Sunstone Hotel Investors: Preferred stock yielding 7.2% offers great risk/reward (SHO).

Art Wager/iStock not published via Getty Images

introduction

Since I have a portion of my investment portfolio invested in bonds, I am still looking for additional exposure to preferred stocks. As interest rates in the financial market fall The price of fixed-rate preferred stock will rise (assuming the issuer’s creditworthiness does not change). i sold mine preferred stock In ~ Sunstone Hotel Investors, Inc. (NYSE:SHO) There was a temporary price surge a few months ago, and I am wondering whether I should take a buying position again.

Take a look at our first quarter performance and outlook for this year

When looking at preferred stocks, I pay attention to two factors: preferred dividend coverage ratio and asset coverage ratio. In other words, “How safe are preferred dividends?” and “How safe are preferred stocks?”

SHO Investor Relations

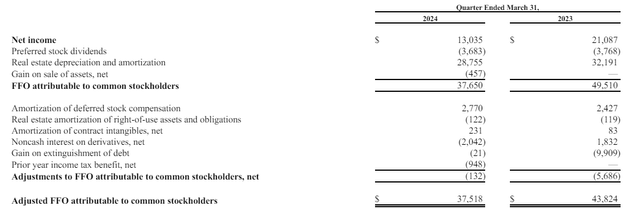

In the first quarter of this year, Sunstone Hotel Investors reported net income of $13 million, but since net income for a REIT is relatively meaningless, we wanted to check Sunstone’s FFO and AFFO performance. As you can see below, total FFO attributable to common shareholders was $37.7 million, and after some adjustments, AFFO was just $100,000 lower at $37.5 million.

SHO Investor Relations

Based on the average share volume of 202.6 million shares in the first quarter, AFFO per share was approximately $0.18. This is a decrease compared to $0.21 in the first quarter of 2023, and 2024 is expected to be relatively weak overall.

That’s because the portfolio is undergoing redevelopment plans and Sunstone plans to spend between $135 million and $155 million in capital expenditures. Most of the impact will be felt in the next few quarters, but these investments will pay off big in 2025. Sunstone is targeting $20-$22 million in EBITDA growth in 2025, so there’s some short-term pain to actually generate long-term benefits. 2025.

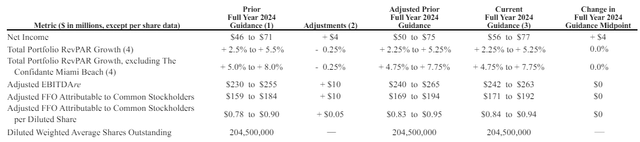

Looking at full-year guidance (shown below), Sunstone expects total AFFO to be in the range of $171 million to $192 million, which would result in AFFO per share of $0.84 to $0.94. This includes the impact of remodeling some of our properties.

SHO Investor Relations

Considering that AFFO of $182 million (the midpoint of current guidance) already includes $14.7 million in annual preferred dividends, AFFO before preferred dividends is approximately $197 million and a preferred dividend payout ratio of 8%. It is less than. This excludes the impact of capital expenditures this year.

How does this affect preferred stock?

As explained in the previous article, there are currently two preferred stock series in issue.

H series (New York Stock Exchange: SHO.PR.H) as the ticker symbol and offers a 6.125% preferred dividend for a total of $1.53125 per year, while the I-Series (NYSE:SHO.PR.I) is the ticker symbol offering a 5.7% preferred dividend for annual payments of $1.425. Both issues are cumulative and may be called by Sunstone starting in May 2026 (SHO.PR.H) and July 2026 (SHO.PR.I).

Since both preferred shares are ranked equally, it is important to buy the preferred stock with the highest yield (I believe the risk of the preferred stock being called is negligible). This is also why looking at current yield is more meaningful than call yield. Because, in my opinion, the chances of a call occurring are slim to none.

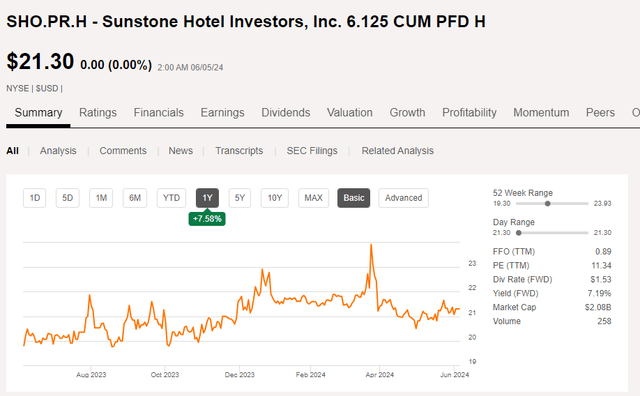

pursue alpha

As of Thursday’s close, H shares are trading at $21.30 and I shares are trading at $20.24, with yields of 7.2% and 7.04%, respectively. This means that based on the current stock price, Series H appears to be a better choice due to its higher preferred dividend yield.

The balance sheet still looks healthy. As you can see below, the REIT had total debt of just $980 million, while it had access to cash and restricted cash of $471 million. Ignoring limited cash, net debt is only $414 million, which is less than 20% of total assets of $2.59 billion (which already includes $1.16 billion in accumulated depreciation).

SHO Investor Relations

Sunstone’s recent $230 million acquisition of the Hyatt Regency San Antonio Riverwalk will likely take a hit to its cash position in the REIT’s next quarterly update. However, this represents only 11.1x estimated 2024 EBITDA and 12.5x NOI, so this acquisition could be accretive in the future.

investment thesis

I sold both series of preferred stock in March of this year, when Series I was trading at over $21 per share and Series H was trading at over $23 per share. Series H is currently trading at $21.30, which is a significant improvement over the price I sold my position at.

Sunstone Hotel Investors certainly doesn’t offer the highest yield in its category, but we think it offers one of the safest preferred dividend yields considering the portfolio’s very low LTV ratio. I’m taking another serious look at preferred stocks, and if I were to re-establish a long position, it would be the highest-yielding position in the series.