Super Micro: Worsening growth and margins mean it’s time to clean up. (NASDAQ:SMCI)

Oseote/iStock via Getty Images

In September 2023, we wrote an article titled “Supermicro: You Should Buy the AI Hype” to talk about supermicro computers (NASDAQ:SMCI) Both prices were okay and Well-positioned to continue. Revenues and profits are growing through a close partnership with Nvidia and the growth of secular generative AI trends.

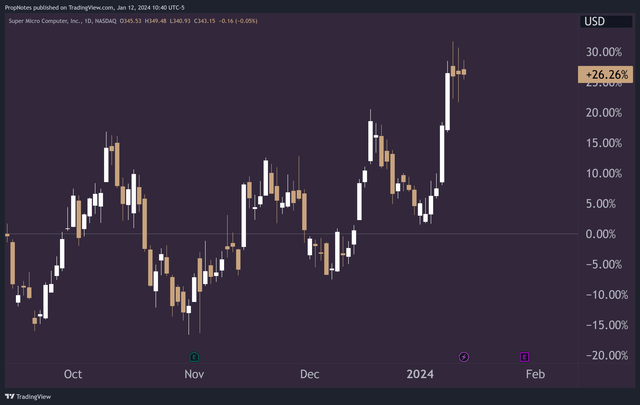

Fast forward to the present and our predictions have come to fruition. SMCI is up more than 26% in the period following another blockbuster earnings result and continued momentum in the generative AI space.

TradingView

But after an initial strong start, the company’s top-line growth has slowed somewhat, margins have grown under pressure and business has become more expensive. Currently, TTM GAAP P/E has increased from 23x to over 31x.

Today we thought this would be a good time. Take another look at the stock, its growth prospects, and its valuation to determine whether the company has become too expensive to continue investing in at this point.

Sounds good?

Let’s jump in!

original paper

Our original bullish outlook was based on some key data that makes sense to review now before jumping into the stock’s latest developments. Here’s what initially supported our belief that SMCI was a solid investment opportunity.

-

Financial Performance and Growth:

- Super Micro Computer’s finances have grown rapidly, with sales more than doubling over the past three years to nearly $7 billion. This was accompanied by an even more impressive increase in net profit, up more than 470% over the same period.

- This growth is primarily due to SMCI’s significant partnership with Nvidia, which has enabled competitive product lines and enterprise and data center deal flow for AI use cases.

-

Positive future outlook:

- Management was and remains optimistic about the future, emphasizing the positive impact of generative AI across product lines.

- The company is well-positioned to meet the demand for high-performance computing and AI server systems, with a focus on the growing demand for improved storage performance to support large data sets in AI applications.

-

evaluation:

- Despite its impressive performance and optimistic outlook, SMCI appeared to be reasonably valued, with Seeking Alpha assigning it a “C-” in its Quant Rating System.

- Although its price/sales ratio has surged recently, its price/earnings ratio of just 23x remains within its historical retracement range, suggesting there is room for potential multiple expansion.

financial results

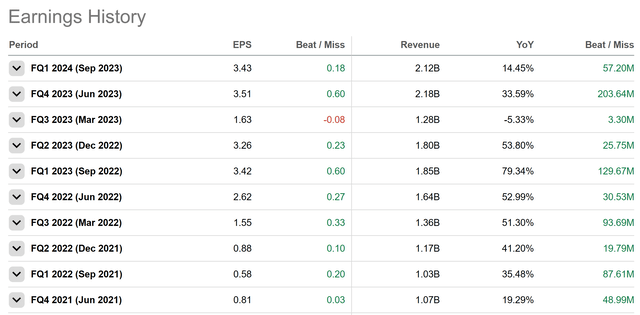

SMCI report after our articleNovember 1st quarter performance announcement 2023 has arrived much earlier than expected.

Revenue topped $57 million, and EPS came in at $3.43 per share, 18 cents ahead of expectations.

pursue alpha

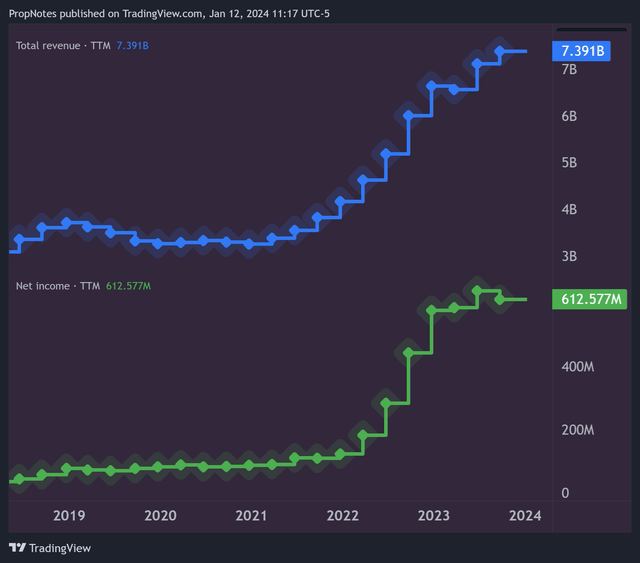

This follows a series of mostly ups and downs over the past few years. This can be seen more clearly in this zoomed-out TTM chart, which shows consistently increasing revenue and net income since 2018.

TradingView

But despite the positive surface-level results, there are some deeper issues worth mentioning.

The first is that margins are actually shrinking for the first time since the recent boom began.

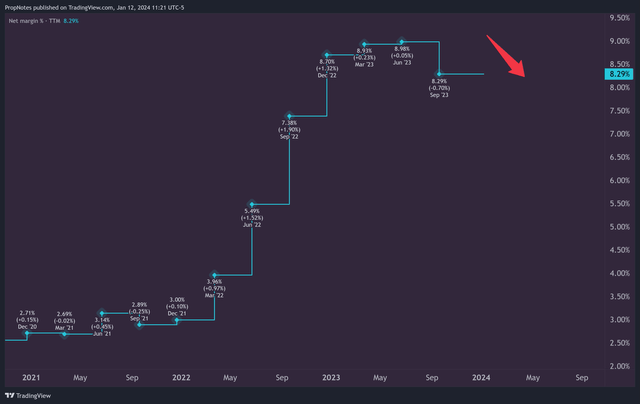

TradingView

This net profit margin chart shows that margin growth, a key driver of EPS outperformance, has stalled and was somewhat negative in the most recent TTM quarter.

If you zoom in on the quarterly chart, you can see that net margin expansion stopped in September 2022 and has been gradually declining until now. This data shows margins under pressure in Q2 2023, Q3 2023, and Q1 2024.

This is a result of cost pressures surrounding inputs into many SMCI end products, but the key point is that this trend is not abating. Here’s how CEO Charles Liang answered questions about increasing cost pressures from Susquehanna analysts on the company’s first-quarter earnings call.

medi Hosseini

all right. thank you And Charles, a big part of your cause is memory and other components. And all we’ve heard from memory manufacturers is that they won’t sell at the prices that prevailed just a few months ago. That’s why memory prices are rising. And how can inflationary trends be tempered to expand margins?

Charles Liang

thank you What I mean is, basically, we can pass the cost on to the customer. So basically we’re okay with that. We will not be affected by it. At least it won’t affect you much.

In other words, since costs are passed on to customers, gross margin is not expected to improve, even if gross margin may remain stable at all.

If SMCI has officially saturated the market opportunity in terms of margins, that completely removes some of the company’s bullish thesis from the picture.

growth

Margins are under pressure while growth is slowing.

As we mentioned, in the first quarter, SMCI beat top estimates by more than $57 million. This is great. What’s not so great is what SMCI is producing in terms of YoY revenue growth.

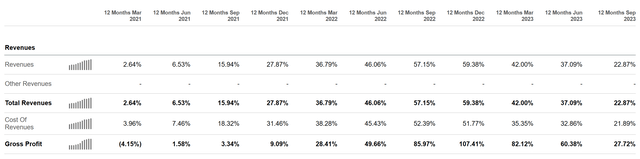

pursue alpha

Looking at TTM results rather than quarterly results, smoothing out some of the unevenness, we see that SMCI’s revenue growth peaked at 59.4% in December 2022. Since then, growth has slowed, reaching just 22% YoY in the most recent TTM period.

To zoom in further, the company’s top line grew only 14% year over year in the first quarter alone.

For a computer hardware company, these rates are still very fast, but much slower than what SMCI was generating in previous periods. This shows that the company is struggling to maintain the same growth rate over time.

To some extent, this is to be expected, as recent deployments of generative AI infrastructure have pushed natural limits to the revenue that companies can generate.

accumulateExpected in a few weeks. And in front of both margins and On the growth front, I think things will continue as they have been. It will grow overall, but in a slower and less profitable way. This appears to be the case due to the profitability momentum we’ve highlighted and some of management’s comments about the future.

That means management is projecting sales of $10 billion to $11 billion in fiscal 2024, which ends in June of this year. So far, the books show sales of $2.1 billion, which means sales will average $2.6 billion over the remaining three quarters.

It’s difficult to know how much of that will fall to the bottom line in the coming quarters, especially since some of the plans highlighted to improve profitability, such as moving manufacturing to Malaysia, are likely to take longer to show in numbers.

Overall, there are some optimistic things to point out and there is no doubt that the company is growing, but it appears that pressures are starting to mount that challenge the company’s market saturation. It looks like most of the low-hanging fruit has already been harvested.

evaluation

Top-line growth is slowing and net profit margins are under pressure, while valuations are also becoming increasingly expensive. This is problematic for us as former bulls on the name.

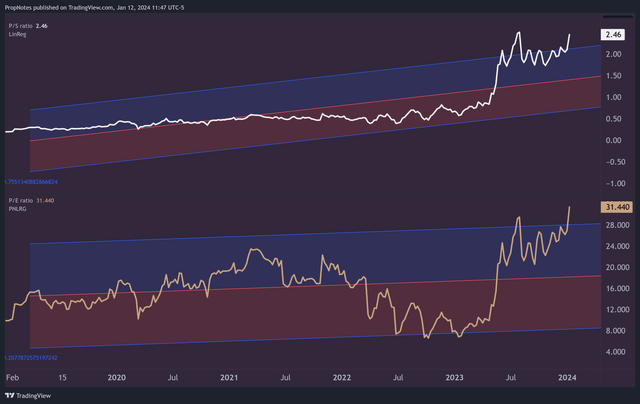

In summarySince our last article, the growth and margin situation has continued to deteriorate, but valuations have moved higher.

When we previously wrote about SMCI in September, the company was trading at 1.9x sales and 23x GAAP P/E.

SMCI currently trades at 2.4x sales and 31x P/E.

TradingView

This is a top and bottom line multiple expansion of 26% and 34% respectively in just four months.

Additionally, multiples are all currently trading well outside their historical deviation ranges, indicating a heightened potential risk of multiple collapse for the time being.

Some may view this expansion as increasing optimism about the company’s future prospects, and this is partially true considering management’s predictions surrounding a reacceleration of sales. However, given the financial pressures outlined above, this does not appear to be the only case.

So what is the culprit?

There seems to be momentum.

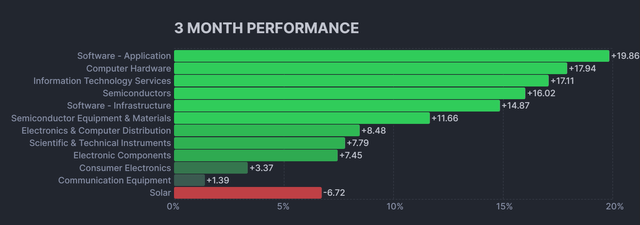

The technology sector has performed well over the past three months, and computer hardware names have been some of the top winners over the period.

pin beads

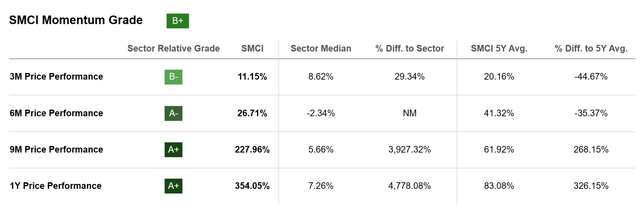

Momentum has generally been strong, as SMCI has produced a strong Seeking Alpha Quant rating in the “B+” category.

pursue alpha

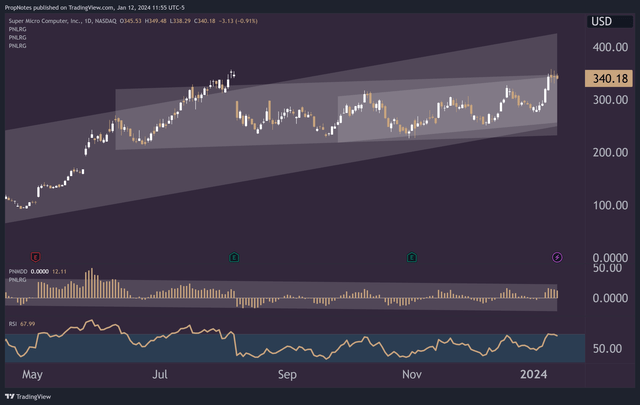

But if you zoom out, SMCI appears to be overbought in the short to medium term.

TradingView

RSI is nearing the ‘overbought’ mark, and the stock is scraping the upper end of the short- and medium-term price range established throughout 2023.

And while the stock could potentially break out of its all-time highs in a more convincing manner and generate sustained near-term velocity from there, things generally appear to be well beyond fundamental skiing, both from a technical and valuation perspective. .

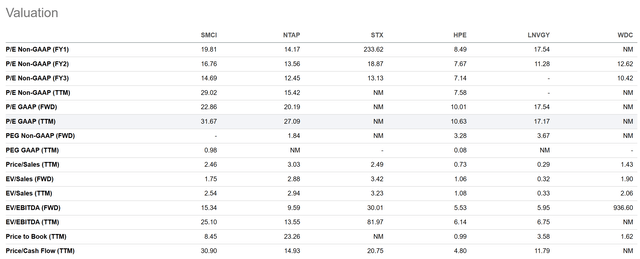

One could argue that the company was previously undervalued and deserves a higher multiple. nowHowever, historically this has not been the case and SMCI’s peer group also appears to be more modestly valued.

pursue alpha

In fact, taking into account its relative premium to peer valuations, lack of debt on its balance sheet, and key Nvidia (NVDA) partnerships, we argue that the company’s fair value is somewhere in the $280-$330 range. .

But at the end of the day, SMCI is a computer hardware company, and despite its growth profile and quality earnings, as things get more saturated and the stock becomes more fully valued, taking a bit of risk off the table here seems like the best course of action. of action.

We want to know how a stock will trade a year from now.

summary

Ultimately, we expect SMCI to be a successful and profitable company for many years to come. However, with growing gross margin pressure and a slowing top-line growth engine, SMCI’s days of explosive EPS growth appear to be in the past, which should be a concern for new buyers of the stock. It’s possible that top-line growth will accelerate again, depending on management’s outlook, but seeing this increase trickle down to bottom line seems a more questionable expectation.

With ever-higher multiples combined with technically overbought momentum conditions, reducing risk appears to be a prudent move for the time being. Given the opportunity, we would wait until the price starts stronger again at a lower price.

Accordingly, we are currently downgrading the SMCI rating to ‘Hold’.

Stay safe out there.

Cheers!