Symbiotic Relationships in the Digital Age

The following is a guest post by Shane Neagle, editor-in-chief of The Tokenist.

When the Federal Reserve manipulated the money supply in 2020, Provides ~40% boostEveryone has paid the cost of this falsification through inflation. In turn, people’s life energy is sucked out as their savings are eroded. When more money can buy less, more energy is needed to maintain the same pace.

The solution to this problem is obvious: make money tamper-proof through decentralization and fixed supply. Make sure no one controls it. This was the initial driving force behind Bitcoin, but it needs a critical component to work: physical grounding.

If Bitcoin were just a digital asset, it would be easier to change the ledger of the network known as the blockchain. An elegant solution to this is proof-of-work mining, which acts as an energy barrier that links Bitcoin’s digital code to real-world resources. If a potential attacker were to change the records of the ledger, it would require a huge amount of energy, utilizing computing power.

At 733.41 EH/s (Hash rate), such an energy barrier is virtually impenetrable. But that means Bitcoin’s energy requirements are the cost of having a tamper-proof currency. Likewise, energy is the cost of slurping text/images/videos/code from data centers every time people stimulate AI agents.

In both cases, human productivity increased. But could their energy needs be optimized in a symbiotic way?

Energy Dynamics of Bitcoin Mining and AI

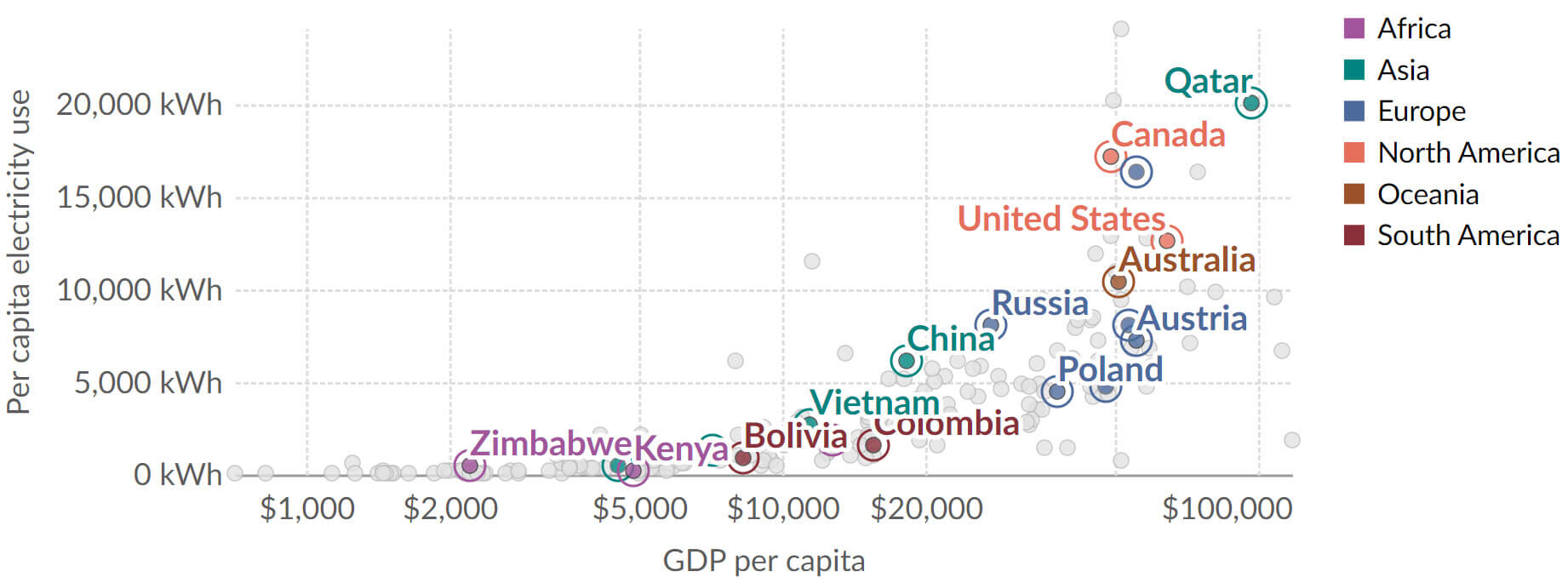

It is no exaggeration to say that becoming a developed country is closely related to high energy consumption. This is clearly shown when comparing the per capita electricity production in kilowatt hours (kWh) with the country’s Gross Domestic Product (GDP).

In other words, access to energy surplus is a prerequisite for the advancement of civilization. After all, as several layers are added to the basic subsistence level such as agriculture, new layers of manufacturing, transportation, public services, urbanization, and computing must be supplied.

Beyond simple data centers for internet browsing and online banking, generative AI and Bitcoin mining represent the latest layer of civilization as high-performance computing (HPC). HPC energy requirements are incredibly high.

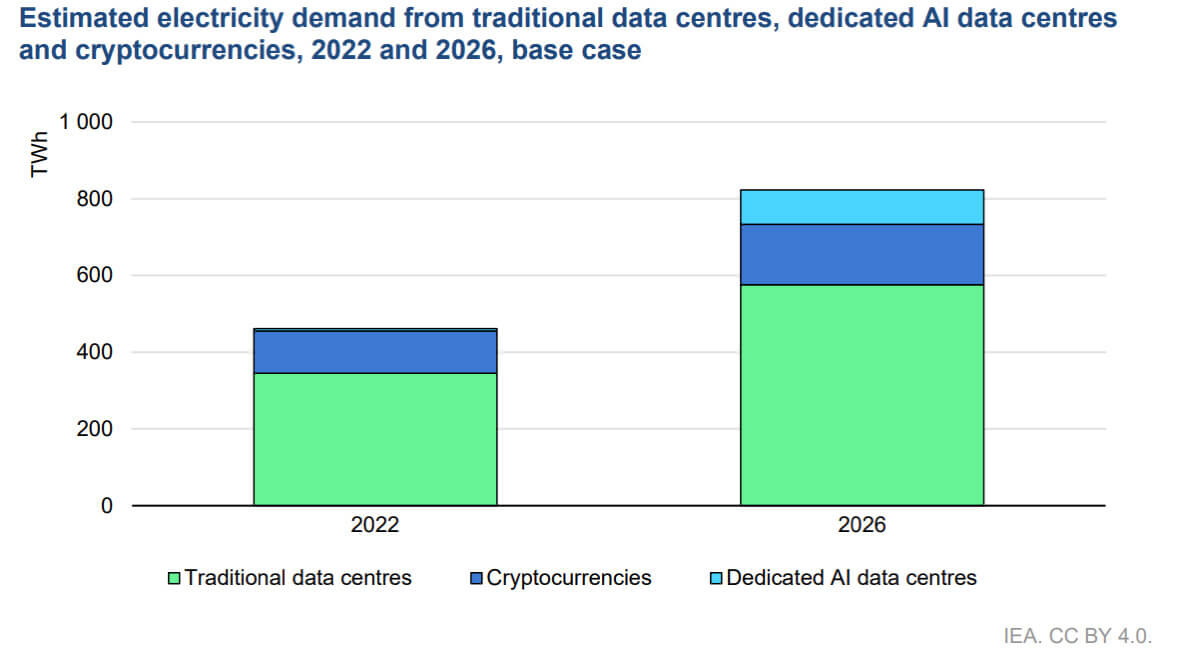

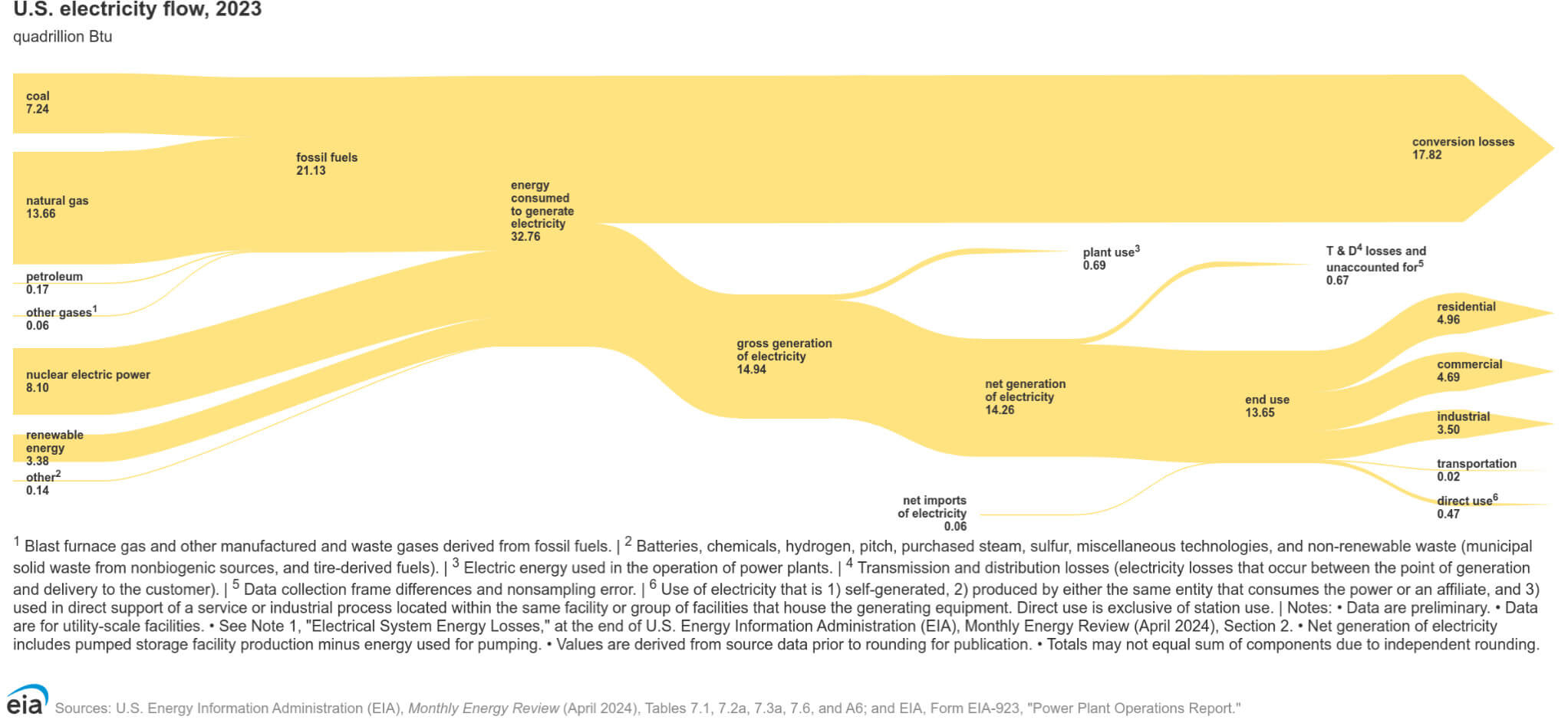

According to the Department of Energy (DoE), data servers already use 10 to 50 times more energy (per square foot) than commercial office buildings, accounting for 2 percent of total U.S. electricity use. Given the growing demand for data centers, the International Energy Agency (IEA) estimates that prediction By 2026, total electricity consumption could increase by more than 1,000 terawatt-hours (TWh).

For comparison, such a surge in demand would be equivalent to Japan’s current electricity consumption. In contrast to Bitcoin mining, the EIA notes that it generates 130 TWh of electricity demand.

Goldman Sachs Research calculation Considering that a simple Google search query requires 0.3 watt-hours of electricity, and a single ChatGPT query requires 2.9 watt-hours of electricity, we estimate that AI data centers will consume 200 TWh per year between 2023 and 2030.

This trend requires significant optimization efforts, which the Bitcoin mining industry has been continuously working on by upgrading to more efficient ASIC machines, mainly produced by Bitmain, MicroBT, Canaan, Bitfury, Ebang, etc.

Likewise, a superior cooling solution allows ASIC equipment to maintain lower operating temperatures for longer periods of time, significantly reducing energy consumption and, in the process, eliminating the need for cooling power consumption. Liquid and immersion cooling It is estimated that this will reduce Bitcoin mining operating costs by up to 33%.

In the AI energy space, Nvidia’s GPUs are estimated to dominate the market. 65% Market share. Nvidia’s latest Blackwell GPU microarchitecture reportedly reduces energy costs by 25x over its predecessor, Hopper. As a major supplier to Big Tech, With Mistral, Meta, and Apple leading the way in the locally hosted large-scale language model (LLM) space, we will soon see an uptick. About GPU Server Hosting And the adjacent buildings.

But there’s much more to optimizing energy consumption than just updating with better chips and tweaked cooling. And that’s where Bitcoin mining in particular can shine.

The Role of Bitcoin Mining in Energy Management

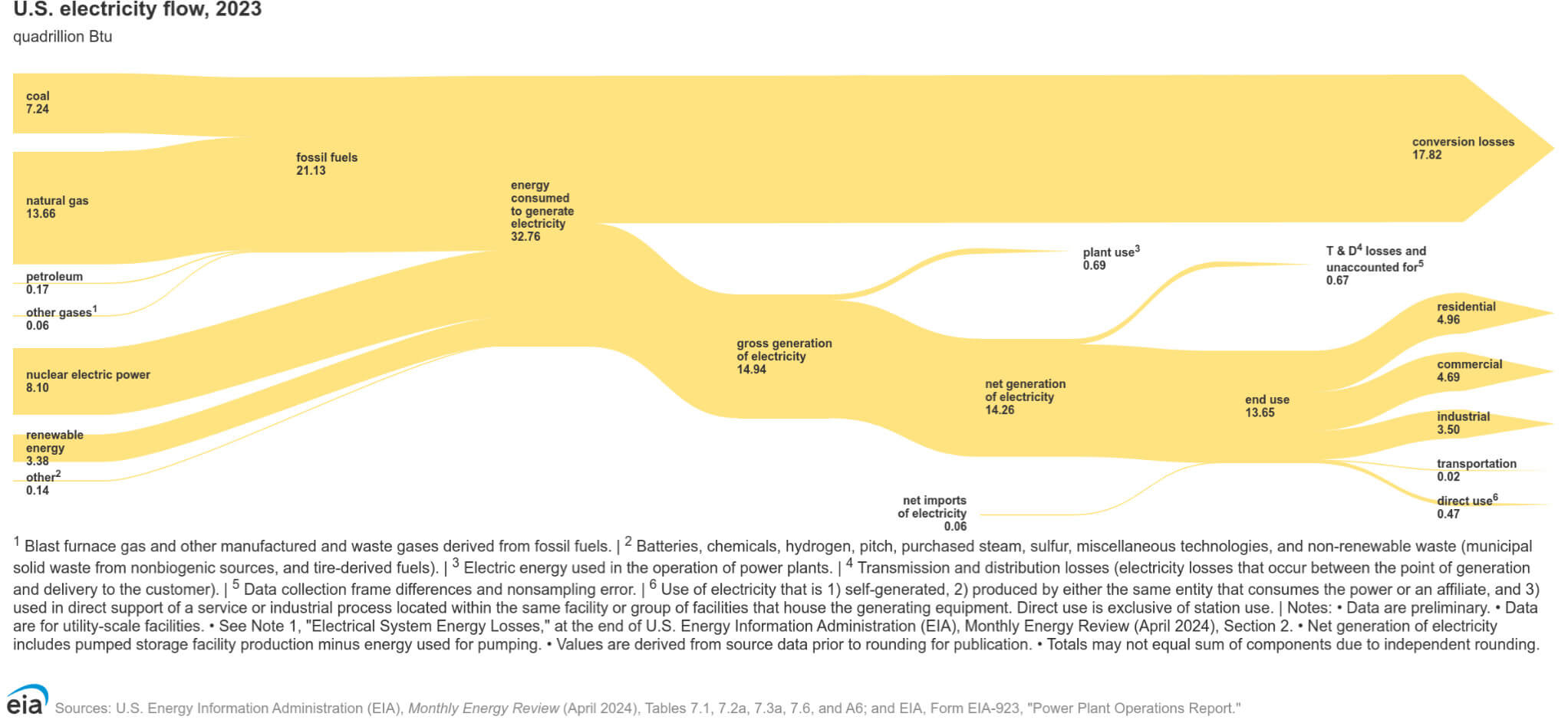

It is a simple idea to think that power plants produce electricity and that output is then transmitted to consumers. Along the way, a transition occurs from long-distance high-voltage transmission to low-voltage transmission for the end users.

That is, power grids have to balance between high output and low input, resulting in transmission and distribution (T&D) losses of up to 5% on average. Environmental impact assessment.

One way to deal with this balancing act is to rely on energy storage to bridge the gap between electricity demand and supply. But battery storage not only has a high initial outlay, but the dominant lithium-ion batteries are known to be prone to thermal runaway, making them prone to overheating.

The bottom line is that no solution can beat the efficiency of getting closer to the energy source, which is why Bitcoin mining company TeraWulf (Nasdaq: WULF) chose the Nautilus Cryptomine as its main facility near the 2.5 GW Susquehanna Nuclear Power Plant in Berwick, Pennsylvania.

TeraWulf is positioned as the most efficient Bitcoin mining operation, producing 300MW directly from its power plant, providing 2 cents per kWh of carbon-free energy.

More importantly, Bitcoin mining can help balance the electricity grid by acting as a dispatchable load. Since HPC is suited to high energy consumption, this leads to real-time adjustments in the load, leveling out fluctuations in energy supply and demand.

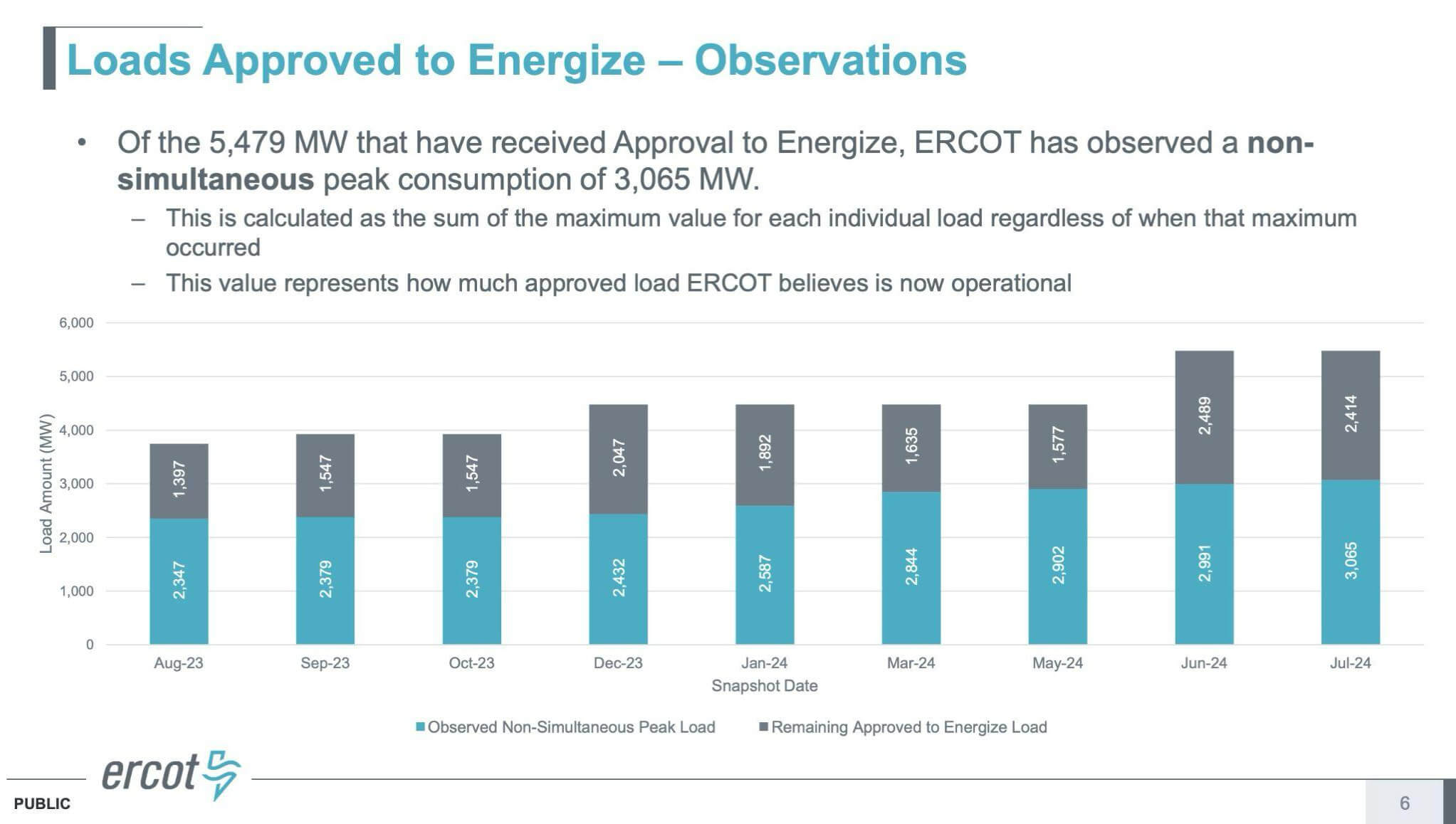

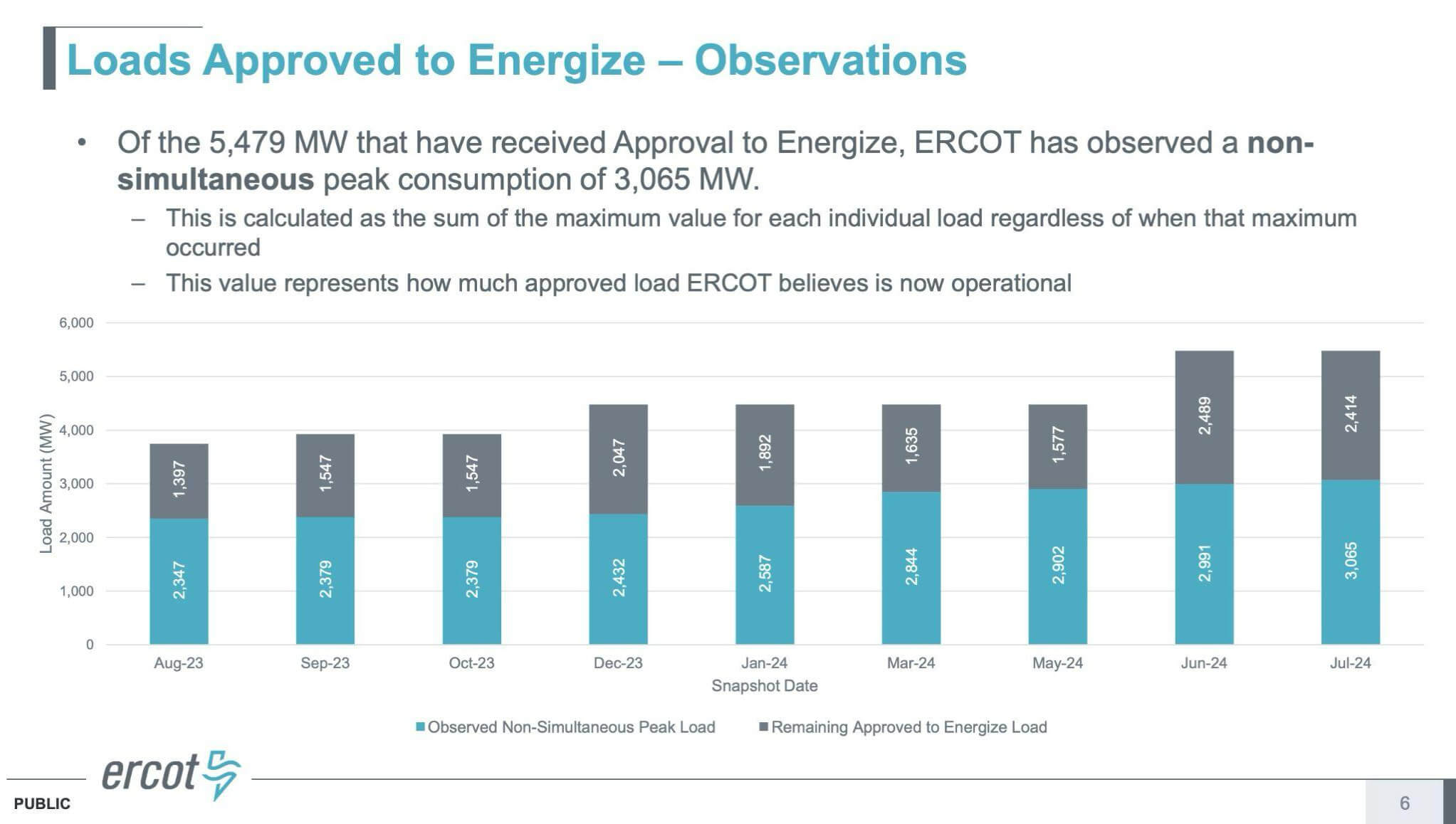

As of July 2024, the Electric Reliability Council of Texas (ERCOT) reported 3 GW of the 5.5 GW of electricity available for load distribution to Bitcoin miners.

Not only does load sharing provide a ramp up/down ramp depending on local power shortages or surpluses, but Bitcoin mining companies are incentivized to perform load sharing once they start reporting power sales.

In turn, this injects another element of security into Bitcoin as a tamper-proof currency. Bitcoin mining companies can be rewarded for their contribution to balancing the electricity grid, as they can offset their costs by scaling back operations during BTC sell-offs. Riot Platforms (Nasdaq: RIOT) is a prime example. 2.2 million dollars From ERCOT’s demand response credits in January 2024.

In a more direct way, Bitcoin miners could use the gas burned in oil or gas fields to generate isolated energy, or they could even collect the heat generated from BTC mining to heat water or greenhouses, or recycle it.

Integrating AI and High Performance Computing (HPC)

So far we have established the following facts:

- Both AI and Bitcoin mining are energy-intensive.

- Electric grids have friction as a function of distribution and load balancing.

- Bitcoin mining can reduce this friction.

But could Bitcoin mining also be integrated with AI data centers?

Both fall into the category of high-performance computing (HPC), but AI services require low interruption. Since the success of current and future AI apps depends on uptime/response time, data centers are not suitable for building flexible load distribution strategies like Bitcoin mining companies.

At the same time, Bitcoin mining companies have a proven track record of innovation, continuous use of hydro/nuclear power, and operational expansion. And as AI-specific data centers put pressure on the electric grid, miners’ flexible load-following can quickly respond to the drain.

We’re starting to see this dynamic in more states with ERCOT, which was introduced in the Oklahoma House in late May. Bill HB1600 This provides tax credit eligibility for digital asset mining operations and also includes special provisions for load balancing.

“Mining must take place at qualified co-location facilities that have entered into a load reduction agreement with a retail electricity supplier.”

To achieve this effect, a growing number of Bitcoin mining companies are moving towards hosting AI tasks themselves.

Hybrid Data Center Strategy

Despite addressing various aspects of HPC, Bitcoin mining facilities are also ideal for hosting AI operations. Not only do they have a veteran workforce, but they are also free from the extremely competitive environment that Bitcoin has. Mining Difficulty And divide it in half.

So it’s no surprise that the shift from pure-play Bitcoin mining to hybrid data center operations is already underway. Australian Iris Energy (Nasdaq: IREN) announced last October that it was partnering with WEKA to provide both storage and GPU stacks for generative AI.

Bernstein analysts recently predicted that Iris would shift 15% of its power capacity to AI data centers. In June, previously bankrupt Core Scientific (Nasdaq: CORZ) launched the same co-hosting model after restructuring. The company signed a 12-year contract with AI startup CoreWeave to dedicate 200MW of its power capacity to AI HPC operations.

During that period, Core Scientific is expected to generate $3.5 billion in revenue, in addition to its Bitcoin mining operation, which relies on BTC. Spot price. Once again, this hybrid strategy increases the bottom line of Bitcoin.

By leveraging the AI data center business, the pressure to sell BTC is reduced as Bitcoin companies are less likely to go bankrupt in a bear market. As a result, sound funds become sounder each year. It is not difficult to see the long-term trajectory. Hybrid data centers provide the following capabilities: Helping businesses manage their digital assets. On the one hand, it is at the center of sound currency, and on the other hand,

conclusion

Fueled by the promise of cognitive automation, the global economy is adding another layer on top of the digital: high-performance computing (HPC).

Just as Bitcoin is making money tamper-proof with massive energy-efficient HPC infrastructure, AI data centers are paving the way for new jobs and a surge in productivity. As the savvy Bitcoin mining operation scales up to GPU stacks alongside ASIC stacks, their convergence is inevitable.

By doing so, they create a feedback loop of incentives. The excess energy capacity of Bitcoin miners flows to AI companies that need load-bearing credits and energy. When combined with AI agents that can make autonomous BTC microtransactions, this synergy creates an interesting beginning of hyperbitcoinization.