Soho House: Growth Is Costly (NYSE:SHCO)

Mark Mainz/Getty Images

Soho House & Co. (New York Stock Exchange: SHCO) is a business with an interesting concept. The company operates several Clubhouses (physical and digital) around the world where people can purchase annual memberships and hang out. You can work, socialize, eat, or just do the activities you enjoy. The concept is somewhat similar to the country clubs people are more familiar with.

The company currently operates 42 Soho Houses, nine Soho Works Clubs, a number of hotels and beach clubs, as well as digital social channels and a retail brand focused on interior design and lifestyle. Each Soho building features unique architectural design and decoration that reflects local culture, traditions and customs. Generally, there are two types of memberships at Soho House: You can become a member of your local Soho House or a global member. You can access all your existing locations at once. Obviously, the latter option costs a lot more than the local option because it opens more doors for people.

facility (Soho House)

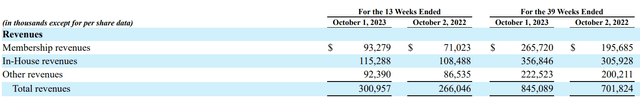

In addition to membership fees, the company generates revenue by selling food and beverages, offering certain amenities at an additional cost, offering hotel rooms, and retail brands. So while some of the company’s revenue is recurring, it also has a lot of variable revenue. As of last quarter, only $93 million of the company’s $301 million in total revenue came from membership revenue, and similarly, only $265 million of the company’s $845 million in total revenue over the past nine months came from membership revenue. The company’s biggest revenue driver was internal revenue, including selling food and drinks to members who visited the company’s social houses.

profit history (Soho House)

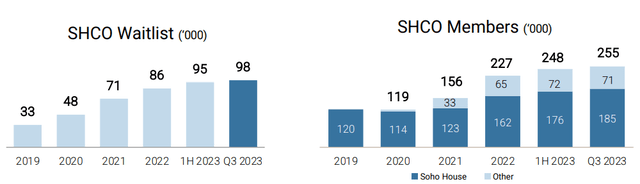

When you look at a company’s business model, it may feel strange and you may wonder if it is sustainable. After all, why would you pay the big bucks (about $4,000 per member per year) to hang out at a social house when you can go to bars, cafes and clubs that don’t charge membership fees and only pay an annual fee? The food or drinks they consume. You might think that there wouldn’t be a lot of demand for Soho House memberships, but you’d be mistaken. Not only is there great demand for company memberships, which continues to grow by double digits each year, but waiting lists are also growing as companies become increasingly selective about who they accept. Between 2019 and the third quarter of 2023, the company’s active membership grew from 120,000 to 255,000, and its waiting list similarly grew from 33,000 to 98,000. It turns out that there is a lot of demand for Soho House.

Membership and Waitlist (Soho House)

With more and more people working from home and many young people turning into digital nomads (people who travel from place to place while working and claim no place as their primary home), it turns out that they need a safe and comfortable environment. We provide a place for you to relax, recover, and socialize with others. After all, humans are social animals, so working from home doesn’t change our DNA.

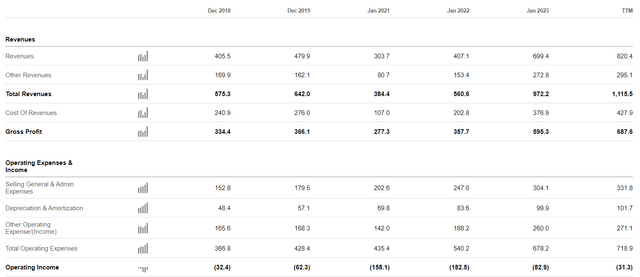

The company is still building more locations and expanding its presence. A fairly large store opened in Mexico City in 2023, and other stores are scheduled to open in Portland (Oregon) and Sao Paulo (Brazil) this year. Because the company is still in the growth phase and adding new buildings is capital intensive, it hasn’t been profitable so far, but it’s getting closer. Over the past 12 months, the company recorded an operating loss of $31 million, a significant improvement compared to an operating loss of $182 million two years ago and an operating loss of $83 million last year. Although the company still has work to do to achieve profitability, it is moving in the right direction with better financial discipline, cost control, and significantly higher sales and gross margins over the past few years. In fact, the company’s gross profits have nearly doubled over the past few years, from about $357 million to $687 million.

Operating performance (Look for alpha)

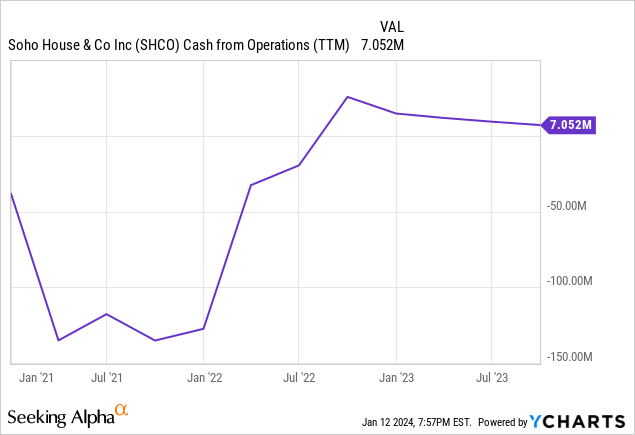

From summer 2021 to present, the company’s operating cash flow profile has changed significantly, from negative $150 million to positive $7 million. While the current numbers are still low and hardly anything to write home about, it’s notable that the company has gone from negative to positive in such a short amount of time.

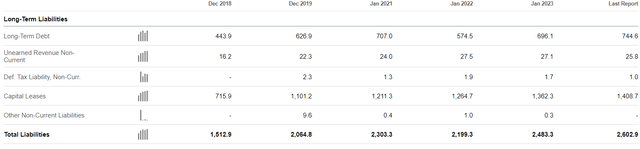

One of the issues is the company’s balance sheet, particularly its long-term debt. As it grew and expanded aggressively, the company accumulated a total of $2.6 billion in long-term debt, of which $744 million was long-term debt and $1.41 billion was capital leases.

long term debt (Look for alpha)

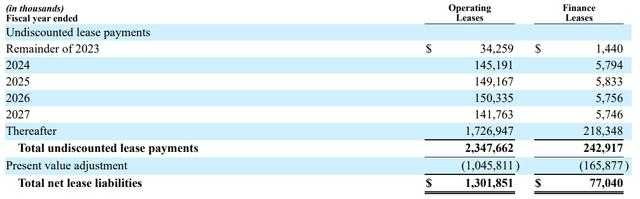

A company’s capital leases can be divided into two categories: operating leases and finance leases. Most of the company’s capital leases are actually operating leases. Most of these payments will not be completed until after 2027, with $140 million to $150 million due annually from 2024 to 2027. Effectively, these leases have fixed terms in addition to the renewal terms, and these range from just a few. Over 30 years. The company has also signed 14 leases for properties still under construction or undergoing improvements. These long-term contracts allow the company to continue operating at that location for many years without having to purchase expensive, costly real estate. The worrying part is that it is incredibly difficult for companies to get out of these contracts and they will have to pay these lease obligations regardless of how they do business. Even if one or more locations underperform for any reason and demand plummets, the company will still have to pay for the lease for several years at the agreed-upon price plus inflation adjustments. This isn’t necessarily surprising at this point, but it’s worth paying attention to.

capital lease (Soho House)

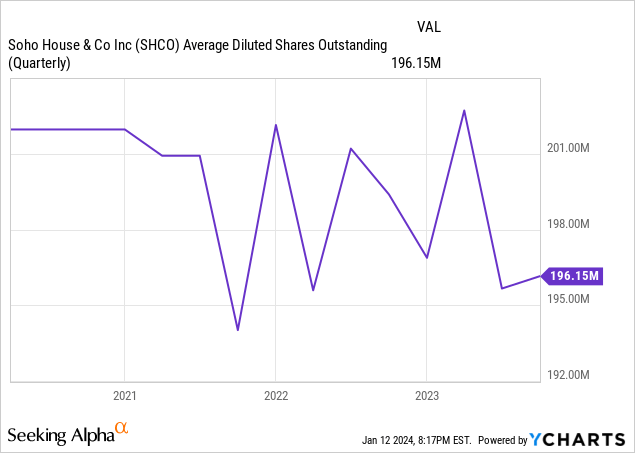

When the company IPOed a few years ago, it initially sold 30 million shares at an average price of more than $14, meaning it raised about $430 million. The company still has about $162 million in cash, meaning it has already spent about two-thirds of the money it raised. The company’s diluted share count hasn’t changed much since then, so it’s safe to assume the company hasn’t raised any more money by issuing any more shares since then.

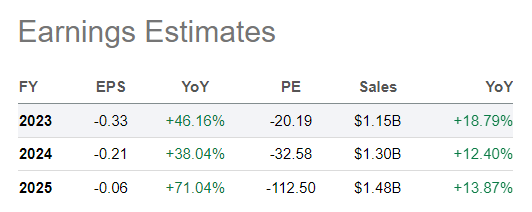

Analysts expect the company’s sales to continue growing at double-digit rates going forward, but they believe profitability may not be visible for some time. Analysts expect the company to continue growing its earnings at about 12% to 13% per year and break even, or suffer a modest loss of 6 cents per share, by 2025.

analyst estimates (Look for alpha)

There are two indicators that may make a company appear cheaper. The first is revenue. The company trades for approximately 1x forward earnings. The second is price to gross profit, with transactions taking place at approximately twice the gross profit. That still doesn’t tell much of a story, as the company’s operating costs are quite high, especially those associated with opening new locations and expanding.

If the company can maintain its growth rate while keeping costs low, it could be an interesting investment opportunity going forward, but we’ll also need to watch its debt situation and liabilities closely. The company isn’t particularly cheap right now, with a market capitalization of $1.3 billion compared to negative earnings and minimal operating cash flow ($7 million last quarter), so conservative investors will probably want to avoid this company. More adventurous investors with a higher risk appetite should ensure that the company makes further progress toward achieving profitability before entering into it.