SMC EA(ExpertSMC) User Guide – Analytics & Forecasts – 8 April 2024

The Inputs Instructions

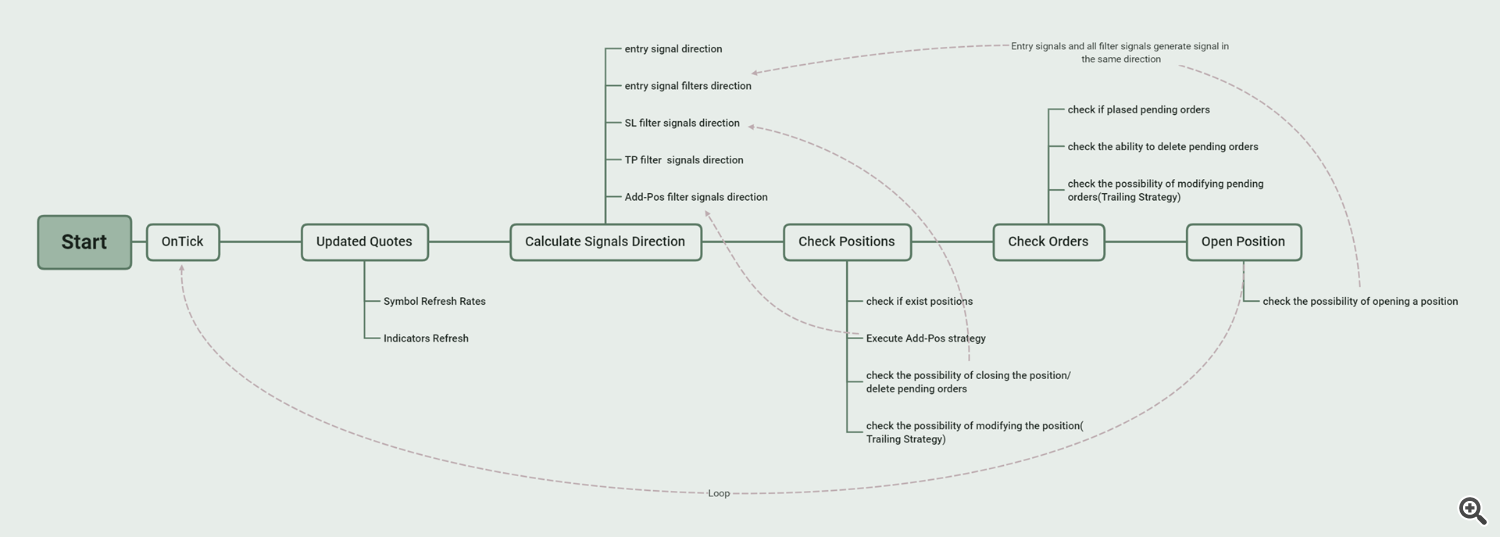

When you first use SMC EA, please remember its basic logic.

Choose one and only one entry signal can be selected. When the entry signal outputs a long direction, if no filtering signal is added, the order will be placed immediately. If multiple filtering signals are added, all of these filtering signals must generate a long direction at the same time before placing an order. As long as one filtering signal does not generate a long direction, it does not meet the conditions for placing an order. The program allows adding filtering signals under two TFs, and multiple filtering signals can be added under each TF. Special attention should be paid here to the option setting of signal validity period(Last Signal Expiration) for each filtered signal. This option is to extend the time of a certain signal, as many signals are only generated on a certain bar.

For example:

If my strategy is to place an order if FVG appears within 10 bars after the main line and signal line of MACD intersect. So I should set it this way:

- First, select FVG as the entry signal, and set the desired bull/bear signal mode and entry mode in the FVG Signal Parameters area. Here, we want to enter the market immediately after FVG appears, so we choose “FVG Formed” for the “Signal Bull/Bear Pattern Usage” and “Trade at Market Price” for the “Signal Entry Pattern Usage”.

- The second step is to set the required SL and TP. You can choose fixed Pips or ATRs, or choose to use the SL and TP provided by the entry signal or filter signal.

- The third step is to set Timeframe1 to “Current”, turn on MACD filter on Timeframe1, and set “Signal Bull/Bear Pattern Usage” to “Look for an intersection of the main and signal line” in the “Inputs FOR TIMEFRAME1 FILTER SIGNAL” section. Set “Last Signal Expiration” to 10.

===========INPUTS FOR EXPERT===========

-

EA Magic Number: a unique identifier that distinguishes between different orders or trades placed by an Expert Advisor (EA). Make sure each EA you are using has a different magic number.

-

EA Run in Every Tick: This parameter is used to decide on price action checks if it will be done on tick or on the formation of a 1 minute. Currently, all signals do not require an On Tick level, so the default setting is false.

===========INPUTS FOR ENTRY SIGNAL===========

———–General Settings———–

-

Select Main Signal for trade: Here, we select the entry signals for trading. The program has 10+ built-in entry signals for selection, and the entry signals can be further expanded according to user needs in the future. After selecting the entry signal, you need to set the parameters of the signal in the corresponding signal parameter setting area.

-

Select SL Type: There are 6 types to choose.

- No SL: No stop loss is set for orders.

- SL in Points: Set a fixed number of points as the stop loss for the order.

- SL in ATRs: Set a fixed multiple ATRs as the stop loss for the order.

- Swing High/Low: Use the recent swing high as a stop loss for short orders and the recent swing low as a stop loss for long orders.

- SL Provided by Entry Signal: Use the stop loss type set by the entry signal as the stop loss for the order. Each entry signal may provide multiple stop loss types, which can be set in the entry signal parameter setting area.

- SL Provided by Filter: We may have added multiple filtering signals to the entry signal, each of which can provide a different stop loss type. Here, we can choose the stop loss type provided by the filtering signal as the stop loss for the order. Each filtering signal may provide multiple stop loss types, which can be set in the filtering signal parameter setting area.

-

—ATR Peroid: If SL in ATRs is selected above, the ATR Period needs to be set here.

-

—Stop Loss level (in pips/ATR): Set specific numerical values for SL in Pips or SL in ATRs. If the number of decimal digits of the price is 3 or 5, 1Pips = 10Points, else 1Pips = 1Point.

-

Select TP Type: There are 7 types to choose.

- No TP: No take profit is set for orders.

- TP in Points: Set a fixed number of points as the take profit for the order.

- TP in ATRs: Set a fixed multiple ATRs as the take profit for the order.

- “X” SL: Use a fixed multiple of SL as the take profit for the order.

- Swing High/Low: Use the recent swing high as a take profit for long orders and the recent swing low as a take profit for short orders.

- TP Provided by Entry Signal: Use the take profit type set by the entry signal as the take profit for the order. Each entry signal may provide multiple take profit types, which can be set in the entry signal parameter setting area.

- TP Provided by Filter: We may have added multiple filtering signals to the entry signal, each of which can provide a different take profit type. Here, we can choose the take profit type provided by the filtering signal as the take profit for the order. Each filtering signal may provide multiple take profit types, which can be set in the filtering signal parameter setting area.

-

—Take Profit level (in pips/ATR): Set specific numerical values for TP in Pips or TP in ATRs. If the number of decimal digits of the price is 3 or 5, 1Pips = 10Points, else 1Pips = 1Point.

-

—TP “X” Value: Set the “X” values for “X” SL selected above.

-

–

-

MS Length (Depth) for Swing High/Low: This is used for the smc indicator that is implemented to analyze market structure, and it has an impact on where to set the SL/TP if the option Swing High/Low is used.

-

Expiration of pending orders (in bars): This parameter will allow you to set an expiration time for your orders, 0 means no expiration time is set, 2 indicates that the expiration time of the order is 2 bars. For example, when trading on the 1 hour, 2 means that the expiration time of the order is 2 hours.

-

Maximum number of orders: The maximum number of orders allowed by EA, which will include the existing positions.

-

Breakeven when previous positions are in loss: When the float loss of the previous position exceeds the specified value, the current order to be entered and the previous order execute a breakeven strategy.

-

—Loss Threshold (in points): If the above selection is true, set the floating loss value here.

-

Close Positions When opposite signal: When the entry signal shows a signal in the opposite direction, Close Position.

-

Signal Inverting: When we need to trade in the opposite direction of the entry signal, we can set this option to True. For example, when our entry signal selects MarketStructurue, we sell when a Bull BOS occurs, and buy when a Bear BOS occurs.

-

–

-

Trade Only in Defined Kill zone: Trading Window, If set to false, the trades will run the entire day. If set to true, you need to set the starting and ending hours of your kill zone.

-

—Killzone Begin Hour(0-23): Starting hour of the kill zone

-

—Killzone Begin Minute(0-59): Starting minute of the kill zone

-

—Killzone End Hour(0-23): Ending hour of the kill zone

-

—Killzone End Minute(0-59): Ending minute of the kill zone

-

–

-

Close Positions at Certain Time: If true, the EA will close all sell or buy trades at the defined close position time.

-

—Hour to Close Positions(0-23): Closing Hour of all open positions

-

—Minute to Close Positions(0-59): Closing Minute of all open positions

-

Cancel Orders at Certain Time: If true, the EA will delete all pending orders at the defined delete orders time.

-

—Hour to Cancel Orders(0-23): Deleting Hour of all open orders

-

—Minute to Cancel Orders(0-59): Deleting Minute of all open orders

-

–

-

Use Daily Profit Limit: This will allow you to activate the daily profit limitation.

-

—Max Daily Profit %:

-

Use Daily Drawdown Limit: This will allow you to activate the daily drawdown limitation.

-

—Max Daily DD %:

———–Composite-Candle Signal Parameter settings———–

- Composite-Candle is bull/bear: The program detects the candles of the latest 3 to ‘ Max Range for Pattern Search ‘. If their price fluctuation is greater than the set ‘ Minimum Fluctuation Range of Price (in ATR) ‘, these candles are combined into one Candle. If the upper shadow of this combined Candle is less than the ‘Shadow Small’ and lower shadow of this combined Candle is greater than ‘ Shadow Big‘, it will generate a long signal. If the lower shadow of this combined Candle is less than the ‘Shadow Small’ and upper shadow of this combined Candle is greater than ‘ Shadow Big‘, it will generate a short signal.

- Composite-Candle is bull/bear and Price near the Swing High/Low: When a combined Candle that meets the conditions appears and it appears near Swing High/Low, it generates a bull/bear signal.

- Trade at Market Price: When there is a bullish or bearish signal, immediately enter at the market price.

-

—Max Range for Pattern Search(in bars): Set the maximum search number of candles.

-

—Minimum Fluctuation Range of Price(in ATR): Set the minimum price fluctuation range for Composite-Candle.

-

—ATR Period for Candles: Set the ATR Period to determine the magnitude of price fluctuations.

-

—Shadow Big for Candles Pattern: Multiply this value by the difference between the high and low of the combined candle.

-

—Shadow Small for Candles Pattern: Multiply this value by the difference between the high and low of the combined candle.

-

—Candles Mode Usage: 3 modes to choose from. By default, select Classic mode.

- Classic: shadow_h=high-((open>close)?open:close); shadow_l=((open<close)?open:close)-low;

- Modern 1: shadow_h=high-close; shadow_l=((open<close)?open:close)-low;

- Modern 2: shadow_h=high-close; shadow_l=open-low;

- Not Set:

- High/Low of the Composite-Candle: Use the high and low points of the combination candle as a stop loss.

———–MA Signal Parameter settings———–

- Close Price Above/Below the indicator

- CloseP above MA, OpenP below MA, MA is upwards

- CloseP and OpenP above MA, LowP below MA, MA is upwards

- Trade at Market Price: When there is a bullish or bearish signal, immediately enter at the market price.

-

—MA Period

-

—MA Shift

-

—MA Method

-

—MA Applied

-

–

———–MACD Signal Parameter settings———–

- MACD line is upwards

- MACD line has a reverse

- Look for an intersection of the main and signal line

- Look for an intersection of the main line and the zero level

- Look for the “divergence” signal

- Look for the “double divergence” signal

- Trade at Market Price: When there is a bullish or bearish signal, immediately enter at the market price.

———–RSI Signal Parameter settings———–

- Oscillator is directed upwards/downwards

- Search for a reverse of the oscillator upwards/downwards behind the level of overselling/overbuying

- Search for the “failed swing” signal

- Search for the “divergence” signal

- Search for the “double divergence” signal

- Search for the “head/shoulders” signal

- Trade at Market Price : When there is a bullish or bearish signal, immediately enter at the market price.

———–WPR Signal Parameter settings———–

- the oscillator is directed upwards

- search for a reverse of the oscillator upwards behind the level of overselling

- search for the “divergence” signal

- Trade at Market Price : When there is a bullish or bearish signal, immediately enter at the market price.

———–BreakerBlocks Signal Parameter settings———–

- BB formed and LowP above BB bottom or HighP below BB top

- Trade at Market Price: When there is a bullish or bearish signal, immediately enter at the market price.

- Trade at Block Price: Trade at Breaker Block Price.

- Mean threshold Price: Trade at the mean threshold price of the Block.

-

—BB iStructure Algo: Internal MS algorithm select.

-

—BB iStructure Break Type: Break Type for Internal MS.

-

—BB iStructure Length: Depth for indicator to analyze internal market structure.

-

—BB sStructure Algo: Swing MS algorithm select.

-

—BB sStructure Break Type: Break Type for swing MS.

-

—BB sStructure Length: Depth for indicator to analyze swing market structure.

-

Select SL Type Provided by this Signal: If the SL TYPE is set to “SL Provided by Entry Signal” in the general settings section, then the SL Type set here will be used for the order.

- Not Set

- Breaker Block High/Low: Use the high and low points of the breaker block as a stop loss.

- N-Shape High/Low: Use the high and low points of the N-Shape as a stop loss.

———–BSL/SSL Signal Parameter settings———–

- BSL/SSL formed,LowP above BSL or HighP below SSL

- BSL/SSL formed

- Trade at Market Price: When there is a bullish or bearish signal, immediately enter at the market price.

- Mean threshold Price:

-

—BSL/SSL iStructure Algo: Internal MS algorithm select.

-

—BSL/SSL iStructure Break Type: Break Type for Internal MS.

-

—BSL/SSL iStructure Length: Depth for indicator to analyze internal market structure.

-

—BSL/SSL sStructure Algo: Swing MS algorithm select.

-

—BSL/SSL sStructure Break Type: Break Type for swing MS.

-

—BSL/SSL sStructure Length: Depth for indicator to analyze swing market structure.

-

Select SL Type Provided by the Signal: If the SL TYPE is set to “SL Provided by Entry Signal” in the general settings section, then the SL Type set here will be used for the order.

- Not Set

- BSL/SSL Region High/Low

———–FiboRe Signal Parameter settings———–

- FiboRe exceeding set value: Fibo-Re level exceeding ‘FiboRe MinRe‘ and less than ‘FiboRe MaxRe‘.

- Trade at Market Price: When there is a bullish or bearish signal, immediately enter at the market price.

- The Price of Max FiboRe Pre-set: Maximum level price of Fibo-Retracement.

- The Price of Min FiboRe Pre-set: Minimum level price of Fibo-Retracement.

-

—FiboRe iStructure Algo: Internal MS algorithm select.

-

—FiboRe iStructure Break Type: Break Type for Internal MS.

-

—FiboRe iStructure Length: Depth for indicator to analyze internal market structure.

-

—FiboRe sStructure Algo: Swing MS algorithm select.

-

—FiboRe sStructure Break Type: Break Type for swing MS.

-

—FiboRe sStructure Length: Depth for indicator to analyze swing market structure.

-

—FiboRe FBR Type: Choose Internal MS or Swing MS for Fibo-Re.

-

—FiboRe MinRe for Signal: Minimum level for Fibo-Re.

-

—FiboRe MaxRe for Signal: Maximum level for Fibo-Re.

-

Select SL Type Provided by the Signal: If the SL TYPE is set to “SL Provided by Entry Signal” in the general settings section, then the SL Type set here will be used for the order.

- Not Set

- Market Structure High/Low

- User Set Fibo-Re Level for SL: Set the specified Fibo-Re level value in the following settings.

———–FVG Signal Parameter settings———–

- FVG formed

- FVG formed and 3 bull/bear candles in a row pattern

- Trade at Market Price: When there is a bullish or bearish signal, immediately enter at the market price.

- Mean threshold Price of the FVG:

- FVG Top/Btm Price: Top/Btm Price of the FVG Block.

-

—FVG Period: The time frame parameter of the FVG.

-

—FVG Filled Type: Select FVG filled type.

-

—FVG MiniSize Filter: FVG Threshold (minval=0.1, step=0.1).

-

Select SL Type Provided by the Signal: If the SL TYPE is set to “SL Provided by Entry Signal” in the general settings section, then the SL Type set here will be used for the order.

- Not Set

- FVG Block High/Low:

- FVG 3 Candles High/Low: The high and low points of the three candles that form FVG.

———–Killzone Signal Parameter settings———–

- Price break KZ: Within the set KILLZONE time, the price will form a rectangular area. When the price breaks through the high and low points of this rectangular area, a signal is generated. For example, we can set the time of KZ for AsiaRange and enter long or short positions when the price breaks through the high and low points of AsiaRange.

- Prohibited trade outside the KZ time: This mode is mainly used to set the time interval for trading, without trading outside the interval.

- Trade at Market Price: When there is a bullish or bearish signal, immediately enter at the market price.

- Mean threshold Price: Use the middle price of Killzone as the open price.

-

—Killzone Begin Hour: Starting hour of the kill zone

-

—Killzone Begin Minute: Starting minute of the kill zone

-

—Killzone End Hour: Ending hour of the kill zone

-

—Killzone End Minute: Ending minute of the kill zone

-

—Killzone Label Text: This parameter specifies the KZ label text that would let easy to view on the chart.

-

—Killzone Show Last: This parameter is set to display the maximum number of KZ rectangles on the chart.

-

—Killzone Show Predict: This parameter is set to display the predicted Level on the chart.

-

Select SL Type Provided by the Signal: If the SL TYPE is set to “SL Provided by Entry Signal” in the general settings section, then the SL Type set here will be used for the order.

- Not Set

- KZ ZONE High/Low: Use the high and low points of the KZ region as stop loss for orders.

———–Market Structure Signal Parameter settings———–

- MS formed: CHOCH(MSS) and BOS formed signal.

- CHOCH formed: CHOCH(MSS) formed signal.

- BOS formed: BOS formed signal.

- Trade at Market Price: When there is a bullish or bearish signal, immediately enter at the market price.

- Mean threshold Price: Middle price of MS structure

- MS Top/Bottom Price: The high and low points of MS structure

-

—MS Structure Algo: MS algorithm select.

-

—MS Structure Break Type: Break Type for MS.

-

—MS Structure Length(Depth): Depth for indicator to analyze market structure.

-

Select SL Type Provided by the Signal: If the SL TYPE is set to “SL Provided by Entry Signal” in the general settings section, then the SL Type set here will be used for the order.

- Not Set

- Market Structure High/Low

———–NWOG/NDOG Signal Parameter settings———–

- NWOG formed and CloseP above/below NWOG

- Price callback to NWOG region

- NDOG formed and CloseP above/below NDOG

- Price callback to NDOG region

- Trade at Market Price

- Meanthreshold Price

- Not Set

- NWOG/NDOG Block High/Low

———–OrderBlock Signal Parameter settings———–

- OB/iOB formed: Swing OrderBlocks and Internal OrderBlocks formed signals.

- OB/iOB touched: Swing OrderBlocks and Internal OrderBlocks touched signals.

- OB/iOB break: Swing OrderBlocks and Internal OrderBlocks break signals.

- OB formed

- iOB formed

- OB touched

- iOB formed

- OB break

- iOB break

- Trade at Market Price

- Meanthreshold Price: Meanthreshold Price of the Order Block

- OB Top/Btm Price: Top or Bottom Price of the Order Block

-

—OB iStructure Algo: Internal MS algorithm select.

-

—OB iStructure Break Type: Break Type for internal MS.

-

—OB iStructure Length: Depth for indicator to analyze internal market structure.

-

—OB sStructure Algo: Swing MS algorithm select.

-

—OB sStructure Break Type: Break Type for swing MS.

-

—OB sStructure Length: Depth for indicator to analyze swing market structure.

-

Select SL Type Provided by the Signal: If the SL TYPE is set to “SL Provided by Entry Signal” in the general settings section, then the SL Type set here will be used for the order.

- Not Set

- OB Block High/Low

===========INPUTS FOR TRAILING===========

- Trailing_None: Do not use the Trailing strategy.

- Trailing_FixedPips: When the profit of position increases with price changes, SL and TP will adjust according to the current price to maintain a set fixed value. The algorithm of FixedPip Trailing is that when the difference between the price and SL is greater than the set value (stop loss trailing level), SL moves up with the price (assuming buy order), and TP is reset to the current price plus take profit tracking level.

- Trailing_Breakeven: When the POS profit exceeds the value we set (‘X’ pips or ‘X’ Risk), adjust SL to Open Price.

- Trailing_MA: Use the current price of MA as the SL for Pos.

- Trailing_Max_Move: When the loss of position increases with price changes, TP will adjust according to the current price to maintain a set fixed value (‘MaxPositive Move level’). When the profit of position increases with price changes, SL will adjust according to the current price to maintain a set fixed value (‘ MaxNegative Move level’).

- Trailing_ParabolicSAR: Use the current price of ParabolicSAR as the SL for Pos.

- Trailing_MS_Step: If the Trailing Type is selected as Profit Trail, EA will tracking the formation of MS, when there is an MS formation (choch, bos), then dynamically adjusting TP to the current profit * ‘The percentage of step1’. When a second MS is formed, adjust TP to the current profit * ‘The percentage of steps 2’, and so on. If the Trailing Type is selected as Loss Trail, EA will tracking the formation of MS, when there is an MS formation (choch, bos), then dynamically adjusting SL to the current LOSS* ‘The percentage of step1’. When a second MS is formed, adjust SL to the current LOSS* ‘The percentage of steps 2’, and so on.

———–FixedPips Trailing Parameter settings———–

-

—Stop Loss trailing level (in pips): If the number of decimal digits of the price is 3 or 5, 1Pips = 10Points, else 1Pips = 1Point.

-

—Take Profit trailing level (in pips): If the number of decimal digits of the price is 3 or 5, 1Pips = 10Points, else 1Pips = 1Point.

-

–

———–Breakeven Trailing Parameter settings———–

-

Select Breakeven Type

-

—“X” Value (in pips): If the number of decimal digits of the price is 3 or 5, 1Pips = 10Points, else 1Pips = 1Point.

-

—“X” Risk to Reward

-

–

———–MA Trailing Parameter settings———–

-

—Trailing MA Period

-

—Trailing MA Shift

-

—Trailing MA Method

-

—Trailing MA Applied

-

–

———–MaxMove Trailing Parameter settings———–

-

—MaxPositive Move level (in pips): If the number of decimal digits of the price is 3 or 5, 1Pips = 10Points, else 1Pips = 1Point.

-

—MaxNegative Move level (in pips)

-

–

———–ParabolicSAR Trailing Parameter settings———–

———–MarketStructureStep Trailing Parameter settings———–

- Profit Trail: Only track and adjust TP.

- Loss Trail: Only track and adjust SL.

- Both Profit and Loss Trail

- Trail only same direction MS: If it is Long Position, only track bull MS. On the contrary, if it is a short position, only track bear MS.

- Trail all MS

-

—The percentage of step1

-

—The percentage of step2

-

—The percentage of step3

-

—The percentage of step4

-

—MS Structure Algo

-

—MS Structure Length(Depth)

-

–

===========INPUTS FOR MONEY===========

- Money_None: No Money Strategy will be applied. By default, the minimum lot is used for trading.

- Money_FixedLot: Each order uses a fixed lot (‘Fixed volume’).

- Money_FixedMargin: The amount of funds used for each order is a fixed percent margin.

- Money_FixedRisk: The funding required for SL for each order is a fixed percent risk.

- Money_SizeOptimized:

———–FixedLot Money Parameter settings———–

———–FixedMargin Money Parameter settings———–

-

—Percentage of margin

-

–

———–FixedRisk Money Parameter settings———–

———–SizeOptimized Money Parameter settings———–

-

—Decrease factor

-

—Percentage

-

–

===========INPUTS FOR TIMEFRAME1 FILTER SIGNAL===========

———–General Settings———–

-

—Select TimeFrame1 for Filters: EA allows you to add two TF signal filters, which can be the current TF or a different HTF, under each TF, you can choose to add multiple filters. So, we can add several filters under the current TF or add filters under different HTFs as needed. For example, if our current trading period is 15m and the entry signal is FVG, I can choose to add two MA filters under the current TF By setting Timeframe1 and Timeframe2 to Current, and turn on MA filter, which are the 20 MA and the 60 MA. The filter signal mode selects the price above the moving average. So the entry condition becomes when there is a bull FVG formed and the price is above the two moving averages, then we will buy. On the contrary, when there is Bear FVG formed and the price is below the two moving averages, then we will sell.

-

– We can open 0 to N filters under Timeframe1 and Timeframe2, and SMC-EA will only execute buy and sell trade when all these filters and entry signals generate signals in the same direction simultaneously.

———–Candles Filter Parameter settings———–

-

Turn On/Off Candles Signal filter On TimeFrame1: Is this signal enabled as a filtering signal under TF1.

-

—ATR Period

-

—Max Range for Pattern Search(in bars)

-

—Minimum Fluctuation Range of Price(in ATR)

-

—Shadow Big for Candles Pattern

-

—Shadow Small for Candles Pattern

-

—Candles Mode

-

Last Signal Expiration(Candles nums): Some signals are only generated on a certain candle, and when using them as filters, we want them to generate signals on several consecutive candles, so we need to set Signal Expiration for them. For example, we use FVG as the entry signal, Timeframe1 selects Current, Turn on MACD signal as the filter, and select “Look for an intersection of the main and signal lines” as the signal mode. The MACD signal is only generated when the main and signal lines intersect. If there is no FVG formed signal at this time, the trading conditions will not be met. Therefore, we need to set the Signal Expiration for the MACD signal. Assuming it is set to 7, in the 7 candles after the main and signal lines intersect, if there is an FVG formed signal, it can be generated a Trading signal.

-

Signal Inverting: When the signal itself generates bullish signal, pass the bearish direction as the filtering signal to the entry signal.

-

Select SL Type Provided by the Signal: If the SL TYPE is set to “SL Provided by Filter” in the Entry Signal section, then the SL Type set here will be used for the order.

-

Select TP Type Provided by the Signal: If the TP TYPE is set to “TP Provided by Filter” in the Entry Signal section, then the TP Type set here will be used for the order.

-

–

———–MA Filter Parameter settings———–

———–MACD Filter Parameter settings———–

———–RSI Filter Parameter settings———–

———–WPR Signal Parameter settings———–

———–BreakerBlocks Filter Parameter settings———–

———–BSL/SSL Filter Parameter settings———–

———–FiboRe Filter Parameter settings———–

———–FVG Filter Parameter settings———–

———–Killzone Filter Parameter settings———–

———–Market Structure Filter Parameter settings———–

———–NWOG/NDOG Filter Parameter settings———–

———–OrderBlock Filter Parameter settings———–

===========INPUTS FOR TIMEFRAME2 FILTER SIGNAL===========

———–General Settings———–

-

—Select TimeFrame2 for Filters: You can choose Current, equal to Timeframe1, or different from TF1.

-

–

———–Candles Filter Parameter settings———–

-

Turn On/Off Candles Signal filter On TimeFrame2

-

—ATR Period

-

—Max Range for Pattern Search(in bars)

-

—Minimum Fluctuation Range of Price(in ATR)

-

—Shadow Big for Candles Pattern

-

—Shadow Small for Candles Pattern

-

—Candles Mode

-

Last Signal Expiration(Candles nums)

-

Signal Inverting

-

Select SL Type Provided by the Signal

-

Select TP Type Provided by the Signal

-

–

———–MA Filter Parameter settings———–

———–MACD Filter Parameter settings———–

———–RSI Filter Parameter settings———–

———–WPR Signal Parameter settings———–

———–BreakerBlocks Filter Parameter settings———–

———–BSL/SSL Filter Parameter settings———–

———–FiboRe Filter Parameter settings———–

———–FVG Filter Parameter settings———–

———–Killzone Filter Parameter settings———–

———–Market Structure Filter Parameter settings———–

———–NWOG/NDOG Filter Parameter settings———–

———–OrderBlock Filter Parameter settings———–

===========INPUTS FOR STOPLOSS FILTER SIGNAL===========

-

– We can choose to use dynamic stop loss instead of setting an SL when the order enters, which means stopping loss immediately when a specified signal is generated. The SL Filtering Signal module is prepared for this purpose. You can choose to enable one or more signals in the settings below, and each signal can run on the same or different TF.

———–Candles Filter Parameter settings———–

-

Select TimeFrame for Filters

-

Turn On/Off Candles Signal filter

-

—ATR Period

-

—Max Range for Pattern Search(in bars)

-

—Minimum Fluctuation Range of Price(in ATR)

-

—Shadow Big for Candles Pattern

-

—Shadow Small for Candles Pattern

-

—Candles Mode

-

Last Signal Expiration(Candles nums)

-

Signal Inverting

-

–

===========INPUTS FOR TAKEPROFIT FILTER SIGNAL===========

-

– We can choose to use dynamic take profit instead of setting an TP when the order enters, which means taking profit immediately when a specified signal is generated. The TP Filtering Signal module is prepared for this purpose. You can choose to enable one or more signals in the settings below, and each signal can run on the same or different TF.

———–Candles Filter Parameter settings———–

-

Select TimeFrame for Filters

-

Turn On/Off Candles Signal filter

-

—ATR Period

-

—Max Range for Pattern Search(in bars)

-

—Minimum Fluctuation Range of Price(in ATR)

-

—Shadow Big for Candles Pattern

-

—Shadow Small for Candles Pattern

-

—Candles Mode

-

Last Signal Expiration(Candles nums)

-

Signal Inverting

-

–

===========INPUTS FOR NEWS FILTER===========

-

Enable News Filter: Choose to avoid trading during the news. This implies posting new positions or orders and also taking control of current open positions or orders.

-

Consider Low Impact Events: True/False

-

Consider Medium Impact Events: True/False

-

Consider High Impact Events: True/False

-

—Stop Before News: Decide when to stop taking new trades before news.

-

—Start After News: Decide when to start taking new trades after news.

-

Currencies Check: Choose the impacted currencies like “USD,EUR,AUD,NZD,JPY,CAD,GBP”, or “USD,EUR”.

-

Check Specific News: Whether to use keywords to filter specified News.

-

Specific News Keywords:

-

Select Action On Trade When News:

- Keep Current Trade

- Close All Trade

- Close Winning Trade