S&P 500 signals major high | a cautious investor

key

gist

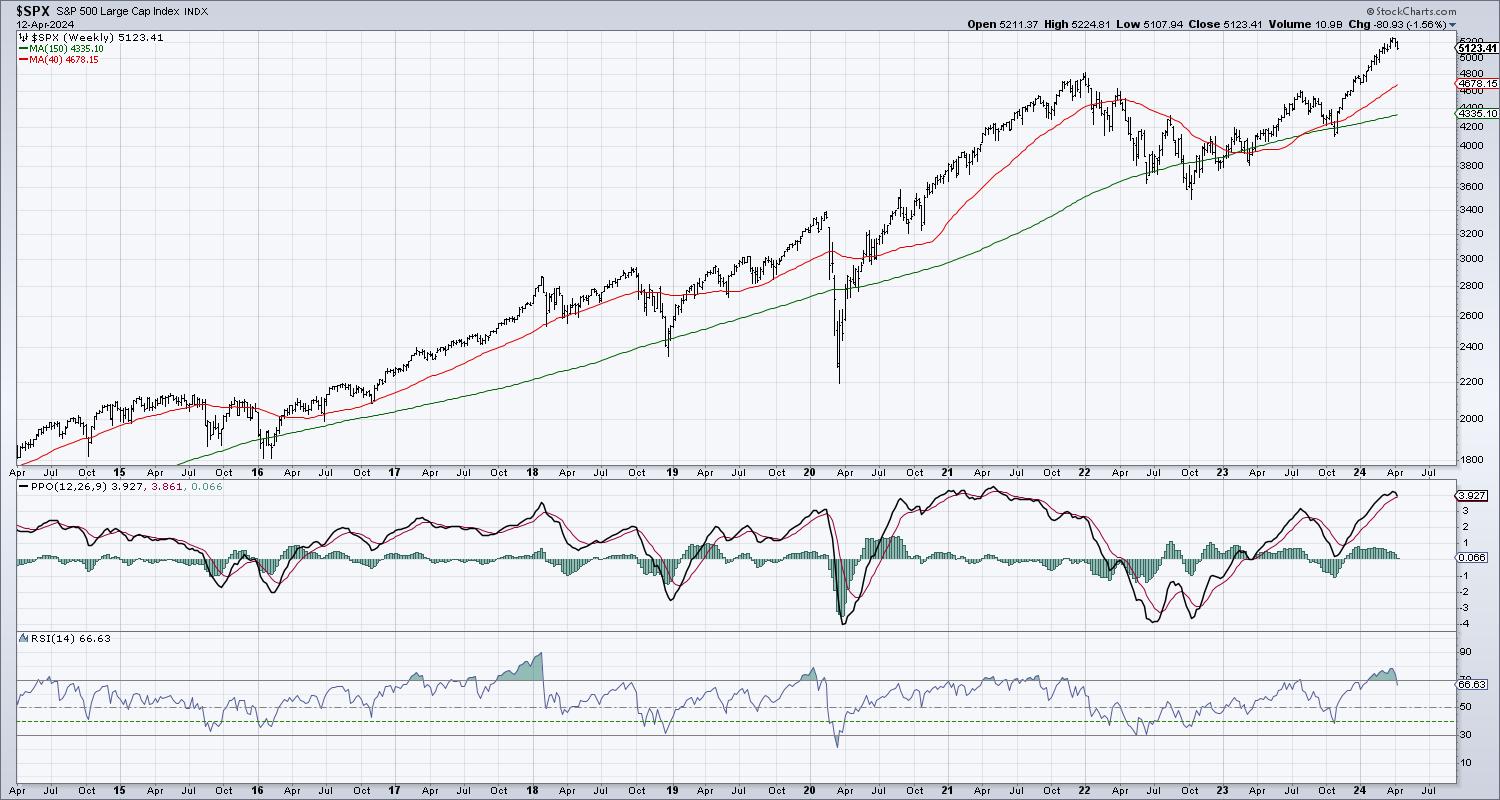

- Weekly RSI has signaled a break from overbought conditions, but weekly PPO has not yet signaled a bearish reversal.

- A break below the 200-day moving average would validate the weekly sell signal and align with the previous market high since the 2009 market bottom.

To the bottom of my Mindful Investor LIVE chart list, I have a series of charts that produce very little signal. So why would I include something like this? Hindenburg Omen and nose width curve, in the basic list of macro charts, what are typically non-factors during regular chart reviews? Because we’ve learned that it’s best to pay attention to these rare signals when they actually happen!

While researching the markets this week over spring break, I noticed that the RSI on the weekly S&P 500 chart was just outside overbought territory. Weekly PPO ended the week with a close sell signal, although it has not yet registered a sell signal.

Major market highs typically see overbought conditions leading to the peak as prices rise aggressively in the later stages of a bull market. Weekly RSI (bottom panel) rose above the 70 level in mid-January and has remained above that mark through this week.

Weekly PPO is an application of Gerald Appel’s fantastic MACD indicator, which uses a series of exponential moving averages to identify underlying trends and indicate trend reversals. If we get a confirmed sell signal next week with the PPO line crossing the signal line, it will be the first signal since the market peak in August 2023.

Let’s pull in some additional price history to consider how often this double sell signal occurred and what typically happened following these bearish confirmations.

This pattern has occurred 10 times since the market bottom in 2009, with five of those signals resulting in the most significant downturns in the past 15 years. The other five were fairly brief downturns within long-term uptrends.

How can you distinguish successful signals from less successful indicators? Well, the winning signal was soon followed by a break in the 40-week moving average, which was used on the weekly chart to mimic the 200-day moving average on the daily chart.

During false sell signals, we never saw a firm break below the 40-week moving average as buyers seemed to buy on weakness and push the price higher. Looking ahead to the next few weeks, if the S&P 500 falls below 4680, that means stocks will likely fall even further.

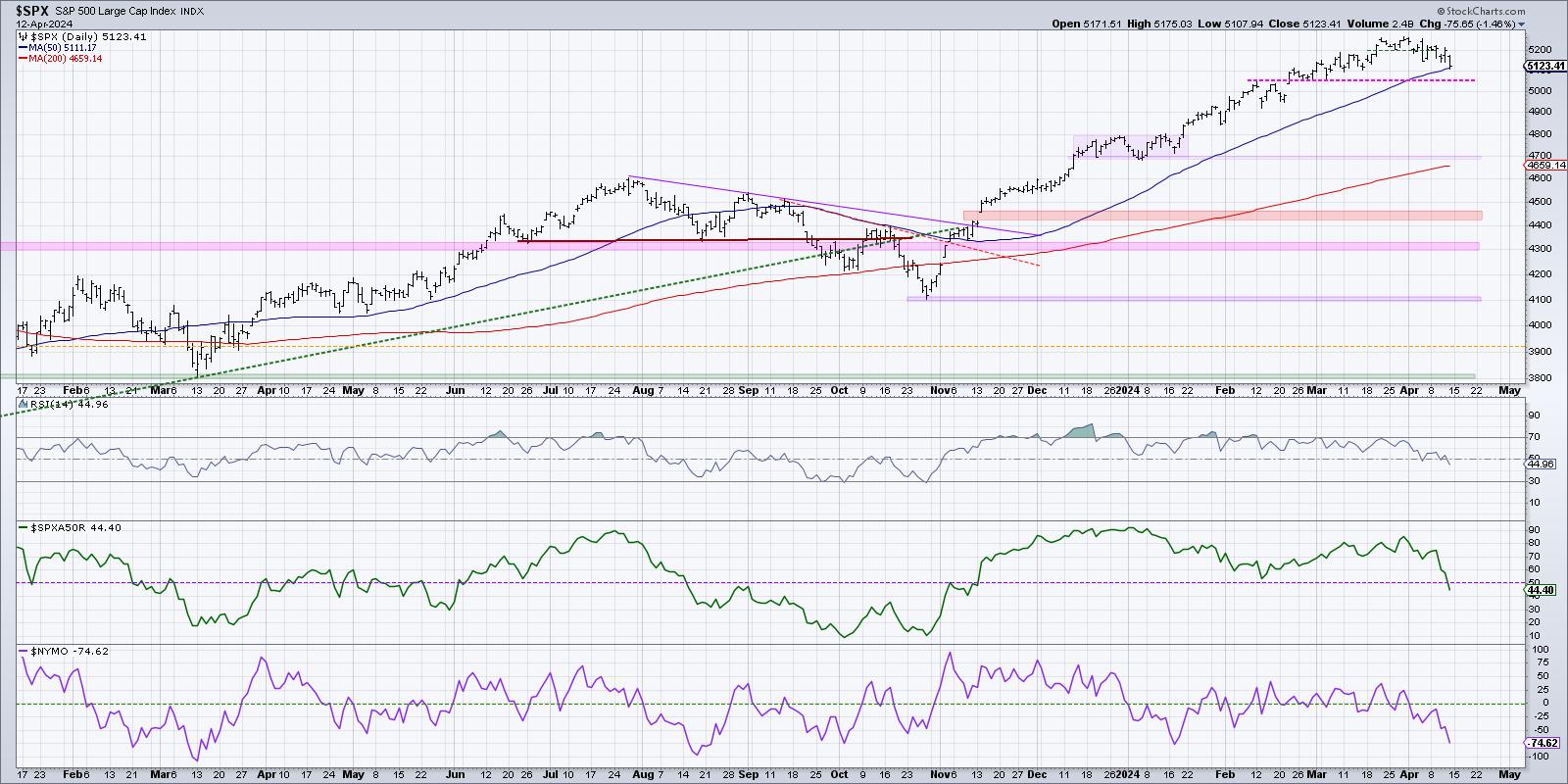

It also means focusing on other macro technical indicators, using breadth indicators and daily S&P 500 charts to further validate short-term price momentum.

The S&P 5050 remains a key near-term support level as it served as a key pivot point in February and March. It is worth noting that the daily RSI is now below 50 as SPX begins a downward rotation to this support level. The percentage of stocks above their 50-day moving average is now less than 50%, and the McClellan Oscillator is well below. Zero level.

All of these short-term signals indicate that the market is in a correction phase. If the S&P 500 falls below its 200-day moving average (less than 500 points since Friday’s close), it means that a near-term deterioration has triggered enough of a collapse to trigger a weekly sell signal.

In both cases, we’ve seen enough to consider a much stronger downturn heading into earnings season after this week’s overheated inflation numbers. Whatever you think could be the next big move for the S&P 500 and Nasdaq 100.Now might be the perfect time to make sure you have a good exit strategy in mind!

RR#6,

dave

P.s Are you ready to upgrade your investment process? Check out our free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

disclaimer: This blog is written for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting a financial professional.

The author had no positions in any securities mentioned at the time of publication. All opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.

David Keller, CMT, is Chief Market Strategist at StockCharts.com, where he helps investors minimize behavioral bias through technical analysis. He is a frequent host of StockCharts TV and links mindfulness techniques to investor decision-making on his blog, The Mindful Investor. David is also President and Chief Strategist at Sierra Alpha Research LLC, a boutique investment research firm focused on risk management through market awareness. He combines strengths in technical analysis, behavioral finance, and data visualization to identify investment opportunities and strengthen relationships between advisors and clients. Learn more