SSX Titan EA – Trading System – December 17, 2023

Important information:

SSX Titan EA Advisor works with sophisticated algorithms that simultaneously integrate 14 different indicators, each with its own parameter settings. This means that the advisor does not execute trades every day. Those looking for daily random trading are advised to look for other advisors on the website. This is because there are many advisors available. If you consider yourself an advanced trader, you will find that the advisor operates on state-of-the-art algorithms that have been meticulously crafted after conducting thorough testing. The algorithm immediately executes a significant number of trades with protective stop-loss actions, earning significant profits from successful trades. The system I developed does not rely on neural networks, artificial intelligence, martingales, or grids. This represents a breakthrough that I have worked hard to create, and I look forward to leveraging it in our trading activities together.

What sets my advisor apart from other advisors in the market?

- Dear Users, I have seen patterns that indicate that the use of neural networks and artificial intelligence is providing advisors with impressive test results. However, these results often prove effective only in the short term in real-time trading. I began developing strategies that would stand the test of time. We have compiled data from a variety of approaches, taking inspiration from time-tested strategies such as level breakouts, news trading, price action, and more. We’ve integrated the fundamentals into SSX Titan EA Advisor.

- Although my initial test results weren’t that impressive, I was confident I was on the right track. Through extensive optimization and continuous improvement, we have gradually improved the performance of our advisors. As we incorporated more indicators, including those we developed personally, we achieved greater stability. In the end, I found the optimal settings that gave me amazing results.

- To be honest, I don’t claim to produce billion-dollar test results like some do, but I firmly believe my results are excellent. In summary, I highlighted the characteristics of my advisor compared to other advisors.

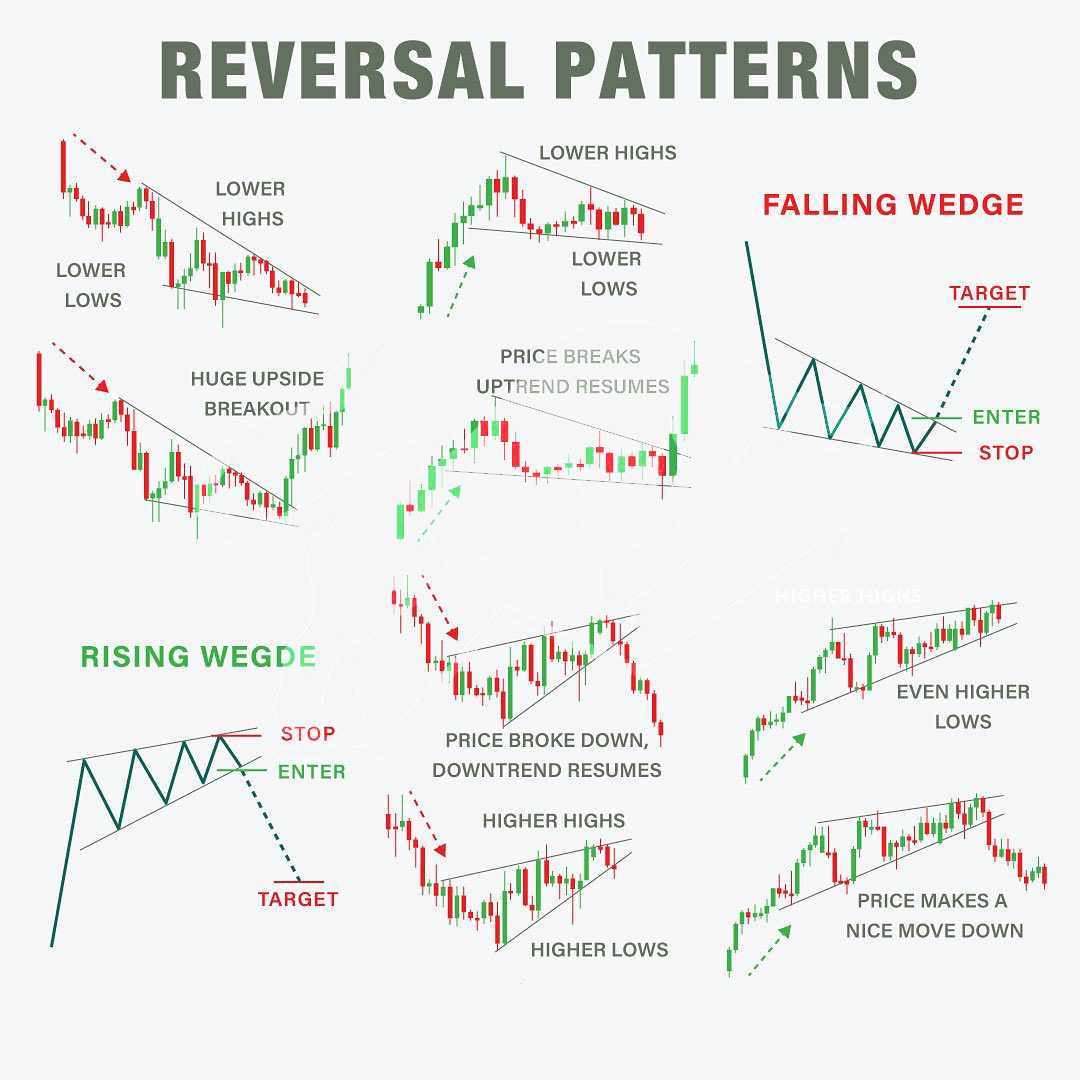

The main reversal patterns I noticed in SSX Titan EA

What are the basics of breakout trading?

Breakout trading is an approach in which traders focus on price movements through key keys. support or resistance level. This strategy is based on the assumption that if the price breaks through a support or resistance level, the price is likely to continue moving in the same direction.

Level building can be quite subjective. Various guidelines are used for this purpose.

- previous pole;

- psychological meaning of price;

- technical analysis patterns;

Indicator values, e.g. market profile).

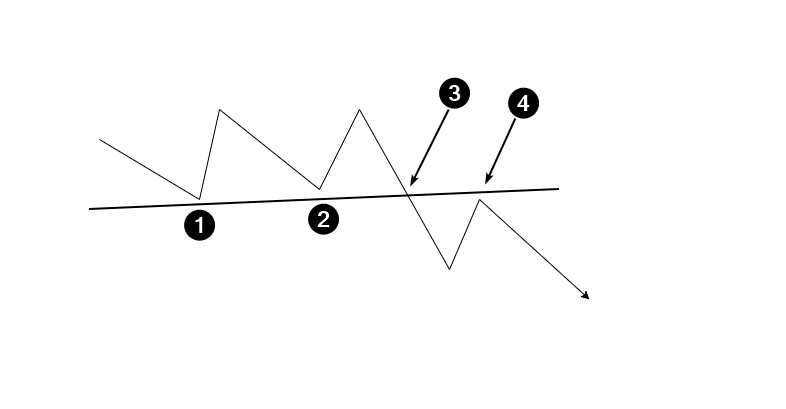

The level can be inclined or horizontal and a varying number of guides are available. Typically trades that break support levels include:

pattern ideas

The concept of a breakout is to disrupt the balance of supply and demand.

Let us assume that the power of buyers and sellers in a market are in balance with each other over a period of time. At the same time, the price was forming a trading range. The boundaries of a formed range (or technical analysis pattern) usually define support and resistance levels.

Let’s continue developing our hypothesis. Under the influence of some negative factors, buyers weakened, sellers became more active, and prices began to fall. At the same time, the support line broke away. — Market participants have reached a consensus that asset prices are too high and fair prices are low. At this moment, sellers become very active, which leads to a breakout.

How to Use Volume Indicators to Identify Breakouts

An experienced trader will know:

- When price is about to break a certain level, volume usually increases as it gets closer to that level.

- Before a true breakout occurs, the following typically occurs: false breakout (deceptive maneuver) in the opposite direction;

- Breakouts occur quickly, leaving traders little time to analyze and enter positions at low prices. Moreover, when starting a trade in the direction of a breakout, the trader may feel emotional discomfort due to the possibility of buying high or selling low.

How to identify breakouts to trade more confidently?

Look for clear evidence that one party has the upper hand over the other. You can find it using the ATAS platform’s advanced volume analysis indicators. for example:

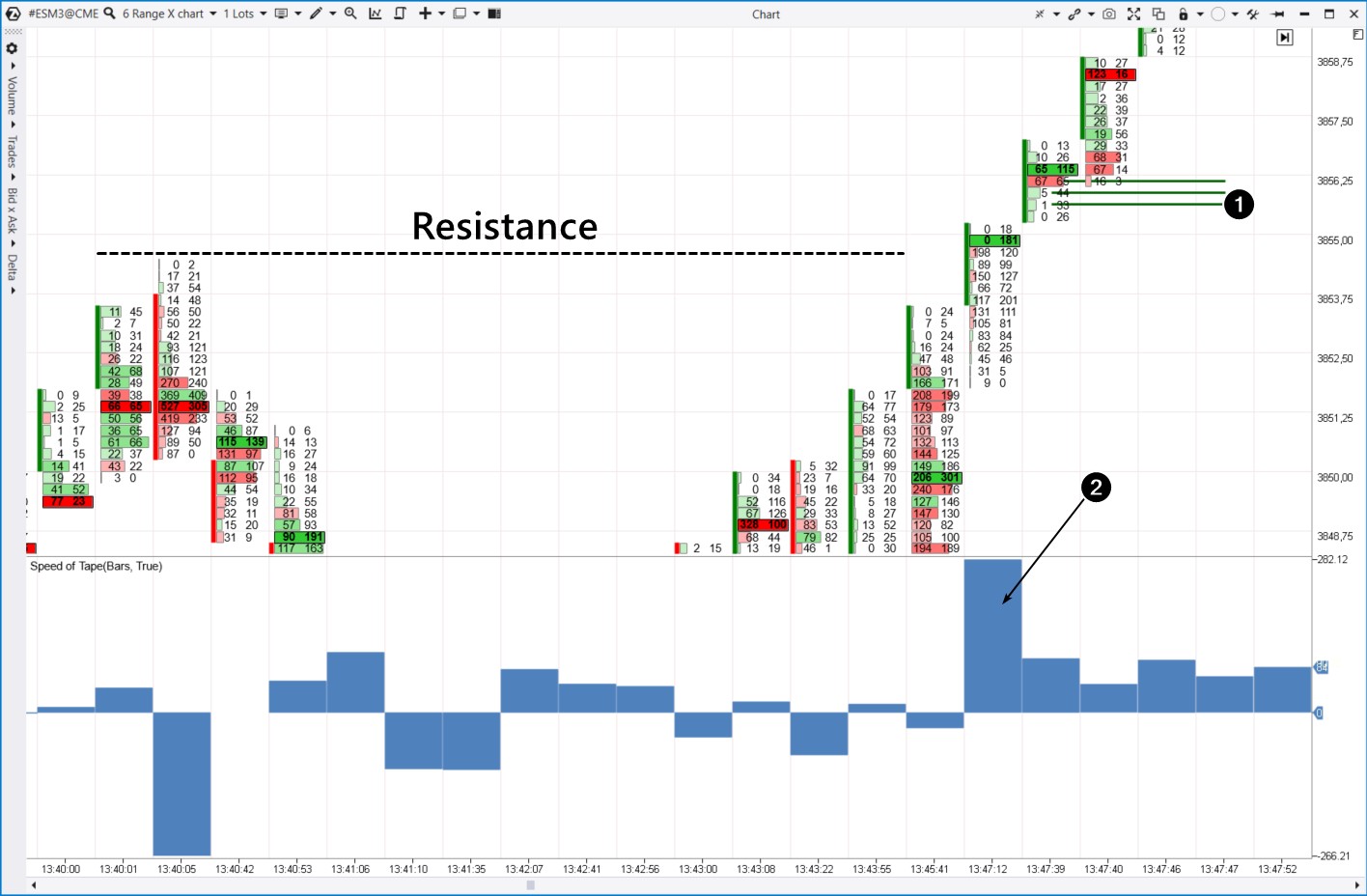

- accumulated imbalance Multiple price values are analyzed sequentially to show the dominance (imbalance) of one of the parties. Imbalances usually occur in breakout areas. This indicator can also be used for money management, as you can see below.

- tape speed Delta mode provides evidence that the pressure on one of the parties increases over time.

The cluster chart below shows a breakout of the resistance level.

I’ve only scratched the surface of the strategies used by SSX Titan EA. I cannot reveal all my trading secrets nor share my trading indicators for free and I believe you understand why. I want to offer my advisors to people who are really ready to trade, people who are patiently waiting for a trade instead of banging their head against the screen when their advisor doesn’t trade for two days. Thorough trading analysis takes time, so advisors cannot trade every day like many others on the website. But at the end of the day, we are here to make deals, not play roulette.

We will only allocate 50 Advisors at an initial price of $399. Naturally, prices increase for a variety of reasons, including competition, product quality, and exclusivity. Thank you for your interest and try trading with SSX Titan EA.