Stocks making the biggest moves midday: NVO, DVA, XOM, AMGN

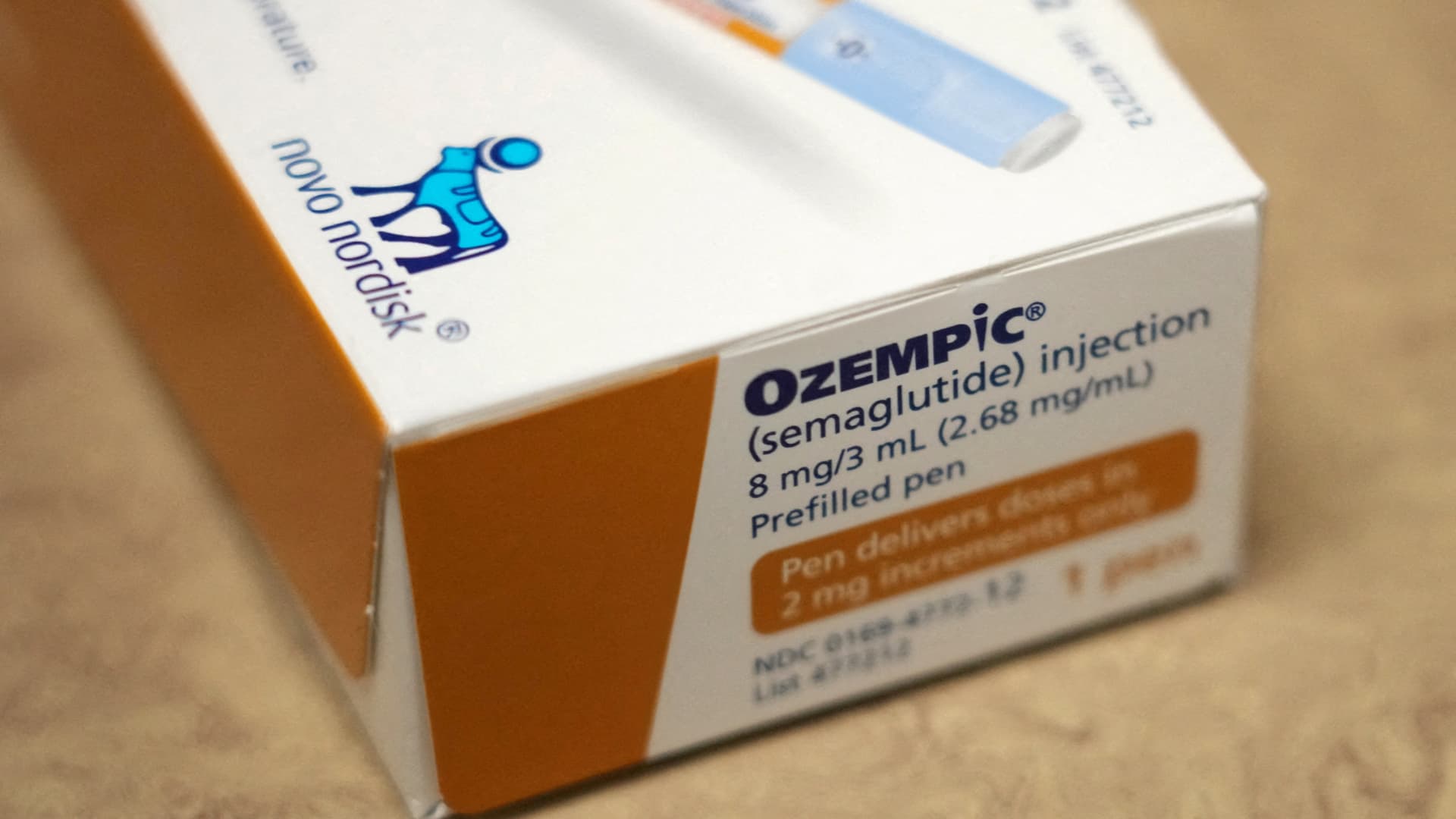

A box of ‘Ozempic’, a semaglutide injection for the treatment of type 2 diabetes, made by Novo Nordisk.

George Frey | Reuters

Check out the companies making big moves midday.

novo nordisk — Shares of the Danish drugmaker added 6.27% late Tuesday after a committee said it was pausing Ozempic’s kidney disease treatment trial after it said an analysis showed signs of success. ellie lilywhich makes the diabetes treatment Jajaro, rose 4.48%.

davita, Fresenius Medical Care, Baxter International — Shares of dialysis providers DaVita and Fresenius Medical Care fell 16.86% and 17.57%, respectively, on the Novo Nordisk news. Baxter International, which makes products for chronic dialysis therapy, fell 12.27%.

ExxonMobil, pioneer natural resources — Exxon Mobil shares fell 3.59% after the largest U.S. oil and gas producer agreed to buy shale rival Pioneer Natural Resources for $59.5 billion, or $253 per share, in an all-stock deal. Pioneer shareholders will receive 2.3234 Exxon shares for each Pioneer share. The transaction, the largest since Exxon acquired Mobil, is expected to close in the first half of 2024. When this news came, Pioneer’s stock price rose 1.44%.

humana — Shares fell 1.39% after CEO Bruce Broussard said he would step down from his position in the second half of 2024. The company named Jim Rechtin of Envision Healthcare as his successor.

Amgen — The biopharmaceutical stock rose 4.55% after being upgraded to outperform by Leerink. Analyst David Risinger cited expanding revenue multiples and pipeline news flow as catalysts.

Scholes Technologies — The stock rose 5.26% after being upgraded to Neutral Buy by Goldman Sachs. The investment bank cited valuation and gross margin upside potential.

alliance finance — The provider of loans to midsize businesses fell 2.12% after CEO Jeffrey Brown announced plans to step down effective Jan. 31, 2024.

Walgreens Boots Alliance — The drugstore chain added 0.98% after former Cigna executive Tim Wentworth was named CEO, effective Oct. 23.

consistent — The stock surged 5.23% in midday trading. Coherent announced Tuesday that Japanese companies will invest $1 billion in Coherent’s silicon carbide business. On Wednesday, B. Riley upgraded the stock to buy from neutral, saying Coherent’s silicon carbide business could be worth more than the Street’s current estimates.

plug power — The battery company rose 5.31% after forecasting revenue to rise sharply to about $6 billion by 2027, according to a regulatory filing.

Take-Two interactive software — Shares rose in midday trading but closed 0.34% lower after Raymond James upgraded to outperform the market. The company said it is seeking a path to more consistent video game releases and a reasonable valuation, building on Take-Two Interactive’s upcoming Grand Theft Auto 6.

— CNBC’s Michael Bloom, Ha-Kyung Kim, Yun Li and Lisa Han contributed reporting.