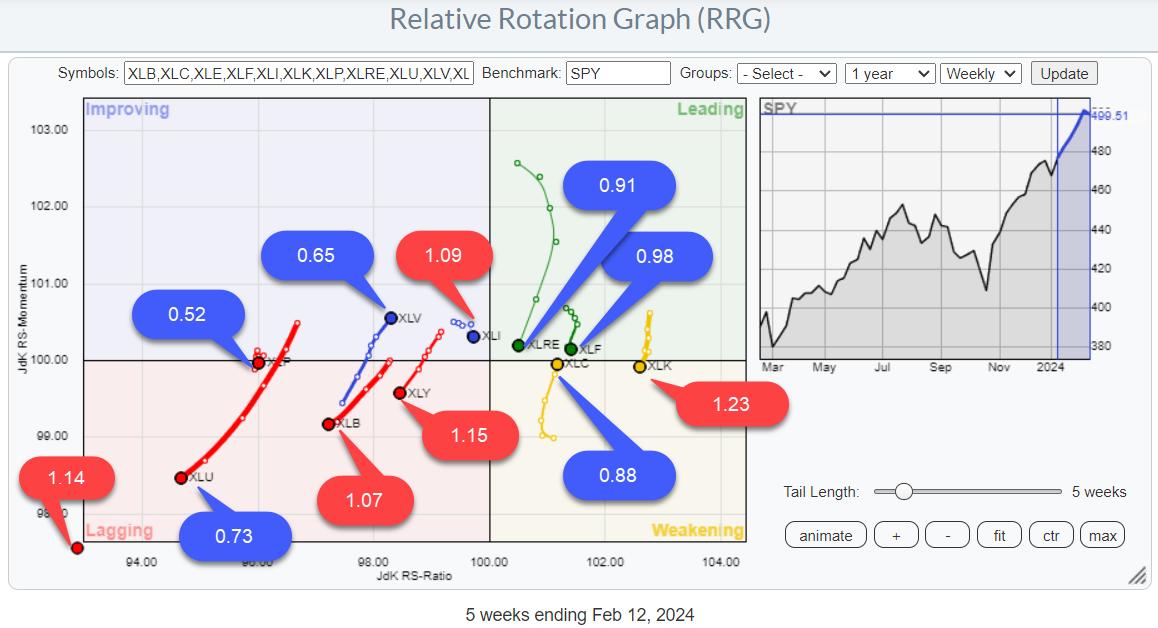

SPY uptrend remains intact, but mixed sector rotation signals hesitation | RRG chart

key

gist

- Explore Risk ON/OFF through BETA

- RRG indicates mixed rotation.

- SPY Uptrend Maintains with Limited Downside Risk

beta

One risk ON/OFF indicator I pay attention to is beta.

From Investopedia:

Beta (β) is a measure of volatility.—or systematic risk—A ratio of a security or portfolio compared to the market as a whole (usually the S&P 500). Stocks with a beta higher than 1.0 can be interpreted as being more volatile than the S&P 500.

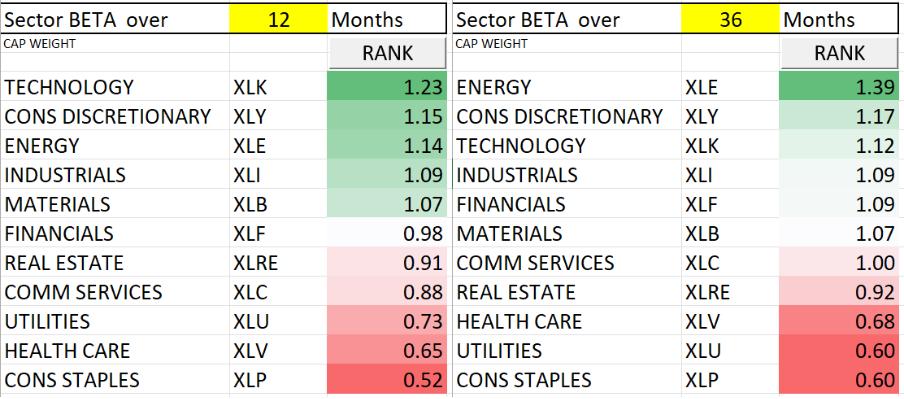

I updated the spreadsheet with last year’s data for this article. And we would like to look at the current (sector) rotation through BETA for each sector.

You can see the 12-month beta values for all sectors in the relative rotation graph above.

Before we look at sector rotation, let’s take a quick look at beta values. As mentioned above, the RRG at the top shows the 12-month beta value.

The table below shows the 12-month and 36-month betas side by side.

Note that there are only minimal position switches between sectors. There can be significant differences in beta values over time. Most notable is the energy sector, which has a BETA of 1.39 over 36 months, but “only” 1.14 over 12 months.

Despite this, there was no change in the top three categories. The same goes for the bottom three industries.

My expectations regarding rotations are that I expect the high BETA sectors to show strong rotations during bullish periods in $SPX, and the low BETA sectors to see strong rotations during bearish periods in $SPX.

Neither side has an advantage

Looking at those RRGs, we can see that neither the high beta sector nor the low beta sector has a dominant direction as a group.

The highest beta sector (1.23) has the highest readings on the RS-Ratio scale and has fallen into the weakening quadrant, while Energy (1.14) lags deep inward but is starting to rise again. Discretionary (1.15) is clearly inside and lagging and moving further into that quadrant.

In the low beta group, Utilities (0.73) plummets deeper into the lagging quadrant, while Staples (0.52) plateaus at low RS-Ratio readings. Health care (0.65) is an exception here, with a strong trajectory toward the improving quadrant in the direction of strong RRG.

RRG images are mixed and there is no clear preference for either group.

Bringing those observations to the SPY chart (daily) can help you interpret the index’s recent price movements.

SPY outlook

Breaking the previous high (January 2022) was clearly a bullish sign. A new ATH is not a sign of a bear market. Yes?

The same was true for the rally that followed the break. The regular rhythm of higher highs and higher lows pushed SPY to a new ATH of 503.50. Despite last Tuesday’s shocking decline, this upward trend is still intact.

However, the mixed rotation in RRG combined with the negative divergence forming between SPY and RSI suggests some hesitation. At least there’s something you need to know.

Downside risks appear to be limited, with the previous resistance level of 480 now expected to return as solid support on the downside.

Clearly, a break above 503.50 would be a positive signal for the market again. On the downside, we are watching the lower limit of the new short-term channel and the previous low of 490. If it breaks this level in the future, it is very likely that it will fall again to the breakout level around 480.

What happens there will be very important for further development in the coming months.

For the time being, the upward trend remains intact and near-term risks are limited. (4-5%)

#Remain vigilant. –Julius

Julius de Kempenaer

Senior Technical Analyststockchart.com

creatorrelative rotation graph

founderRRG research

owner of: Spotlight by sector

Please find my handle. social media channels It’s under Bio below.

Please send any feedback, comments or questions to Juliusdk@stockcharts.com.. We cannot promise to respond to every message, but we will ensure that we read them and, where reasonably possible, utilize your feedback and comments or answer your questions.

To discuss RRG with me on SCANHey, please tag me using your handle. Julius_RRG.

RRG, Relative Rotation Graph, JdK RS-Ratio, and JdK RS-Momentum are registered trademarks of RRG Research.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This unique way to visualize relative strength within the world of securities was first launched on the Bloomberg Professional Services Terminal in January 2011 and made public on StockCharts.com in July 2014. After graduating from the Royal Netherlands Military Academy, Julius served in the Dutch army. Airmen of various officer ranks. He retired from the military in 1990 with the rank of captain and entered the financial industry as a portfolio manager at Equity & Law (now part of AXA Investment Managers). Learn more