STMicroelectronics: 2024 Will Be a Year of Transformation (NYSE:STM)

sinology/Moment via Getty Images

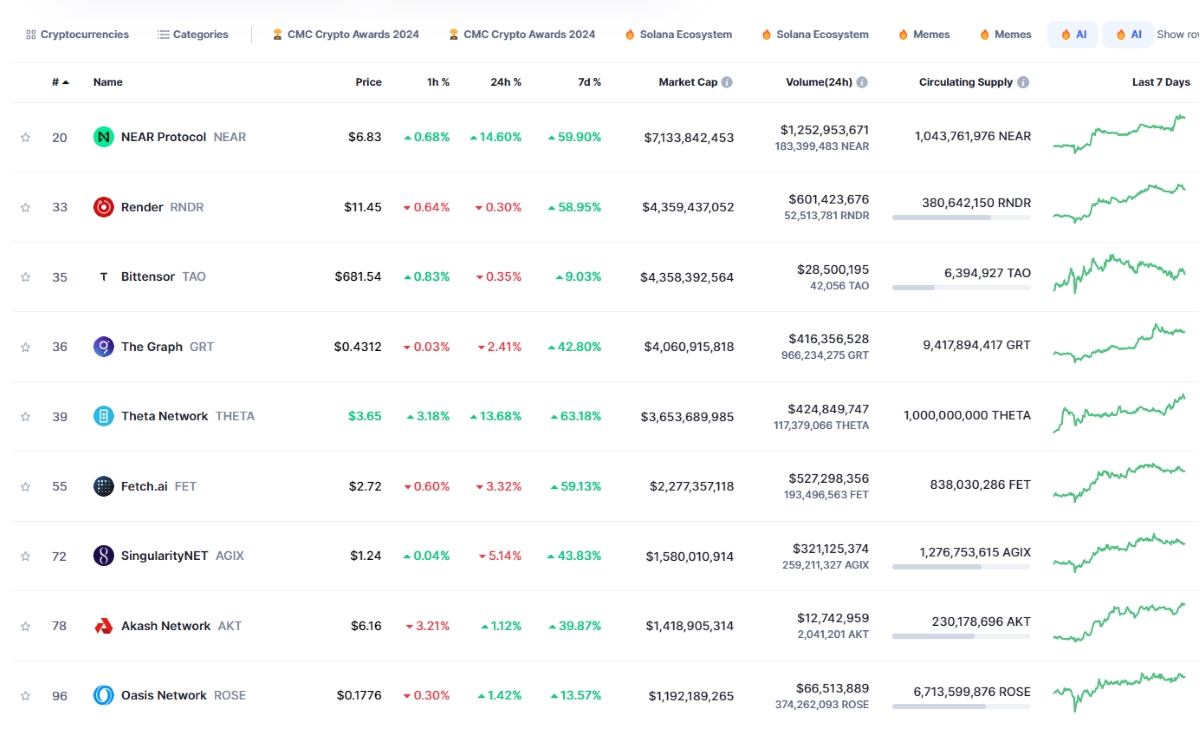

ST Microelectronics (New York Stock Exchange: STM) reported its fourth quarter earnings on January 25th. In our previous coverage, we presented a ‘strong buy’ thesis highlighting the solid growth of automotive silicon carbide despite the sluggish personal electronics market in FY23. Considering the following Regarding the challenges expected for the industry in FY 2024, I see this year as a transition year for STM. Therefore, we maintain a ‘strong buy’ opinion with a fair value of 73 euros.

Automotive Silicon Carbide Growth and Inventory Replenishment

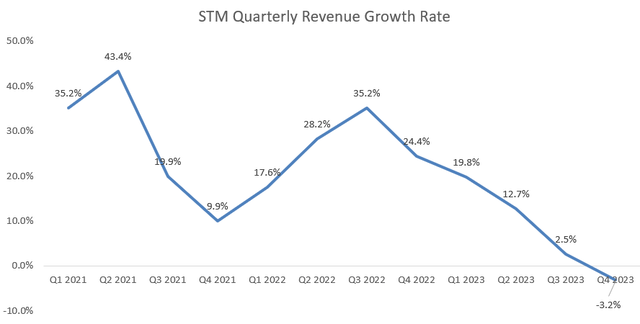

In the fourth quarter of 2023, STM recorded revenue growth of -3.2% and gross margin of 45.5%, slightly below initial expectations, primarily due to slower growth in the automotive segment. The automotive market currently accounts for 41% of the group’s revenue and is experiencing 33.5% year-on-year growth, driven by the adoption of electric vehicles and the growth of silicon carbide, as I previously reported..

STMicroelectronics Quarterly Results

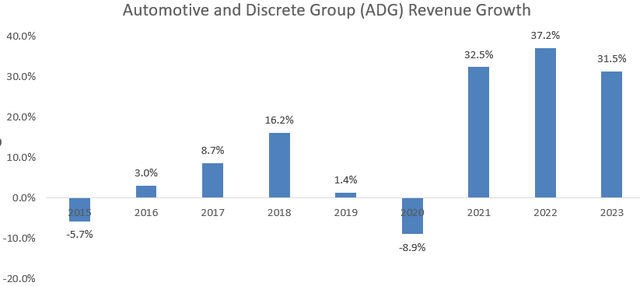

In the automotive silicon carbide segment, STM achieved sales of $1.14 billion in FY23, accounting for 6.6% of group sales. On the earnings call, management expected silicon carbide sales to reach $1.5 billion to $1.6 billion in FY24 and $2 billion in FY25. As illustrated in the accompanying charts, growth in silicon carbide and ADAS played a significant role in boosting the performance of both Automotive and the individual groups.

STMicroelectronics Annual Report

I agree with STM’s revenue forecast for its silicon carbide business for several reasons. First, STM has invested significantly in expanding its silicon carbide manufacturing facilities. In their earnings call, they revealed expansions underway at facilities across Catania, Singapore, Morocco and China. They have also started production at their new integrated silicon carbide substrate manufacturing facility in Catania. The imminent launch of silicon carbide manufacturing in China, expected in the fourth quarter of 2025, further strengthens our global manufacturing capabilities, setting the stage for substantial growth in the coming years.

Second, STM’s plan to expand its 300mm wafer production capacity is promising. They have qualified a new 300mm wafer fab in Italy for production and signed a tripartite agreement with the French state and Global Foundries for another facility. This expansion will enable STM to produce advanced silicon carbide products for automotive OEMs, strengthening its market presence in the near future.

Despite the optimistic outlook for its silicon carbide business, STM faces challenges such as adjusting ADAS inventory for certain customers starting late in the third quarter of 2023. This adjustment is expected to last until FY24, which will create a growth headwind for the automotive sector. STM also expects capacity reservation fees to decline in FY24 due to improving supply chain conditions. This is because automotive OEMs no longer need to secure their supply through these fees. As a result, STM expects a revenue headwind of approximately $800 million in FY24. Nonetheless, the long-term prospects for silicon carbide remain attractive. This is especially true considering the rapidly growing demand for electric vehicles globally, with the World Economic Forum highlighting that EV production must increase 18-fold by 2030 to meet emissions targets.

Industrial inventory correction

STM’s industrial business, which accounts for 30% of the group’s revenue, recorded revenue growth of 11.4% in FY23. However, the company started witnessing end market inventory adjustments from the late third quarter of FY23. Accordingly, the industrial market growth rate in the first half of 2024 is expected to be negative.

It is noteworthy that approximately 65% of STM Industries’ business is derived from the factory automation and industrial infrastructure end markets, with the Consumer Products industry contributing 25% of its revenue, as disclosed at the date of analysis. A slowdown in the factory automation and consumer goods industry markets seems logical. The industrial sector has received a boost during the pandemic as consumers purchase higher-than-usual physical goods. However, in the post-pandemic period, concerns about supply chain issues have led to inventory build-up as consumption of physical goods has slowed. The entire industrial market is now faced with the challenge of rectifying this excess inventory, which poses a growth headwind for STM in FY24.

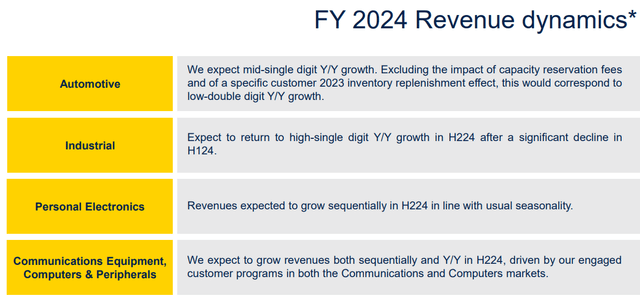

FY24 Outlook

STM expects automotive growth to reach mid-single digits in FY24, industrials to mid-teens and personal electronics to low-teens, as outlined in the attached slide. Excluding the impact of ADAS inventory issues and capacity reservation fees, the automotive business is expected to grow 13% year-on-year.

STMicroelectronics Q4 FY23 Presentation

In fact, considering the guidance provided, market dynamics are expected to be weak in both industrial and personal electronics segments. As discussed earlier, industrial markets are poised to undergo an inventory correction in FY24, while rising interest rates are expected to slow consumer demand for physical goods. Assuming 5% growth in automotive, 15% decline in industrials and 11% decline in personal electronics, total revenue in FY24 would decline by approximately 4.5%. This highlights the notion that 2024 is likely to be a transition year for STM as it navigates changes in market cycles.

Assessment updates

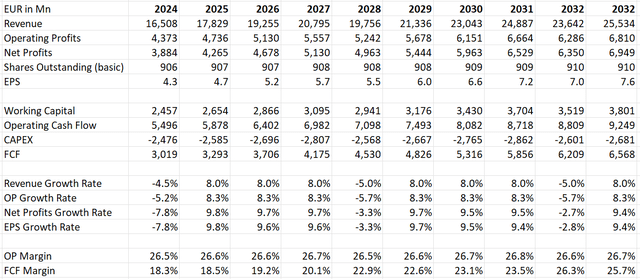

As analyzed above, revenue is expected to decline by 4.5% in FY24, reflecting weakness in the industrial and personal electronics markets. The company also faces $800 million in capacity reservation fees in FY24. I have revised my revenue projections for the next 10 years from my current model. All three major end markets are cyclical in nature, so the new assumptions reflect the cyclical nature of the STM business model. I assume 8% revenue growth in the upcycle period, consistent with historical averages, and -5% growth in the downcycle period, using FY24 as a proxy.

Their operating margins are determined purely by operating leverage. I calculate a 10 basis point margin expansion in up cycle years and a 20 basis point margin contraction in down cycle years, assuming 70% of operating expenses are fixed.

On the capital expenditure side, STM is guiding for $2.5 billion in FY24, a significant decline compared to the $4.1 billion level in FY23. The reduction in capital expenditures makes sense to me since the company has already expanded several manufacturing facilities over the past few years. Updated new assumptions in the model.

The remaining assumptions remain the same and the fair value is estimated to be EUR 73 per share, or USD 78 per share using current exchange rates. The stock is currently trading at only 12 times forward free cash flow, which I think is a significant discount.

STMicroelectronics DCF – Author’s Calculations

main risks

As highlighted in a previous article, STM’s silicon carbide business faces stiff competition from ON Semiconductor (ON) and Infineon Technologies (OTCQX:IFNNY). ON Semiconductor generated $800 million in silicon carbide revenue in FY23, quadrupling from FY22. The company has been investing heavily in its silicon carbide manufacturing facility, as disclosed in its fourth quarter 2023 results. Significant progress has also been made in 200mm technology.

Infineon Technologies aims to achieve silicon carbide sales of €500 million, representing a 50% year-on-year growth, as stated in its Q1 FY24 earnings call.

It is important for STM’s shareholders to closely monitor the competitive dynamics and performance of ON Semiconductor and Infineon Technologies. These developments will provide valuable insight into the market environment and potential impact on STM’s silicon carbide business.

conclusion

Given the temporary nature of the industrial market inventory correction and the outlook for FY24, STM’s transition year, I maintain a “Strong Buy” recommendation with a fair value of €73 per share.