Small-cap stocks join the trend – here are the top stocks to consider | MEM edge

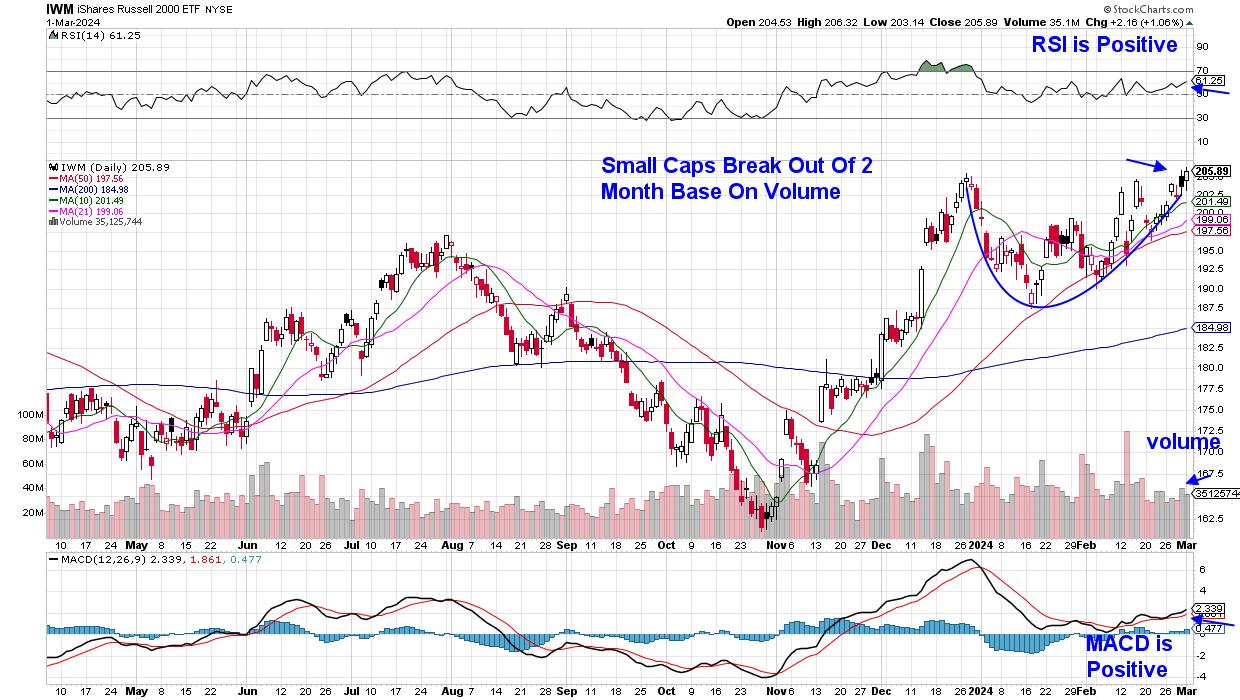

The S&P 500 and Nasdaq both hit record highs today, helped by a technology-led rally among AI-related companies. Small-cap stocks also performed strongly after breaking their short-term highs in two months. The index has had a difficult time recently, with about 15% of its stocks belonging to regional banking groups, which are down 9.5% year-on-year. Relatively high interest rates have also taken a toll, with higher borrowing costs lowering growth prospects for many small businesses.

Russell 2000 Small Cap Index (IWM) daily chart

Russell 2000 Small Cap Index (IWM) daily chart

Renewed interest in biotech stocks is one reason the Russell 2000 index has risen recently. This group makes up 25% of the index and has been fueled by a combination of positive clinical trials and expectations of increased mergers between biotech and big pharma companies.

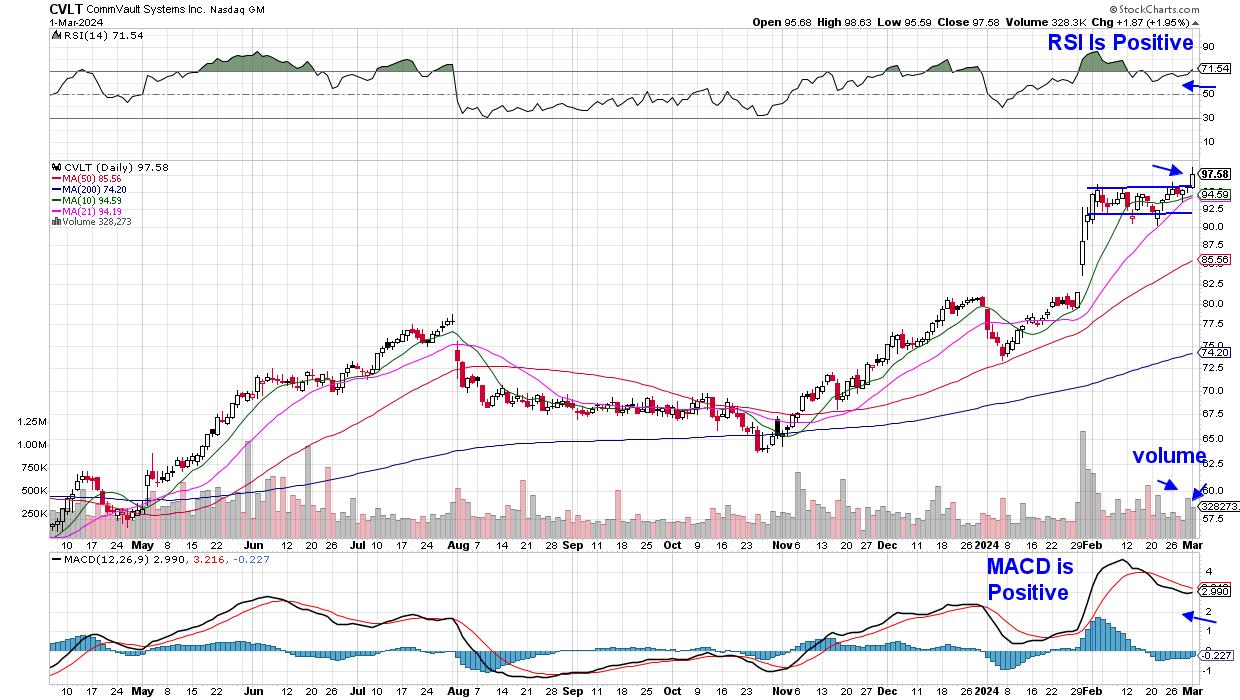

AI-related stocks also contributed to the rise, led by Super Micro Computer (SMCI), which showed explosive growth over the past two months. Below is a chart for CommVault Systems (CVLT), another notable small-cap technology company.

CommVault Systems (CVLT) Daily Chart

CommVault Systems (CVLT) Daily Chart

The provider of data protection systems that help businesses recover from cyberattacks reported its best-ever quarterly results in late January after subscription revenue rose 29% from last year. CVLT rose in price in response, and a four-week consolidation period primed the stock for another rally.

However, since small-cap stocks are inherently more volatile, it is a good idea to watch their RSI closely for any hints of more than a small decline. In my work, I tend to stick to large-cap stocks that can attract institutional money, which can help me achieve huge gains. In fact, my MEM Edge report identified four of the top five stocks in the S&P 500 to date. In addition to adding it to my recommended holdings list in November, subscribers also received notifications of exact buy points on pullbacks.

These four standout stocks have gained between 34% and 66% over the past two months, and are some of the other 20 cultivating stocks in my report that are poised to continue outperforming this uptrend market.

Published twice weekly, MEM Edge reports also provide in-depth information on sector cycles and broader market trends. Be sure to check and use the link here You can access a 4-week trial for a small fee. You’ll also get instant access to our previous reports that explain why these winning stocks are trading higher and how to find the exact buying point.

warmly,

Mary Ellen McGonagle

MEM Investment Research

Mary Ellen McGonagle is a professional investment consultant and president of MEM Investment Research. After working on Wall Street for eight years, Ms. McGonagle left the company to become an experienced stock analyst, where she worked with William O’Neill, where she identified sound stocks with the potential to take off. She has worked with clients around the world, including renowned firms such as Fidelity Asset Management, Morgan Stanley, Merrill Lynch, and Oppenheimer. Learn more