SiteOne Landscape Supply: Water the Flowers, Not the Weeds (NYSE:SITE)

Andreus K

introduction

SiteOne Landscape Supply, Inc. (New York Stock Exchange: Site) is a supplier of landscaping supplies, tools and equipment. This includes everything from landscaping accessories, blocks and stones, outdoor lighting products, ice melt, irrigation suppliers and equipment, and more. Over the past few years, the company has taken the following actions: The company recorded an impressive growth rate of 17% CAGR in sales. We believe there is reason to believe growth is slowing in the most recent quarter released on February 14th and we recommend a Hold rating.

company background

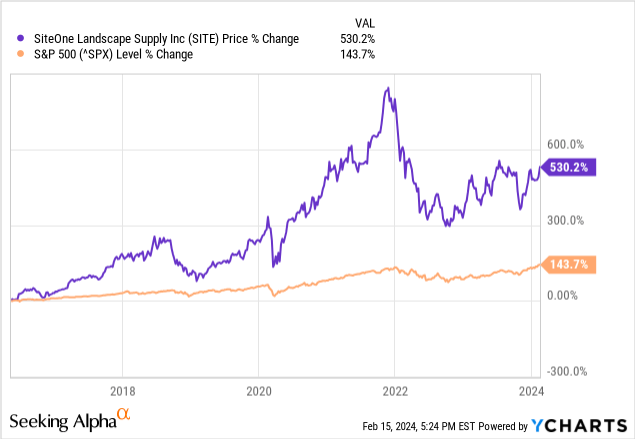

Over the past few years, SiteOne has performed very well in terms of total returns to shareholders. For example, over the past 10 years, the company has delivered a total return of 530.2%, significantly outpacing the S&P 500, compared with the index’s return of just 143.7%. Converting 10 years to an annual average, the annual average is 19.7%. return. Not bad for a company that sells dirt and gardening equipment!

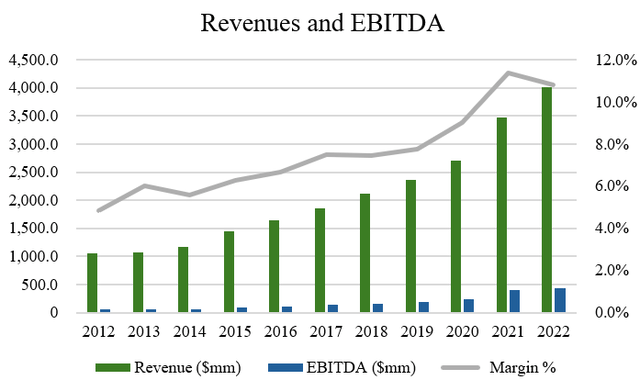

SiteOne’s impressive stock performance is also reflected in the company’s financials. Over the past 10 years, the company has achieved a revenue CAGR of 14.2% and an EBITDA CAGR of 23.8%. Over the past five years, the company has grown revenue and EBITDA at a CAGR of 16.6% and 25.5% (Source: S&P Capital IQ). With EBITDA growth outpacing revenue growth, this shows that SiteOne has expanded its margins over time due to improved operating performance.

Author, based on S&P Capital IQ data

All of this growth has been funded with fairly minimal dilution. Since the IPO, share counts have remained roughly the same, growing by an average of less than 1% per year. This shows that SiteOne’s management has a fairly rigorous approach to managing its profitability-per-share metrics and does not need to rely on raising equity capital to grow its business.

Latest Results

Looking at the company’s most recent results, SiteOne reported improvements in both revenue and EPS, with revenue of $965 million (above $22.8 million) and EPS of -$0.08 compared to consensus estimates of -$0.22.

Overall, this was a relatively mediocre quarter for SiteOne. Sales increased 8.4% year-over-year, but this was driven almost entirely by acquisitive growth. Across the rest of the business, organic daily sales were down 1% compared to last year, especially in the more essential items the company sells, such as grass seed and fertilizer.

The company also faced challenges due to macro factors. If markets were weaker and operating cost inflation occurred, EBITDA would have been virtually flat, excluding the impact of acquisitions. The 11 acquisitions that fueled the sales surge resulted in $320 million in one-year trailing sales.

There’s no question about that. SiteOne has proven to be the market leader in its industry with a 17% market share, three times higher than its closest competitor. Growth rates are likely to slow going forward, as sales have historically nearly doubled every five years at a ~15% CAGR over the past decade.

The U.S. landscaping industry is protected to grow at a CAGR of 3% through 2029, with organic growth in the 3% range and 7% growth through acquisitions (annual net sales growing 7% to $4.3 billion in 2023). SiteOne will be able to grow approximately 10% per year going forward. Therefore, growth rates are expected to slow in the coming years. For all of 2024, management is projecting low single-digit organic daily sales growth, which further solidifies my argument that growth is slowing from here.

One of the most disconcerting trends we see at SiteOne is shrinking margins. Price is one factor, but cost management is another. With gross margins down 200 basis points, we think it will be more difficult for SiteOne to continue to raise prices.

The company didn’t provide any color on exactly how it plans to grow its gross and EBITDA margins, and given the macroeconomic outlook and more commodity products, much of it will likely be out of its control. Therefore, I am not very optimistic about the future of the company. I’d be willing to change my view if I could see meaningful margin expansion from cost synergies from acquisitions the company has already made, but I’m not particularly excited about it at the moment. .

On the balance sheet front, SiteOne’s net debt was essentially unchanged from a year ago at $382 million, and its net debt-to-EBITDA ratio was 0.9x (an improvement of one round). Therefore, the company’s balance sheet appears to be manageable, improving, and in good shape. As I mentioned, the key risks are slowing growth and an unstable macroeconomic environment, and how this could impact consumer spending going forward.

Evaluation and Summary

Based on the 8 analysts covering SiteOne’s stock, there are 2 ‘Buy’ ratings, 4 ‘Hold’ ratings, and 2 ‘Sell’ ratings. The average target price is $162.25, with a high expected price of $204.00 and a low expected price of $120.00 (Source: TD Securities). From the current price to the average target price one year from now, this represents a downside of 2.8%, suggesting that analysts believe the company’s stock is overvalued at its current price.

I agree with the analysts’ assessment here. If we look at the company’s EV/EBITDA multiples, it has definitely risen to 20.8x EV/EBITDA in the last little while. More than historical multiples, I think this helps with the fact that despite the evidence I’ve discussed, the market is still assessing growth prospects as unlikely to slow down. For this reason, SiteOne should trade at a lower multiple.

For a company that needs to grow in the single digits to low teens, I think SiteOne should be trading near the lower end of its historical range near 15.0x.

Why 15.0x? That’s because when compared to competitors like Watsco (WSO), MSC Industrial Direct (MSM), Pool Corp (POOL), Core & Main (CNM), and Beacon Roofing, the average EV/EBITDA multiple is exactly 15.0x. Because these companies have similar growth characteristics and business quality and operate in similar adjacent industries, we believe the comparison is warranted.

An EV/EBITDA of 15.0x would mean a target of $119.40, which would mean about a 28% downside from my price target. Therefore, I would rate the stock as a sell based on today’s price.

If I were to buy a stock, I would wait for a drop to that target price and enter multiple positions. For long-term investors who already own the stock, I would consider selling a covered call against my position to generate some premium for your equity position. For example, the October 2024 $170 call contract is selling for about $20.30, which equates to an annualized yield of about 18.8%, which is certainly quite attractive in my opinion.