Stocks maintain “move” trend amid slim leadership in technology and utilities | GoNoGo Chart

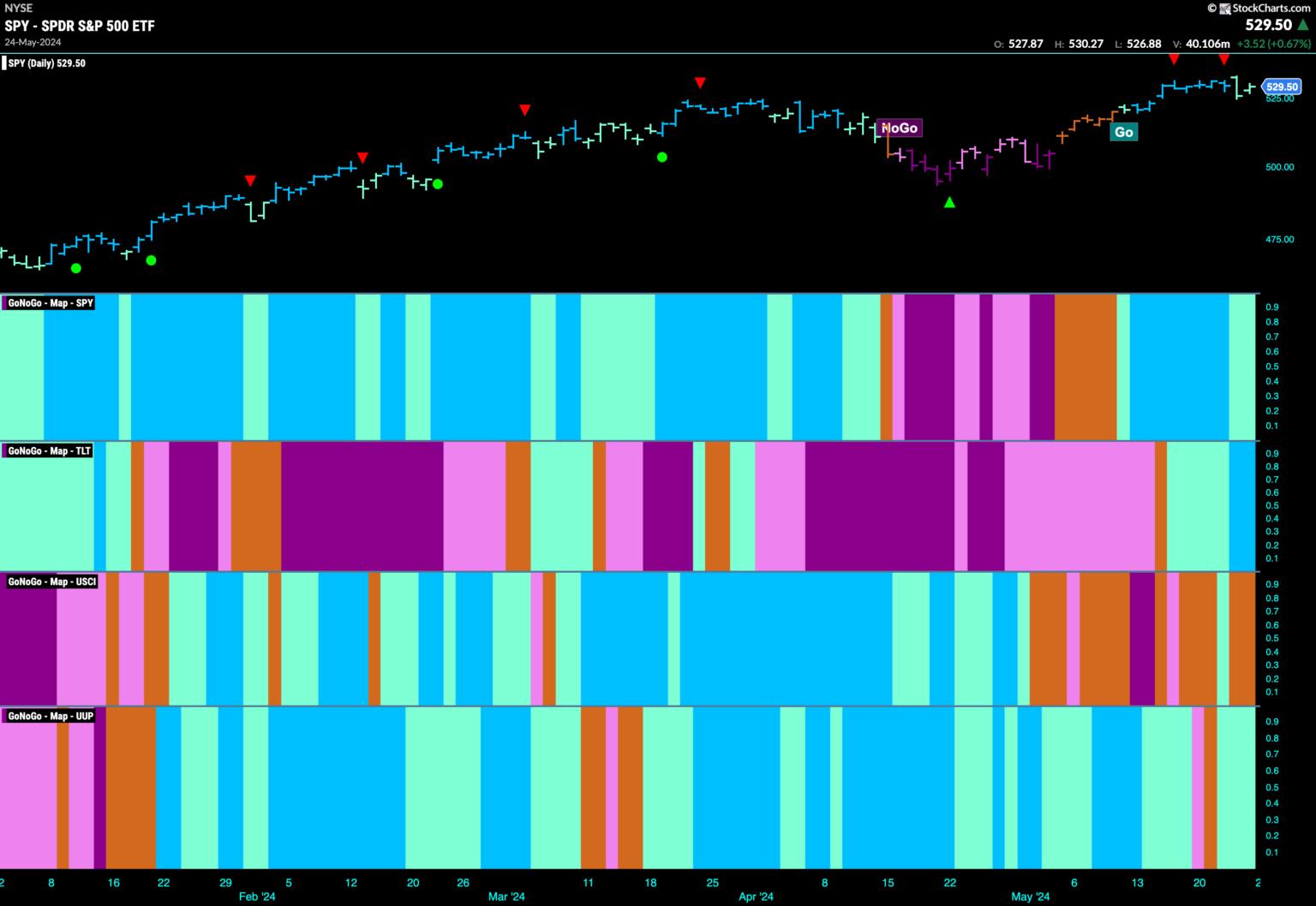

good morning. Welcome to this week’s Flight Path. There was some weakness this week, with prices falling slightly from their all-time highs. As momentum cools, we see this in the form of Go Countertrend Correction Icons (red arrows) and the GoNoGo Trend draws weaker aqua bars. Treasury bond prices showed strength and drew a blue bar. U.S. commodity indices continued to show market uncertainty and the dollar regained its “Go” color, albeit on a weaker note.

$SPY shows investors digesting profits

“Go” remains in place this week, but prices have cooled as the market absorbs the gains we have seen over the past few weeks. Towards the end of the trading week, we saw weakness in the GoNoGo Trend as it drew two aqua bars. Now let’s take a look at the oscillator panel and watch the GoNoGo oscillator approach the zero line. We will look to find support at this level and see if it bounces back into positive territory. If so, we will see a Go Trend Continuation (green circle) and can expect the price to attack towards new highs.

Looking at the larger weekly chart, we can see that the bigger picture remains extremely bullish, with another strong blue bar painted and the price hitting an all-time high. The GoNoGo Oscillator is in positive territory but not yet overbought after finding support at the 0 level.

Treasury yield flash “Go Fish” bar

GoNoGo Trend couldn’t continue painting the amber “Go Fish” bars because it ended last week. As the price rose from the most recent lows, the indicator moved away from the “NoGo” color and painted a few uncertain “Go Fish” bars. Now it will be important to note which direction the trend will go next. Going back to a “NoGo” bar, which could be positive for the stock, a transition from amber to a “Go” color could spell trouble. The GoNoGo Oscillator rides the zero line where you can see the start of the GoNoGo Squeeze building. The direction of the squeeze break will likely determine the next trend in price.

The dollar has regained its “Go” trend.

After a brief flirtation with the “NoGo” and “Go Fish” rods, the buck was able to regain its “Go” color, albeit a weak turquoise. This is an inflection point for the dollar, as you can see the GoNoGo Oscillator is retesting the zero line below. The oscillator has been in negative territory for several weeks now, so it needs to get back into positive territory for the “Go” trend to survive. If so, we will likely see the “Go” trend strengthening. If it is rejected again at level 0 we would expect further price struggles.

The weekly chart continues to show how important these levels are. Now the GoNoGo oscillator has fallen back to the zero line as the price tries hard to find support at its previous higher levels than a year ago. I’ll see if I can find support here. If so, you will see a Go trend continuation icon (green circle) below the price bar as the oscillator bounces into positive territory, signaling a resurgence of momentum in the direction of the underlying “Go” trend.

Tyler Wood, CMT, co-founder of GoNoGo Charts, is committed to expanding the use of data visualization tools that simplify market analysis, removing emotional bias from investment decisions. Tyler has served as Executive Director of the CMT Association for over 10 years to advance investor proficiency and skill in mitigating market risk and maximizing capital markets returns. He is a seasoned business executive focused on educational technology for the financial services industry. Since 2011, Tyler has presented technical analysis tools to investment firms, regulators, exchanges and broker-dealers around the world. Learn more

Alex Cole, CEO and Chief Market Strategist at GoNoGo Charts, is a market analyst and software developer. For the past 15 years, Alex has led technical analytics and data visualization teams, directing business strategy and product development of analytics tools for investment professionals. Alex has created and implemented training programs for large corporations and individual clients. His lectures cover a wide range of technical analysis topics, from introductory to advanced trading strategies. Learn more