Spire Inc.: Valuation and Returns Too Good to Pass Here (NYSE:SR)

Onur round

Investment summary

Over the past few quarters, as well as over the past decade, there has been a notable shift away from more traditional investment areas such as utilities and industrials towards technology companies. I think all investors can agree on this. to. I am Spire Inc. (New York Stock Exchange:SR) When this trend occurs, it opens up many opportunities. Companies like SR, which have a very large asset base and are trading at their lowest levels in recent years, make for good buying opportunities. all 5% return And with continued bottom line growth, SR appears to be the company’s backbone for the portfolio.

Utility companies often accumulate a lot of debt over the course of their operations, but we don’t think this should be confused with a significant amount of debt. Degree of risk. Companies like SR are well-positioned to continue generating higher cash flow and earnings to service their debt, and they tend to be fairly reliable.

company division

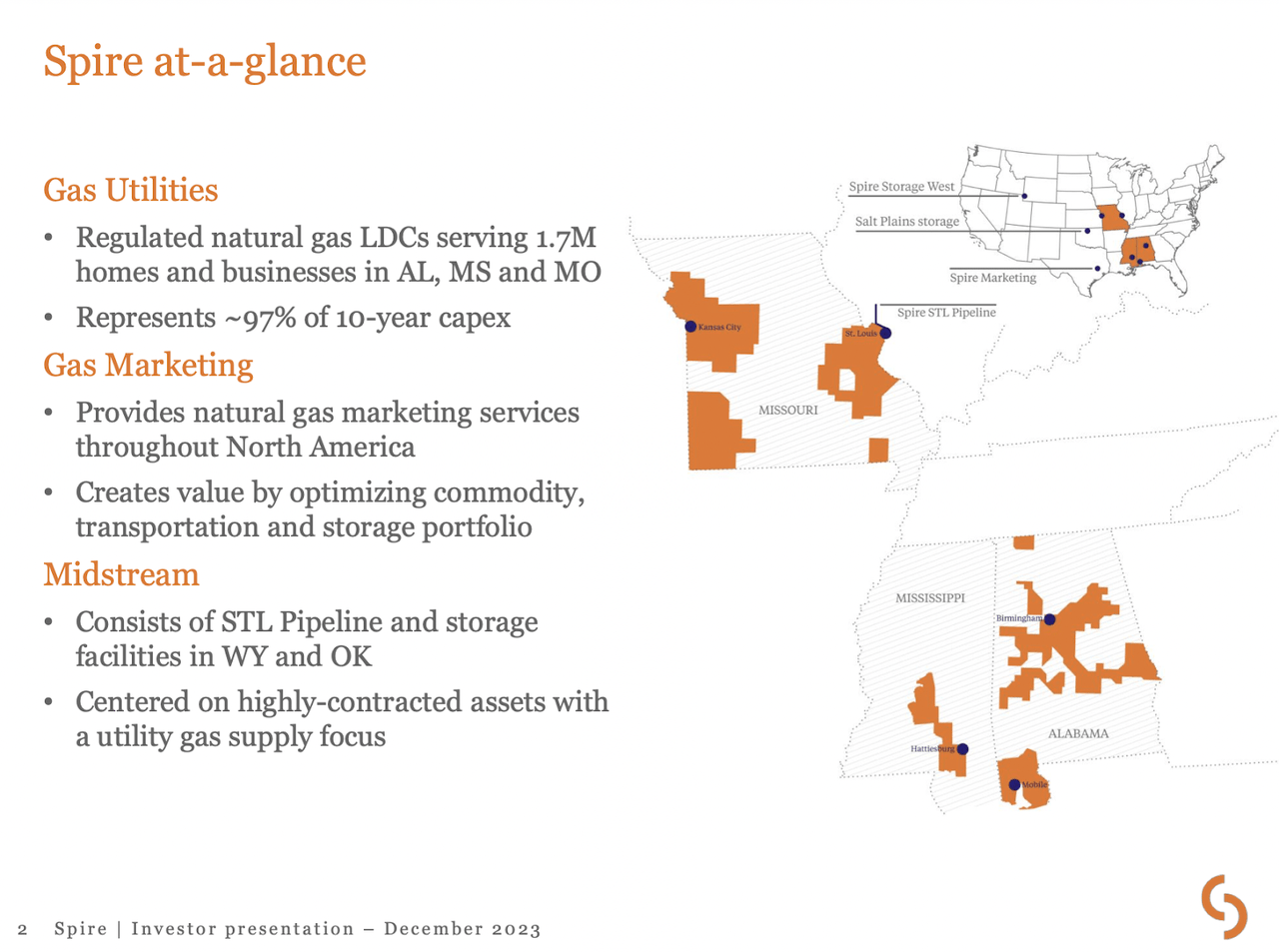

SR is responsible for the acquisition, distribution and sale of natural gas to a variety of consumers throughout the United States. The company operates through three main segments: Gas Utilities, Gas Marketing, and Midstream. SR is committed to providing natural gas to residential, commercial and industrial users. It also participates in natural gas transportation and storage, while also playing a role in marketing natural gas services. SR is also engaged in propane operations, including propane pipeline activities, risk management and various related ventures.

Company Overview (Investor presentation)

Over the years that it has been in operation since 1857, SR has diversified its operations and now operates in several states such as Alabama, Mississippi, and Missouri. Most of our customers are located in Missouri, with over 1.2 million customers making up the majority of our total 1.7 million customers. A company running a pipeline means that most of the value it creates comes from existing infrastructure and then manufacturing and selling something. The total length of the pipeline is 61,200 miles. 90% of its revenue comes from its regulated gas utilities segment, with the remainder comprised of marketing and some midstream operations. Another gas company I covered was Southwest Gas Holdings (SWX), which had a similar trading pattern to SR. This suggests a lack of growth this year as investment firms appear to be more inclined towards growth companies after news of rate cuts emerged.

Revenue Highlights

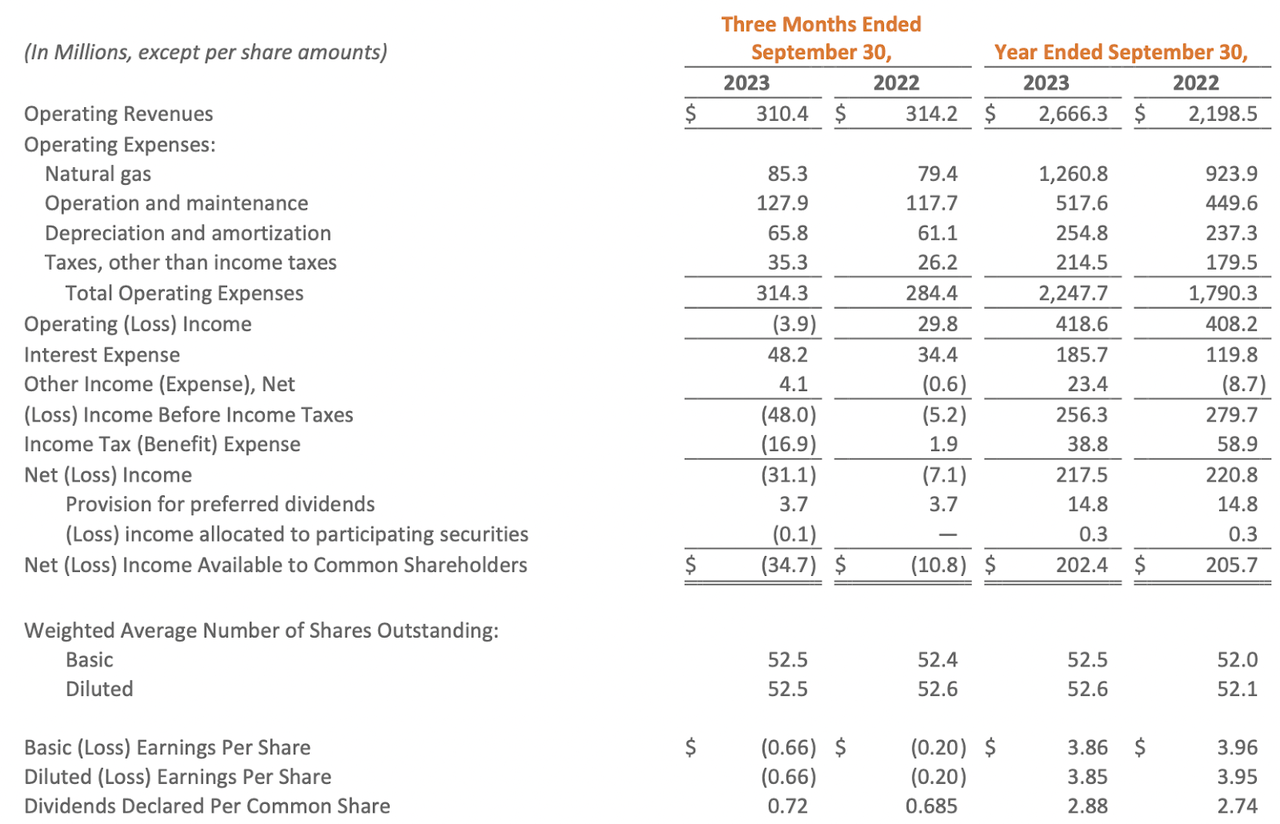

Income Statement (Earnings Report)

The company’s last report showed a notable year-over-year improvement in sales for the full fiscal year 2023, if not last quarter. It has increased by more than 20%. This leaves the company’s FWD p/s at just 1.25, a nearly 30% discount to its five-year historical multiple of 1.74. If you look closely at the income statement, you can see that net profit has decreased slightly compared to the previous year. This appears to be the main cause of increased interest costs and slight dilution of around 1% compared to the previous year. However, as we see interest rates developing further over the near term, we think margins will stabilize in late 2024 and early 2025. The last report was released on November 16th, and in the weeks that followed, the stock price rose steadily but then fell back to the same level. SR’s 52-week high is $75 and its next report is expected to come out on January 30th. At that time, I think the stock will rebound if SR posts strong numbers and raises its outlook for the year. There have been steady declines and reversals that are only possible if the company posts strong results.

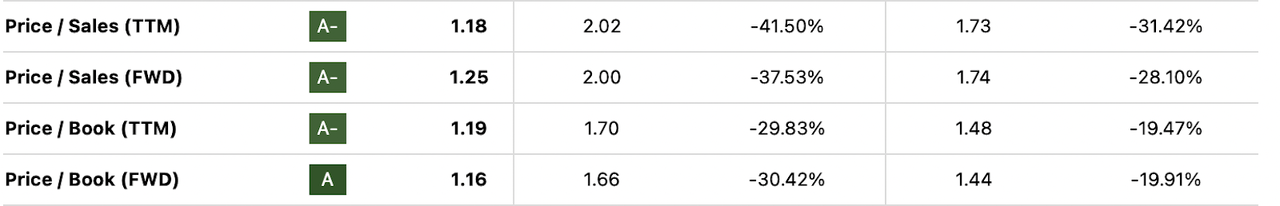

evaluation (Look for alpha)

The primary way SR generates revenue is through its pipeline, which is the majority of its asset base. Earnings tend to be somewhat stable over the long term, with some fluctuation from quarter to quarter depending on price changes and how assets are depreciated. Despite an almost 8% year-over-year increase in assets since 2021, the company is trading at some of the lowest multiples, namely a 37% discount on a p/s basis to the utilities sector. Even though there are some risks facing the company, I think a fair multiple here would be at least 1.7. I would argue that this is justified because of the stability of SR’s revenue generation and how reliable it has been over the last decade (10.12% compounded). Using a 1.7 multiple gives us a current price target of $91, with a 2024 earnings per share estimate of $51. I think SR in 2024 could very realistically have similar returns as 2023 and possibly even more growth all the way to the bottom. It all depends on how interest rates fall. But with that said, I think SR will post just under $2.7 billion in revenue in 2024.

Let’s compare SR further with its close peer, ONE Gas, Inc. (OGS). These companies are very similar in terms of market capitalization, ranging between $3 and $3.3 billion. However, shares are down more than 22% for GGS over the past 12 months, compared to just 17% for SR. Return wise SR is the winner here with 5.1% and GGS is 4.4%. Where I prefer SR and think it is a better option is first of all valuation. Here, SR trades at a lower multiple than GGS. For example, the p/e for GGS is 13.4 and for GGS it is 14.2. Historically, SR has been the best company, with a compound annual growth rate (CAGR) of 10.12 over the past 10 years, while GGS has only grown 4.91%. I think SR has a better foundation for further growth over the next decade. This is why it is my preferred choice of the two.

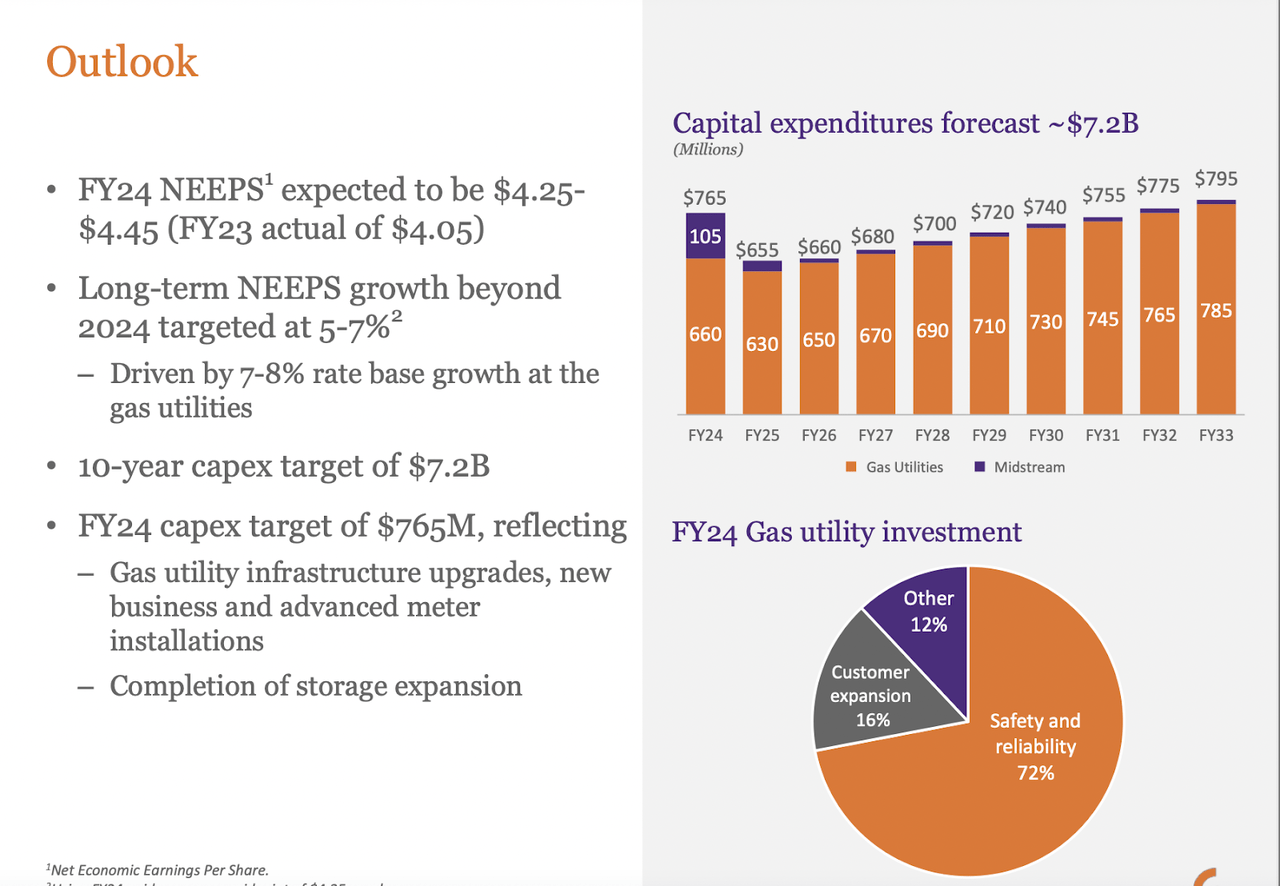

company outlook (Investor presentation)

The company forecasts a very strong long-term NEEPS growth rate of 5-7%, driven by a 7-8% underlying growth rate in gas utilities, the largest segment of the business. This outlook is consistent with the 2024 revenue forecast for SR. With a price target of $91, we have about a 50% upside today and a divine 5% yield could see us reach 55% in the next 12 months. I think it’s not unreasonable to rate that forecast quite high, but a steady 55% return in 12 months would have every investment firm investing in SR today. SR offers a very compelling opportunity to outperform the broader market over the next 12 months, but we think this is possible. That means I’m also giving it a Buy rating right now.

danger

Notable risks facing SR stem from environmental volatility in terms of climate and natural gas costs. Warmer weather increases asset depreciation, which increases capital expenditures and maintenance costs. This long-term impact on our earnings may require us to reduce shareholder-friendly initiatives, such as share buybacks and dividends, to ensure continued operating efficiency. Weather patterns continue to change in the United States, and we believe it is reasonable to assume that depreciation of SR assets will accelerate over the next decade as a result.

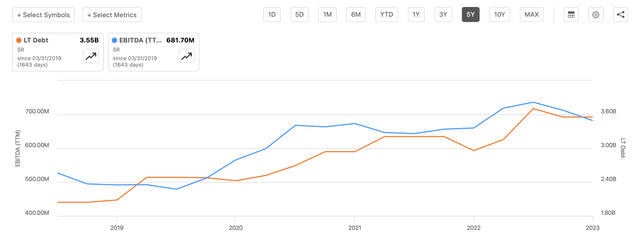

Debt and EBITDA (Look for alpha)

A closer to near-term risk is rising interest rates in the US, which is putting pressure on SR’s earnings. The company has always had a lot of debt on its balance sheet, and we don’t think this is a big risk for investors. The leverage between EBITDA and long-term debt is roughly 5, and with this consistent EBITDA generation, I don’t think higher leverage is an issue here. Debt levels are currently below $3 billion, but the risk to me is still low, with the chart clearly showing that EBITDA can keep up with that. TTM EBITDA is $681 million, but has grown quickly from $448 million in 2018. This is a 52% increase in just 5 years. The problem is further compounded by the fact that in the near term, SR may not be able to make acquisitions and expansions as aggressively as before, which could justify a lower valuation than we’ve seen for the stock over the past 12 months. This risk is also related to the first risk I mentioned, along with changing weather conditions, which could potentially increase asset depreciation. If SR already has a lot of debt and is currently facing high maintenance costs, a dividend increase may be put on hold as it needs capital elsewhere.

final words

Utility companies have struggled over the past 12 months, and SR is no different, down nearly 20% over the past 12 months. Digging deeper into the company, we find that its asset base and operating areas demonstrate a strong business model that leaves a lot of value for current investors. With valuations dropping to historic lows and yields exceeding 5%, it’s hard to resist buying SR at this price point. My price target indicates that significant outperformance could be possible over the next 12 months, which makes me rate the company a Buy right now.