for Q4 2023.

original post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.