Taiwan Stopover + Non-Tech Taiwan Stock Updates

Since the start of COVID, I had a frequent flyer mile award on China Airlines (TPE: 2610) that kept being extended until last summer when I was finally forced to make a booking as it was about to expire. As I wrote back in February (Japan Trip Report (Plus Japanese Stocks)), I wanted to visit Kyoto but could not get a redemption seat for the Taipei-Osaka leg (as the fall foliage season is a popular time to visit Japan). I was forced to fly KL-Taipei-Tokyo – with around 14 to 18 hour overnight layovers in Taiwan as using FF mile awards can be a real hassle!

This post is organized as follows:

Note: Taiwan’s Market Observation Post System (MOPS) has company profiles and financial information in English, but the site is slightly clunky to use as it seems like you need to re-search for the company under each tab and can save a URL for a search…

China Airlines (TPE: 2610) is the state-owned flag carrier of Taiwan while privately-owned Eva Airways Corp (TPE: 2618) is an affiliate of shipping conglomerate Evergreen Group:

Taiwan actually has several passenger airlines:

However, UNI Air is a subsidiary of the Evergreen Group while domestic/region Mandarin Airlines is a subsidiary of China Airlines with low cost carrier Tigerair Taiwan being a joint venture of theirs with Singapore Airlines (SGX: C6L / FRA: SIA1 / OTCMKTS: SINGY / SINGF)’s low cost venture TigerAir (now Scoot).

Unlike in Malaysia where there are several local airlines who sometimes seek to cut each other’s throats, Taiwan based airlines seem to have carved out their own niches to maintain friendlier and more profitable competition. For example: The domestic market is mainly limited to serving outlying islands where there are price caps for tickets bought by islanders or military personnel. Smaller cities in Taiwan or mainland China are served by Mandarin or Uni Air leaving the big international cities to their parent airlines.

However, STARLUX Airlines Co Ltd (TPEx: 2646) is a new player that has a stock listing on Taiwan’s over-the-counter (OTC) market and I have seen advertisements or billboards for them at the San Francisco Airport.

I don’t know much about STARLUX other than their planes are new. They are also present in the cargo market and might already be shaking up the Taiwan and regional air travel and cargo markets.

I have normally been flying China Airlines as no matter what, I need to make a stopover on the way to the USA and Taiwan has better weather year round than, say, Japan or Korea. It’s also probably a bit cheaper to visit Taiwan than Hong Kong (more expensive accommodations…) or North Asia.

I should note that between 1994 and 2002, China Airlines suffered four fatal accidents – three of which each resulted in more than 200 deaths. However, they have long since cleaned up their act and have improved both safety and maintenance.

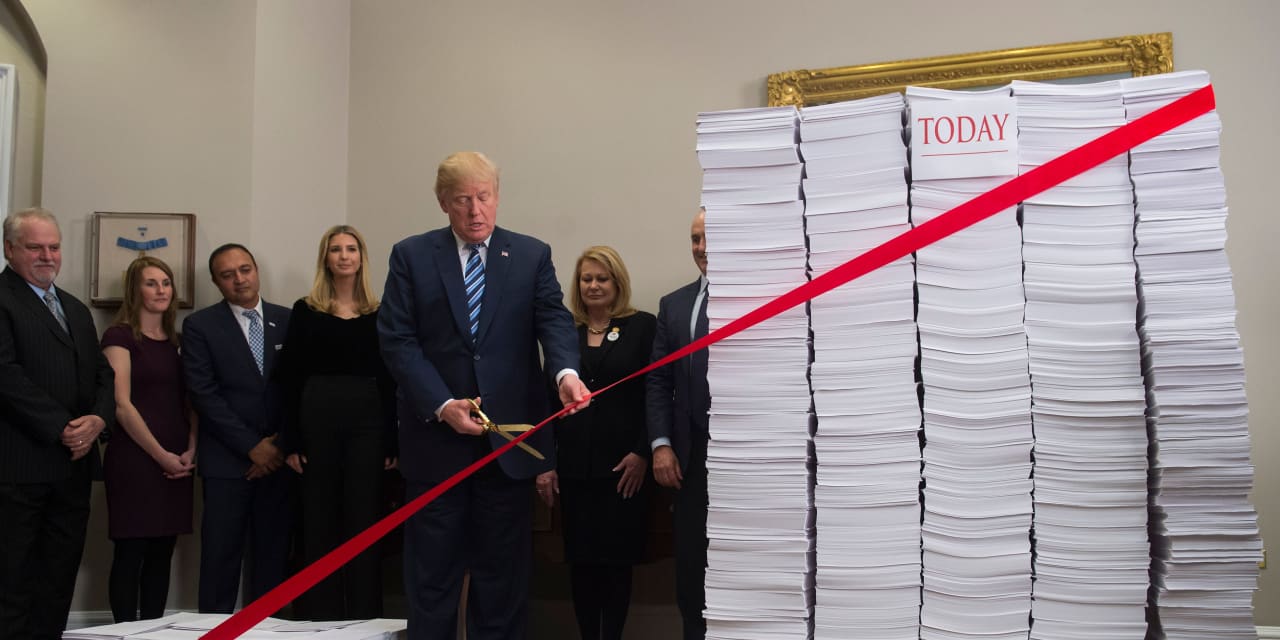

Nevertheless, China Airlines still unfairly has a bad reputation as they usually appear near the top of the lists for having the most fatalities from air crashes. I have also seen many comments from Americans on such articles who just (ignorantly…) assume that China Airlines belongs to the People Republic of China (PRC) – not the Republic of China (ROC) or Taiwan.

I think this forces them to keep prices a bit lower than what they could otherwise charge or into doing deals with package tour operators or travel agents (there are always many passengers on package tours between Kuala Lumpur and Taipei).

China Airlines does have new planes which I think are better pressurized as I don’t feel as jet lagged anymore (able to sleep better) or have head-sinus problems when flying long flights. I have also noticed an improvement in the food post-COVID albeit it is not up to the standards of an ANA flight from ANA Holdings (TYO: 9202 / FRA: ANCA / LON: 0Q09 / OTCMKTS: ALNPY / ALNPF).

Prior to COVID, I normally booked flights in person in the office because their online booking system used to be bad and I could not use it to book multiday Taiwan stopovers. Nobody seems to want personalized service anymore, but doing things face to face would always result in me getting good seats (e.g. the emergency exit or certain back row seats where you have only one person next to you).

However, they now have seat charges. Even the staff I talked to thought the seat charges were a bad idea as that makes a full service airline no different than a no frills discount airline. On recent flights though, I have found that being extra tall will get me reassigned to good seats – at-least at KLIA – without me asking or complaining…

They also want everyone to book things online or via their app as they have improved these. But using these methods is less personal and garners less loyalty e.g. I can also use such methods (like flight aggregators, etc.) to find the cheapest flight without having any loyalty to any particular airline plus (as mentioned before) frequent flyer mile redemption flights come with hassles.

Its been many years since I have flown Eva Air – so I can’t comment about them. To me, it feels like Eva Air has scaled back the number of passenger flight destinations in recent years whereas China Airlines has not or rather can’t as they are the state flag carrier. This also means the latter will never be allowed to go bankrupt should they run into financial trouble.

What I would be looking at more closely with airline stocks are their air cargo businesses given the ongoing disruptions due to conflicts or problems with the Panama Canal. As noted in recent Monday posts:

🔬 There’s Something About Air Cargo (Smart Karma) December 2023 $

FT article (West’s love for Shein and Temu drives ecommerce boom for air freighters) uncovers other contributors to surging air freight rates—Chinese online brands Temu and Shein are flooding Western nations with fast fashion and inexpensive e-commerce goods

The biggest beneficiaries are Chinese carriers with significant air cargo exposure, and Cathay Pacific (Swire Pacific Limited (HKG: 0019 / HKG: 0087 / OTCMKTS: SWRAY / OTCMKTS: SWRAF)). This presents a potential catalyst for an earnings beat and a boost to the share price.

Carriers from Taiwan and South Korea will benefit from supply tightness to the U.S.. Logistics providers are unlikely to benefit much due to tight margins and volatile high freight rates

🔬 There’s Something About Air Cargo (Part II) (Smart Karma) January 2024 $

Air cargo rates from Hong Kong and Shanghai have plunged in the past week, as spot demand dries up post-Christmas rush and reverts to previous (lower) contractual rates

Sea freight rates surged due to the Red Sea/Suez situation, with further increases expected. China to Europe air freight is highly competitive, potentially prompting a shift from sea freight

Chinese air carriers and Cathay Pacific (Swire Pacific Limited (HKG: 0019 / HKG: 0087 / OTCMKTS: SWRAY / OTCMKTS: SWRAF)) will record stronger than expected 2H23 performance on air freight, and we think air freight should continue to be firm in 1Q24

Higher cargo rates are already benefiting both China Airlines and Eva Air:

🔬 China Airlines (2610 TT, NEUTRAL, TP:TWD 23.00): Superb 2023 Masks Upcoming Challenges (Smart Karma) December 2023 $

China Airlines (TPE: 2610) will deliver record profit in 2023 on strong passenger and rising cargo rates

Beyond 2023, hard to forecast due to high exposure (~30%) to volatile cargo, and it lacks brand recognition and customer loyalty evidenced by its weaker yields to local rival

Target price of TWD23 based on 1.71x FY2024 P/BV ratio – one SD above mean. Limited 6% UPSIDE, with 3,9% dividend yield. Prefer Eva Airways (2618 TT)

🔬 Eva Airways (2618 TT, BUY, TP:TWD34.90) The Best, but Not the Cheapest (Smart Karma) December 2023 $

Eva Airways Corp (TPE: 2618) is enjoying the perfect tailwind of strong demand from both inbound and outbound, capacity deficit, a resurgence in corporate travel, and rising cargo rates

Consensus believes FY2023 will be peak earnings as 2024 capacity rollout will balance the demand-supply, but our observations suggest things will likely remain the same until the end of 1H24

Target price of TWD34.90 based on 13.4x FY2024 PE ratio – its long-term mean. Borderline attractive with a modest 11% UPSIDE, but 5.9% dividend yield is a sweetener

For cargo though, Eva Airways might be a better positioned to win new orders given its parent company owns Evergreen Marine Corp Taiwan Ltd (TPE: 2603):

Finally, here is some data and stock charts for both airlines:

Trailing P/E: 17.70 (no forward P/E) / Forward Dividend & Yield: 2.34% (Yahoo! Finance)

MOPS Data

Trailing P/E: 7.98 (no forward P/E) / Forward Dividend & Yield: 2.51% (Yahoo! Finance)

MOPS Data

Under Restaurant Stocks, I have more detailed writeups with plenty of links from last July about two Taiwan restaurant stocks that you might not be familiar with, but are worth taking a much closer look at:

🔬 Bafang Yunji International (TPE: 2753): Turning Things Around and Expanding in HK Plus the USA

Taiwan based Bafang Yunji International Co., Ltd. (TPE: 2753) operates dumpling-potsticker plus pork rib restaurant chains with branches in China (closing), Hong Kong & the USA where they are starting to expand

🔬 Gourmet Master (TPE: 2723): Taiwan’s Rapidly Expanding Version of Starbucks

Gourmet Master Co., Ltd. (TPE: 2723) is an investment holding company operating around 1,000 bakery cafes under the 85°C name in Taiwan, China, Hong Kong, Australia, United States, and Cambodia.

Both have their strengths, but I think the former has a better business strategy than the latter.

Although founded in Taiwan, Gourmet Master Co., Ltd. (TPE: 2723) is actually a “foreign company” registered in the Cayman Islands to help its Taiwanese owners avoid local taxes as most revenue is derived from abroad (e.g. China and the USA) – see The Secrets behind the Shortfall. I don’t have a problem with a company using every legal loophole to pay less taxes, but this method in particular is bound to cause ire with politicians and their voters.

It also makes for a murky complicated legal structure for shareholders to decipher:

Nevertheless, they have been expanding 85°C’s operations in the USA:

🎥 85C Bakery Cafe draws long lines at new US location in Phoenix, Arizona (民視英語新聞 Formosa TV English News) 2.22 Minutes (December 2022)

Taiwanese food is becoming popular around the world, and several chains have already set up shop in the U.S. Recently, 85C Bakery Cafe opened a branch in Phoenix, Arizona, where it sells a range of Taiwanese bread. The store drew long lines at its grand opening, and business is only expected to get better.

And note the following:

📰 ‘Starbucks of Taiwan’ – 85 Degrees C – expands in Southern California (Photos) (LAist 89.3) January 2013

The company is scouting new locations. On average, the chain’s U.S. stores make more than $700,000 in monthly sales, seven times more than what the average store makes in China, according to a January presentation on 85°C’s website. So far, all the locations in the United States have been company-owned and 85°C said it is not looking for local franchisees.

At least in Asia, there would be tremendous amounts of competition for bakery and coffee chains. For example: Hogan Bakery is another Taiwanese bakery cafe chain with outlets in Taiwan, China and Malaysia. I have eaten at one in Shanghai while the Malaysian or SE Asia franchise operations are under the Parkson Group who own the Parkson Department stores (separate listings in Hong Kong, Malaysia and Singapore) which have struggled a bit in recent years (meaning they may not be in position to dramatically expand the bakery chain).

In the USA though, 85°C might actually have an easier time as I assume their locations are going to be in communities with large Asian student and recent immigrant populations. In other words, communities that have high incomes where there would be demand for Asian style soft breads (vs. the harder breads Westerns prefer) and bakery products covered with chicken floss, full of sweet bean pastes, etc.

However, having a big presence in both China and the USA is increasingly a business liability:

📰 Taiwanese Presidential Stop at LA Bakery Causes Massive Political Fallout in China (Eater Los Angeles) August 2018

Tensions are heating up between China and Taiwan, all over a cup of coffee

📰 Taiwan furious after 85C Bakery Cafe bows to mainland backlash over gift bag for Taiwanese president (SCMP) August 2018

US branch’s gesture to Tsai Ing-wen while she visited Los Angeles prompts calls on mainland for boycott, then company statement endorsing ‘One China’

On the other hand, Bafang Dumpling will not have to worry about these sorts of political problems:

📰 Bafang Dumpling from Taiwan eyes China exit (Taiwan News) September 2022

Bafang business in China hit by surging cost, fierce competition, and relentless COVID restrictions

Taiwan remains the main source of its revenues, accounting for 81%, while mainland China and Hong Kong make up 0.7% and 16.9%, respectively, per CNA.

The dumpling giant has pivoted away from China to the U.S. market. In March, it opened its first store outside Asia in Southern California and looks to expand to eight branches in the country by 2024, according to CNA.

As I noted last July, there seems to be a Bafang outlet in every neighbourhood of Taipei (I have also eaten at an outlet in Xiamen). They are always crowded around meal times (students, office workers, etc.) plus evenings (as Taiwanese tend to eat out) as their potstickers and dumplings are reasonably cheap, filling, and usually quick to prepare. Taiwanese also go to the outlets to buy frozen dumplings and potstickers to cook at home.

There would be some food items or restaurant concepts that have near universal appeal e.g.:

The latter don’t need to be made with pork, can be vegetarian, and served any number of ways. For example: I had dumplings at a Russian restaurant once in Pattaya and I think they had butter on them and served them with sour cream (when my dad saw my pictures, he said they looked like the ones his Slovenian or Croatian grandmother had made…). In Malaysia, I go to hawker stand where they pan fry dumplings with a scrambled egg – delicious and extra filling when eaten with soy sauce.

My favorite Bafang dumpling menu items are the curry or Korean kim chi potstickers along with the corn chowder soup or the hot and sour soup (if its winter time when Taipei is cool and damp…):

🎥 Ba Fang Yun Ji Dumpling / 八方雲集 (Slideshow / 幻燈片) (Taiwan Travel Guide) 2:56 Minutes (June 2016)

This video appears to be a promotional video showing most aspects of the business:

🎥 伴我成長 八方雲集 (八方雲集) 4:05 Minutes (June 2017)

On my last multi-hour stopover in Taiwan on the way back from Japan, I had enough time to make it to an outlet in Zhongli before it closed.

The first thing I noticed was that prices had gone up, but not by that much:

Ten kimchi and 10 curry pan-fried potstickers came to NTD132 or a little more than US$4:

Note that I did not go into a FamilyMart (Itochu Corporation (TYO: 8001 / FRA: IOC / OTCMKTS: ITOCF) or 7-Eleven (President Chain Store Corporation (TPE: 2912)) to see if the price of their ready-to-eat meals (RTE) have gone up; but I would say paying NTD66 for a plate of 10 potstickers is still fairly competitive (and better than eating RTE…) as most decent RTE meals are usually higher.

In the past, I might have only ordered 6 or 8 of each. But some outlets started having a minimum order number. Ten of each was more than filling and a bit of a regret because I saw more delicious looking dumplings at the nearby night market I went to – but I was too full to eat any more…

I was also having some problems with my nose when returning from Japan that might have impacted my taste buds as the potstickers tasted plainer than from what I remembered in the past. But that was not a problem as (below the window) they had the usual sauces (soy, vinegar, etc.) and seasonings available for customers to add according to their taste preferences:

I should note that Bafang (the company) is actually more than just dumplings/potstickers:

The restaurant group currently has six brands: The “BAFANG” brand provides sales and services of a wide range of pot stickers, dumplings, spicy wontons, noodle dishes, soups and beverages. The “Liang She-Han Pork Ribs” and “Bai Fung Bento” in Hong Kong provide a variety of rice/noodle dishes, soups and hand-shaken beverages, such as fried/marinated pork ribs, crispy chicken drumsticks, soy-poach chicken, red vinasse meat, chicken nuggets with pepper salt and soy-stewed meat. The “FJ Veggie” offers sales and services of a wide range of plant-based meals including pan-fried dumplings, dumplings, noodles and beverages. The “Dante Coffee” brand provides sales and services of coffee, tea and light meals. The brand “Bafang Noodles & More” in Hong Kong focuses on Taiwanese noodle dishes such as beef noodle/wonton noodle/spicy and sour noodle soup/various kinds of dry noodle/Taiwanese vermicelli, etc., together with Taiwanese popcorn chicken and various hot and cold hand-shaken drinks.

Since COVID, they have been been working to improve operations and expand further:

📰 Bafang Yunji seeks to curb losses at its dumpling chain (Taipei Times) August 2022

The company said it is considering shutting down coffee shop chain Dante Coffee and Foods Co (丹堤咖啡), which it acquired in 2020, and other outlets that incur losses.

The COVID-19 pandemic affected Dante, especially during a level 3 COVID-19 alert last year and a prolonged outbreak of the disease this year, and operations remain disappointing after adjustments, Bafang Yunji told an investors’ conference.

Takeout services at Dante generated less than 5 percent of the company’s overall revenue, rendering the chain a heavy financial drag, it said.

The closure plan would extend to unprofitable dumpling outlets in China, where strict COVID-19 controls are hurting sales without a solution in sight, the company said.

Their 2023 annual report is not yet available, but this is from their 2022 annual report:

In addition to achieving double-digit growth in terms of consolidated revenues in both Taiwan and Hong Kong, stores in the U.S. also managed to deliver outstanding performance in 2022. With regards to profit performance, the Company recognized losses from the discontinuance of Chinese operations and adjustments of the Dante brand; aside from the above, operations in Taiwan and Hong Kong both reported double-digit growth compared to 2021. While U.S. stores did manage to deliver profits, the central factory operated below economies of scale and reported slight losses as a result. Total store count reached 1,319 worldwide at the end of 2022, including 1,057 Bafang Yunji stores and 201 Liang, She-Han Pork Ribs stores; meanwhile, the new brand – FJ Veggie introduced at the end of 2021, grew to 18 stores, whereas Bai Fung Bento and Bafang Noodles & More in Hong Kong had 11 and 5 stores, respectively. As for Dante Coffee, further actions were taken to consolidate underperforming stores, and the total store count was reduced to 27 by the end of the year.

And:

The Company has more than one thousand stores under its brands; 88% of which are franchise stores, and the percentage is as high as 91% in Taiwan. Additional resources have to be invested in store management and maintenance of brand image

When I was looking on Google Maps for an outlet in Zhongli, I thought I saw a review that either this one or another nearby one had recently been closed for remodelling – something I remembered reading about in the annual report:

In 2023, the Company looks forward to growing its businesses further and aims to expand more actively into international markets with its multi-brand and multi-market strategy. As for operations in Taiwan, Bafang Yunji will continue remodeling stores with smart grills and automated noodle cookers for more consistent product quality and improved operating efficiency. We expect to complete remodeling for all major stores by the end of the year, and will introduce new seasonal offerings to satisfy consumers’ desire for diversity. We also have plans to launch frozen prepared food packages in the second half of the year to expand the diversity of store offerings and bring convenient food options to consumers seeking to dine at home. Liang, She-Han Pork Ribs, now in its fourth year, has expanded to more than 200 stores and created strong brand awareness. More emphasis will be directed toward improving product quality and increasing visitor count in the coming year. The new brand – FJ Veggie will continue its store expansion efforts and aim for 60 stores by the end of the year. As for Dante Coffee, we plan to first weed out underperformers and reduce to a profitable size before undertaking any expansion. For the Hong Kong market, new stores will continually be opened under Bai Fung Bento and Bafang Noodles & More; in the meantime, we will introduce Liang, She-Han Pork Ribs to the market and plan to have 2 stores opened for business in the first half of the year. The U.S. presents another key market, where we recently opened our 2nd store in Chino Hills in Southern California on January 6, and expect to have a total of 8 stores by the end of the year. Aside from Southern California, we are actively looking for suitable locations in Northern California where we can establish a central factory to support our expansion efforts in that region.

I do hope they open in Northern California as I think they could do well in the region. Even the Central Valley town I grew-up in now has a Japanese restaurant offering sushi and there are Vietnamese restaurants pretty much everywhere in the area now. One neighbouring town has a Hunan restaurant and another a Thai restaurant with both offering reasonably authentic food. In other words, its no longer just bad Americanized Chinese food any more.

So far, it looks like they have around six outlets open in Los Angeles-Orange County and now San Diego:

🎥 Trying ALL Menu Items from Bafang Dumpling with 胡安安 (RealTomChou) 8:45 Minutes (April 2022)

Note the roughly 4X difference in prices between California and Taiwan:

📰 Taiwan’s Bafang Dumpling opening new locations in southern California (Focus Taiwan) December 2023

In terms of the menu, a set of six dumplings or pot stickers at Bafang’s U.S. locations costs US$5.25, while a set of 12 costs US$10 — equivalent to around NT$26 per dumpling, compared to NT$6.5 in Taiwan.

Meanwhile, a dozen dumplings with a side of hot and sour soup or corn chowder costs US$11.75, while the most expensive item on the menu — Taiwanese beef noodle soup — costs US$16.75, according to the company.

The retailer’s U.S. stores also offer various noodle and side dishes, soy milk, “hand-shaken” drinks and frozen dumplings/pot stickers with both meat and vegetarian fillings.

What could go wrong for Bafang? Obviously there is always the threat of China trying to reunite with Taiwan by force. But such a move would “nuke” much of the stock market and especially tech stocks.

A more mundane risk would be food safety – the same risk faced by all food related businesses. For example: In 2014, there was a massive gutter oil scandal in Taiwan that ended up touching many food groups in the region as the oil had been exported:

📰 Hong Kong conducts food tests as fear mounts over Taiwan’s gutter oil scandal (The Straits Times) September 2014

An investigation has been launched after oil from a Taiwanese company accused of using illegally recycled products – including fat collected from grease traps – was exported to the southern Chinese city.

Taiwanese authorities say a factory in the south of the island illegally used 243 tonnes of tainted products, often referred to as “gutter oil”, to mix into lard oil in a case that has reignited regional concerns about food safety standards.

The lard oil – a clear oil pressed from pig fat – was supplied to at least 900 restaurants and bakeries in Taiwan. The owner of the factory was arrested on Sunday.

There was also this recent incident:

📰 Dumpling, instant noodle makers bought tainted chili powder: Authorities (Focus Taiwan) March 2024

Taipei, March 5 (CNA) The restaurant chain Bafang Dumpling and instant noodle maker Wei Lih Foods both purchased chili powder from two Kaohsiung importers that has since been found to contain an industrial dye banned for use in foods, health authorities in the city have said.

However, none of these incidents are the fault of the companies buying the tainted products and this sort of risk comes with the territory when you are in the food business – especially in Asia.

Finally, here are some data and stock charts for both Bafang and Gourmet Master:

Trailing P/E: 18.52 (no forward P/E) / Forward Dividend & Yield: 4.29% (Yahoo! Finance)

MOPS Data

Forward P/E: 25.77 / Forward Dividend & Yield: 2.80% (Yahoo! Finance)

MOPS Data

I have been to Taiwan on many multi-day stopovers on the way to the USA (enough times to put up an informal YouTube Channel that’s no longer monetized due to their forever shifting goal posts…) – including visits to most of the outlying Islands (Penghu / Pescadores Islands, Kinmen (Quemoy), Matsu Islands, Little Liuqiu / Lamay Island, etc.).

Taiwan is one of those places you are not going to take 12 to 18 hour flights to make a special visit to unless you have family there, or are going there for business, or have an interest in traditional Chinese culture as there just aren’t any Forbidden Cities, Angkor Wats, Bagans, etc. type of attractions to see.

However, if you live in the region only a few hours away or need to make a flight stopover (e.g. to get to the USA), its a great place to do a multi-day stopover at any time of the year.

While Taipei can be chilly and damp in winter time, the rest of Taiwan will have fairly decent and warm weather (southern Taiwan is subtropical). For example: Taichung, either the second or third largest city just a little south of Taipei, was warm and sunny in December 2019 when I went there:

Taiwan is also fairly easy to get around (great infrastructure) with key cities having good bus and subway networks plus there are plenty of night markets to explore.

The only problem when visiting Taiwan or doing a layover there is typhoon season – roughly June to November. Typhoons can disrupt flights and the country to some degree; but not as badly as they do in places like the Philippines.

If you are planning a long trip to visit Taiwan (and need information in English or have some questions), I highly suggest checking out Nick Kembel’s Facebook group Taiwan Travel Planning for asking questions or his website.

For long flight layovers, the Tourism Administration offers free half-day tours:

You will need to book at-least a five days in advance for a bus tour.

For a self-guided walking tour with a free roundtrip MRT voucher to get you in and out of Taipei, you will also need to book five days in advance. I had thought it was three days and missed the cut-off. However, I emailed them, they sent me a form to fill out, and the free vouchers were waiting for me to pick up at the tourism desk.

I opted on both stopovers to go to Zhongli (the opposite direction of Taipei on the airport MRT) as that’s closer to the airport and it was evening when I flew in or by the time I got through immigration. There are a few places there worth visiting there on a layover:

There is a second night market in Zhongli (Chung Yuan Night Market) that’s along a busy road by a university, but its a much further walk from the MRT station:

Finally, here is a short video (no narration and I did not have enough time to visit the temple…):

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Taiwan Stopover + Non-Tech Taiwan Stock Updates was also published on our website under the Newsletter & EMS Analysis categories.