SoundHound AI Stock’s Strong SaaS Growth, But Risky Customer Focus (SOUN)

Jay Studio

Formerly SoundHound AI, Inc. (NASDAQ:SOUN) In March 2024, NVIDIA (NVDA)’s equity disclosure and a surge in stock price due to increased demand for voice AI were discussed. technology Enable large-scale language model integration as proprietary SaaS across both cloud-native and hardware-embedded platforms.

However, given that the company’s profitability is still poor due to a deteriorating balance sheet and large-scale stock short selling, we judged that there may be short-term volatility and assigned a neutral rating.

Since then, SOUN has already significantly underperformed the broader market, having retreated sharply -52% since its March 2024 peak. Nonetheless, with the stock still trading at a notable premium to its generative AI SaaS peers, it’s not clear whether it would be wise to recommend buying here.

It combines an early start-up phase with a tendency for equity dilution; Recent acquisitions have impacted profit margins in Q1 2024, so we think it may be wiser to wait a little longer and observe execution.

SOUN continues to report strong SaaS growth.

SOUN’s Revenue Division

pursue alpha

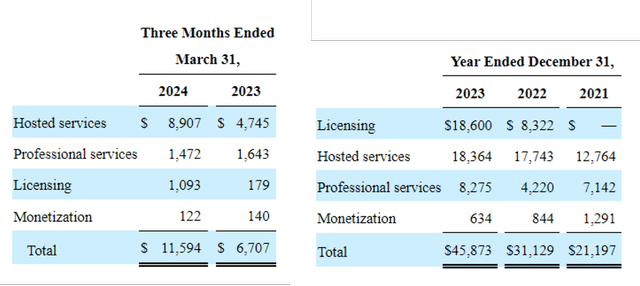

Currently, SOUN is scheduled to announce first quarter 2024 earnings on May 9, 2024, with revenue of $11.59 million (-32.4% QoQ/ +72.9% YoY) and adjusted EPS of -$0.07 (inline QoQ/ +46.1% YoY). Reported to the ship. ).

Most of the key tailwinds are due to accelerated growth observed in the Hosting Services segment to $8.9 million (+58.6% QoQ/ +87.7% YoY), driven by revenue recognition based on usage and/or fixed-fee subscriptions. It further highlights the robustness of the voice AI SaaS platform.

However, despite SOUN’s solid top-line growth, readers should also note that its gross margin was a disappointing 65.5% (-11.5 points QoQ/-6.8YoY) and its adjusted EBITDA margin was -132% (-111 points). QoQ/ -90 YoY) Latest quarter

Much of the profitability headwind is due to its lower-margin call center agent business thanks to the recently completed acquisition of SYNQ3 Restaurant Solutions.

Nonetheless, given the positive impact of SOUN’s automated voice AI technology solutions and its diversification into restaurants (including customer service/drive-thru) and fitness businesses, we believe things could improve in the medium term.

This builds on the SaaS company’s existing presence in automotive, broadcast and communications platforms across TV, smart devices and IoT devices.

That’s why SOUN reported significant expansion in its multi-year cumulative subscription and reservation balance to $682 million (+3.1% QoQ/ +80% YoY) in the latest quarter, providing insight into long-term revenue/profits. .

This is in addition to fiscal 2024 revenue guidance, which was raised modestly to $71 million (+54.6% YoY) from its original midpoint of $70 million (+52.5% YoY).

Unfortunately, the good news ends here.

SOUN’s high customer concentration poses risks to its future prospects – reader monitoring

Upon closer inspection, we found that the two key customers (highlighted by A and C) account for 48% of SOUN’s Q1 2024 revenue (+12 points YoY). Margin dilution in the event of contract renewals and/or preferential contract rates in the face of increased market competition.

The recent capital raising of $137 million contributed to an improvement in the balance sheet to $211.74 million (+122.2% QoQ/ +357% YoY) in cash/equivalents, but naturally the share count decreased to $286.59 million (+ 13.37M QoQ/ +81.51M YoY), partially due to new shares issued for the SYNQ3 acquisition.

SOUN’s shareholder equity erosion has progressed as discussed in previous articles, with further dilution likely in the medium term due to the inherent lack of positive free cash flow to date, with -$22.05M reported in the most recent quarter (-58.2%) . QoQ/ -51.4% YoY).

At the same time, as insiders continued to generate profits of $2.6 million (+432% QoQ/ +432% QoQ/ +16.3% YoY) in Q1 2024, stock-based compensation expense also increased to $6.97 million (+7.5% QoQ/ +16.3% YoY). % YoY). 253% YoY).

So, is SOUN stock a buy?Sell or Hold?

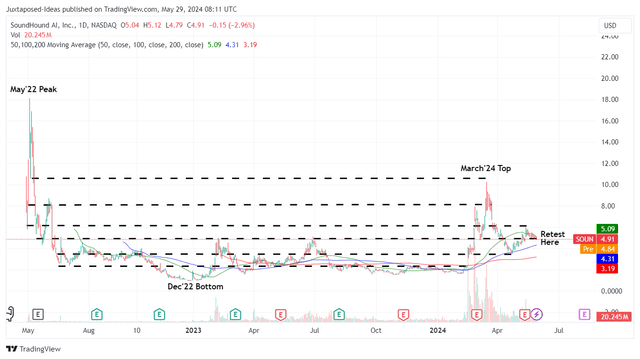

SOUN 2 year stock price

trading view

Currently, SOUN has given back most of its gains since its recent Q1 2024 earnings release, and the stock appears to have retested its previous support level of $4.90.

Nonetheless, I’m not sure if it would be wise to add it here.

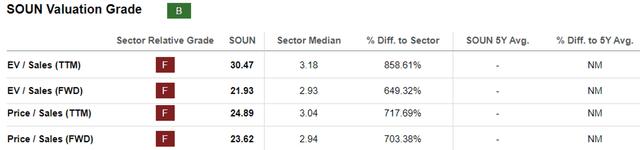

SOUN Valuation

pursue alpha

With SOUN still firmly in the cash-burning startup stage with negative EPS expected through FY2025, the only metric we can use to value the stock is its FWD EV/Sales of 21.93x, which is significantly more expensive than its 2023 average of 10.62. x and sector median are 2.93x.

This is especially true because SaaS companies will need to continue to report high double-digit growth over the next few years to warrant premium EV/sales valuations.

Even when comparing SOUN’s valuation to other generative AI SaaS stocks such as C3.ai (AI) at 7.21x FWD EV/Sales, BigBear.ai Holdings, Inc. (BBAI) at 2.61x, and Palantir (PLTR) at 16.05x It is clear that SOUN is overextended here, giving interested investors a minimal margin of safety.

At the same time, SOUN continues to record high short-term interest rates of 23.9%, above the previous level of 14.6% in March 2024, suggesting further volatility in the near term.

Even those still holding on here should remain (extremely) patient, as we don’t yet know when the company can achieve operating profitability going forward, and whether the stock can be well-supported at current levels.

With greater uncertainty ahead, it goes without saying that stocks are only suitable for those with a high risk tolerance.

Repeat the hold (neutral) here.