Stock market investors face another ugly election. Does history offer comfort?

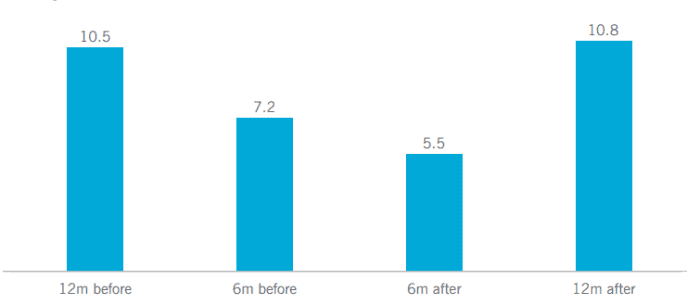

Here’s some good news for investors nervous about the highly contentious 2024 U.S. presidential election. History shows that stocks tend to rise the day before Election Day.

But Saira Malik, chief investment officer at Nuveen, which has $1.2 trillion in assets under management, said there are problems: The S&P 500 SPX, on the other hand, has averaged total returns of about 10% in presidential election years based on data going back to 1928. , the large-cap benchmark has already rebounded more than that between early November and the end of last year.

In other words, these pre-election gains may have already occurred.

“This is an interesting statistic and one of the many reasons we are a little more concerned about stocks coming out in early 2024,” Malik said in a phone interview with MarketWatch.

Quilted

Other reasons include the tendency for markets to become more volatile during election years and concerns that investors are still pricing in more interest rate cuts than the Fed is likely to deliver, Malik said. Stocks are also expensive, she noted, with the S&P 500 trading at about a 20% premium to its average value since 2010.

Investors also know that the 2024 election will be highly contentious. Donald Trump enters Tuesday’s Republican primary as the clear front-runner for his party’s nomination as he seeks a rematch with President Joe Biden in November.

Washington Clock: New Hampshire Republican Primary: With Trump cruising toward the 2024 nomination, Haley is looking to change things up.

Trump is campaigning amid numerous legal challenges. President Trump has been indicted in Washington, D.C., and Fulton County, Georgia, on charges of election interference, and was indicted last year in a secret documents case and a secret documents case. He denied any wrongdoing and claimed prosecutors were politically motivated, repeating his false claims about his 2020 presidential election loss.

Biden faces low approval ratings, including from his own party. An ABC News poll this week found that 57% of Democrats and Democratic-leaning independents would be satisfied with Biden’s nomination, while 72% of Republican-leaning adults would be satisfied with Trump being the party’s nominee.

Meanwhile, concerns about political dysfunction in the United States are growing. Last year’s federal debt ceiling showdown and Kevin McCarthy’s loss of the House speakership highlighted concerns among some investors that trust in U.S. institutions and governance is beginning to erode.

see: What America’s Political Dysfunction Means for the Stock Market and Investors

As the election approaches, an increasingly contentious political backdrop could be a recipe for increased market volatility. Malik said the outcome of a contested election could lead to further volatility.

Additionally, a presidential election year means investors should brace for a deluge of charts and tables analyzing historical market performance for the quadrennial event.

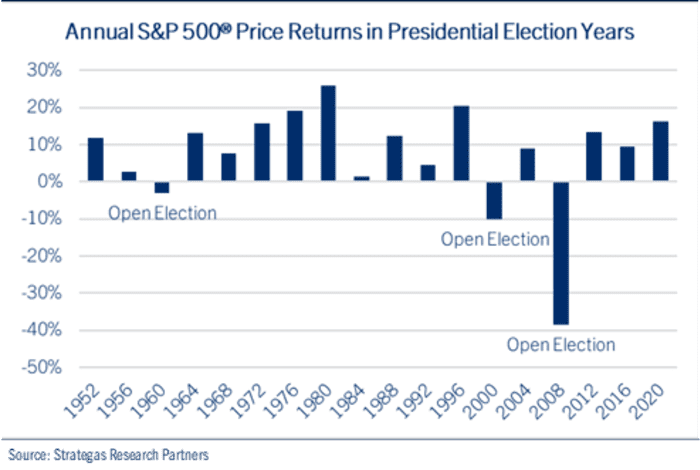

John Lynch, chief investment officer at Comerica Wealth Management, acknowledged the “risk of a jinx,” when stocks decline annually when a sitting president runs for re-election (whether he wins or loses). We have highlighted below that we have never recorded . This includes 2020, when stocks tumbled in February and March due to the COVID-19 pandemic, but soon recovered and posted an annual gain.

Strategist at Research Partners

Going back to 1952, the index has only declined three times in election years: 1960, 2000, and 2008. Lynch pointed out that all three were “open” election years in which no incumbent was running for re-election.

Still, the market’s performance may be telling of a candidate’s prospects, as long as it reflects the economy. Lynch pointed out that every president who avoided a recession in the two years before his re-election won a second term, while every president who suffered a recession during that period ended up losing.

He noted that stocks typically perform better in presidential election years when the incumbent president wins. Ultimately, a strong economy and markets likely mean voters’ feelings toward the incumbent president are lagging.

Meanwhile, the pattern of years in which incumbents lose tends to include a pair of selloffs. One during the height of primary season in early spring and the other after party conventions in late summer.

This gives the stock market a seemingly powerful predictive power, Lynch said.

Citing data from Strategas, Lynch said that in 24 presidential elections since 1928, the direction of the index has influenced the election results. If the S&P 500 index is positive in the three months preceding an election, the incumbent or the candidate of the incumbent party is winning. Among the four cases where the index was inaccurate, the index increased, but the incumbent candidate still lost.

U.S. stocks have had a strong rally in 2023. This coincided with the so-called presidential cycle, which typically sees a solid uptick in the third year of a president’s term. Stocks were consolidated to start the new year, but the week ended on a strong note, with the S&P 500 hitting its first all-time high in more than two years.

see: After a record high for the S&P 500, here’s what history tells us can happen next:

The Dow Jones Industrial Average DJIA also posted a record close for the week, up 0.7%, while the Nasdaq Composite COMP rose 2.3% for the week as technology stocks reaffirmed their leadership.

Meanwhile, strong technical performance may reflect consumer concerns about sustainability, Nuveen’s Malik said. The company argues that the combination of cyclical risks and politically inspired volatility provides a rationale for taking a defensive strategy.

This includes a focus on stocks of dividend growth companies that have consistently increased their dividends over time, as well as global infrastructure companies that may see additional benefits from trends favoring reshoring, nearshoring and other supply chain changes. This includes:

Malik said dividend growth and global infrastructure stocks have historically underperformed the market relatively well, underscoring Nuveen’s concerns about a possible downside following the “very strong” equity rally seen in the final two months of 2023.