S&P 500: Conditions for a High – Week Beginning January 15 (Technical Analysis) (SP500)

video graphics

The S&P 500 (SPY) surpassed its 2023 high this week, and the reversal pattern pointed out in last weekend’s article failed. Technical analysis identifies what the key players in the market are doing. If they’re on vacation, just like before During the December peak, the signal becomes less reliable.

In this article, we will look at what new highs mean for the S&P500 trend and what to expect near the all-time high of 4818. Various technical analysis techniques are applied at different time frames in a top-down process that takes into account key market drivers. The goal is to provide actionable guidance that includes directional bias, important levels, and expectations for future price action.

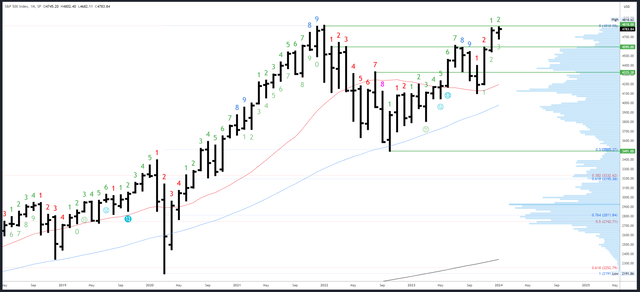

S&P 500 Monthly

An article last weekend pointed out the lack of a monthly reversal, with the December bar closing near the high. It has now reached a new high. If done, the reversal pattern could unfold in a similar way to the December/January 2021/2022 highs. This requires the formation of a weak January bar. It should first fall past the monthly open of 4745 and then close near the low of the bar. The current low is 4682, but it could definitely go lower. The lower the closing price, the better the signal.

SPX Monthly (Trading View)

The all-time high of 4818 is the next major level. Above this is the “blue sky” where measured movements and Fibonacci extensions act as a guide to the target. The first (1.618* extension of the July-October decline) appears at 4918.

4682 is the first important support level, followed by 4607. The December low of 4546 is also relevant.

We will have to wait a long time for the next monthly Demark signal. January is bar 2 (out of a possible 9) in the number of new upside burns.

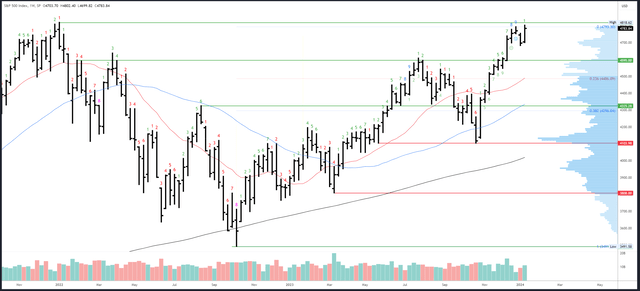

S&P 500 Weekly

Last weekend’s weekly chart showed a decent reversal, but the reversal failed due to a clear lack of participation and trading volume. Volume during the December peak week was almost half of this week’s volume.

This week the bar has a higher low, a higher high and a higher close with no downtrend. always. Again, a reversal could unfold as it fails higher, but it is likely that it will first surge past the 2022 peak of 4818.

SPX Weekly (Trading View)

Often, when the market trades back to significant highs after a long downtrend, a series of failed pullbacks, failed rallies, and “messy” short-term actions occur. Bears get excited when prices fall (double tops!) and bulls get excited when prices rise (breakouts!). It may feel like the market is playing both sides, but this is more likely just a result of indecision.

It is often more stable to wait for clear weekly or monthly signals than to get involved in all the twists and turns.

- If the S&P 500 closes above 4818 next week and closes near the weekly high, it will likely go on to break a new all-time high, the “blue sky.” 4918 is the next target.

- If the S&P 500 bounces above 4802 or 4818 and reverses lower to close near the week’s lows, here’s what you might get: start I’m looking for a top. A break of the short-term support at 4682 increases the odds of hitting a major high.

Demark burnout readings are complete, up from bar 9 of December highs. It may still work, but price action is needed to confirm the weakness.

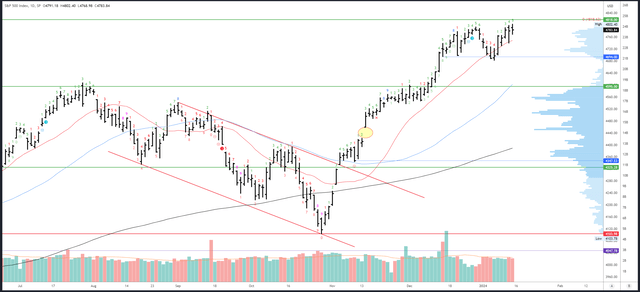

S&P 500 Daily Index

The daily chart allows you to see price action before and after Thursday’s CPI release. Apparently the release was fully implemented with heavy action from Monday to Wednesday. The bar weakened after the announcement. This is understandable, given that the CPI numbers were better than expected. However, it still reached new highs and no solid reversal pattern was formed.

It is somewhat puzzling to see CPI rise and then hit new highs. However, trying to rationalize it too much will not help performance. Technical analysis identifies what traders do, not why they do it.

SPX Daily (Trading View)

4818 is the only remaining resistance.

The post-CPI low of 4739 is the first support level and the 20dma is close by. 4682-94 is major support.

The upper Demark burnout is expected to be seen at 6 bars (or possibly 9 bars) on Monday, which means there could be a reaction starting on Wednesday.

Next week’s drivers/events

The probability of a March increase actually increased late last week and currently stands at 77%. This despite a majority of FOMC members rejecting dovish expectations and a higher-than-expected CPI reading.

Perhaps progress in core inflation is encouraging the doves. Perhaps they are optimistic that two CPI releases before the March meeting will be in their favor. Or maybe they know something we don’t know?! Nonetheless, they are unlikely to back off their dovish bets until they actually have to.

Next week’s data is bright. Retail sales on Wednesday and consumer sentiment on Friday are highlights, while unemployment claims on Thursday are always data points to watch.

Next week is the Fed’s last chance to get its message across before the blackout period ahead of its January meeting. There is no mention of Powell, but there is a full schedule of speakers. The hawkish tone is likely to continue, but without explicitly ruling out a March cut (and there’s no need to do that yet), markets may continue to ignore this rhetoric.

Earnings season continues next week. Citigroup (C) issued a mixed report on Friday and plans to cut 20,000 jobs over the next two years.

Movement expected next week

The rally from the October low of 4103 looks set to continue, and price action could become erratic as it approaches the all-time high of 4818. This often happens when the price moves back to a major high after a significant decline.

In the short term, the initial surge above 4818 is expected to fail, but a second attempt is expected to take place above the post-CPI low of 4739.

The weekly close will be much more significant than any minor movement around 4818 and I outlined the conditions for a reversal to continue or begin earlier in this article. A confirmed breakout should continue towards major highs above 4900. A reversal could mean that the high has already been reached and 4300 is targeted for the first half of the year.

Given the strong trend and optimistic response to CPI, there is a higher probability of sustainability. A strong break above 4818 would force even the stubborn bears to throw in the towel and create conditions for a final high. I still think we’ll see a first quarter reversal and a major decline, but I’m not going to fight this trend just yet.