Stocks suffer strong “NoGo” as materials attempt to contain damage | GoNoGo Chart

good morning. Welcome to this week’s Flight Path. The stock “Go” trend is over. We saw an amber “Go Fish” bar indicating uncertainty followed by a pink “NoGo” bar, followed by a strong purple bar as the week continued. Treasury prices maintained a strong “NoGo” trend as we saw persistent “NoGo” purple bars throughout the week. Commodity prices went through a weak period, drawing a strong blue bar over the weekend. The dollar strengthened throughout the week with a GoNoGo trend. All bars were colored dark blue “Go”.

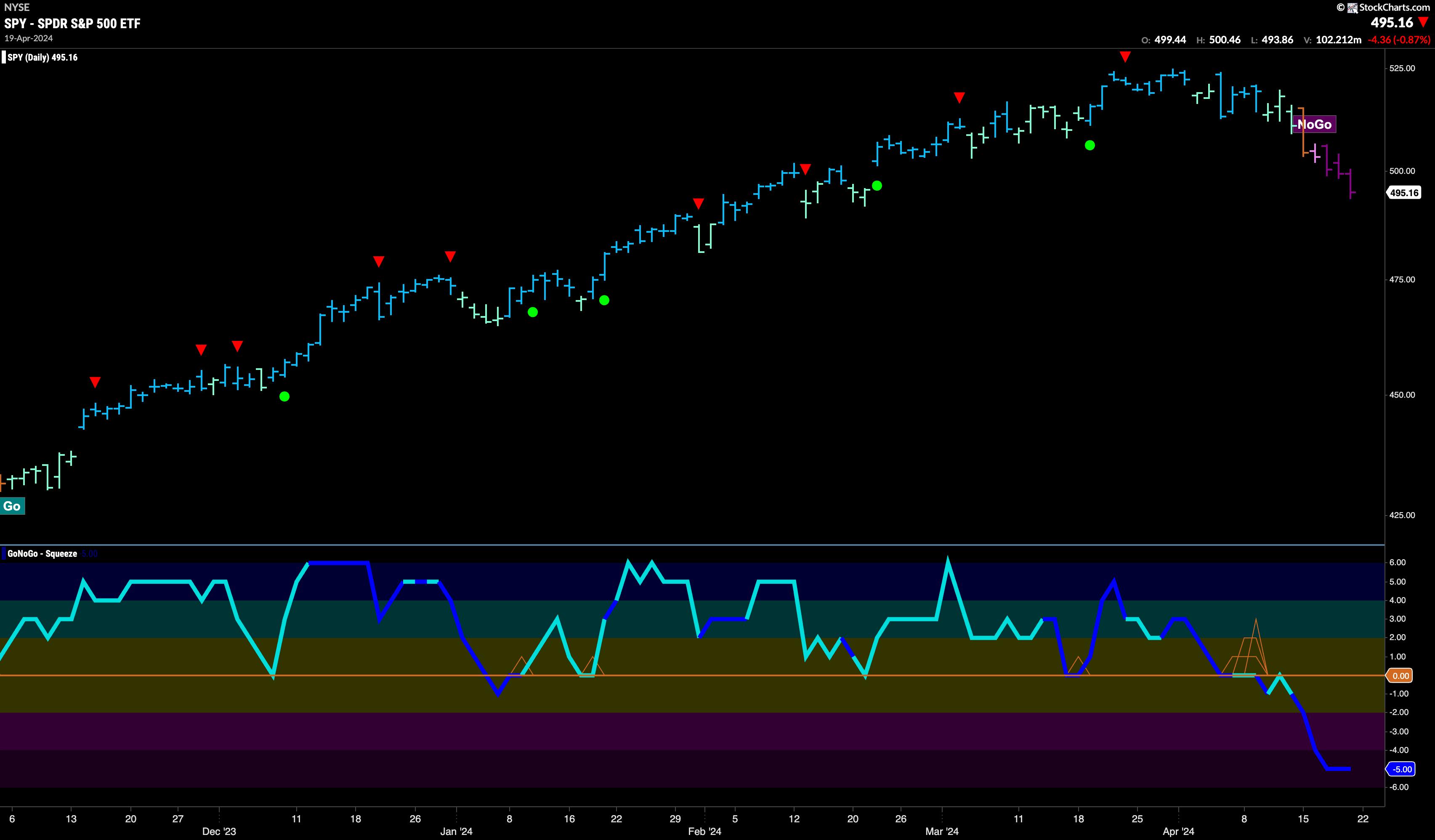

The stock goes “NoGo.”

Last week we pointed out the weakness seen in the “Go” trend. The last high triggered the Go Countertrend Correction icon (red arrow), which indicates that prices may struggle to move higher in the near term. Prices have mostly moved sideways or away from the highs since then, and the technical landscape has changed over the past week. First, the amber “Go Fish” bar reminded us that there was uncertainty in the current trend, which soon gave way to a pink “NoGo” bar. Without looking back, the latter part of the week saw a strong purple “NoGo” bar appear as the price gradually lowered.

Last week, a Go Countertrend Correction icon (red arrow) was added to the lighter cyan “Go” bar. This week we see the price fall further from the most recent high as the GoNoGo trend draws its second weakest aqua bar. If you look at the oscillator panel, you will see that it is rapidly approaching the zero line. This will be the next important test of this “Go” trend. As the price continues to fall, we will want to see support where the oscillator finds itself at 0. Finding this allows you to expect the price to hit a new low and look for signs of a continuation of the trend. If the oscillator fails to find support at the zero line, we can see a deeper correction and possible trend change in the price panel.

Exchange rates in a strong “Go” trend

We’ve seen a strong blue “Go” bar in Treasury yields for a week now. After hitting record highs earlier in the week, the chart has triggered a Go Countertrend Correction icon (red arrow) and we know it will be difficult for the price to move higher in the near term. The GoNoGo oscillator is in positive territory but is no longer overbought. We will see if the trend can continue after some consolidation at these levels.

Dollar pauses at new highs

After the gap rose higher last week, we saw the price consolidating to new higher levels. The GoNoGo trend has been drawing strong blue bars all week and we will be looking at the top of that gap for potential support going forward. The GoNoGo oscillator remains overbought at 5 and is heavily traded. We will be watching to see if the momentum weakens, which will give us a Go Countertrend Correction icon on the chart and lead to further price consolidation.

The long-term chart now clearly shows where to look for long-term support. Last week’s strong price action pushed the price above the horizontal resistance seen at previous highs on the charts. If momentum is overbought, the price is likely to take a breather soon. As we return to neutral territory and potentially move towards the zero line, we will look for price support at horizontal levels and oscillator support at the zero line.

Tyler Wood, CMT, co-founder of GoNoGo Charts, is committed to expanding the use of data visualization tools that simplify market analysis to remove emotional bias from investment decisions. Tyler served as Executive Director of the CMT Association for over 10 years to advance the proficiency and skill of investors in mitigating market risk and maximizing capital markets returns. He is a seasoned business executive focused on educational technology for the financial services industry. Since 2011, Tyler has presented technical analysis tools to investment firms, regulators, exchanges and broker-dealers around the world. Learn more

Alex Cole, CEO and Chief Market Strategist at GoNoGo Charts, is a market analyst and software developer. For the past 15 years, Alex has led technical analytics and data visualization teams, directing business strategy and product development of analytics tools for investment professionals. Alex has created and implemented training programs for large corporations and individual clients. His lectures cover a wide range of technical analysis topics, from introductory to advanced trading strategies. Learn more