Shooting Star – Price Action Pattern – Analysis and Forecast – January 13, 2024

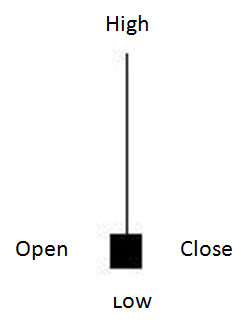

The shooting star price action pattern is a bearish signal that means the market is more likely to fall than to rise, and is often used in bearish markets. In essence, it’s the opposite. hammer pattern. Here’s an example of what a shooting star candle looks like:

A shooting star shows buyers pushing the market to new highs. However, the buyers are not strong enough to hold the high and decide to hold their positions. This causes the market to fall and sellers to enter the market as well. Both the open and close prices should be in the bottom half of the candle. Traditionally, the closing price may be higher than the opening level, but if the closing price is below the opening level, this is a stronger signal.

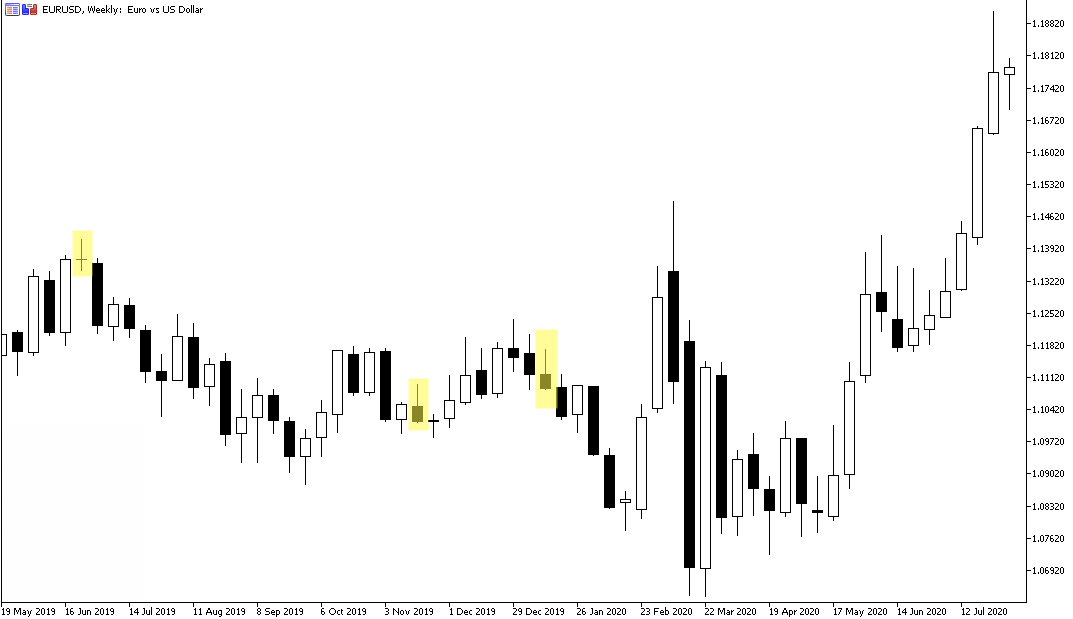

The EUR/USD price action forex chart above shows three examples of a shooting star pattern, all of which are highlighted with gold boxes. By analyzing the open, close, high, and low levels, the pattern suggests a possible downtrend. In this example, the price fell after the candle formed. Again, there is no guarantee that this will happen, and if you look closely you can see examples on the same chart where the price has not been lowered. How could you trade that?

item: The price level at which you can engage in trading may be when the market finally breaks the low of the shooting star candle. The low of the third shooting candle formed on the week of January 12, 2020 is at 1.1086. So the entry price could be 1.1085.

stop loss: The possible stop loss level may be the highest level of meteorism. candle. At the high of the shooting star candle at 1.1171, a possible stop loss could be 1.1173.

target: If a trade is in profit, there are several ways to exit a profit trade, including exiting at the close of the candle, targeting support or resistance levels, or using a trailing stop loss. In this case, targeting the previous swing low would result in a target price of 1.0981.

Trade: If the entry price is 1.1085 and the stop loss price is 1.1173, the total risk of the trade is 88 pips. Trading with 0.1 lots means that if this trade triggers the entry price and then hits the stop loss, your total loss will be $88. In this case, the market traded lower to reach the target price, resulting in a trading profit of approximately $104.

Subscribe to learn more about price action trading and other trading-related topics. our channel.