Stem Stock: Waiting for Your Software (NYSE:STEM)

Petmal

Here at the lab, we have a positive view of battery energy storage system companies following the chicken-and-egg publication on superchargers and electric vehicles in 2020. In the final analysis, we recently analyzed Stem (New York Stock Exchange: Stem) was We are moving in a positive direction in the second half of 2023; But looking back on our research and incorporating Stem’s third quarter results, we are now more cautious. Today we’ll briefly discuss last quarter’s results and implement changes for the next visible period. Our Buy rating is supported by long-term growth thanks to its asset-light business model and favorable environment. Our team is disappointed with the company’s share price, and Stem’s stock is currently trading at $3.7 per share. In reality, Wall Street no longer justifies the company’s valuation, and we partially agree.

Third quarter results Negative & Positive Take

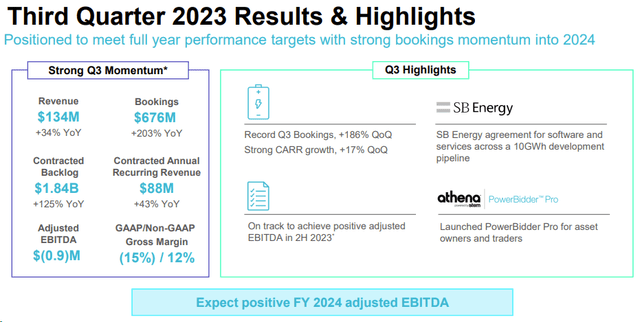

In the third quarter, the company delivered mixed results that included a top-line adjustment to its historic hardware sales. Stem confirmed its outlook for positive adjusted EBITDA in the fourth quarter of 2024. However, at last assessment, we expected 75% of total company revenue to be in the second half of the year, with third-quarter revenue guidance of between $165 million and $195 million and bookings between $350 million and $425 million. It was reported that it was done. Given Stem’s 2024 growth targets, we project positive EBITDA in 2024. Looking at the details, Stem reported a one-time negative $37 million in hardware sold last year. Third quarter revenue grew 34% to $134 million, well below our expectations, while non-GAAP gross margin was 12.5%. Third quarter bookings grew 203% year-over-year to reach $676 million, well exceeding our optimistic guidance. Nonetheless, the company has previously provided some assurances that the value of its hardware will not decrease. But this adjustment proved a different story and suggested another risk to consider. The company also lowered its fiscal 2023 top-line revenue target to between $513 million and $613 million and narrowed the scope of the adjustments. The EBITDA outlook changes from a loss of -5/-$35 million to a loss of -15/-$25 million. This new outlook implies fourth quarter adjusted EBITDA of between -$1 million and +$9 million. The positive is that bookings remained at a total of $1.4 billion to $1.6 billion. Our team is now more cautious about cash and cash equivalents. In the first half of the year, Stem ended the quarter with $140 million and was told to increase cash levels by $10 million at the end of the year. Lower numbers are now expected once third quarter results are posted.

Stem Q3 results in a snap.

Change in estimate

Based on the results, we have revised our 2023-25 Adjusted EBITDA forecast from $(21)/75/150 million to $(20)/20/85 million. The above figures are based on 2023, 2024, and 2025 revenues of $565, $865, and $1.2 billion. Looking ahead to fiscal 2024, the company ended the third quarter of 2023 with $125 million in cash and cash equivalents, and top management has a year-end cash balance of $150 million. Our team sees this as achievable, but we also know that the move to a modular solution is critical to the company’s future cash flow. Stem expects to improve working capital. However, we are now more cautious after the higher cash conversion cycle recorded in 2023. As has already happened with other growth stories, we are now more cautious about our long-term growth aspirations. Looking back, Stem’s sales in 2023 are up 31% compared to the previous year. On the positive side, we believe Stem is a clear beneficiary of IRA-centric storage demand. The company announced a partnership with SB Energy to support procurement to provide software for its 10 GWh North American project portfolio. On the positive side, we still see Athena as an important differentiator, and PowerBidder Pro will help the company achieve higher software sales. There are also cross-selling opportunities, although still minimal. Nevertheless, it should be noted that demand for electric vehicles was lower than expected.

Stem Contract Win

Conclusion and Evaluation

Our internal team has always viewed Stem as a leader in the growing energy storage market. Combined with the Athena platform, the company has the advantage of integrating solar monitoring with EV charging applications. A key milestone for Stem is progress toward profitable growth, and we must also focus on growing the company’s software sales. Here at the lab, it’s important to emphasize how STEM is a high-risk/reward investment, and the company has yet to report quarterly earnings. Therefore, we decided to lower our Buy rating and target price from $9 per share to $4.2 per share. This is based on an EV/EBITDA multiple of 6.5x. Peer Multiple proposes this objective valuation. Nonetheless, Stem’s backlog currently stands at $1.84 billion, supporting solid revenue visibility well into 2024 and beyond. We are looking forward to leveraging our software (low capital intensity, high margins). The lower price target is due to lower profit estimates and lower margin expansion for the visible period. Additionally, there is uncertainty about the acceleration of storage capital investments, and these risks cannot be overlooked.