SSR Mining Faces Unprecedented Challenges in Turkey (NASDAQ:SSRM)

Yuichiro Chino/Moment via Getty Images

The SSR mining landslide hit the company.

SSR Mining Co., Ltd. (NASDAQ:SSRM), a recognized mid-tier gold and silver producer with a diversified portfolio in the United States, Canada, South America and Turkey, has experienced significant difficulties recently. that much The company has previously been applauded for its performance and has received several optimistic reviews. Analyst Rating The stock plunged more than 50% on platforms like Seeking Alpha. a catastrophic event At the Çöpler mine.

The major sale was triggered by a significant landslide at the mine heap leach pad, which halted 80%-owned Çöpler’s operations and trapped nine workers.

Prior to this incident, SSR Mining was on the rise, reporting production of 706,894 gold-equivalent ounces for 2023 at an all-in sustaining cost (AISC) of $1,461 per ounce. The company also provided ambitious multi-year guidance, projecting production growth to be close to 2020. AISC will reduce the 800,000 ounces by 2027 to about $1,300 per ounce.

This previous optimism was supported by Çakmaktepe’s significant reserve growth and extensive technical assessments and improvements across the portfolio, including investments to increase gold recovery. These developments promised to substantially extend the life and production capacity of Çakmaktepe and bring a new asset (Hod Maden) into production.

But this optimism has now been suddenly curtailed by the devastating landslide at the Çöpler mine, which led to the tragic disappearance of nine workers and sparked a wide-ranging investigation into the mine’s safety practices, including the arrest of four people as part of the investigation into the incident.

The disaster, which halted operations and revoked SSR Mining’s environmental permits for the site, cast a long shadow over the company’s future. To make matters worse, there are concerns that nearby rivers may be polluted by chemicals such as cyanide stored in the mine.

Investors are advised to exercise caution as the company grapples with the immediate aftermath and regulatory scrutiny. We await further clarity on the status of the mine and its broader implications for SSR Mining’s operational outlook.

Are SSR mining stocks cheap here? Take a closer look

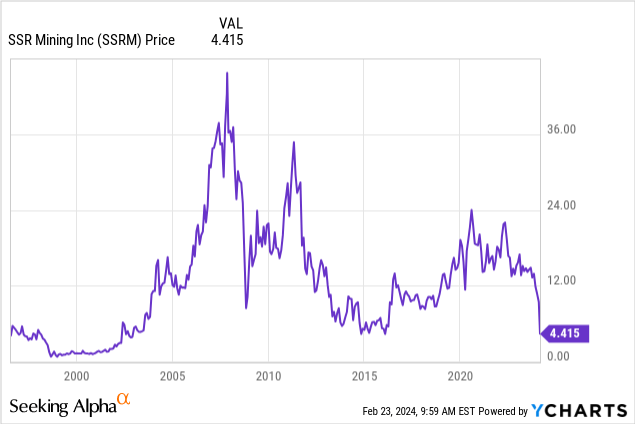

Y chart

The aftermath of the tragic landslide at SSR Mining’s Çöpler mine had a severe impact on the company’s stock, causing its value to plummet by 50%, significantly reducing SSR Mining’s market capitalization to $886 million.

Due to this economic downturn, the company’s price-to-earnings (P/E) ratio has decreased. 4.30With something that looks attractive on the outside 6.4% Dividend yield tempts value investors to think stocks are cheap.

However, given the uncertainty surrounding the future operations of the Çöpler mine and the wider implications for the company’s production capacity and growth prospects, the situation clearly requires a more cautious approach.

The immediate cessation of Çöpler’s operations will remove 200,000 to 220,000 ounces from SSR Mining’s annual gold production. This is a significant blow, accounting for about half of the company’s production. Considering this news, we think it’s likely that the dividend will also be cut to preserve liquidity.

Don’t forget Hod Maden

These losses were compounded by potential challenges facing the development of Turkey’s Hod Maden mine, which is expected to contribute significantly to SSR Mining’s production with 2 million ounces of gold and 255 million pounds of copper.

The company’s $270 million investment for a 40% stake in Hod Maden is balanced by the project’s troubled history of delays and the recent disaster at Çöpler, potentially souring government and regulator sentiment. .

Industry analysts, including RBC (new $3 price target), express skepticism about SSR Mining’s ability to recover value from Çöpler or secure the permits needed for construction at Hod Maden. These sentiments reflect concerns that the impact of the Çöpler incident could go beyond immediate operational disruption and pose long-term risks to SSR Mining’s operations.

Investors are therefore advised to tread cautiously as the unfolding situation may reveal further challenges and setbacks for the company that are not yet reflected in the stock price.

SSR Mining: What to Do Now

The catastrophic landslide at the Çöpler mine pit has caused serious problems for SSR mining, directly affecting half of its production and casting a shadow over key development assets.

Unfortunately, this incident shows the high risk of mining. Despite SSR Mining Inc.’s strong liquidity, which suggests a low near-term bankruptcy risk, the ongoing situation could worsen further, especially as potential developments emerge at Hod Maden.

Considering this situation, I holding SSR Mining Inc. Ratings for stocks. If there are no positive developments related to recovery efforts at the Çöpler mine, the stock could face additional pressure.

final thoughts

The tragic event not only affected the operational prospects of SSR Mining Inc., but also deeply affected the mining community and everyone involved in the rescue operation.

As someone who has been analyzing the mining sector for over a decade, these incidents are a stark reminder of the risks to the industry and the human costs they can incur. My sincere thoughts and prayers are with the workers still missing and all those affected by this tragic event.