Should CalPERS fire everyone and just buy some ETFs? – Meb Faber study

“He was a slick politician at the American level and that was the only way to survive in that job. “It has nothing to do with investments,” he said.

That’s the way institutional investor We recently featured the former CIO of the California Public Employees’ Retirement System, also known as CalPERS.

This explanation is especially interesting considering that the ‘I’ in ‘CIO’ means ‘investment’. It raises eyebrows as to whether this role could have ‘nothing to do with investment’.

For readers unfamiliar with CalPERS, it manages pension and health benefits for more than one million public employees, retirees and their families. They oversee the nation’s largest pension fund, worth more than $450 billion.

The sheer volume of assets places great scrutiny on how those assets are distributed. The CIO role, which manages these pensions, is one of the most prestigious and powerful roles in the country. institutional investor‘S interest. Obviously, it’s also one of the hardest roles to pull off. This position has averaged out to a new CIO roughly once every two years over the past decade.

Now, I’m not going to spend a lot of time on CalPERS governance in this article. Because a lot of other people have spilled a lot of ink about CalPERS governance. Plus, there’s no end to the drama surrounding the pension, and there’s a good chance there will be a new twist by the time we publish the article. (To be fair, Harvard’s endowment problems are almost equally dramatic…)

Instead, we will use CalPERS’ investment approach as a starting point for a broader discussion of portfolio allocation, returns, fees, and wasted effort. And if we do our job right, we hope that by the time we’re done, you’ll feel a little less stressed about positioning your portfolio.

A colossal waste of the CalPERS market approach.

CalPERS’ stated mission is “to provide retirement and health benefits to our members and beneficiaries.”

Nowhere in this mission does it state that the goal is to invest in numerous private equity funds and pay inflated salaries to numerous private equity and hedge fund managers. But that’s exactly what CalPERS does.

The pension’s investment policy document – we are not making this up – is 118 pages long.

Their list of investments and funds runs to 286 pages. (Maybe they should read a book.)index card“.)

The structure is so complex that for a long time CalPERS couldn’t even calculate the fees it pays on private investments. In that regard, the biggest reason for the high fees so far is CalPERS’ private equity allocation, and it plans to increase that allocation. Is it a well thought out idea or a Hail Mary passing after years of poor performance? CalPER’s venture capital portfolio recently returned 0.49% from 2000 to 2020.

It’s easy to criticize now. But is there a better way?

Let’s take a look at CalPERS’ historical returns for some basic asset allocation strategies.

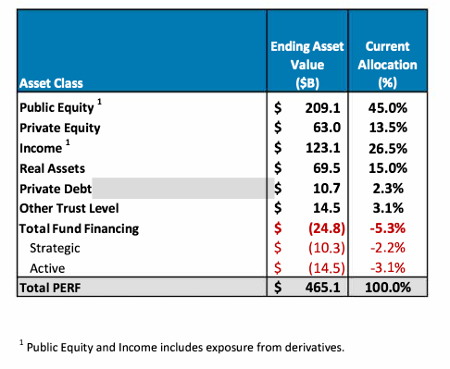

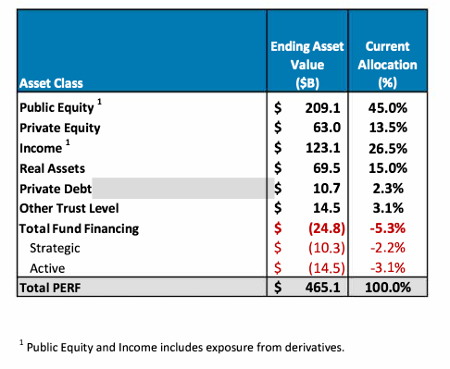

Let’s start with CalPERS’ current portfolio allocation.

Source: CalPERS

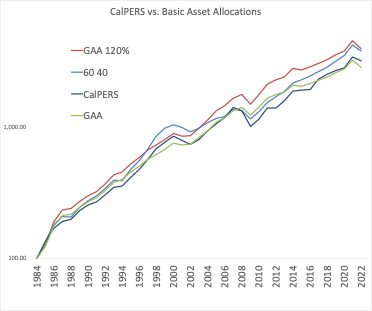

Now that you know what CalPERS uses, let’s compare the returns to three basic portfolios launched in 1985.

- A typical 60/40 US stock and bond benchmark.

- Our Book’s Global Asset Allocation (GAA) Portfolio Global Asset Allocation (Available as a free eBook here) The allocation is similar to the allocation of a global market portfolio of all public assets in the world.

- This is a GAA portfolio with some leverage, as leverage is inherent in many of the funds and strategies CalPERS utilizes.

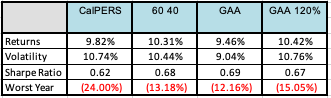

Source: CalPERS, Global Financial Data, Cambria

As the table shows, from 1985 to 2022, CalPERS did not differentiate itself from a simple “do nothing” benchmark.

To be clearer, profits are not. bad. they just don’t good.

Consider the following implications:

All the time and money spent by investment committees discussing allocations…

All the time and money spent on private financing and allocation…

All the time and money spent on consultants…

Time and money poured into recruiting new employees and CIOs…

All that time and money was spent creating endless reports to track thousands of investments.

All of that – completely wasted.

CalPERS would have been better off laying off its entire staff and buying some ETFs. Should I call Steve Edmondson? It will definitely make record keeping much easier!

It can also save hundreds of millions of dollars annually in operating costs and external fund fees. Over the years, the cumulative cost amounts to billions of dollars.

Personally, I take the “I” part of the acronym very seriously and offered to administer my CalPERS pension for free.

“This is a pension fund suffering from poor performance and major cost and headcount issues. We manage your portfolio for free. Buy some ETFs. Reval occurs about every year. Call your annual general meeting over a pale ale. Maybe I could write a year’s worth of reviews.”

I applied for the CIO role three times, but CalPERS declined to interview me each time.

CalPERS may need to update its mission statement to: member CalPERS employees, personal fund manager and their beneficiaries.”

In this case, they will be very successful.

Is it just CalPERS or is it the industry?

Looking at the results above, we can conclude that CalPERS is an outlier.

Critics might retort, “OK Meb, I know CalPERS can’t beat basic buy and hold, but let’s face it, it’s the government!” We define government as mediocrity. “Any serious private pension or institution should tap into the smart money that is the large hedge fund managers.”

That’s a fair point. So let’s expand the analysis a little further.

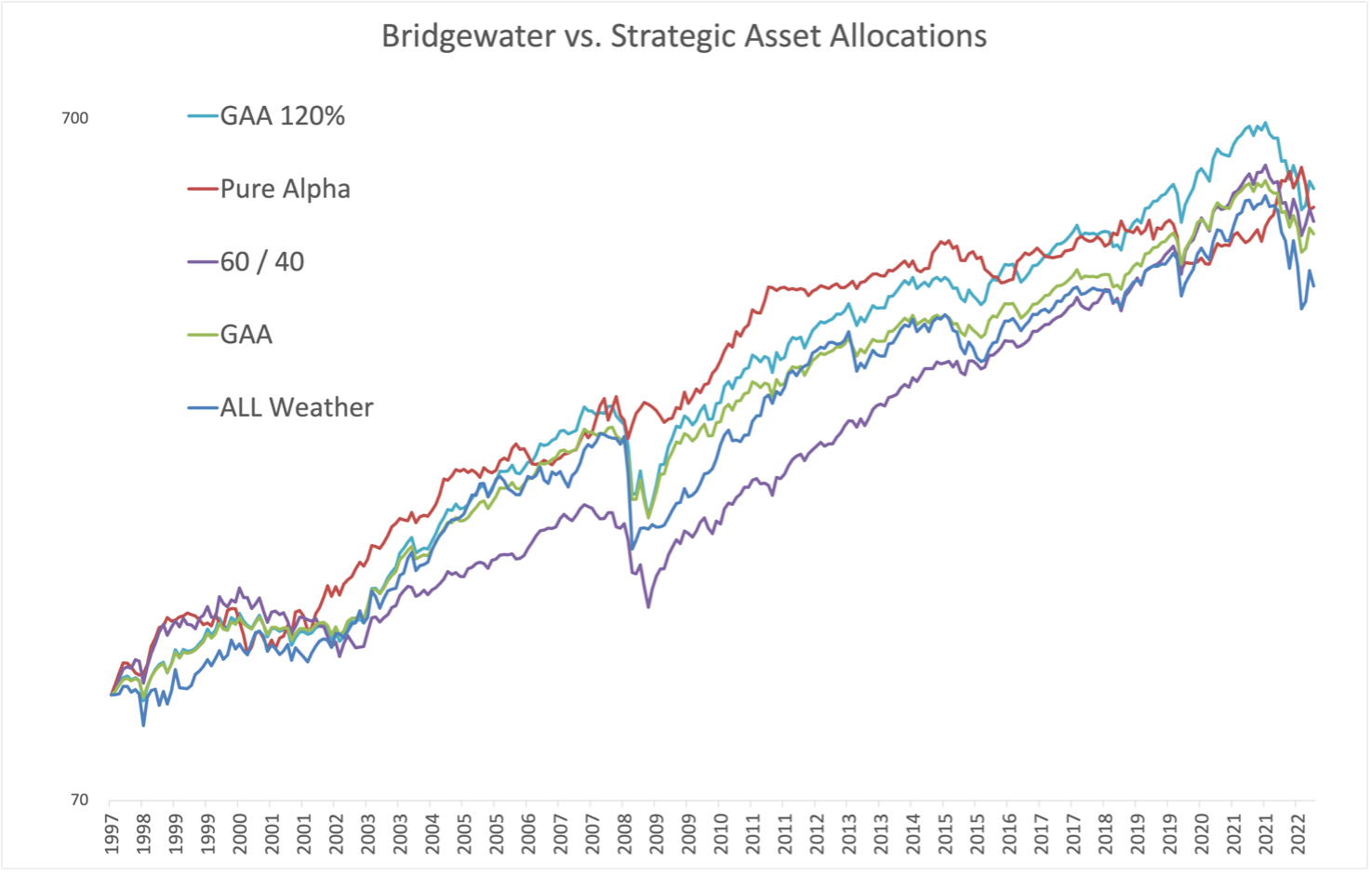

Let’s take a look at one of the largest and most famous hedge fund managers, Bridgewater. This $100 billion-plus money manager offers two main portfolios: a buy-and-hold “all-weather” strategy and a “pure alpha” strategy.

In 2014, we began replicating Bridgewater’s “All Weather” portfolio. Bridgewater said the portfolio was stress-tested through two recessions, a real estate bubble and the global financial crisis.

The clone, based on a simple, indexed global market portfolio, replicated Bridgewater’s product well when retested. More importantly, running a clone wouldn’t have required any hedge fund management fees, no lockups, and wouldn’t have been burdened by tax inefficiencies. To be fair, this backrest has the benefit of hindsight and you don’t pay any fees or transaction costs.

With its focus on risk parity, the All Weather Portfolio shows that you don’t necessarily have to embrace pre-packaged asset classes when building a portfolio.

For example, stocks are inherently leveraged and most companies have debt on their balance sheets. Therefore, there is no reason or obligation to acquire shares at nominal value. One option for “equity deleveraging” is to invest half your money in stocks and half in cash. The same goes for bonds. Bonds can be leveraged up or down to increase or decrease volatility.

This approach has been around for well over 60 years. This concept, which dates back to the days of Markowitz, Tobin and Sharpe, is essentially a highly diversified buy-and-hold and rebalance portfolio. Bridgewater founder Ray Dalio said he would invest if he passed away and needed a simple allocation. his children.

So is it clear that the world’s largest hedge fund can eclipse the allocations you can write on an index card?

Once again, from 1998 to 2022, we find that a basic 60/40 or global markets portfolio performs better than the world’s largest hedge fund complex.

Source: Morningstar, Global Financial Data, Cambria

“OK Meb, All Weather should be a buy and hold portfolio. They charge low fees. You want a good, actively managed Pure Alpha!”

What about Bridgewater’s actively managed portfolio?

Dalio separated the All Weather portfolio from Bridgewater’s Pure Alpha strategy. This stands for Multi-Strategy Go Anywhere Portfolio.

His idea was to separate “beta,” or market performance, from “alpha,” or performance added above average market returns. He believes that beta is something you have to pay very little for (we are on record saying you shouldn’t pay anything for it).

Now let’s mix up the Pure Alpha strategy. Below we compare this to the traditional 60/40 portfolio All Weather and our book and the Global Asset Allocation (GAA) portfolio above. Finally, since the risk parity strategy uses some leverage, we also tested it with GAA and 20% leverage.

The replication strategy retested the performance of each of the portfolios from 1998 to 2022.

Source: Morningstar, Global Financial Data, Cambria

Again, Pure Alpha’s returns were nearly identical to the GAA and 60/40 portfolios, with a performance difference of less than 0.5%. And don’t miss the fact that Pure Alpha actually followed up with a leveraged version of the GAA portfolio.

Again, this isn’t a bad thing, it’s just not a good thing.

Some people might say, “But Dalio and company did this in real time, with real money, in the 1990s.”

We completely agree with that argument, and also that Pure Alpha appears to be taking a different return path than other allocations and likely offers some diversification benefits due to its uncorrelation with existing assets. We also acknowledge that the benchmark contains particularly strong tracking of U.S. stocks.

Here’s the problem. Most of these hedge fund and private equity strategies incur a 20-20% management fee and 20% performance fee to the end investor. Therefore, the 10% annual gross performance is reduced to 6% excluding all fees.

That’s right. Perhaps Bridgewater and other funds will generate some alpha. The problem is that they keep it all to themselves.

Nonetheless, a huge amount of the strategy can be replicated simply by purchasing a global market portfolio with an ETF and rebalancing it once a year while avoiding hefty management fees, paying additional taxes, or requiring hefty minimum buy-ins. It’s good to know it exists.

Relevance to Portfolio

Let’s take this away from academics and make it relevant to your money and portfolio.

Take a look at our year-end articles declaring how to position your portfolio for the monster 2024, or given the experts’ penchant for gloom and doom, while you’re stressing about how much money you should invest, the big recession and crash is just around the corner. You will hear that there is. Gold, crude oil, emerging markets… If you can’t sleep worrying about whether American stocks are too expensive… Consider the more important question…

“Does that matter?”

If the largest pension funds and the largest hedge funds can’t outperform their basic buy-and-hold asset allocations, what chance do they have?

The offer is valid for all pension funds and endowments. We are happy to design your strategic asset allocation for free. We’ll save you $1 million in base and bonuses for your CalPERS CIO role. All we want is to meet maybe once a year to strike a balance and share a drink.