Solo Bitcoin Miner Earns $200K Reward Amid Growing Centralization Fears

A solo Bitcoin miner independently solved a BTC block and received a reward of 3.275 BTC, equivalent to about $200,000.

On August 29, Kon Colivas, software engineer and manager of solo mining pool ckpool, announced that a miner on X had successfully solved the 291st solo block in Bitcoin history. He congratulated the miner, saying:

“Congrats to miner 36AisvWi1UiwLTeTZxLzindAkorqeUc3tT for solving the 291st solo block on solo.ckpool.org! With 38PH, this heavy miner solves a block about once every 4 months on average.”

According to blockchain data, miners have successfully mined block 858,978 on the Bitcoin blockchain, which contains 2,391 transactions.

Concerns about centralization

This achievement comes at a time when concerns are growing within the community about the centralization of Bitcoin mining.

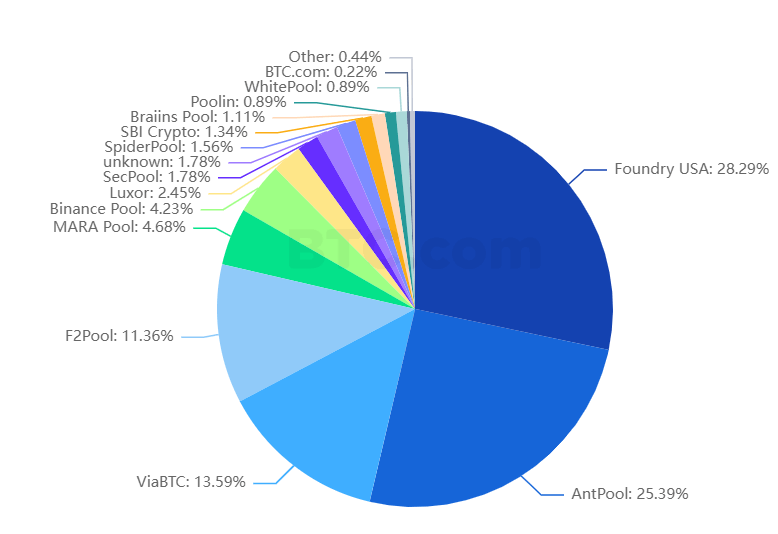

According to data from BTC.com, four mining pools – Foundry USA, AntPool, ViaBTC, and F2Pool – have created about 80% of Bitcoin blocks over the past three days, which has raised alarm among community members.

Foundry USA and AntPool alone accounted for over 50% of the blocks mined by these pools.

This high level of centralization has raised concerns about the future of Bitcoin. CasaHODL co-founder Jameson Robb has commented on the issue, explaining that Bitcoin mining centralization is a conflict between economies of scale and the decentralized nature of the energy source. However, he is optimistic that decentralization will ultimately prevail.

In particular, the recent halving event exacerbated the risk, halving the block mining reward. This reduction caused many small miners to withdraw from the market, leaving the industry dominated by publicly traded mining companies.

Bitfinex warned that this concentration of mining power could potentially lead to transaction censorship and increased vulnerability to coordinated attacks or regulatory pressure. The company said:

“The concentration of mining power in such a small number of entities could lead to centralization, which is contrary to the spirit of Bitcoin. The risk of centralization could mean potential censorship of transactions and increased vulnerability to coordinated attacks or regulatory pressure.”