Stock Market Today: NVDA Report, Tech Lagging, Financials Leading | ChartWatchers

key

Takeaway

- The leading sector today is finance, followed by healthcare and public services.

- Technology stocks were heavily sold off and were among the worst performers in the sector.

- Financial stocks could rally further as a rate cut is expected at the next FOMC meeting.

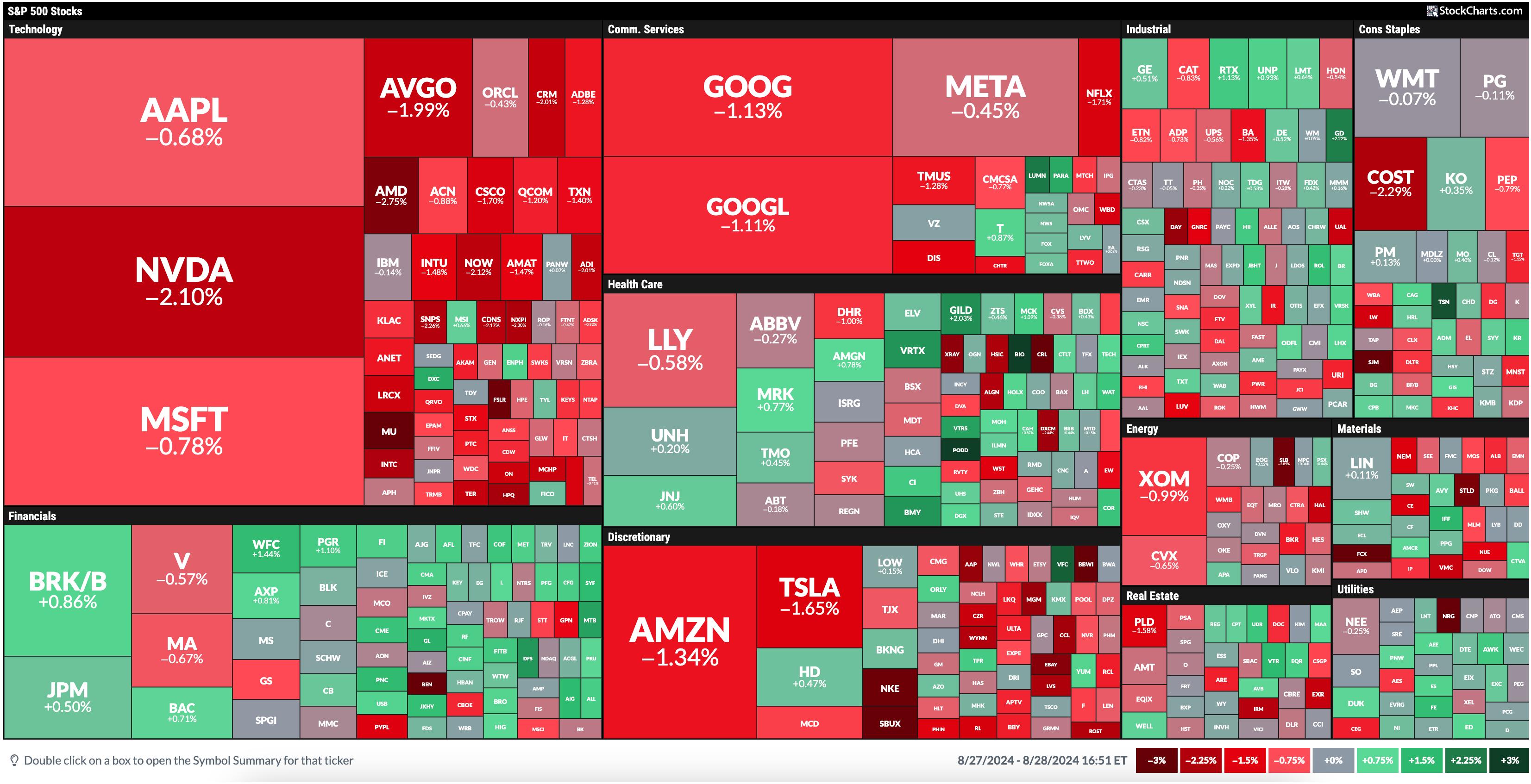

Today’s MarketCarpet was a sea of red with a few green spots. Financials led the pack, followed by healthcare and utilities.

Figure 1. Red Sea. Today’s stock market action was dominated by selling pressure, but there was more buying in some sectors.Image source: StockCharts.com. For educational purposes only.

The technology sector, yesterday’s leader, is on the bottom today. The three largest stocks in the sector by market cap, Apple (AAPL), Nvidia (NVDA), and Microsoft (MSFT), were sold off, with NVDA down 2.10%. This is ahead of NVDA’s gains. Reported after the close. NVDA beat estimates and provided strong guidance, but stocks were extremely volatile and faced more selling pressure.

Given that NVDA makes up about 7% of the S&P 500 ($SPX) and about 8% of the Nasdaq Composite ($COMPQ), the indexes are following NVDA’s path. We’ll have to wait until tomorrow’s market open to see if things settle down.

Find investment opportunities

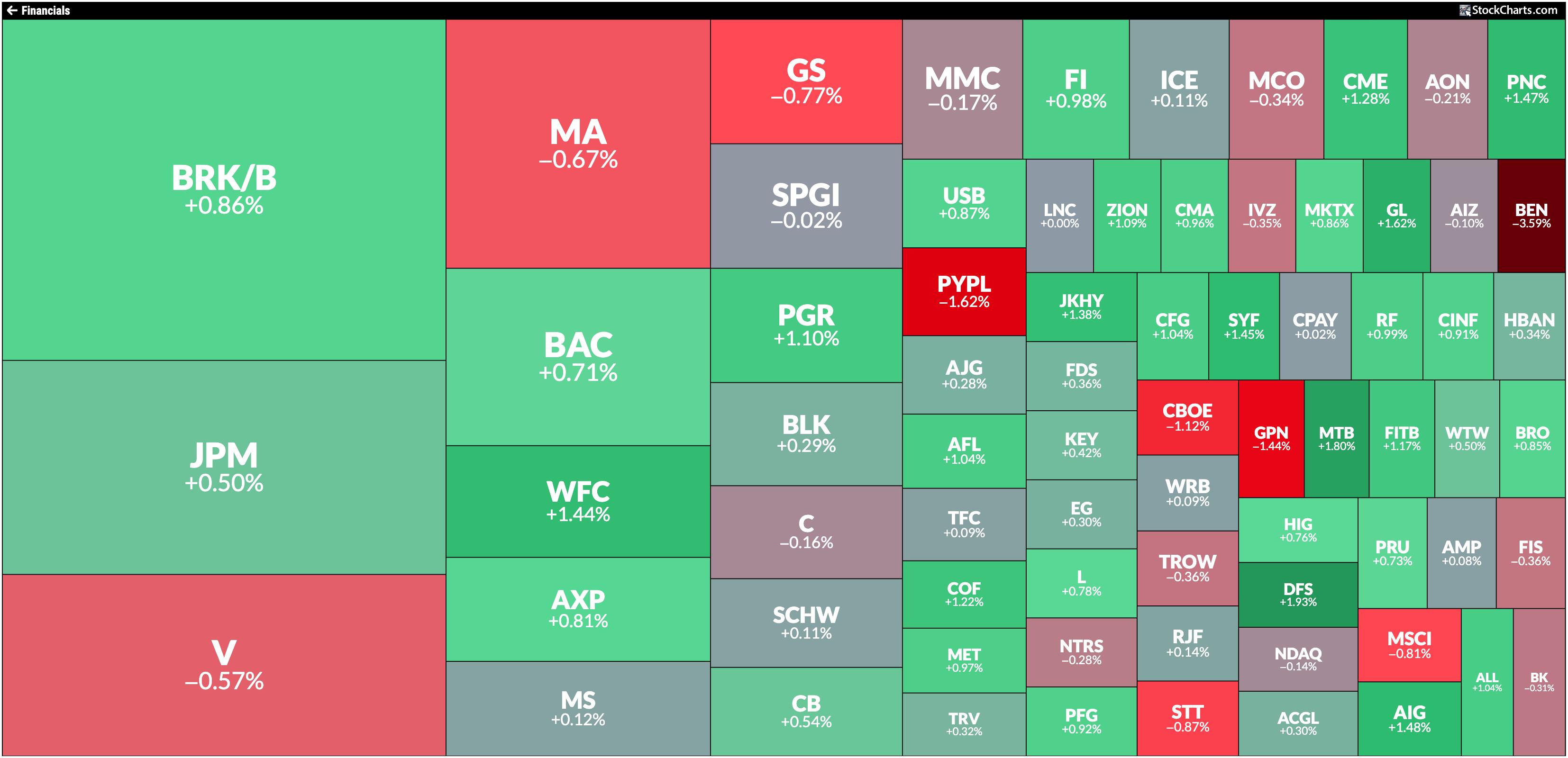

Let’s take a closer look at the sectors that have been showing stability in the stock market. One sector that stands out is financials. In yesterday’s post, we focused on the Financial Select Sector SPDR Fund (XLF), which continues to make new all-time highs. In today’s MarketCarpet, the Financials quadrant was led by Discover Financial (DFS), up 1.94%.

The XLF daily chart below shows that XLF is trading above both the 5-day exponential moving average (EMA) and the 20-day simple moving average (SMA).

Figure 2. Daily chart of the Financial Select Sector SPDR Fund (XLF). XLF is starting to show strength compared to the SPDR S&P 500 Fund (SPY). The ETF is also trading above the 1-week EMA and the 20-day SMA.Chart source: StockChartsACP. For educational purposes only.

Also, note that XLF is outperforming the SPDR S&P 500 Fund (SPY), currently outperforming SPY by about 1.06%.

While all eyes are on tech, telecom services, and consumer discretionary stocks, financials have been quietly gaining ground. With the next FOMC meeting just weeks away, XLF could continue to rally. Since Fed Chair Jerome Powell said on August 23rd in Jackson Hole that the Fed is ready to cut rates, XLF has continued to hit new all-time highs. With rate cuts expected this year (the CME FedWatch tool says the target rate could be 4.25%-4.5% by December), just think how high XLF could go!

If you’re tired of investing in ETFs, consider picking a few stocks from the financial sector. Click on the Financials header on MarketCarpet to see stocks from that sector.

Figure 3. Financial Sector Market Carpet. The largest squares represent the largest stocks by market capitalization, and the darkest green squares represent stocks with the largest gains.Image source: StockCharts.com. For educational purposes only.

At the end

The stock market can be very volatile, especially around the time of a big earnings report. To avoid getting caught up in all the market noise, identify sectors that are showing stability. Right now, that could be the financial sector. But that can change, so be flexible and be prepared to sell your positions as you see the situation changing.

Stock chart tips.

Stock chart tips.

Create a chart list It is one of 11 sector ETFs that StockCharts uses as sector proxies.

disclaimer: This blog is intended for educational purposes only and should not be construed as financial advice. The ideas and strategies should not be used without first evaluating your personal and financial situation or consulting a financial professional.

Jayanthi Gopalakrishnan is the Site Content Director at StockCharts.com. She spends her time devising content strategy, delivering content that educates traders and investors, and finding ways to make technical analysis fun. Jayanthi was the Editor-in-Chief of T3 Custom, a content marketing agency for financial brands. Prior to that, she was the Technical Analysis Editor at Stocks & Commodities magazine for over 15 years. Learn More