Strong returns are causing the sector to rotate into these two groups | MEM edge

The S&P 500’s new highs this week come as the stock plunged on Wednesday’s Federal Reserve news and then rallied behind strong earnings from some Magnificent 7 companies. All three indexes recorded gains for the fourth consecutive week, with interest rates rising sharply following today’s strong employment data that showed a hot labor market along with rising wages.

While this week’s list of winners is led by Meta Platform (META), which surged 20% after posting strong quarterly results and leading growth estimates higher, the following nine standouts from the S&P 500 have consistently outperformed the market since their early days: These were stocks from two sectors. december. These winners are each up more than 9% in the past week on strong earnings and optimistic outlooks, and what’s surprising is that none of them come from the technology or internet sectors.

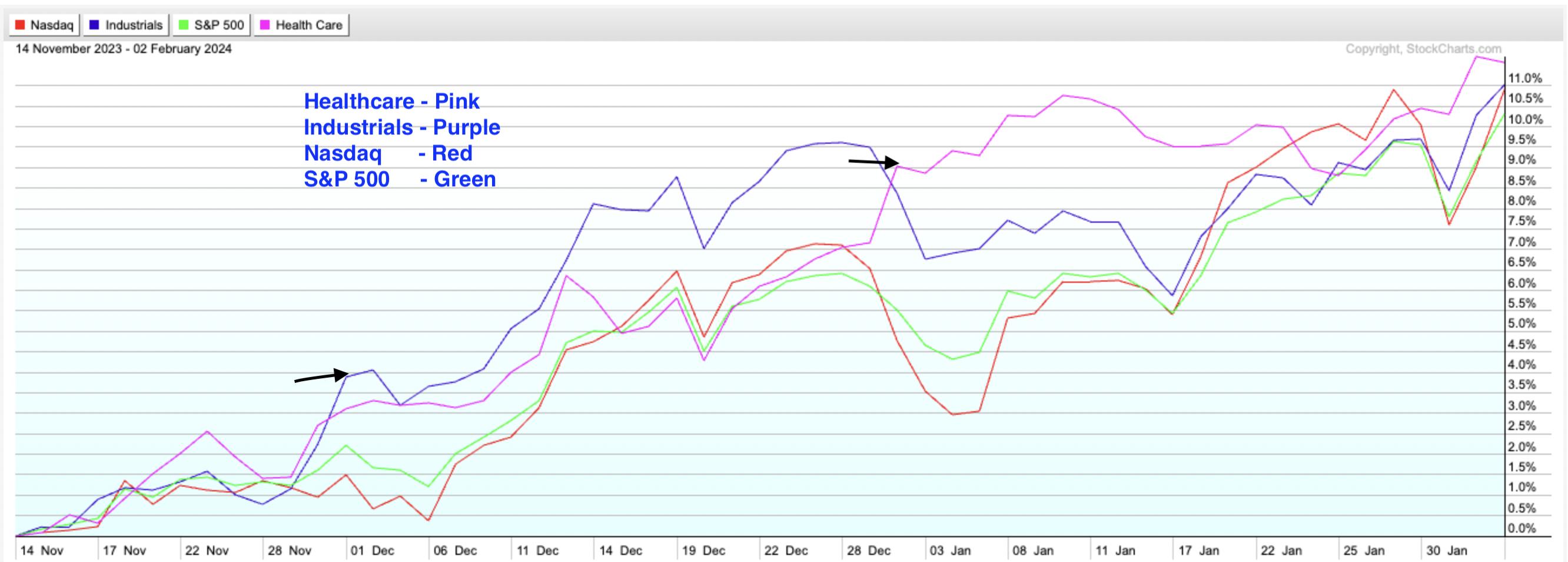

Comparing the performance of the S&P 500, Nasdaq, Industrial and Healthcare sectors

Comparing the performance of the S&P 500, Nasdaq, Industrial and Healthcare sectors

The chart above shows sectors that have both recorded varying degrees of outperformance since early December, including Industrials (XLI) and Healthcare (XLV). With headline news focusing on large-cap technology names, it would have been easy to miss this cycle. But subscribers to my MEM Edge reports were alerted earlier this year when we started adding healthcare stocks to our recommended holdings.

Rounding out the S&P 500 top 10 in the healthcare sector last week was medical and surgical equipment maker Stryker (SYK), which broke for a ninth straight month after the company reported that it posted earnings ahead of expectations while guiding its growth outlook. This year it’s even higher. Although the RSI is in an overbought position on the daily chart, the weekly chart points to further upside after a bullish MACD crossover at relatively low levels.

Stryker Corp. (SYK) daily chart

Stryker Corp. (SYK) daily chart

Another top-10 gainer last week was Eaton (ETN) in the Industrials sector. The power and control equipment supplier gapped on huge volumes Thursday after the company reported ahead-of-expected earnings, guiding higher estimates for this year and next. Overall, the increase in electricity demand is expected to accelerate due to data centers processing AI, EVs, heat pumps, etc. A fundamental breakout would put the stock in a position to trade higher from here.

Eaton Corp. (ETN) daily chart

Eaton Corp. (ETN) daily chart

Earnings season is often marked as a period of sector rotation, as strong growth prospects attract capital flows to specific areas of the market. After spending several years at Willliam O’Neil & Co., and more recently working at the company, it has become clear to me that earnings growth is a key driver of stocks that are far outperforming the market.

My MEM Edge report has a list of names selected for recommended holdings, highlighting most of the year’s biggest winners, such as Deckers (DECK) and Meta (META), which were strong today. Published twice a week, the report also provides seasoned insights into the broader market that have helped investors remain winners despite sharp declines like last Wednesday’s. Use this link here to access your 4-week trial and all previous reports.

We hope you take advantage of this offer. This will be a game-changing earning season!

warmly,

Mary Ellen McGonagle

MEM Investment Research

Mary Ellen McGonagle is a professional investment consultant and president of MEM Investment Research. After working on Wall Street for eight years, Ms. McGonagle left the company to become an experienced stock analyst, where she worked with William O’Neill, where she identified sound stocks with the potential to take off. She has worked with clients around the world, including renowned firms such as Fidelity Asset Management, Morgan Stanley, Merrill Lynch, and Oppenheimer. Learn more