After announcing key details about the hotly anticipated STRK token airdrop. This morningEthereum software company Starkware backtracked after cryptocurrency users raised ethical questions about how quickly the network’s investors and contributors could sell large STRK positions after the network’s launch.

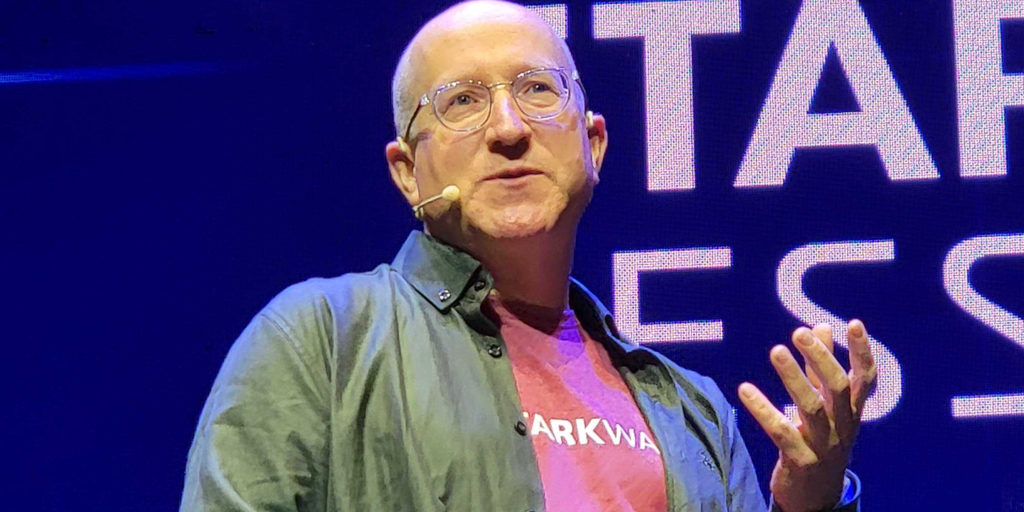

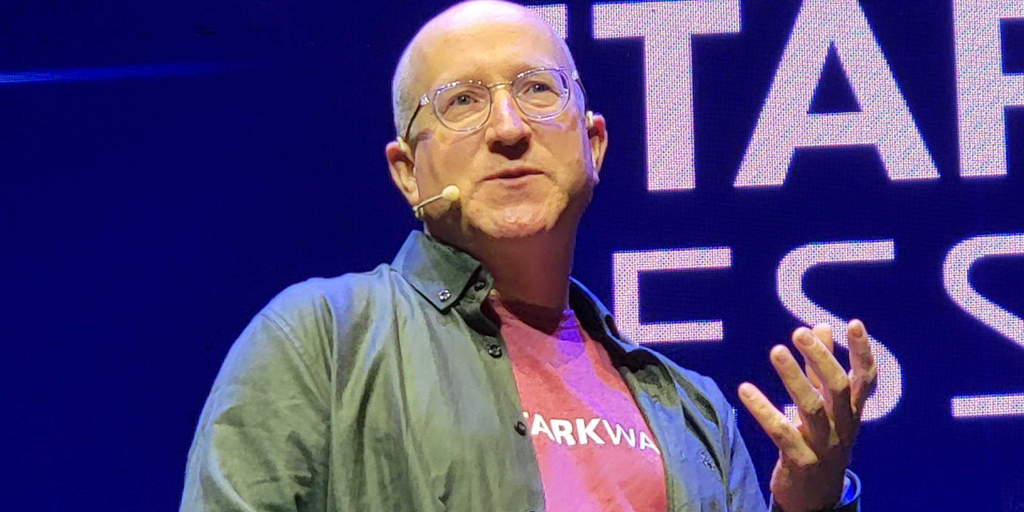

However, in an exclusive interview decryptionStarkware’s CEO hit back at detractors, doubling down on the Starknet airdrop roadmap and explaining why he believes it won’t harm the token community.

On April 15, less than two months after the launch of STRK on February 20, over 1.3 billion STRK tokens will be allocated to investors and early Starknet contributors (13.1% of the total STRK token supply). release For transfer and sale. It is already estimated to be worth more than $2.15 billion, according to premarket data. transaction price.

Airdrop allocations, which are usually reserved for project teams and investors, are locked for a period of at least one year or longer for various reasons. Doing so can help ensure the team’s long-term commitment to the project, prevent initial volatility in token prices if internal parties sell large amounts of tokens, and protect the company behind the airdrop. Securities Litigation.

Cryptocurrency users were quick to note the Starknet airdrop as a departure from standard practice, with some criticizing the quick offloading of tradable tokens to insiders. “predatory” and “Borderline criminal.”

Eli Ben-Sasson, co-founder and CEO of Starkware, acknowledges that the structure of the Starknet airdrop is unusual. But he considers departures from the norm to represent a strength, not a weakness, for Starkware.

“Unlocking it for the team and early investors… is one of the aspects where we can be non-standard,” Ben-Sasson said. decryption. “But we build differently and see things a little differently.”

In Ben-Sasson’s view, longer token lock-ups for investors and contributors are designed to increase trust in the teams behind the projects that initiate airdrops. But industry standards are just one measure of a project’s reliability, he says. And he believes that Starkware has already proven its credibility with users.

“Let’s talk about the elephant in the room,” Ben-Sasson said. “What people are really worried about is whether Starkware or anyone in the Starknet ecosystem will still be working on and passionate about building on Starknet in three months, or in a year.”

“As CEO of Starkware, I will announce this publicly,” he continued. “As far as the eye can see, the only thing on the radar of Starkware’s 150 employees and their extended team is advancing Starknet.”

To emphasize this point, Ben-Sasson cited his personal commitment to the company.

“I left a very lucrative position as an academic professor to do this and I’m not going back,” he said.

Ben-Sasson previously served as a professor at the Israel Institute of Technology in Haifa from 2010 to 2018.

In response to concerns that investors might start dumping STRK tokens as soon as possible in April, impacting STRK’s price and theoretically leaving dedicated community members in trouble, Ben-Sasson said extending the token lock-up period would prevent such a scenario. He emphasized that it cannot be prevented. .

“These concerns could happen even a year later,” he said.

According to the former academic, Starkware ultimately decided to make STRK’s token lock-up period for investors and contributors much shorter than other airdrops. Because these individuals deserve to be rewarded for their contributions. The CEO believes there is no risk of him or his team exploiting the airdrop structure inappropriately.

“When we are fully confident in our long-term commitment to the advancement of Starknet, it is not right to delay it unnecessarily,” Ben-Sasson said.

Editor: Andrew Hayward

Stay up to date with cryptocurrency news and receive daily updates in your inbox.