Swiss Group Watches (OTCMKTS:WOSGF) trading at attractive valuation

Editorial by Nickbeer/iStock via Getty Images

Investment summary

My recommendation, Watches of Switzerland Group (OTCPK:WOSGF), is a Buy rating. Two major driving factors have led to a 70% drop in the stock price since its recent peak; Values were excessively punished. I don’t think WOSGF’s position in the distribution chain has collapsed at all, and the market must eventually realize this. Demand in the UK is weak, but this appears to have been driven by strong growth over the past few years and weak macroeconomic conditions. As can be seen in the U.S. market, demand for luxury watches remains strong.

business overview

WOSGF is an official retailer of luxury watches, luxury jewelry and other fashion products. As of 9M24, luxury watches have become the most important segment of the business, with revenue sharing ratios of 85%, 6.2%, and 8.7%, respectively. The business only serves two regions of the United States (43% of the country). (total) and Europe, including the UK (57% of the total). Rolex is the largest revenue-generating brand in the business (accounting for approximately 60% of group revenue in fiscal 2020). 2FQ22 performance announcement). WOSGF’s stock price has shown a significant decline, down 70% since August of last year, and the driving force is believed to be two factors: Rolex’s acquisition of Bucherer and poor performance in the third quarter. Below I explain two reasons and why I think this is an investment opportunity.

Bucherer’s acquisition of Rolex does not threaten WOSGF position

As background, Rolex announced the acquisition of Bucherer last August, which led many investors to believe that Rolex would begin vertical integration (direct distribution). This could pose a major threat to WOSGF’s business as Rolex accounts for a large portion of its business. I think this story has little merit. First of all, if you look at the press release, one paragraph stands out suggesting that Rolex has no intention of going into direct distribution. If this isn’t enough evidence, WSOGY’s press release after the deal should convince investors.

“Bucherer will retain its name and continue to operate its business independently. The group’s management remains unchanged. Bucherer’s integration into the Rolex Group will take effect once the competition authorities approve the acquisition transaction.”

“Rolex will not have any operational involvement in Bucherer’s business. Rolex appoints non-executive board members. There will be no changes to Rolex’s product allocation or distribution development processes as a result of this acquisition.”

So why did Rolex acquire Bucherer? The headline reason was that Jörg Bucherer had died and there was no succession plan, but I believe there was a bigger picture behind it that made strategic sense for Rolex. If Rolex does not acquire Bucherer, it would present an opportunity for an acquisition by Rolex’s competitors such as Richemont or LVMH, which could harm Rolex’s sales (Bucherer is the world’s largest luxury watch retailer). The acquisition was thus completed.

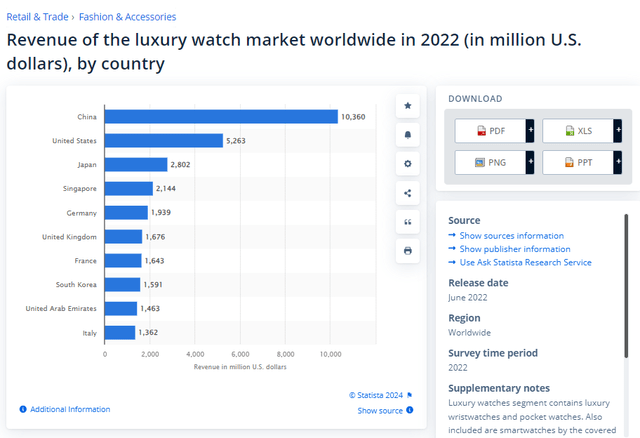

politician

Moreover, Rolex has historically relied on a distributed network of third-party retailers for distribution. As one of the major Rolex dealers worldwide, Bucherer accounts for approximately 5% of Rolex sales. Using Rolex’s reported sales of $11.5 billion, this would mean a contribution to Rolex of approximately $650 million. For WOSGF, this business contributes close to $1 billion in revenue (about 60% of total revenue) to Rolex, primarily in the US and UK. For perspective, the United States is the largest consumer of luxury watches (excluding China) and WOSGF has a greater presence here. As such, WOSGF still has a very important positive element in Rolex’s distribution network.

Even if Rolex is willing to vertically integrate, it cannot achieve this simply by securing a distribution channel that accounts for 5% of sales. What’s notable here is that Rolex only relies on offline retail and does not allow online transactions. This further complicates the ability to internalize distribution. It is unlikely that this model will change, as the customer experience while viewing the watch in the showroom is an important part of the luxury watch buying journey. Currently, WSOGY’s retail stores are occupied by partners with long-term leases, meaning Rolex will not be able to enter the market in earnest any time soon. Rebuilding this retail network would take decades and billions of dollars and would involve Rolex taking on enormous operational risks that could damage its reputation. Even if Rolex wants to vertically integrate, it would be good for WOSGF. That’s because Rolex is more likely to acquire WOSGF than wait out the lease and make a big bid for a prime location.

We are the largest and oldest Rolex retailer. We have achieved the best visibility we have had on the projects we have undertaken to date, and overall we have a very exciting few years ahead of us with Rolex. 2Q24 performance announcement

demand outlook

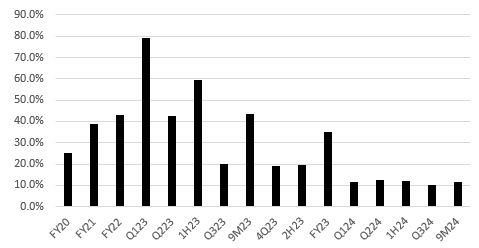

US revenues support year-over-year growth (Redfox Capital Idea)

In the third quarter of ’24, WOSGF reported a 7% sustained currency revenue decline in Europe, including the UK, to £222 million, confirming that it was experiencing a challenging trading environment. This led to another massive sell-off in stocks. Although Europe/UK is weak, our US business continues to support double-digit revenue growth (11.4% underlying growth in 3Q24) and remember, this is the largest luxury watch market in the world. Additionally, I would like to point out that FY23 was a very difficult year for WOSGF. The UK business grew 11.4% in FY23, on top of growth of 29.6% in FY22. So I think the industry will need some time to digest all the purchases. Given the UK’s macro headwinds, luxury discretionary spending is unlikely to see a significant recovery anytime soon. However, given that demand for luxury watches remains structurally intact, we believe this is a temporary problem (look at WOSGF’s US growth for evidence).

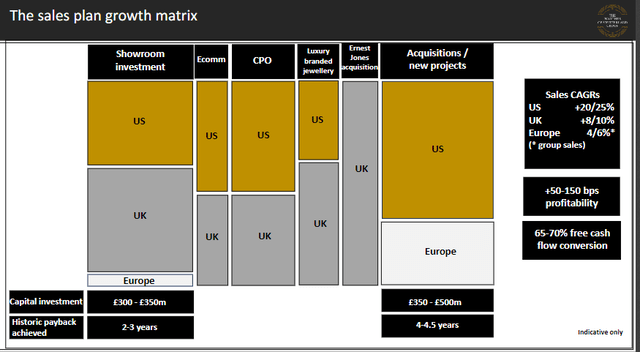

During its most recent investor day, management announced its intention to allocate between GBP300 million and GBP500 million to M&A and new projects to consolidate the US market and expand in Europe. These investments have historically produced very attractive payback periods of 2-3 years (20+% ROI). As WOS continues to expand its footprint with improving macroeconomic conditions going forward, we believe overall growth could easily rise to at least the mid-single digits, in line with industry expectations.

WOSGF

evaluation

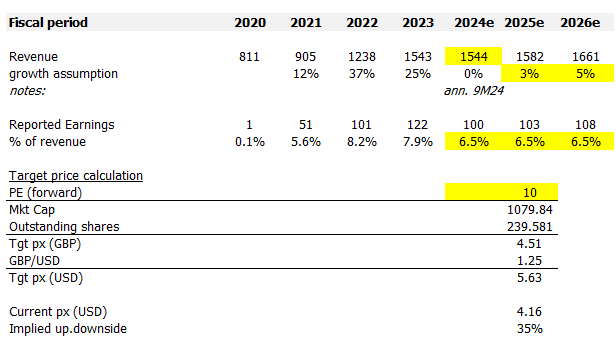

Redfox Capital Ideas

I model WOSGF using a forward PE approach and using assumptions, I believe WOSGF is worth $5.63. My assumption is that growth will eventually return to industry-like rates over the next two years, by which time macroeconomic conditions will ease. Considering the impressive growth seen over the past three years and the industry needing time to digest it, growth in FY24 is likely to slow down (9M24 results calculated on an annualized basis). We don’t expect margin improvement here, as management will continue to expand its presence in the U.S. and Europe. This means costs will rise. The biggest upside in my model is that PE multiples should trade up to 10x. This is a discount to the level before Rolex announced the acquisition (12x forward PE). As mentioned above, we don’t think the acquisition should have an impact on WOSG’s valuation given the reasons stated, but a discount is warranted because growth is much slower today. Between the current 7.5x and the previous 12.5x, the midpoint was taken as the reference point.

danger

If Rolex decides to acquire more retailers and enter direct distribution, this would be a major game changer for WOSGF as its stake value and business position could be permanently damaged.

conclusion

My opinion on WOSGF is a buy despite the recent share price decline. The bearish sentiment surrounding Rolex’s acquisition of Bucherer and its poor performance in Europe has been overblown. WOSGF remains an important partner for Rolex, especially in the lucrative US market. The UK’s economic slowdown is likely to be temporary due to the impressive growth over the past few years and weak macro conditions. Looking ahead, we are positive about WOSGF’s planned investments, which have performed well historically and will easily support industry-like growth going forward.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.