Sysco Stock: Dividend King Benefits from Rising Demand (NYSE:SYY)

RiverNorthPhotography/iStock via Getty Images.

outline

I know many of us are familiar with Sysco Corporation’s (New York Stock Exchange: SYY) We use products most of our lives without realizing it. There is a beautiful side This is a company that acts as a silent ruler in a space where everyone absolutely has to spend money. That space is food! No matter what the economy is like, how stagnant wages are, or how expensive things are, we all need to spend money on food. Sysco is one of the global leaders in foodservice distribution, with most of its business located in the United States. They sell, market, and distribute their products to restaurants, schools, hospitals, hotels, stadiums, etc.

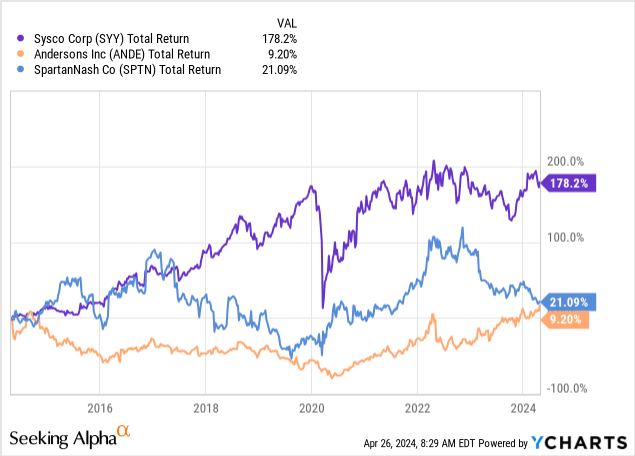

We can see that SYY has performed much better compared to some of its dividend-paying peers. SYY is It has achieved the elite milestone of over 50 consecutive years of dividend increases and is now a Dividend King. The 2.6% starting yield isn’t all that attractive, but the dividend growth has been pretty solid. Additionally, since SYY has attractive valuation metrics, we believe the current price offers upside opportunities.

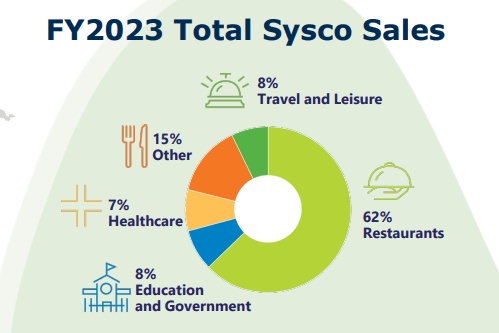

2nd quarter SYY presentation

The business has seen solid growth across all segments and has also increased in volume. If you look at the overall sales for fiscal 2023, you will see that the largest portion of sales comes from the restaurant category. I believe this will continue to be our biggest source of revenue over the next decade, as data shows that people are spending more money than eating out at restaurants. Therefore, I think SYY should continue to focus on this.

Other sectors such as education and healthcare are also robust sectors of business as these locations always have cafeterias and people can easily spend most of their day in these places. Therefore, exposure to these markets is equally important and could be another source of growth for Sysco.

Financial – Revenue Estimation

Looking back at our last second quarter earnings report, we saw 3.7% year-over-year revenue growth and increased sales overall. EPS was reported at $0.89, slightly exceeding expectations. There was overall growth across all segments, driven by increased sales and positive operating margins. Restaurant sales volume increased by 3.4% and sales increased by 3.7%. Adjusted EBITDA growth is also strong, with the most recent growth rate of 11.6%, totaling $927 million for the quarter. Over the past five years, SYY has recorded a high EBITDA growth rate of 11.17% on average compared to the industry average of 5.73%.

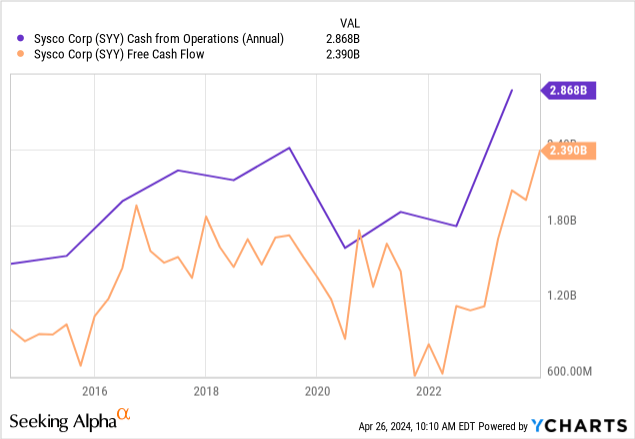

The increase in sales volume also increased operating cash and free cash flow. This abundance of cash has been used to fuel further growth within the business. Free cash flow last quarter was $527.4 million, a 140.5% increase from the previous quarter. We have identified a total of $328 million in capital expenditures, which could be used to increase our dividend or expand our operations.

The business also experienced growth in its international foodservice segment, with sales increasing 9.6% to up to $3.6 billion. The segment’s gross profit also increased by 13.4%, while operating profit increased by a whopping 44.4%, reaching up to $83 million. This strong growth appears to be driven by increased consumer spending on dining out, primarily driven within the restaurant category.

SYY is scheduled to report third quarter results at the end of April. EPS estimates for the next quarter are approximately $0.94, representing an increase of approximately 5% from the previous year’s third quarter. While this is certainly realistic, we actually expect reported EPS to be somewhat stronger due to increased cash flow and sales overall. The operating cash flow growth rate is 22.64%, which is significantly higher than the five-year average of 12.6%. Additionally, the CAPEX growth rate is also showing a slight increase of 9.11%. Therefore, earnings are likely to increase at these levels as cash flow increases and investment in the business also increases.

In our last earnings call, we were assured that fiscal 2024 would remain strong. Management appears focused on execution to drive growth.

We are excited about the strong start to fiscal 2024 as we continue our track record of profitably growing market share and delivering strong top and bottom line growth. For the remainder of fiscal 2024, we remain focused on advancing the execution elements and growth strategies I highlighted today. We are confident that these efforts will enable Sysco to deliver on its financial plans. – Kevin Hourican, President and CEO

Catalyst – Increased Meal Spending

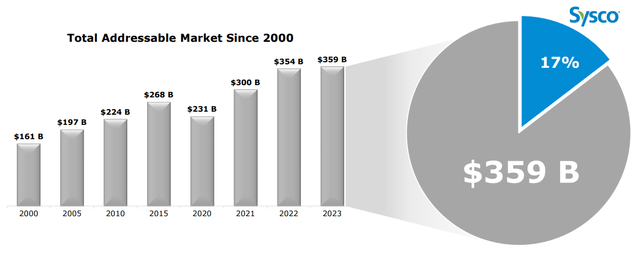

I believe that increasing consumer spending on dining out will be a key catalyst. We can see that Sysco’s market share is only around 17%, which leaves a lot of room for future growth. Besides restaurants, you can increase your exposure to other sectors. There are several data points that suggest a higher allocation to restaurant spending has become more acceptable, especially among younger generations.

SYY 2nd Quarter Presentation

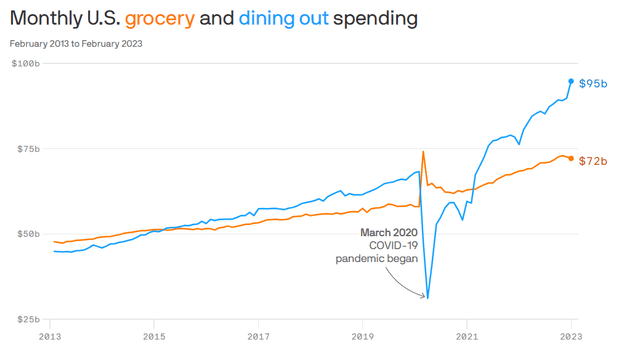

Data shows that the cost of eating out far exceeds the cost of groceries. This has been a common phenomenon since around 2016, but the spread between the two has reached an all-time high. Although we can see this actually starting after the pandemic period, I believe the root cause of this problem goes beyond the impact of the pandemic. With inflation higher than expected, food prices rising and wages stagnating, the culture of being rewarded for eating out has changed.

Axios

I think this is very relevant to the younger generation of adults. According to the report, nearly a third of all young adults have decided to stay at home with their parents. With housing becoming unaffordable across America, many young people have given up hope. Therefore, this generation tends to spend most of their income on food-related items. Once you get used to a lifestyle of eating out, it’s very difficult to get back into that lifestyle. As a result, I firmly believe that eating outside the home will become more and more the norm, especially as grocery prices remain inflated.

Valuation and Dividend

Sysco’s price peaked above $85 per share in December 2019 and has not reached that level since the pandemic began. There are some signs of attractive valuation at this price point. For example, the current average Wall Street price target is $87.46 per share, which offers a significant upside of 12.75% from current levels. Additionally, the current price-to-earnings ratio is 18.35 times. This closely matches the industry’s median P/E of 18.44x, but is well below SYY’s five-year average P/E of 25x.

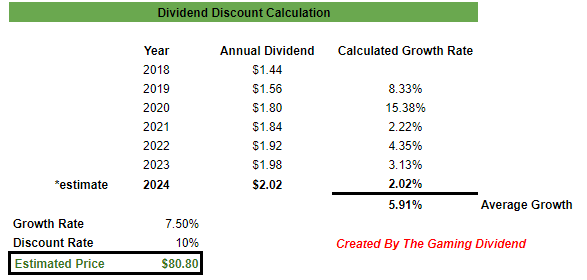

By gathering dividend data from the past few years, you can use the dividend discount model to construct your own valuation. We can see that the dividend has grown at a compound annual growth rate (CAGR) of 5.91% since 2018. If we expand to a longer period of 10 years, dividends grow at a CAGR of 5.78%. Ideally, with a dividend yield of less than 3%, the average annual growth rate is at least 5%, so I’d like SYY to get the green flag here. With all that free cash flow growing, the dividend is also safe, with a cash dividend payout ratio of just 42%. We’ve seen payout ratios hit 75% when sales have fallen due to the pandemic, so it’s nice to see this coming back down to a healthy level.

In the last earnings report, the CFO specified expected EPS growth of 5-10%. A smaller, more specific range is ideal, but here you can get a more accurate estimate by using a few data points. Over the past five years, sales have increased by an average of 6.5%. However, as transaction volumes increase, sales growth is expected to exceed the 7-8% range from this point on. The return on capital also averaged 10.5% over the past five years. Therefore, we believe that our 7.5% growth estimate is realistic and achievable at this time, if it falls within the estimated guidance range provided by management.

Author has been created.

Finally, the dividend was recently increased to $0.51 per share. Therefore, I entered my full year 2024 estimate at $2.02 per share. The current dividend yield is 2.6%, slightly higher than the 4-year average yield of 2.54%. These growth projection inputs lead us to a fair value estimate of $80.80 per share. That’s below Wall Street’s average price target of $87.46 per share, but still represents a modest upside of over 5% by conservative estimates. Things are improving due to the pandemic, and there are clear catalysts for increased sales, which could push growth much higher than I expect. Combine this with the current dividend yield and you get a solid 7.5% growth return.

In addition, management increased the amount of share repurchases than originally expected. The original expectation was for share buybacks totaling $750 million in 2024. However, this amount has recently increased to $1.25 billion for the full year. Not only does this show that management is confident in its ability to create more value, but it is also likely to contribute to higher prices.

weakness

Sysco appears to be very weak in sales, as evidenced by the pandemic decline. We cannot expect this type of event to happen again on such a scale, but it is something to consider. If the U.S. were to fall into any kind of severe recession, it could severely hurt revenue growth if consumer spending begins to tighten and impacts key markets. Their primary revenue comes from the restaurant segment, which has perhaps the weakest and least predictable sources of growth.

In my opinion, it would make a lot of sense if the company focused on more stable alternative segments of its operations, such as schools. Children must go to school and be provided with meals. We believe that SYY’s increased exposure to this sector would provide a bit more credibility and offset its sensitivity to changes in trading volume.

takeout

Sysco Corporation (SYY) has seen very healthy growth across multiple segments since the end of the pandemic. They are increasing free cash flow to support further growth. The company also strengthened its share repurchase agreement, signaling its confidence in its ability to create more value. In terms of valuation, my dividend discount model estimates fair value at $80.80 per share, assuming a conservative 7.5% growth rate.

The catalyst for SYY is that more people are spending money on eating out rather than on groceries. I believe this trend will continue in the future as eating out at a restaurant has become a culturally accepted way to treat yourself during difficult times. A nice meal out was a small pleasure that became cheaper than grocery shopping in some places. The 2.6% dividend yield is still well-covered, and SYY has an impressive streak of dividend increases spanning over 50 years, making it an attractive choice for investors looking for a consistent source of dividend income.