SPY Analysis: How to Know When a Bearish Trend Has Ended | Don’t ignore this chart!

key

gist

- SPY is trading within a descending channel on the daily chart and a breakout in either direction is equally likely.

- The weekly chart shows that the uptrend is still ongoing and SPY is undergoing a healthy correction.

- Analyze various index and sector exchange traded funds to understand which areas are performing and which are underperforming.

Last week, investors were spooked by geopolitical tensions and expectations that interest rates would remain high for longer. Fear caused investors to sell stocks, which resulted in broad indices falling below their rising trend lines. The market looked poised to bounce back this week, and many investors were wondering if it could happen.

So is now a good time to buy stocks? It may seem attractive, but the market appears indecisive. In such cases, it is best to tread carefully.

This is a big earnings week with big tech companies reporting. If this is weak, it can harm the stock market. We saw this unfold. meta platform (META) reported earnings on Wednesday after the market closed. Despite META’s earnings and revenue beating expectations, disappointing second-quarter guidance sent the stock down like a rock. This spread to other stocks, and major indices continued their downward trend.

Another data point dampening investor optimism was first-quarter GDP, which came in well below economic expectations. Broad indexes were all lower and closer to Friday’s close. But the market bounced back and there were positive earnings reports. microsoft (MSFT) and alphabet (GOOGL) added some optimism. A key area to pay attention to is where the index closes compared to the previous week. If it stays above Friday’s close, it would be a positive sign.

What does all this mean for the market going forward?

SPY’s fullback play

Check out the real-time charts.

Let’s take a closer look at the daily chart. SPDR S&P 500 ETF (spy). This ETF has been trading above its 50-day simple moving average (SMA) since November 2023 and has been moving in a fairly steady upward trend (red dotted line) until early April 2024, when its value fell below the trendline. Since the collapse, SPY has been trading in a downward channel. This week’s bounce has taken us to the top of the downward channel.

Chart 1. Spy’s daily chart. The ETF appears to want to move higher, but is still trading within a downward channel. SPY is also moving out of oversold territory, but could fall quickly.Chart source: StockCharts.com. For educational purposes.

There are three possible scenarios:

- SPY may continue to bounce in the falling price channel for longer.

- A breakout above the channel could set up a reversal.

- It could break below the lower channel line and fall to the next support line.

It would be helpful to add indicators that help determine whether the market is oversold or overbought. In this example, a Stochastic Oscillator (bottom panel) has been applied. This shows that SPY has been in oversold territory since the close on Friday, but is now out of that area. However, it could easily and quickly fall back below 20.

Check out the real-time charts.

Looking at SPY’s weekly chart (see below), it looks like the uptrend is still underway. SPY is trading above its 50-day SMA and is no longer in overbought territory (see Stochastic Oscillator in the bottom panel). Although SPY has fallen below the short-term trendline, the downtrend looks much healthier than on the daily chart.

Chart 2. Spy’s weekly chart. In the long term, SPY’s upward trend is still valid. If it falls below the 50-day SMA and the Stochastic Oscillator falls into oversold territory, there may be cause for concern.Chart source: StockCharts.com. For educational purposes.

Market behavior changes every day, and right now it looks like bad news is hurting stock indices. If you are trying to decide whether to unload some positions or add new positions to your portfolio, it is best to be patient and wait for the market to decide which way it will go.

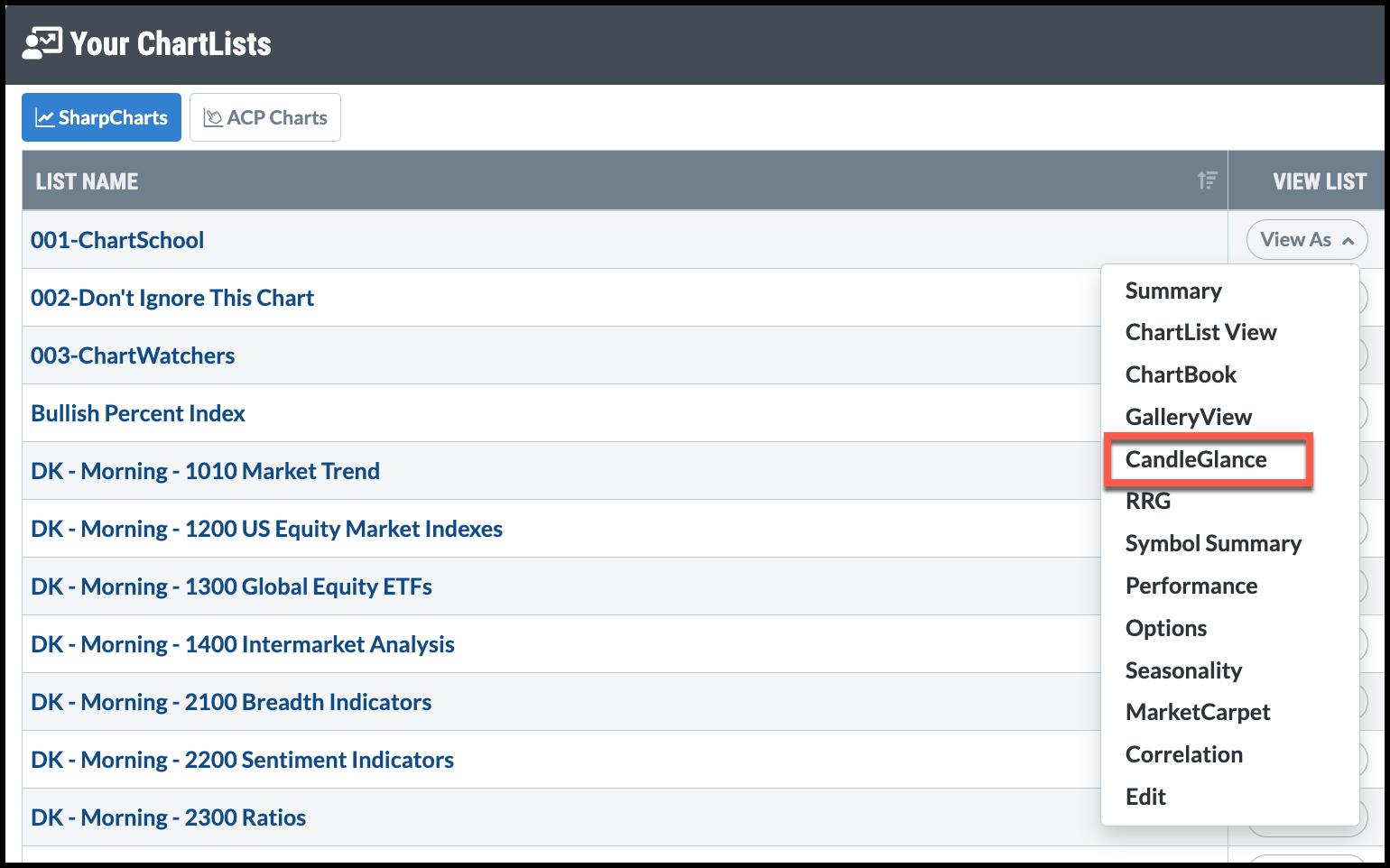

Set up a ChartList with an index such as DIA, QQQ, SPY, XLK, or the corresponding ETF proxy and sector ETF. Annotate lines in the sand (trend lines, support/resistance, significant highs/lows) and view them with CandleGlance. You can view all charts simultaneously.

Figure 3. How to view the chart list. There are several ways to view the ChartList. CandleGlance allows you to view all charts simultaneously, allowing you to see stock market movements at a glance.Chart source: StockCharts.com. For educational purposes.

This will help you identify which ETFs are breaking above strong resistance levels and which are collapsing below support levels. Anything can change the market narrative, so watch the action closely.

disclaimer: This blog is written for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting with a financial professional.

Jayanthi Gopalakrishnan is the Director of Site Content at StockCharts.com. She spends her time creating content strategies, providing content to educate traders and investors, and finding ways to make technical analysis fun. Jayanthi was the Editor-in-Chief of T3 Custom, a content marketing agency for financial brands. Prior to that, she served as editor-in-chief of Stocks and Commodities Technical Analysis magazine for over 15 years. Learn more